Trade in Whisky;

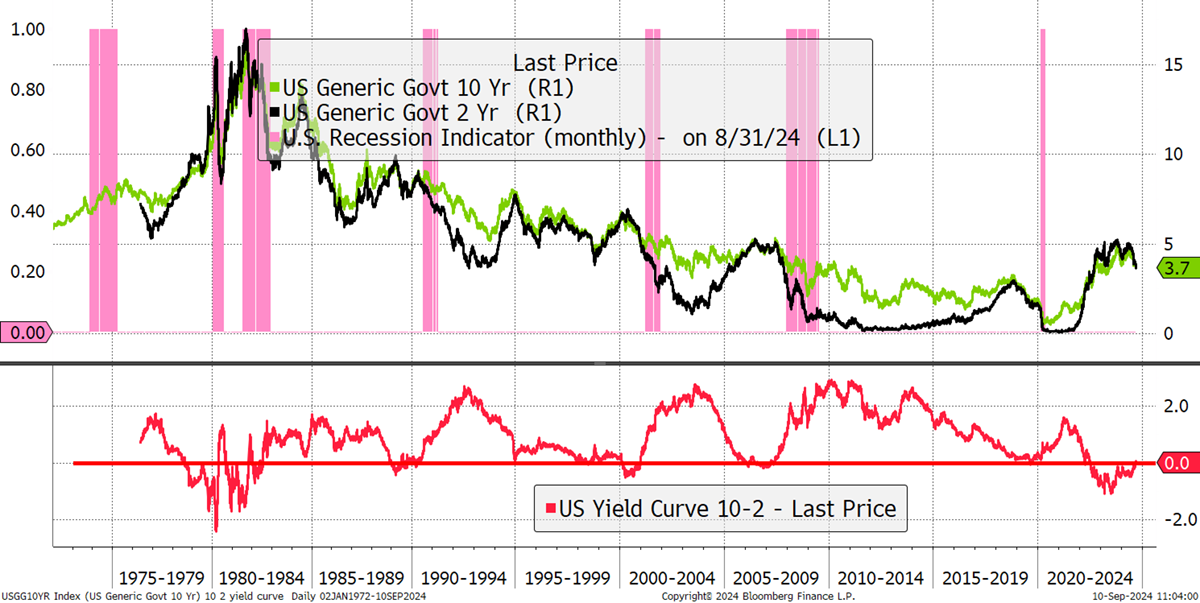

The big news this week came from the US bond market, which saw the yield curve normalise for the first time since mid-2022. That means the 10-year bond yield is now marginally above the 2-year yield, and so the yield curve is no longer “inverted”. This is the normal state of affairs because it incentivises the banks to make long-term loans, as long-term rates, where they lend, are higher than short-term rates, where they borrow.

Yield Curve Normalisation

Yet an inverted curve is thought to forecast a recession (pink verticals), just as it did in 1982, 1989, 2001, 2007 and 2020. Yet those with an eagle eye will notice that the inverted curve warned of trouble ahead, but the past recessions didn’t start until the yield curve normalised. Might this time be different?

It is hard to say because it’s September, the month of uncertainty. Tomorrow, the US releases inflation data, which is likely to be soft, and next Tuesday, we will find out not only the scale of the rate cuts but the accompanying message. Is it a weak economy or justified easing in the face of falling inflation? The messaging will be more important than the level of the cuts.

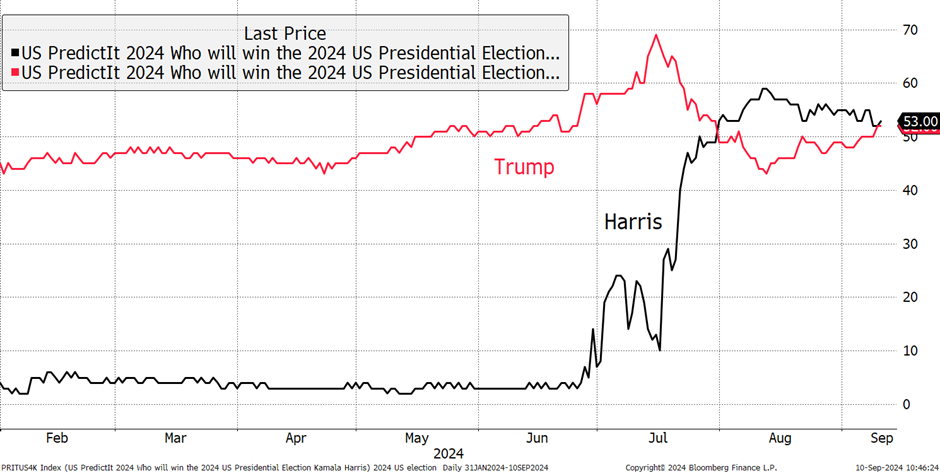

If the macro isn’t enough, there’s US politics, which are neck and neck. Tonight sees the first TV debate between Trump and Harris, which will be eventful. Presumably, Harris is more of the same, and Trump is more of what was before, but with experience to get things done. The stockmarket has done well under both regimes, but even the US stockmarket can have too much of a good thing.

US Presidential Election Polls

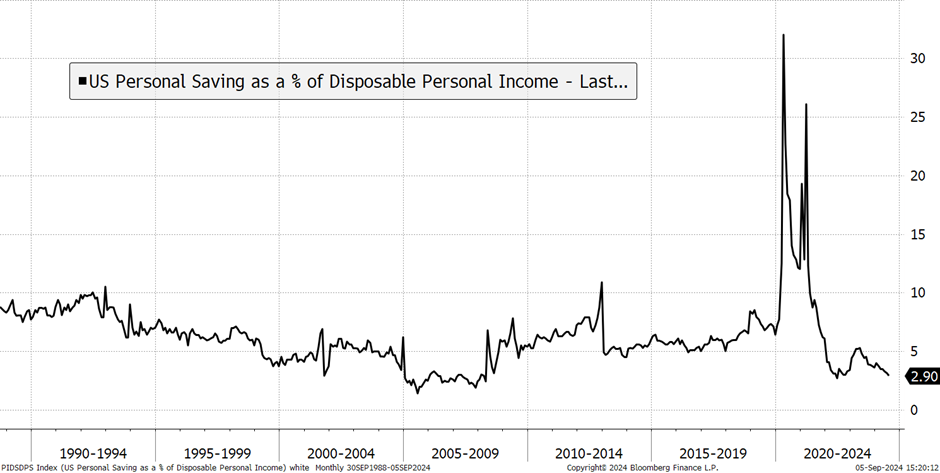

There are still some other inconvenient truths, such as rising unemployment, weak commodities, sluggish industrial demand, and this chart. The pandemic saw personal savings surge, but that is well and truly behind us. We are seeing a squeezed consumer, from which lower rates can’t come soon enough.

Consumer Savings Weak

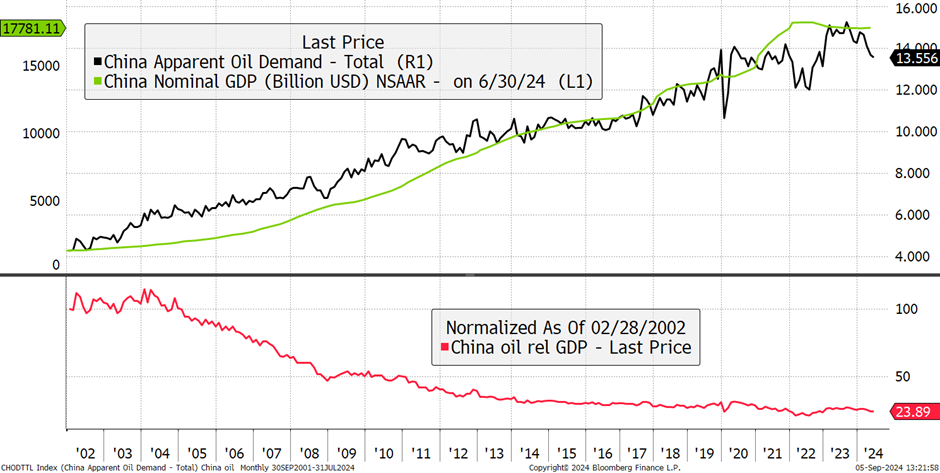

Not to forget China, which continues to slow, as shown by its consumption of oil. I show Chinese demand against nominal GDP, which has grown 13-fold over two decades when oil demand was up 3x. The Chinese economy is less dependent on oil to grow than it was 20 years ago, which is normal as an economy develops. Yet demand (green) has levelled off, and this is further evidence that the post-pandemic Chinese recovery has been underwhelming.

Chinese Oil Demand Slows

It helps to explain why commodity prices have softened in the face of lower demand. The squeeze from the pandemic disruption years is behind us, and previously reliable Chinese demand has become sluggish.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd