Working Together

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD Index Monthly Rebalancing Report;

The Vinter ByteTree BOLD1 Index (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

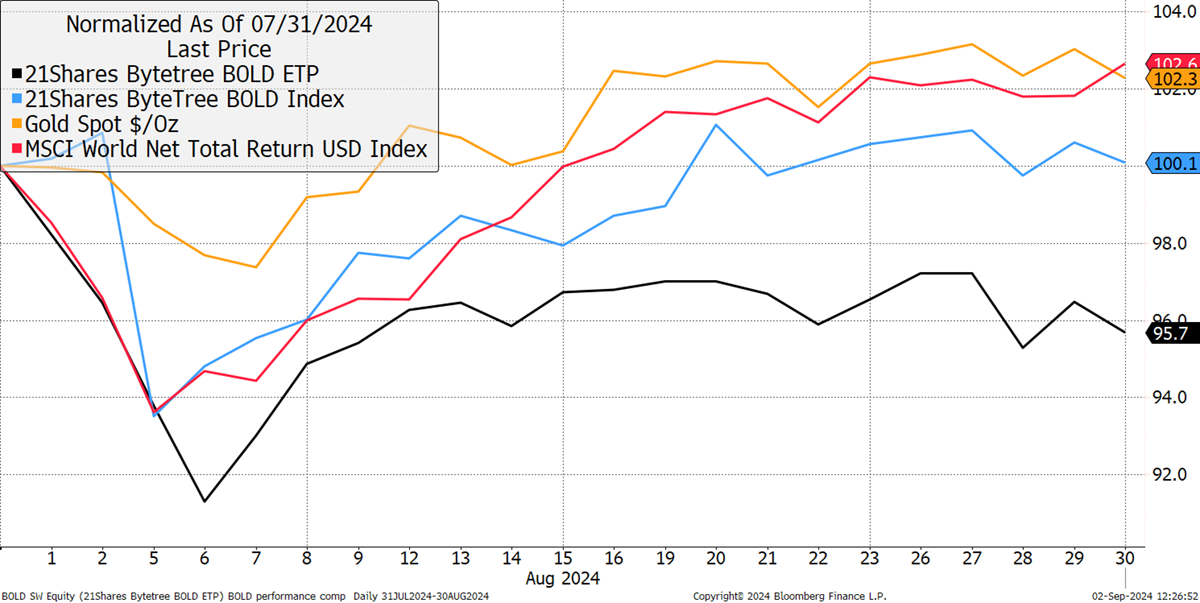

In August, BOLD rose by 0.1%, Bitcoin fell by 8.7%, Gold rose by 2.3%, and global equities rose by 2.5% in USD terms. The target weights last month were 25.3% and 74.7% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 22.6% and 77.4%. This means the latest rebalancing has seen 2.4% added to Bitcoin and correspondingly reduced from Gold to meet the new target weights.

Bitcoin, Gold, BOLD and Equities in August 2024

BOLD Performance

Over the past year, Bitcoin’s performance has returned 102.2%, in contrast to Gold with 27.4%, while equities rose 21.5%. BOLD has returned 47.5%.