Issue 41;

In a recent piece, I made the case for why the junior gold mining and exploration stocks would run as the price of gold kept on rising. It takes a lot to get a gold bull market started, but once it’s off, it can keep on going for years. The miners get dragged along until, eventually, investors catch on. As you’ll soon see, there’s no fever like gold fever.

This is the sixth gold miner I have added to Venture since last year. Centamin (CEY) was recently bid for, capturing an 84% profit, with the others still running. The shift has moved from production companies to exploration because that is where the most value can be realised.

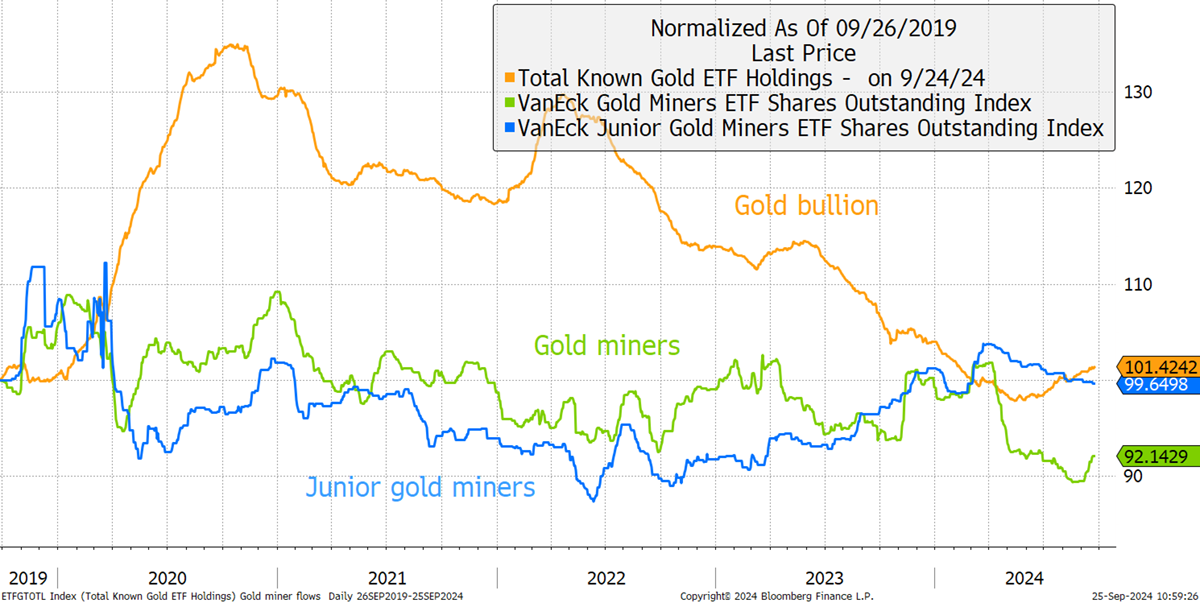

However, while conditions for gold fever are ripe, it hasn’t started yet. The smart money is in, but most investors remain on the sidelines. The flows into the gold ETFs have been negative since mid-2020 and have only just started to rise. The gold miners and junior gold miners have seen outflows this year despite the surge in the gold price. Investors couldn’t be less interested in this once-in-a-decade opportunity.

Flows into Gold and Gold Miners

Yet, 93% of gold stocks are in uptrends, and 82% for the juniors. ByteTree Venture has them on the radar, and with strong gold, low energy costs, a weak dollar, high-spending governments, an unstable world, and complacency on inflation, the gods are on gold’s side.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd