Issue 37;

Time to Consider Gold Exploration

The smart crowd will tell you that the gold miners are risky businesses and that the royalty companies, which are lenders with the first claim on gold production, are much better businesses. That is true because having the first claim on production is a position of privilege that gets fed first, while the miner carries on producing until it’s their turn.

But what happens when the price of gold rises?

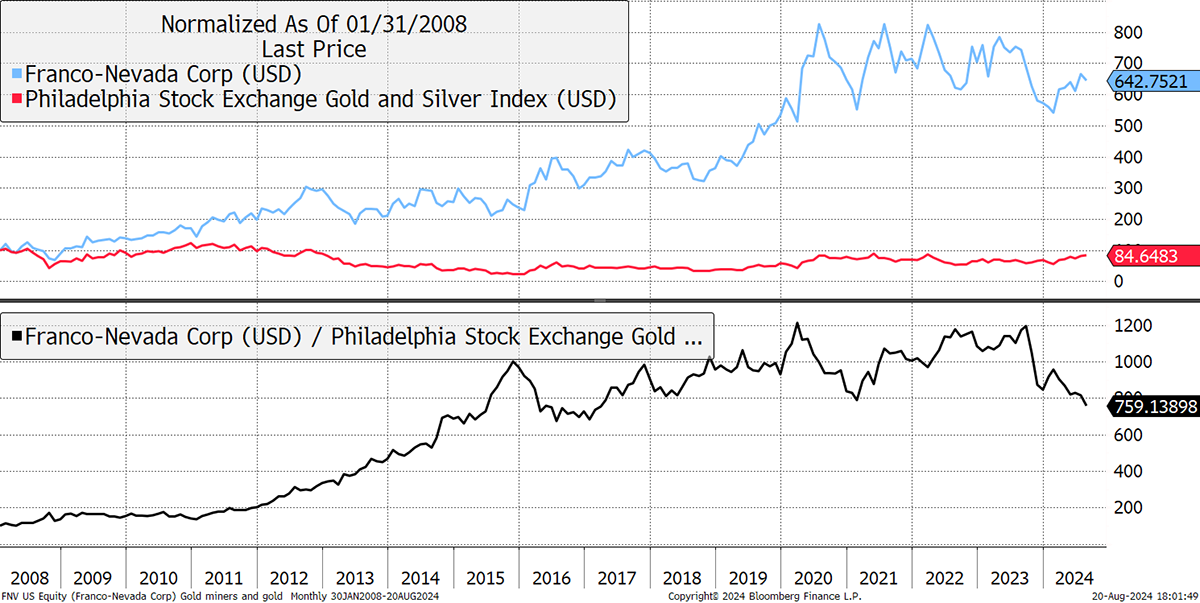

The high-quality, low-risk royalty companies, such as Franco Nevada (FNV), start to lag the market as we can see here. And worst still, they start to lag the gold mining sector (black) significantly.

The Best Stocks Can Lose in Bull Markets

That’s because the gold price is high enough to float all boats, and the gold miners are seeing their profitability increase, and so they outperform the royalty companies, whose margins are stable. As the gold price keeps on rising further, margins rise across the board, until one day, the miners are so profitable they simply match the performance of the gold price. Under those circumstances, to keep on growing profits, they must boost production.

If you extrapolate that, you get to a point where the exploration companies become the most desirable assets because they have negative margins that can only improve and the potential for vast production growth. That makes gold exploration stocks the most desirable business model during established gold bull markets, as these companies are the only ones capable of delivering positive surprises at high gold prices.

I was told that in the late 1970s, at the peak of the greatest gold bull market of all time, the gold miners traded at a premium to the value of their reserves. With the gold price above $2,500, it’s time to embrace gold exploration.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd