Bitcoin Makes a Higher Low

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 128;

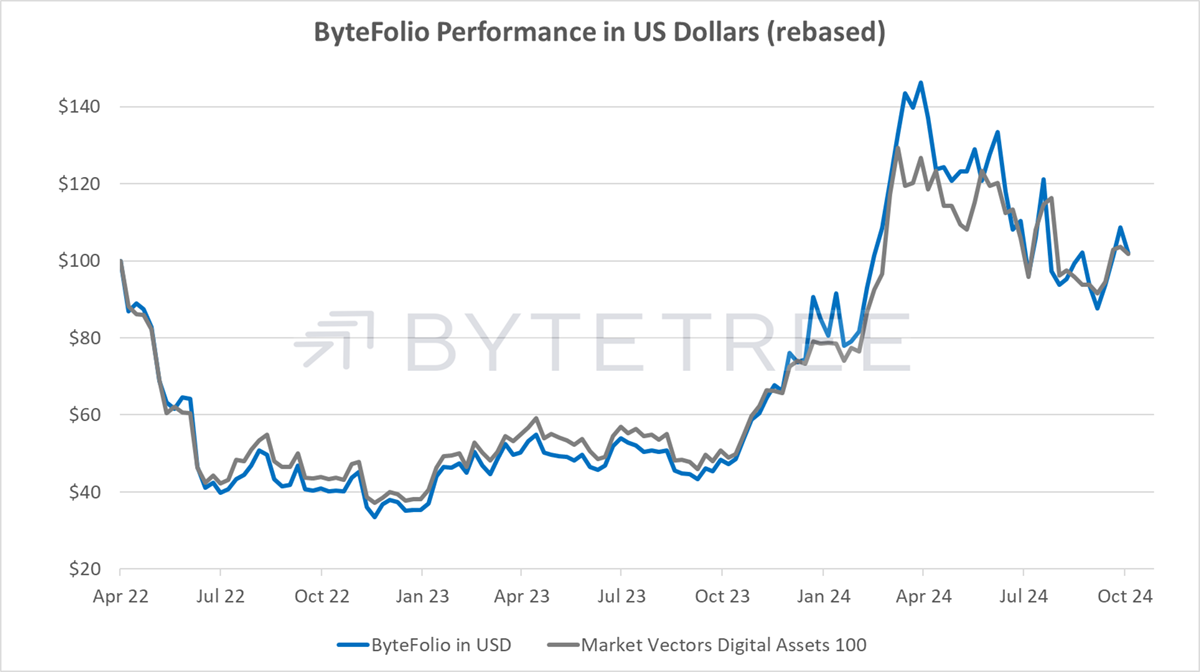

There was great expectation this month, but it started with a crack. The good news is that the price made a higher high at the end of September, and as of last week, it made a higher low. That could mean a bullish change in the trend. It makes sense, as expectations were high, so a modest bump isn’t unreasonable. That $60k held is encouraging. If the price takes out the September high, I suspect the animal spirits will fire up again.

Bitcoin Makes a Higher Low

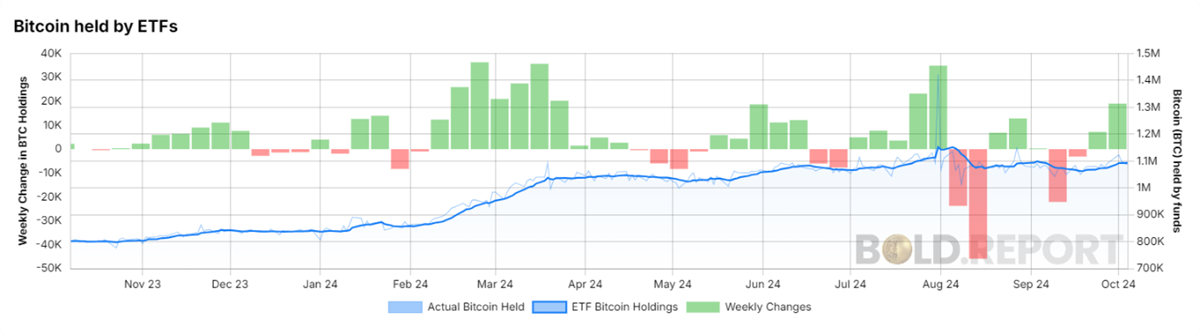

The market is prepared for an uptrend as investor flows are positive, with two healthy weeks of inflows. iShares Bitcoin (IBIT) is firmly in the lead with continuous positive flows. Grayscale (GBTC), on the other hand, has been the main source of the outflows. With these stabilised, inflows are likely to remain consistent, which is a requirement for a bull market.

Bitcoin ETF Holdings

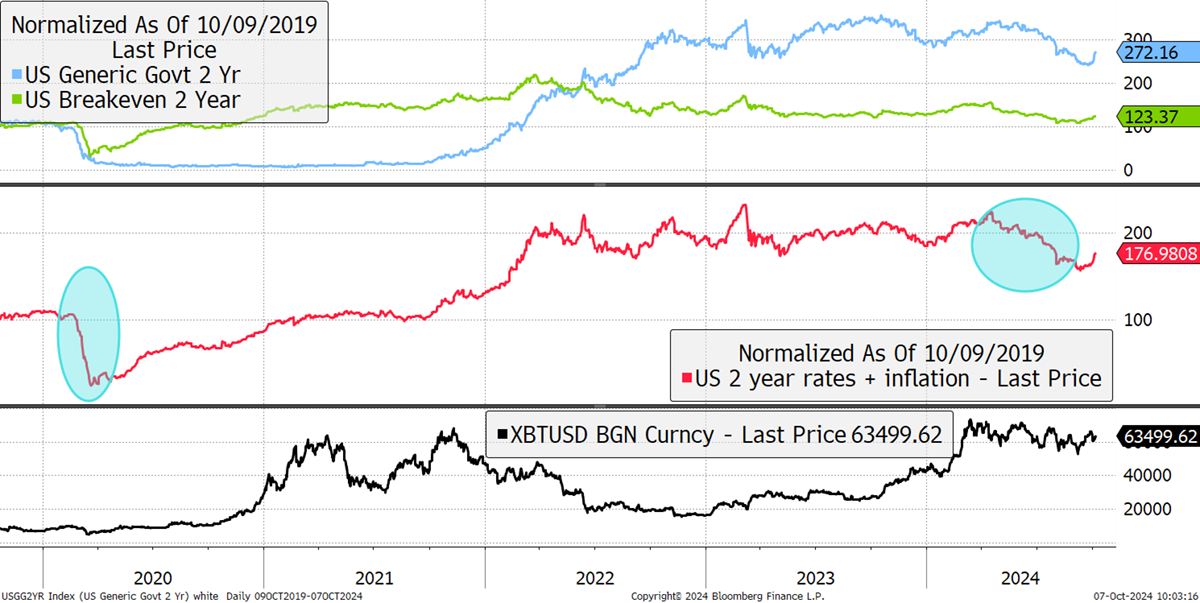

The other good news is an upturn in bond yields (blue) and inflation (green), shown added together (red). Investors often get confused by this. Bitcoin does not so much like easy money (that’s gold) but rather hot money. More inflation and a stronger economy mean things are heating up, and Bitcoin likes that.

Money Is Heating Up