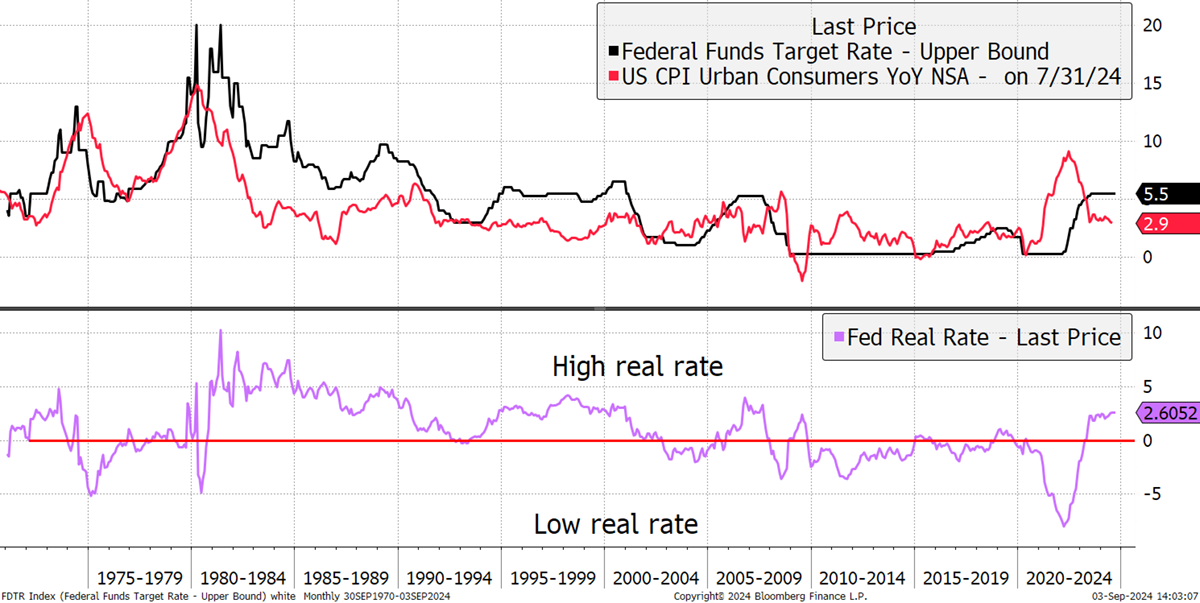

All eyes are on the Federal Reserve, who meet in two weeks tomorrow, Wednesday 18th September. They are likely to cut interest rates. The Bank of England meets the next day, and they are likely to do whatever the Fed do, with some suitably opaque language. The interest rate is 5.5%, and inflation is back down to 2.9%. It looks like the masters of the universe are ready to reverse course.

Lower Inflation Primes Lower Rates

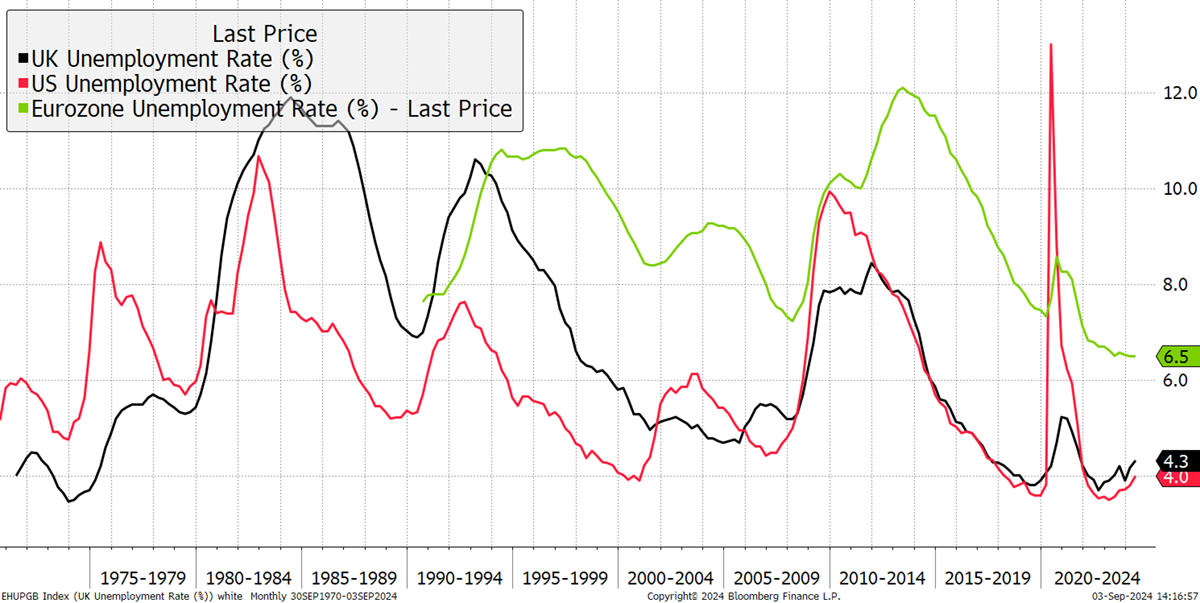

When you simply look at rates and inflation, the picture is similar around the world. But things are different when you add unemployment, which itself has become a trickier thing to measure due to the increasing amount of self-employed, part-time, and long-term sick.

Go back to the pandemic and see how US companies ditched their staff in a heartbeat. There was some more unemployment in the UK, and a little more in Europe, but the way things are done could not be more different. It means the unemployment data in the US is much more telling than what we see over here.

Unemployment Rates

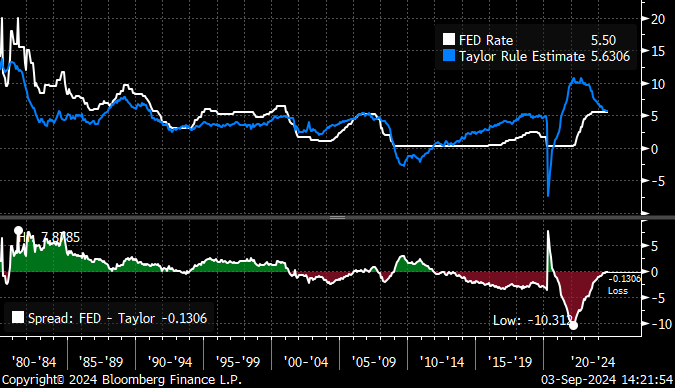

The Taylor rule is a monetary policy guideline that suggests how central banks should adjust interest rates in response to inflation and unemployment. As with all of these things, it was dismissed ahead of the pandemic despite forecasting 5% interest rates three years ahead of time. That soon collapsed when the economy shut down, but it’s a reminder that this indicator has the smarts.

Taylor Rule USA

The trouble is that US rates are about right, and according to Taylor, would only fall if the blue line fell. For that, we need both lower inflation and higher unemployment. We may well get that, but the point is that rate cuts may be glacial when market expectations are thinking it’ll be like the last time and the time before.

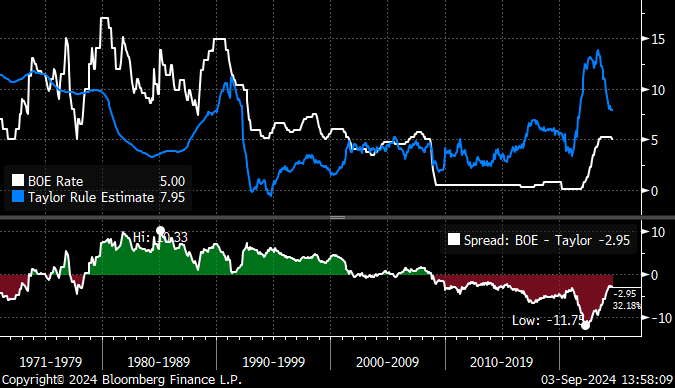

Here in the UK, the rule suggests rates need to rise by another 3%. We may well get another cut, but it will be nothing like a return to zero.

Taylor Rule UK

We’d see rates rise by 3% in Australia and 4% in Japan (you saw 0.15%, imagine that) if the Taylor Rule was applied. Germany would see rates 5% higher, but Italy, just 2%, while the Nordic countries would be broadly stable with some room for cuts. Rates would be held steady in Brazil and be cut by 3% in Mexico.

It is a very different picture of the world than what markets seem to be prepared for, and unless the economy sinks, which it likely won’t, I suspect this rate-cutting cycle could be a disappointment.

After two significant trades last week, the portfolios are in good shape for the autumn. Whisky has a modest cash pile, which is quite large if you add the yen, and so well positioned for a period of uncertainty.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd