Trades in Soda and Whisky;

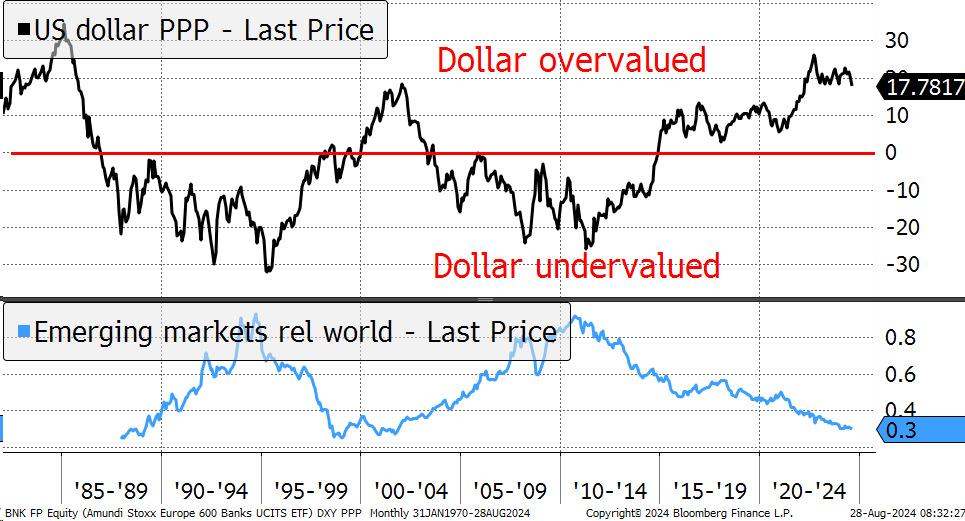

The US dollar has enjoyed long cycles, with major peaks in 1985 and 2002 and troughs in 1995 and 2008. Dollar upcycles saw weak performance from the emerging markets (relative to the world index shown). In contrast, weak dollar cycles have seen the emerging markets boom. Since the financial crisis in 2008, the dollar has surged again, but it is once again rich compared to other currencies, and sooner or later, it will cool back to fair value and perhaps below it. That’s how these things tend to happen.

A Weak Dollar Stirs the Emerging Markets

The measure is purchasing power parity (PPP), which measures inflation differentials across countries over time. A country with high inflation will see the value of its currency fall, and vice versa. In this cycle, the dollar has risen much faster than can be justified using this measure. This means it is cheaper to buy many goods and services outside of the USA than within. A strong dollar makes the rest of the world more competitive, and nowhere more so than in the emerging markets, whose stock and bond markets have lagged behind since 2011.

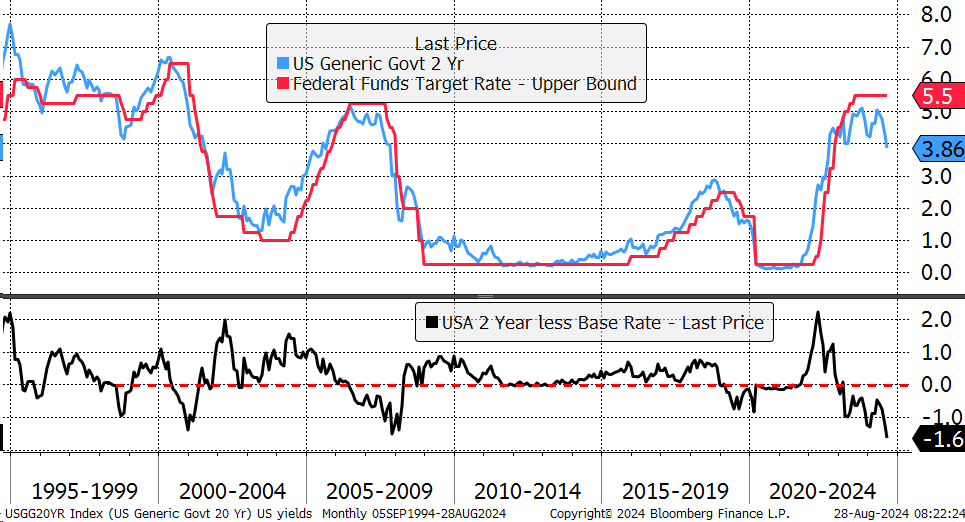

The recent Jackson Hole conference, where the central bankers gather each year to make speeches and play golf, saw a willingness to cut interest rates. The Fed Chair, Jerome Powell, has made it clear that this rate cycle is over and that cuts are coming. He is concerned that employment is slowing and that inflation expectations are now anchored at 2%. He’s ready to cut rates in September, and the market thinks that will be 0.25% or possibly 0.5%.

The 2-year yield has fallen to 3.9% compared to base rates at 5.5%, which is the bond market’s way of pricing in future rate cuts. The lower chart shows the difference at -1.6%, meaning that a full rate-cutting cycle lies ahead. Indeed, this reading is more pronounced than seen in 2001 and 2008, implying the cuts could come thick and fast.

Bond Yield Prepares for Rate Cuts

Currencies are driven by many things, but PPP is a long-term measure. Shorter term, interest rate differentials are more important, as we recently saw with the recovery in the yen, where the Bank of Japan did the first hike in years. If US rates tumble, the dollar will fall. This has already begun, which is another reason why gold and silver have been strong.

It is hard to say whether the US cutting cycle is good or bad for equities. On the one hand, it was a bear signal in 2001, 2008 and 2019, but all of those led to hard landings in the economy. The bulls believe this time it’s different, and it will be a soft landing that avoids recession. It is hard to say which way things go, but there is no harm in being prepared. Naturally, a hard landing will favour bonds over equities. The inflation is deemed to be under control for the time being, but the risk is that the next upcycle could see it return. Regardless, here and now, the inflation genie is back in the bottle.

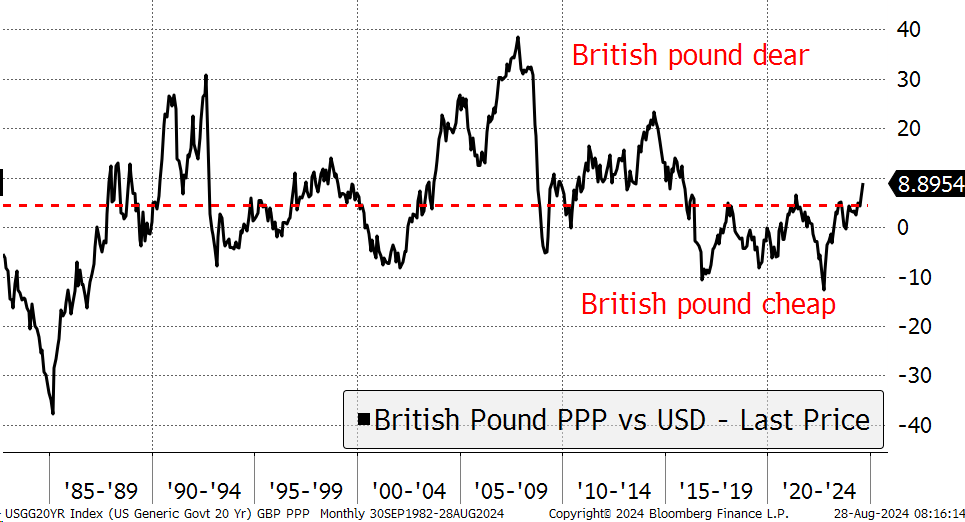

While we are here, I’ll check in on the pound. With London being a major financial centre, it tends to rise and fall alongside the bull/bear equity market cycle. Currently, it is 9% overvalued by PPP, which will likely keep on going for as long as the equity bull persists. The pound was cheap post-Brexit and during the Truss gilts crisis but has subsequently recovered.

The Pound Has Recovered

It makes sense for UK investors to embrace foreign assets when the pound is rich and less so when it is cheap. We are entering the zone whereby overseas diversification is becoming more compelling because your pounds go further when buying overseas assets, but only if they offer value. Nowhere is this more compelling than in Sweden, Japan, and, best of all, the emerging markets.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd