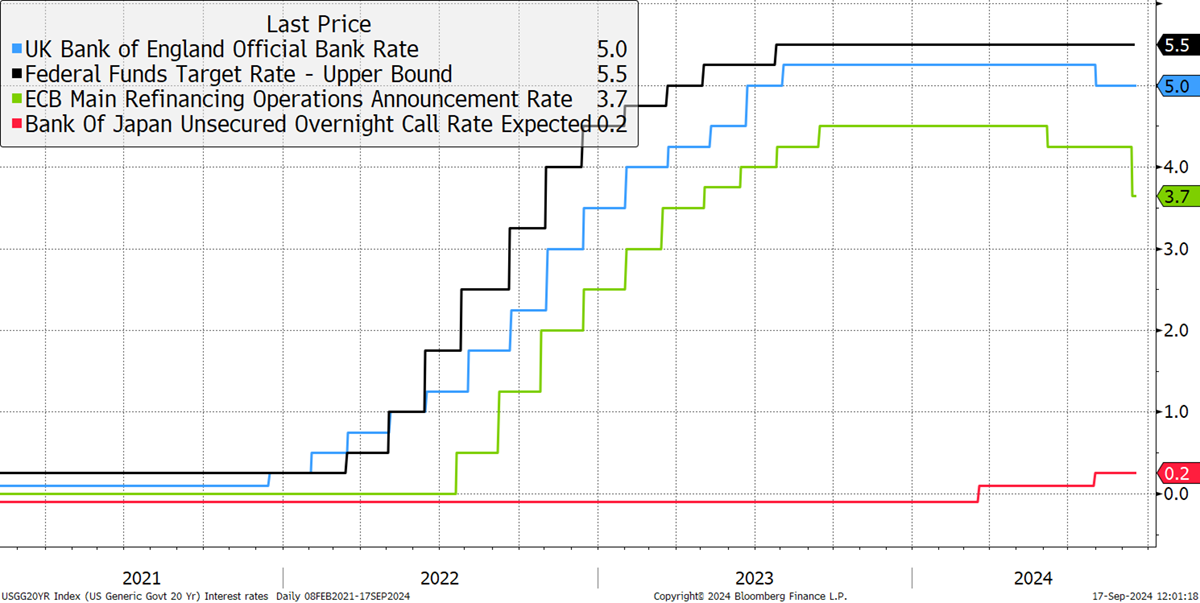

Later today, the Federal Reserve will cut interest rates for the first time since 2020. In recent days, the odds of a 0.5% cut have increased significantly, so the thought is it’s at least 0.25%.

The market has been waiting for this for a year, and as I have said in recent weeks, there is no guarantee that rate cuts will be well received. If they are deemed to be a result of lower inflation, that’s bullish. But if they are deemed to be thwarting off a sharp slowdown, that would have mixed reviews. Above all, it’s the messaging that the market is most excited about. Where might interest rates be in the months and years ahead? Currently, it is priced such that they will be under 3% by the end of next year.

Converging Rates

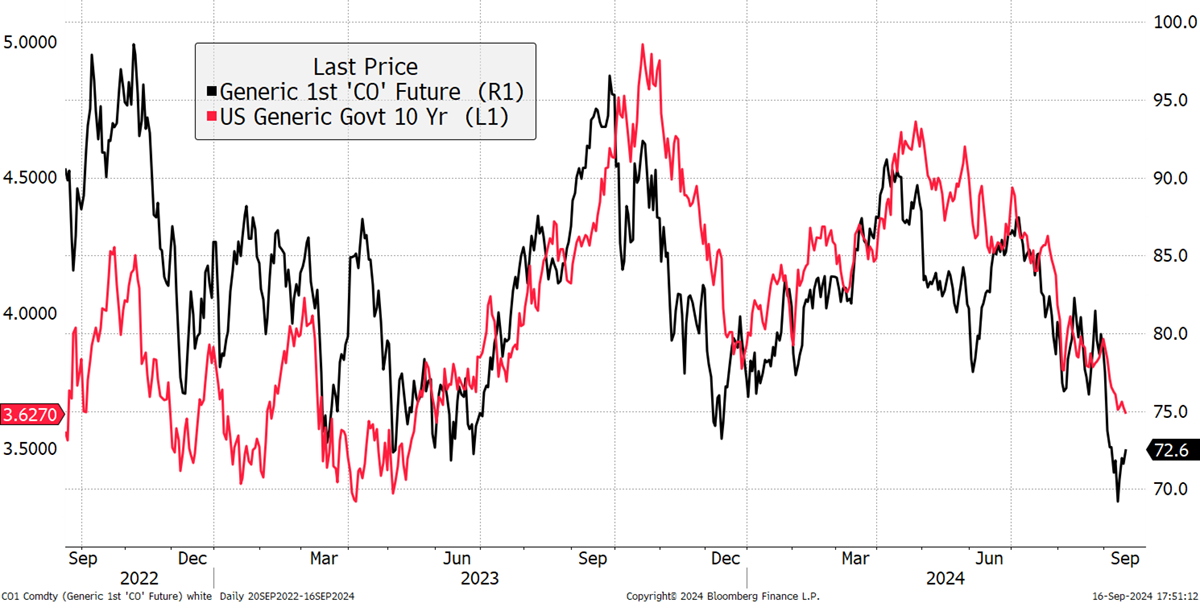

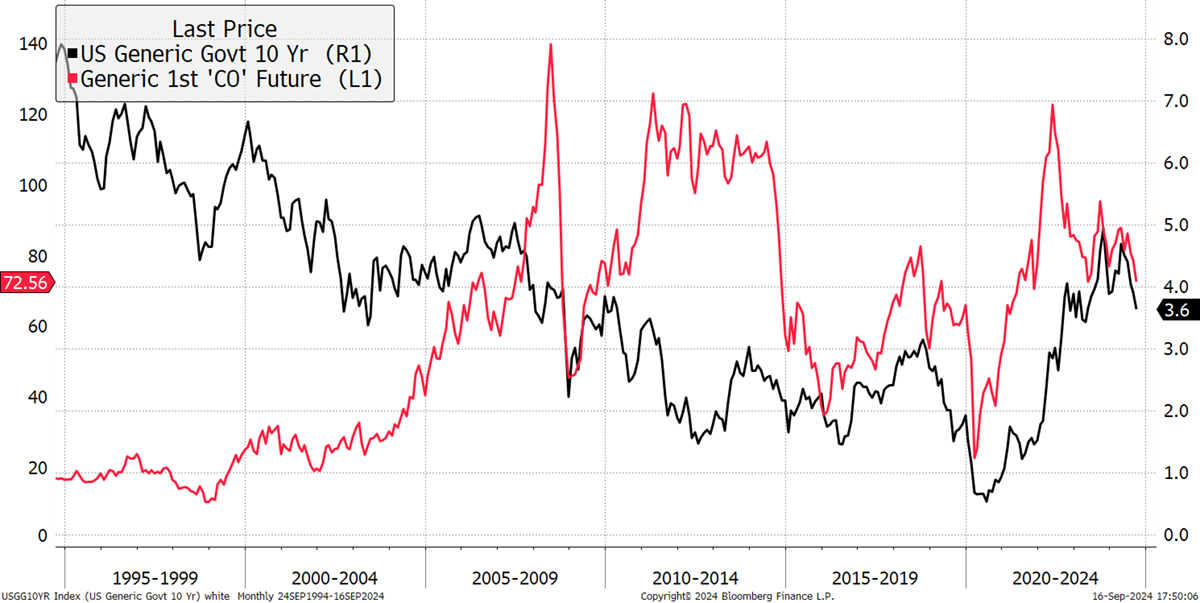

Rates and bond yields are important because they drive the markets, even the oil price, but especially the gold price. Starting with oil, over the past two years, it has moved in sync with bond yields, which implies that higher yields mean more growth because a vibrant economy consumes more oil. In searching for reasons why oil has slumped of late, might this link have gone a step too far?

Oil and the Bond Yield

I say that because over 30 years, a period when the return from oil and gold have been roughly the same, the link with oil and bond yields is a post-2014 story that has been steadily building. There always has been a link, but never quite this close.

Oil and the Bond Yield Have Moved in Sync but Never This Closely

Expectations for outsized rate cuts are so high that there is plenty of room for disappointment. I suspect that the oil price will bounce if it can be shown that the world economy is stronger than the message being sent by the US bond market. I am conscious that despite profiting from oil investments over the years, we have exposure in both portfolios, but recently, it hasn’t worked. In trying to understand why oil has slumped, I keep coming back to the same conclusion that it is oversold and underpriced. Hold oil.

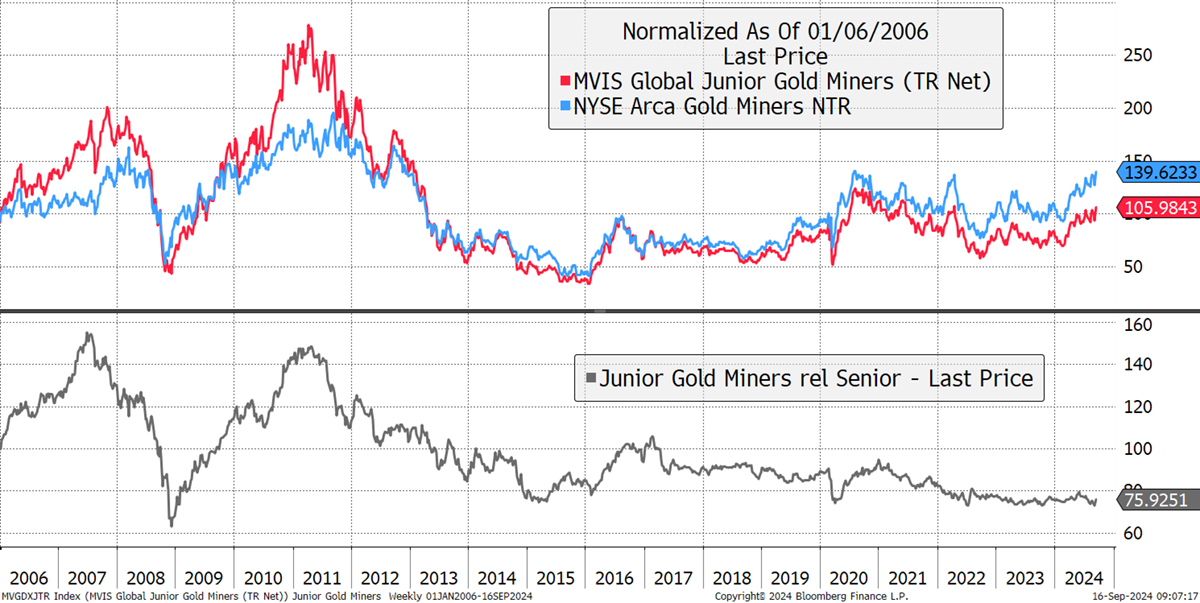

The other question I have been asking is regarding the junior gold miners. The performance of the smaller miners has been similar to that of the larger miners since around 2012, but two things stand out. The first is that during the booms of 2007 and 2011, the juniors went a step higher, and the other is that the juniors have lagged significantly, meaning a catch-up rally is overdue.

Junior and Senior Gold Miners

I wrote more on this recently in the ByteTree Weekly Roundup: Why Gold Exploration Beats the Royalty Companies in a Gold Bull Market and Rich Gold and Cheap Oil Will Drive the Gold Miners. I will expand on this in Atlas Pulse, which I will write later this week. As much as I have been tempted to add junior miners today, it would be best to wait until after the Fed’s decision. I suspect it will lead to a market shake-up.

Finally, I have also been exploring the Bitcoin stocks, some of which are (digital) miners. I mentioned this piece in yesterday’s ByteFolio about stablecoins, a $160 billion market that is active in emerging markets. Be in no doubt that the crypto world is real and has a use case.

Once again, the stocks are cheap versus Bitcoin, and those of you who follow my ATOMIC monthly letter will know that the seasonality for Bitcoin is about to turn positive. I am tempted to add both junior gold miners and Bitcoin stocks to Whisky but will wait for the Fed’s moment to pass.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd