Issue 42;

The price of gold has been strong, driven by many factors, including rate cuts, increasing money supply, investor demand, inflation, a weakened dollar, and the central banks’ demand for an alternative to US treasuries. The big money is behind this trend, meaning that this gold bull market is built on strong foundations.

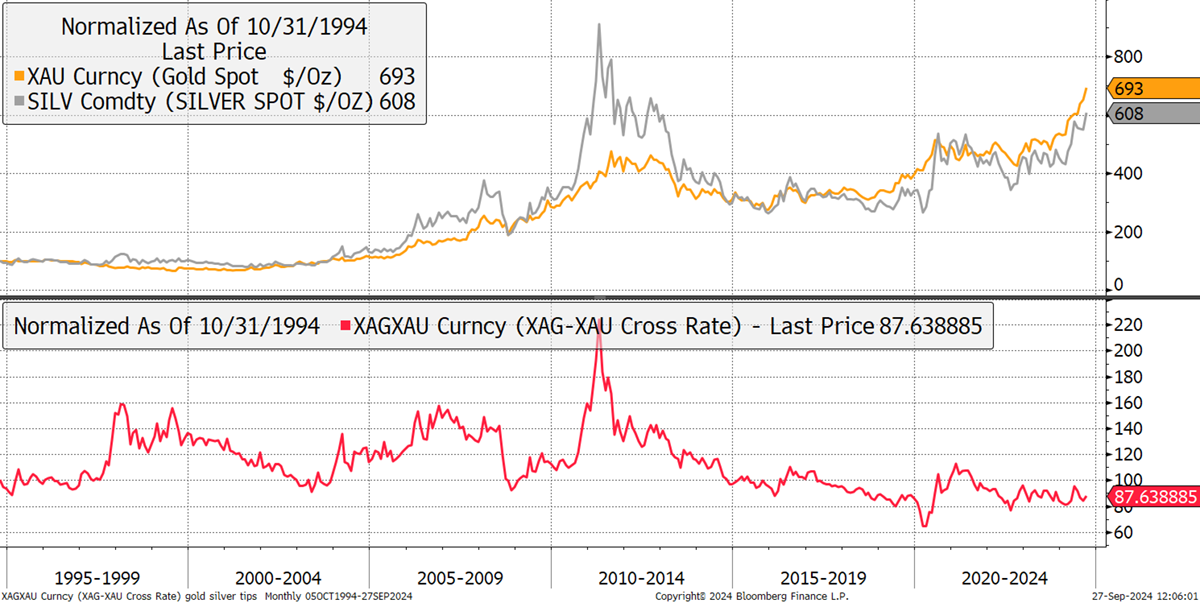

We shouldn’t forget silver. In contrast to gold, central bank demand is close to zero, and investors are yet to notice the recent breakout to an 11-year high. Yet silver has tracked the gold price through the ages. Normally, we expect silver to lead bull markets and slide during the bears. It is more volatile and less liquid than gold, but that makes it more compelling when precious metals are on the up.

Curiously, this strong bull market has seen silver left behind. Over the past three decades, silver lagged 13% behind gold when, at this stage of the cycle, you might reasonably expect it to be ahead. The last silver bull market in 2011 saw the price run to $50 per ounce, which was 120% ahead of gold since 1995. History repeats, and as investors engage with this “stealth bull market”, it is not unreasonable to expect silver to end up ahead.

Silver Catches Up with Gold

I have identified yet another miner with an even greater exposure to silver. It appears to be significantly undervalued, and with the market so strong, it is well-placed to be re-rated.

Fresnillo (FRES UK)

“We are the world’s leading silver miner and one of Mexico’s largest gold producers. We see the enduring value of precious metals beyond the current cycle. We’re profitable and we’re investing in the future. We operate a portfolio of low-cost silver and gold mines and advanced exploration prospects. Fresnillo has always taken the long-term view on precious metals, with a value creation strategy that allows for changing market dynamics.”

FRES is a Mexican family-controlled business, where the Bailleres own 74.9% of the business. This gives the company a low free float and comparatively low representation in the indices for its size. It floated on the London Stock Exchange in 2008 but had been around for a long time prior. It was briefly held in the ByteTree Whisky Portfolio in 2021 and cut before the downturn just above breakeven.

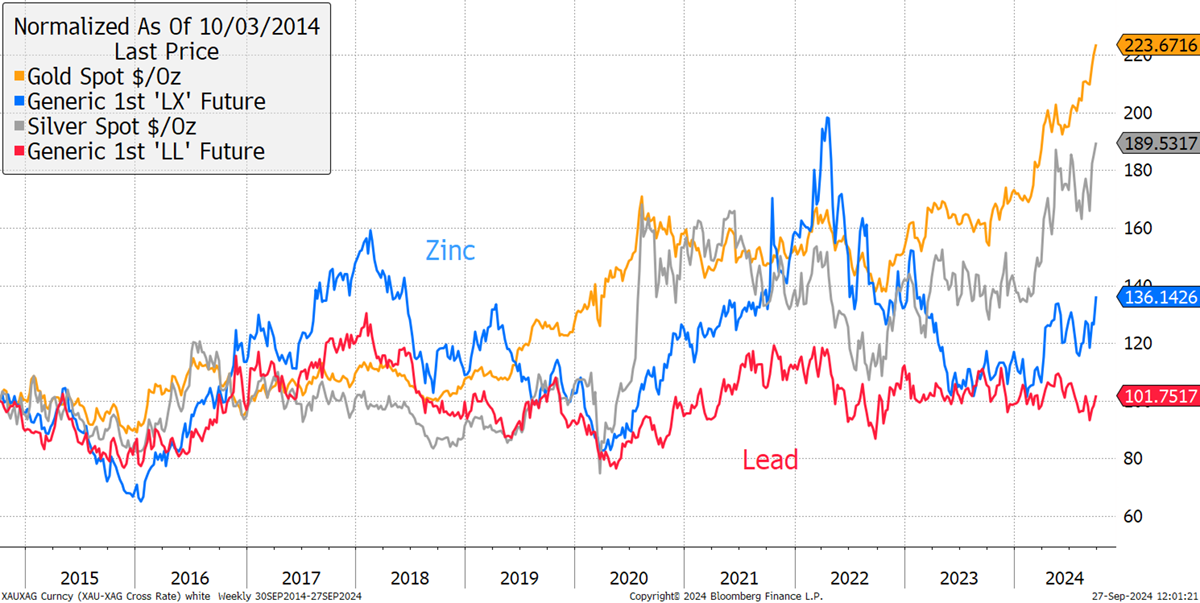

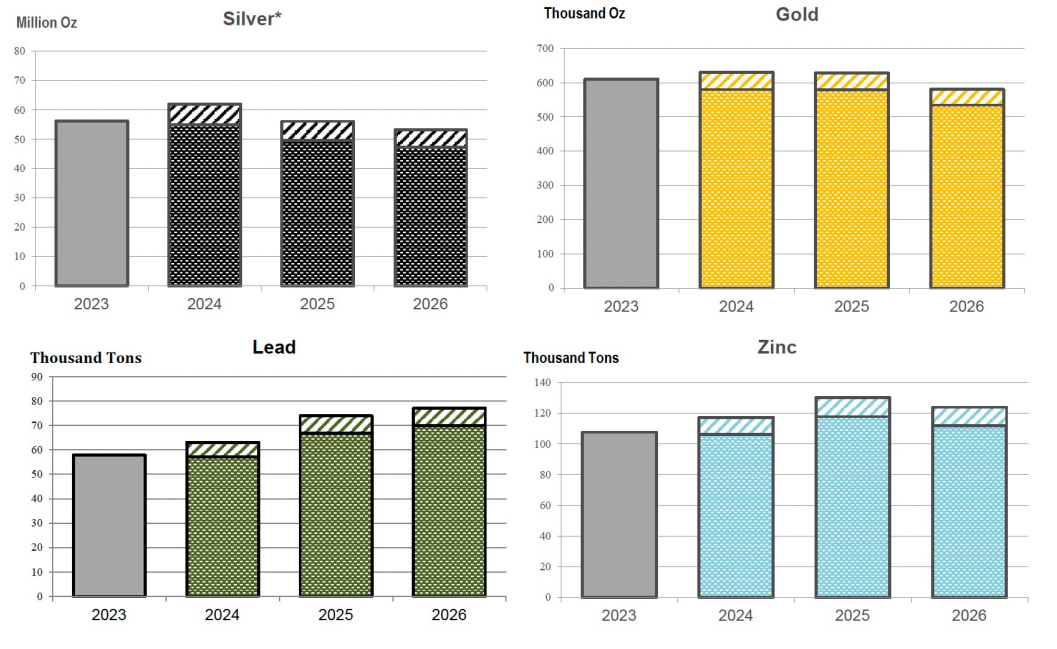

The investment case is value, where the stock has become steadily cheaper over the years despite growing sales. But production has only been growing in silver, lead and zinc, and declining in gold since 2016. I believe this is what the market has been most focused on. Gold is riding high, with silver close behind. Zinc is also rising, with lead lagging behind. But all the metals are either stable or in bull markets. Silver has broken out to an 11-year high, with the potential to surge past gold, as often happens during bull markets. The market is yet to catch silver fever.

Metal Prices – Past Decade

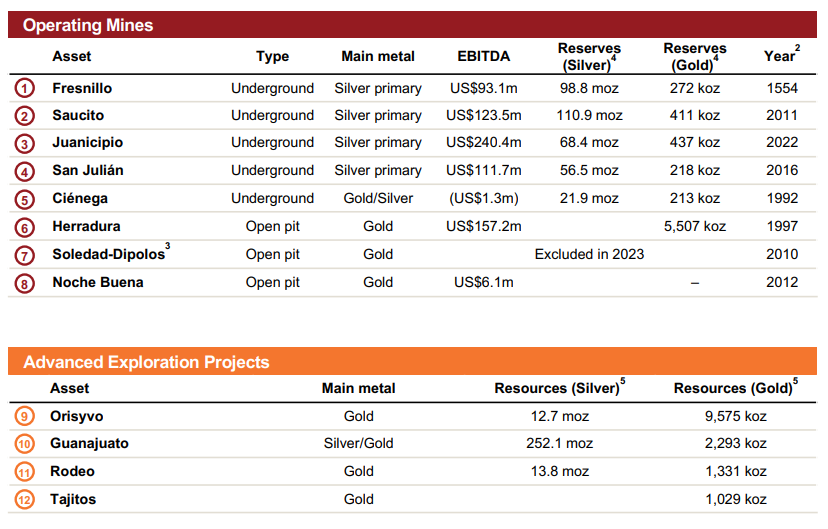

On 16th September, FRES presented at the Denver Gold Forum, and I will share a few observations. It is a diversified business with seven producing mines (Soledad-Dipolos is currently suspended) and four exploration projects.

That makes this a stable company with a diversified earnings stream. The company forecasts increased production in base metals but stability within gold. With CapEx stable, free cashflow will benefit from higher metal prices.

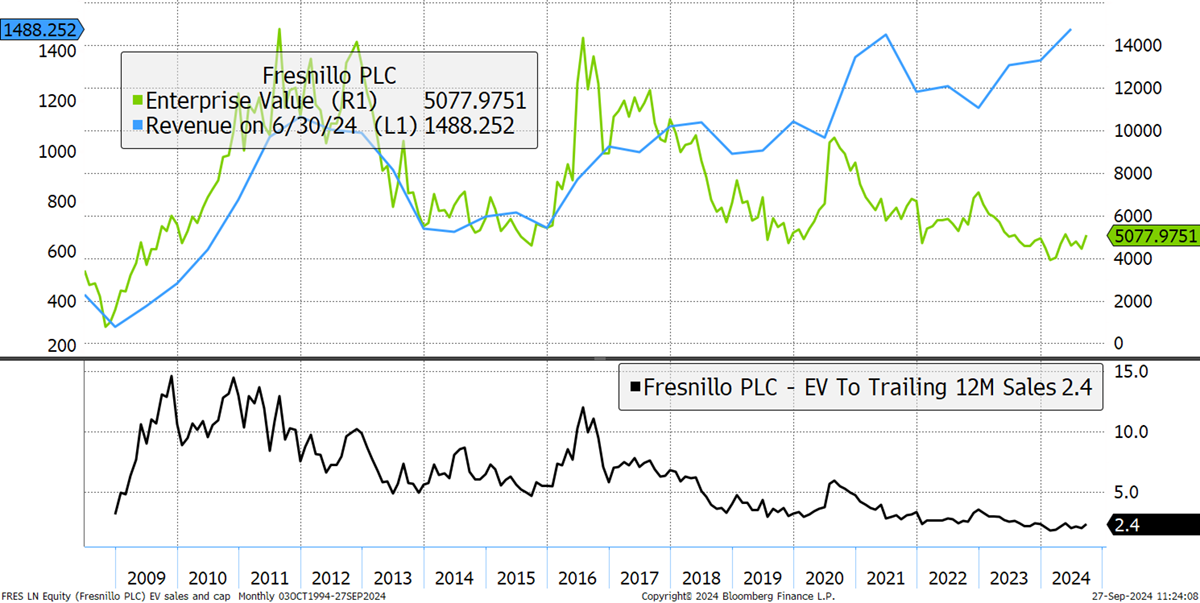

FRES traded above 10x EV to sales in the 2010/11 gold bull market, when silver touched $50 per ounce ($31.9 current), and today it trades at 2.4x. This is a significant discount to the company’s own history and the sector. That would rank 54th of the 76 producing listed miners in my model, demonstrating it is cheap in absolute terms.

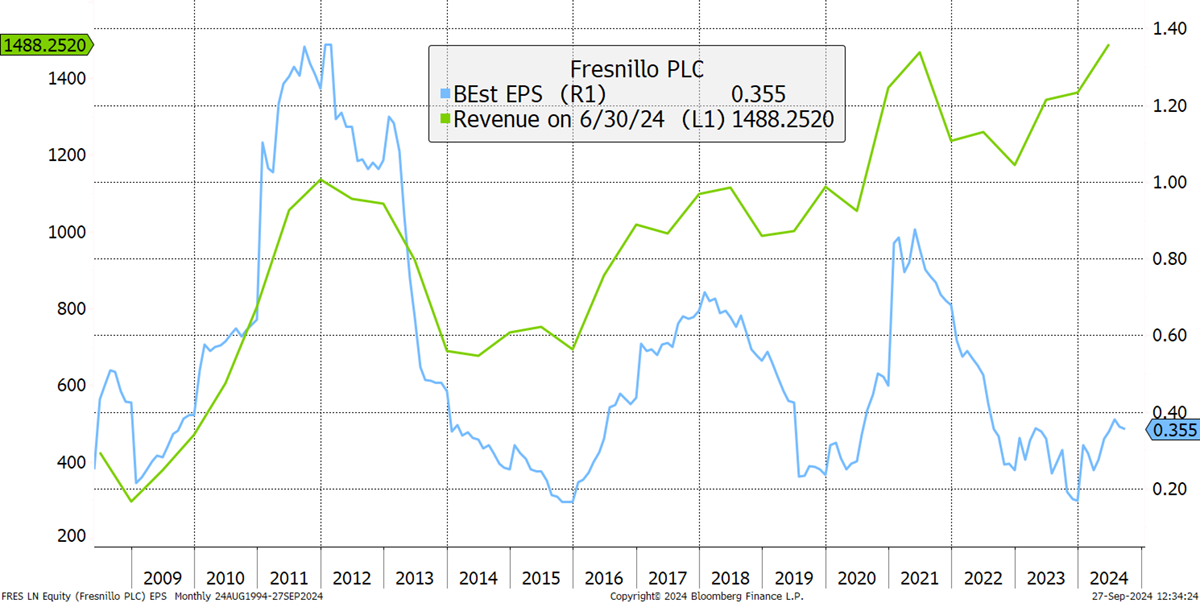

Fresnillo Has Sales Growth and a Low Valuation

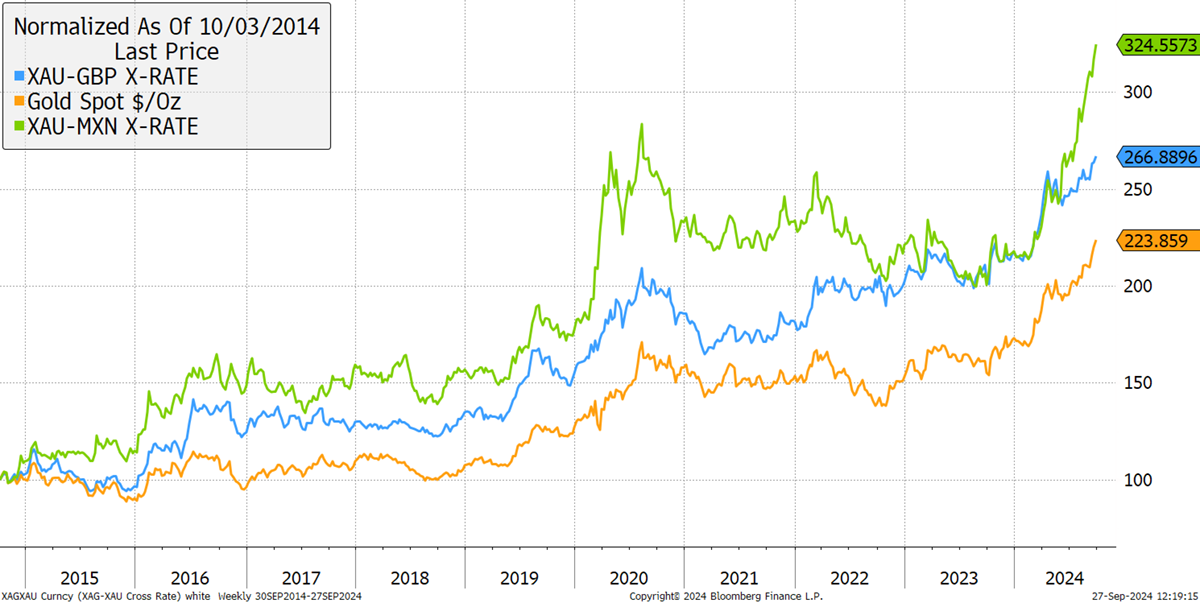

I would also add that the weak Mexican Peso has been a tail wind as costs are in MXN and sales are in USD. Using gold to illustrate this, there are substantial upward revisions on the horizon. I show the gold price in relevant currencies. Notice how the MXN strengthened post-2020, which would be a reason for lower margins since. Now that MXN is weakening again, that headwind will become a tailwind. I show gold in GBP because that is relevant to the country of listing.

Gold in GBP, USD and MXN

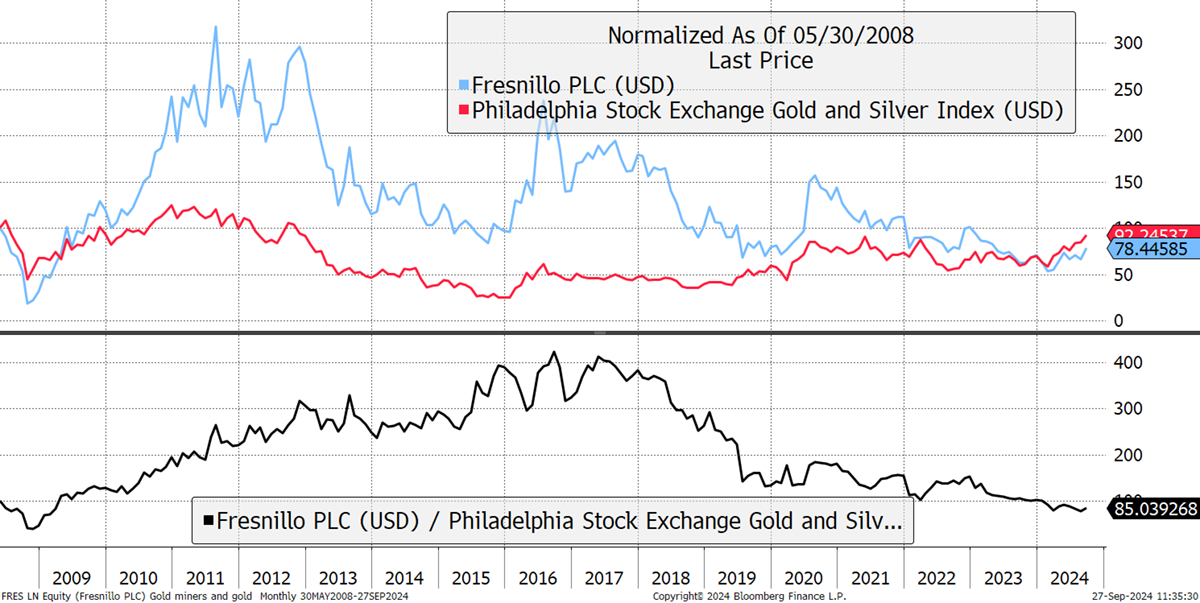

FRES outperformed the gold mining sector from the IPO until 2017 and then lagged. This multi-year derating means it has only lagged the sector slightly since IPO, having given back the pre-2017 lead. The last six months have seen FRES perform in line with the sector, which means it is no longer lagging and is primed to outperform in a bull market.

FRES and the Gold Miners

The balance sheet is strong, with a modest debt of $850 million equivalent issued in MXN. It trades on 1.5x book. It increased equity by 2% in 2013, but none since. Being majority-held by the family, buybacks are unlikely. The dividend yield is 1.3%, having cut back the payout in recent years. That has maintained the balance sheet strength.

In Q2 results, the CEO, Octavio Alvídrez, said:

“The Group has maintained the steady operating performance demonstrated in the first quarter and we remain on track to meet full year guidance. I am particularly pleased with the strong output from Saucito which has offset a slightly weaker performance at the Fresnillo mine. I would also like to highlight the excellent work done by the team at Juanicipio where we have gained access to higher grade areas, and Ciénega where we have reported a strong rise in gold output. The period was not without weather-related challenges, as heavy rain impacted Herradura. The Herradura team has done a fantastic job in ensuring access to higher grade areas which will result in higher gold output in the second half of the year. Our priorities for the second half are unchanged. Safety is of paramount importance where we will look to build on the strong safety performance in the second quarter, while we will also focus on delivering the maximum performance from all our mine sites.”

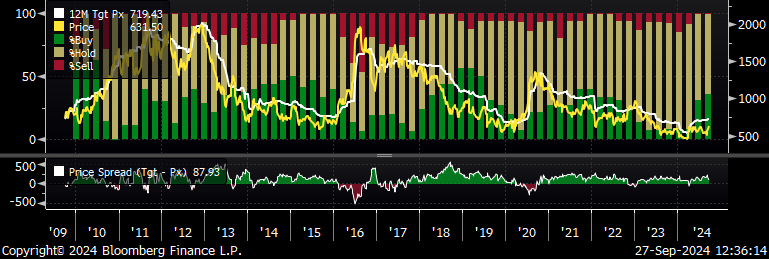

Fourteen analysts cover the stock, with 5 buys and 9 holds. The target price is 719p against the current price of 628.5p (range 620p to 1130p), implying a 14% upside. There is division among the analysts, which is often the way at turning points. There was just one buyer in March, and now five, and no sellers. That is encouraging, and I believe the consensus is too focused on current gold production and underappreciating “where the puck is headed.”

Fresnillo Analyst Forecasts

You can see why there are sceptics as earnings have lagged sales, but that is likely to change. Upgrades have been coming through since March, and free cashflow forecasts point towards $532 million for this year and $645 million for 2025. That implies a forward-looking free cashflow yield above 10%.

Fresnillo Profitability Has Lagged

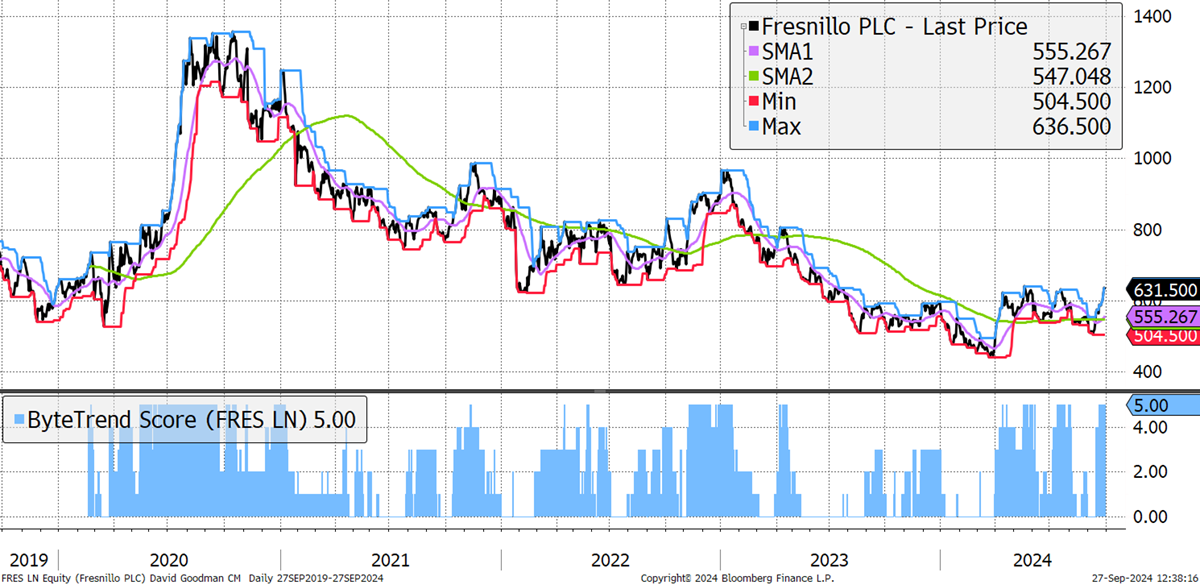

Technicals

The shares have a ByteTrend score of 5/5, with a notable higher low since late March, meaning the share price is in an uptrend. There is some minor resistance at current levels, with the likelihood of a breakout should metal prices remain firm.

Fresnillo Uptrend Begins

This company has robust operations and, while not strong on production growth, has exploration projects that are not included in the current forecasts. These are due to come on stream between 2027 and 2029, where gold production will rise substantially.

With a low valuation, FRES has high operational gearing, meaning it has the potential to become a leader in the next stage of this bull market in precious metals. I do not believe this is currently priced in. It is a compelling opportunity for cautious gold and silver bulls.

Risk

The shares are surprisingly liquid for a company with a low free float, trading on average £4.1 million per day. The volatility is low for a miner at 36% over the past year, ranking 64th lowest of the 76 stocks in my producing universe, just above the royalty and streaming companies. That is low for a producer and reflects that this is materially less risky than most in the sector. The other risks relate to currency, where a surge in the MXN would see downgrades. There is the potential for environmental and operating risk, and above all, the price of metals, which the investment case depends on. I deem FRES to be medium to high risk.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd