In this quarterly update, I shall review the Soda and Whisky Portfolios alongside Venture, our deep-value research service.

ByteTree offers active investment management research. Active, as opposed to passive or index-tracking, means active management delivers an outcome that will often differ from the market, either better or worse. Over the long-term, ByteTree’s performance has been resoundingly better than the market, but over the past 18 months or so, it has been challenging. The main reason is that a few large and highly valued companies (NVIDIA, Apple, etc.) have overwhelmed market returns.

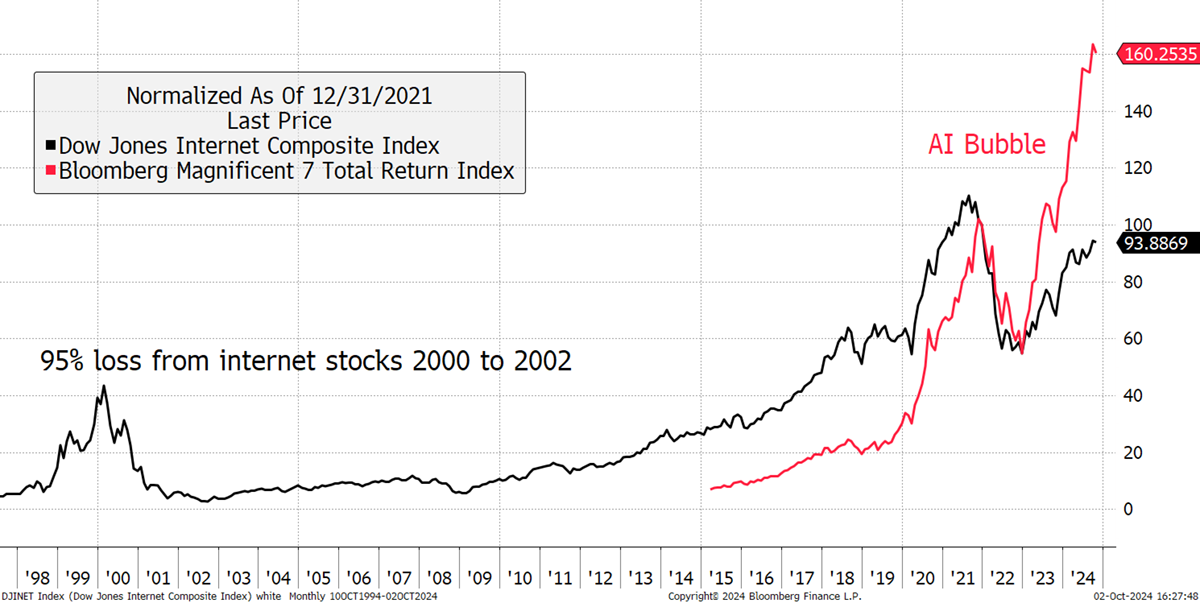

At ByteTree, we are value investors and, as a result, and to our detriment, we have not owned the big tech stocks. The artificial intelligence revolution is exciting, but valuations are most likely ahead of reality. AI will change the world, just as the internet did, but that doesn’t mean the stockmarket won’t be shaken. At the turn of the century, the internet stocks fell 95%, despite bullish predictions being right… in the end. They were certainly right about the future success of the internet, but many of the leaders at the time didn’t survive.

High Valuations Lead to Painful Corrections

Amazon was a notable exception, although what it became post-2000 was quite different from what it had been. It had to adapt to survive.

Since the end of 2022, the seven largest technology stocks have risen in value from $6 trillion to $14.4 trillion, creating $8.4 trillion of value. For reference, the NASDAQ Index was valued at around $4 trillion during the 2000 bubble, and the S&P 500 was valued at $14.3 trillion in 2007 ahead of the global financial crisis. The valuations of big tech are unprecedented and have been the overwhelming driver of US equity outperformance.

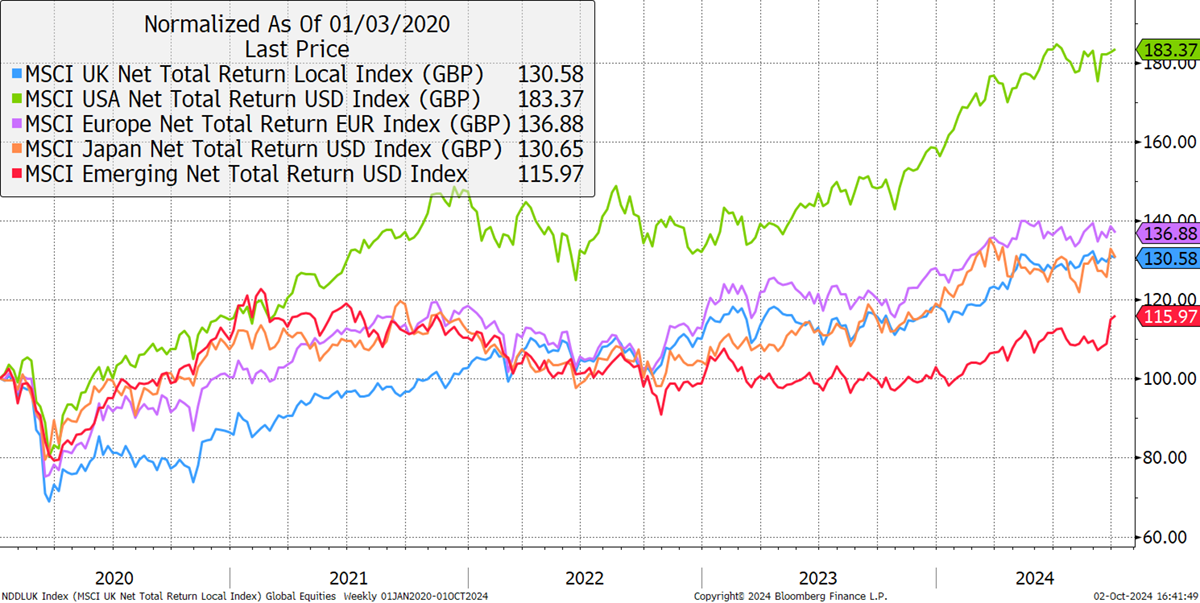

Global Equity Performance by Market – Past Five Years

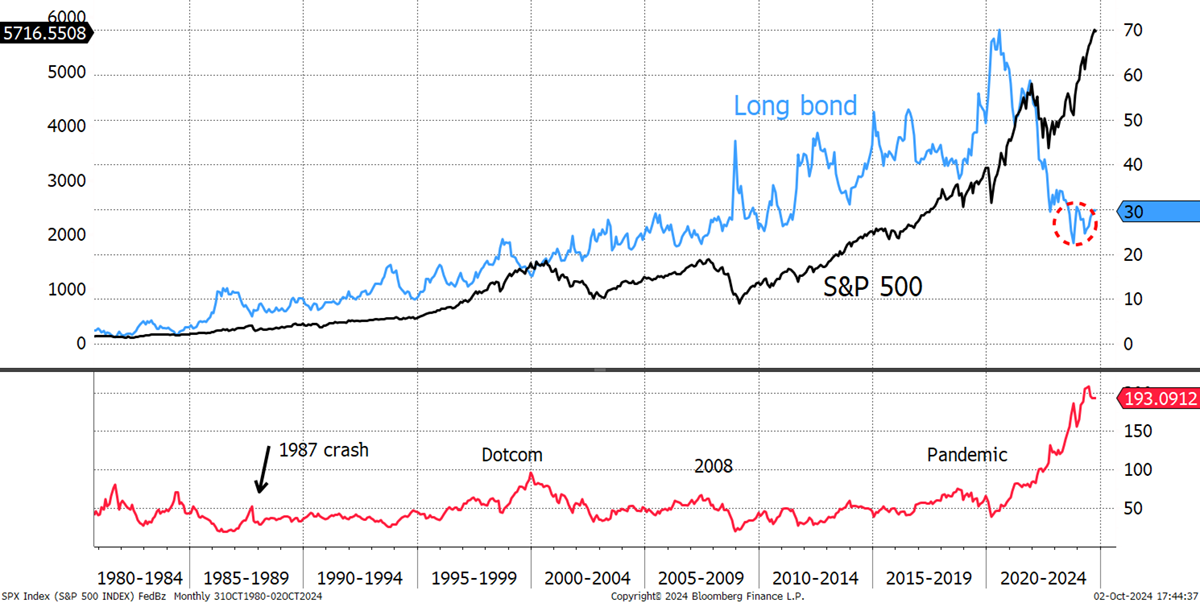

Then there’s the bond market, which welcomed rate cuts around the world, and for the first time since 2020, the bond market rallied. That is normal as the economy cools, but inflation remains above the 2% target, which confuses the situation. Not only that, but long-term inflation expectations have remained stubborn and remain above target. Many believe bonds now offer value, and to some extent they do, but there are unusually large complexities and distortions within financial markets.

Equities versus Bonds

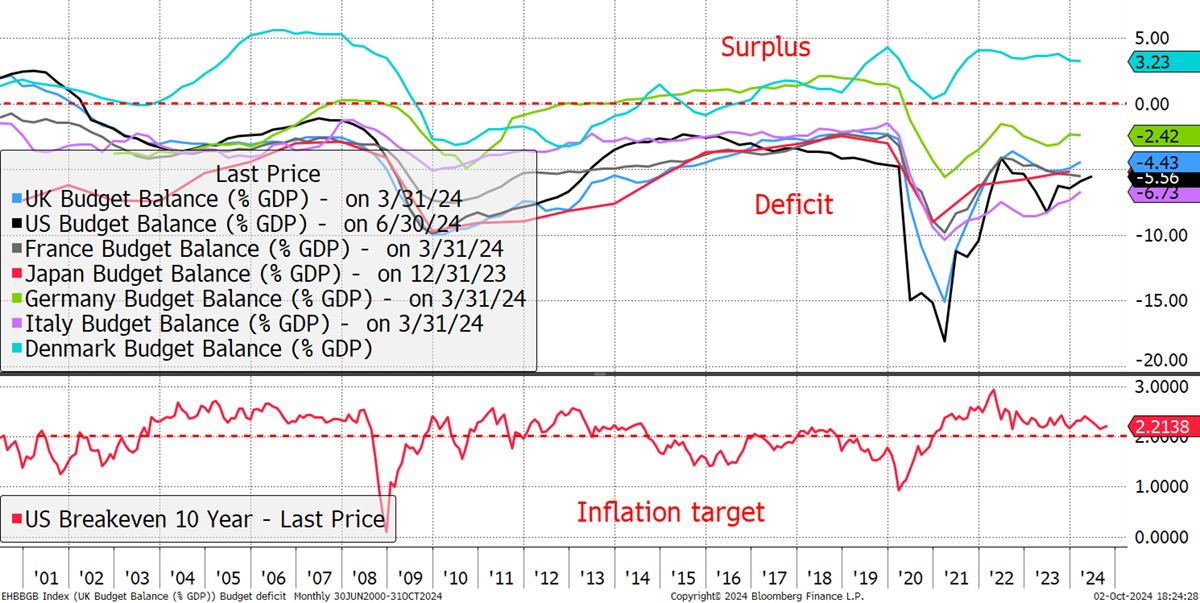

There is also the issue of government spending, where recession-sized deficits have become the norm. Although it isn’t much discussed in politics, there can be no doubt that high spending is another reason why inflation remains high. The government needs ever more money to appease the electorate, and without robust growth, this has become problematic.

Governments need to contain the cost of borrowing, making anti-inflationary fighting talk non-negotiable. Yet, at the same time, a combination of fiscal deficits and stimulus by stealth have kept financial markets afloat. These have not benefitted the real economy but the most liquid financial assets, such as big tech. Financial markets have become the dog, and the real economy, the tail. In the good old days, it was the other way around.

Government Deficits Are the Norm but Not Compulsory

Unlike most countries, Denmark has low public debt and a fiscal surplus, which Germany used to have until the pandemic. As a result, Denmark pays slightly less (0.08%) to borrow money than Germany. France, on the other hand, pays 0.8% more. Back in 2010, the European debt crisis saw the spreads widen, meaning the most indebted countries, such as Greece and Ireland, had their access to capital cut off. It was time for a bailout. This hasn’t gone away and will inevitably come back to haunt the markets again.

It goes without saying that with government bond markets not quite as gilt-edged as they should be, there has been high demand for gold. This has been particularly strong from the emerging economies, which seek to diversify their reserves. Gold has been strong, and silver and the miners have followed, but not to the extent you might normally expect. Once again, money flows to the most liquid assets, meaning gold has also become a primary beneficiary.

Precious metals aside, commodity prices normally reflect the real economy. In recent months, we have seen the oil price slide back to $70 while industrial metals and agriculture have remained firm. As a result, the relationship between gold and oil is stretched, and I can only suspect that when the next upcycle comes, oil will reassert itself. The dash to renewables continues at pace, but in Europe, the result has been materially higher energy costs than in the rest of the world.

And finally, there’s always a source and this time it all seems to trace back to Japan and the weak yen. As interest rates shot up after the pandemic, they remained low in Japan. That led to a source of cheap funding on a vast scale. We know this because when the yen falls, the stockmarket rallies, implying yen loans are boosting asset prices. The unwind has begun, and the yen has turned. Policymakers are keen to ensure that this trend proceeds with caution.

ByteTree Investment Performance

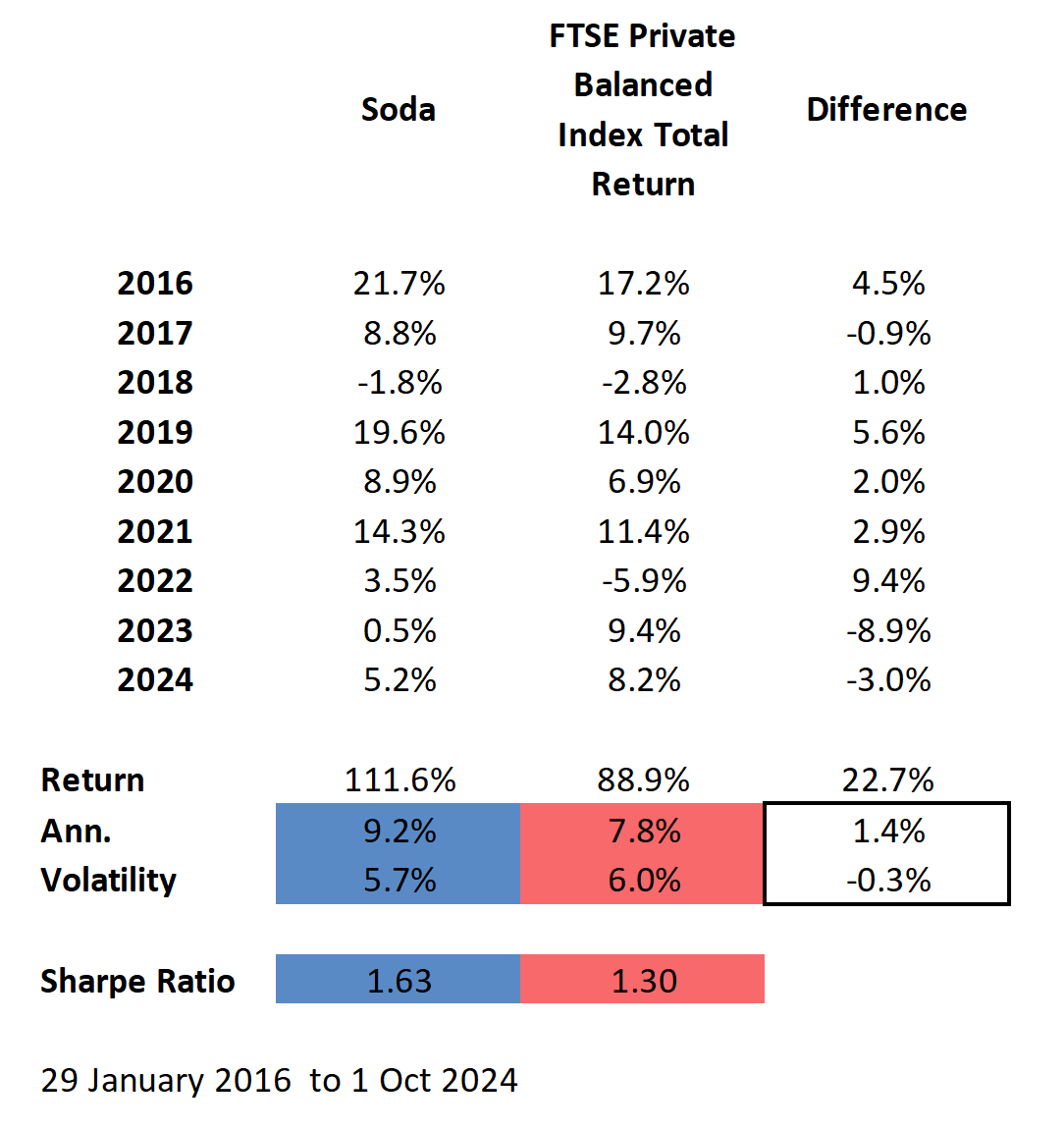

I am pleased to report that both portfolios have performed broadly in line with the market over the past quarter. Soda was slightly ahead and Whisky slightly behind, with Venture delivering some spectacular winners.

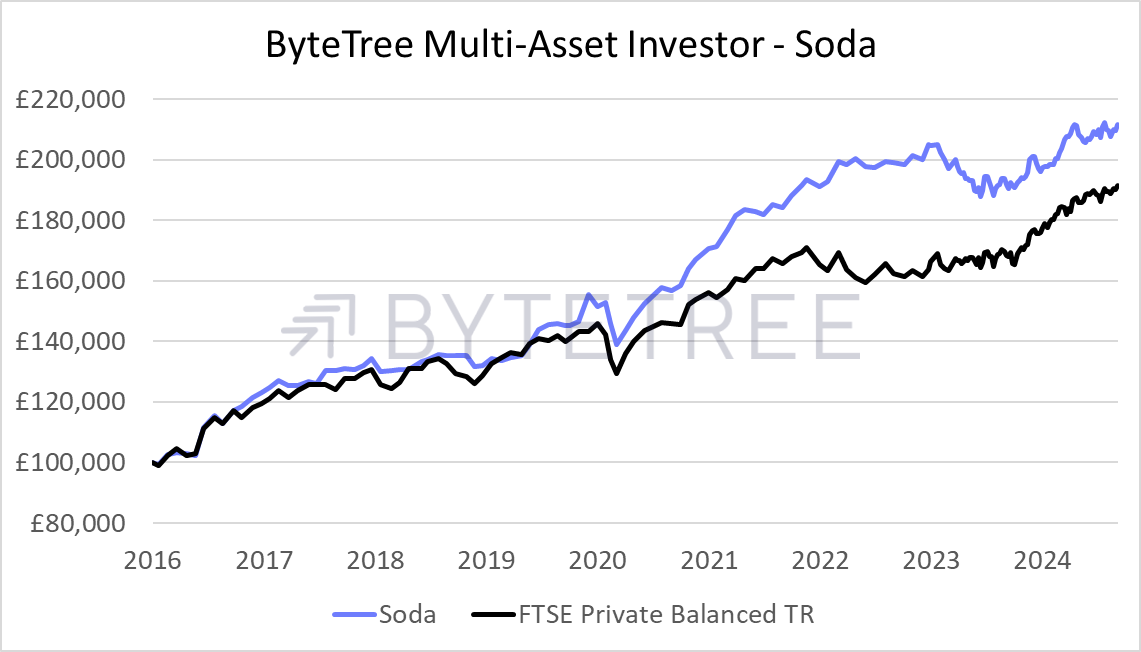

The Soda Portfolio

The FTSE Private Balanced Index, used for comparison, is a diversified 60/40 portfolio (60% equities and 40% bonds). The Soda Portfolio did well during the bond bear market in 2020/22, gave back some performance in 2023, and is now more or less back on track. I believe the major stockmarket indices will slow, along with the bond market, which will play to Soda’s strengths.

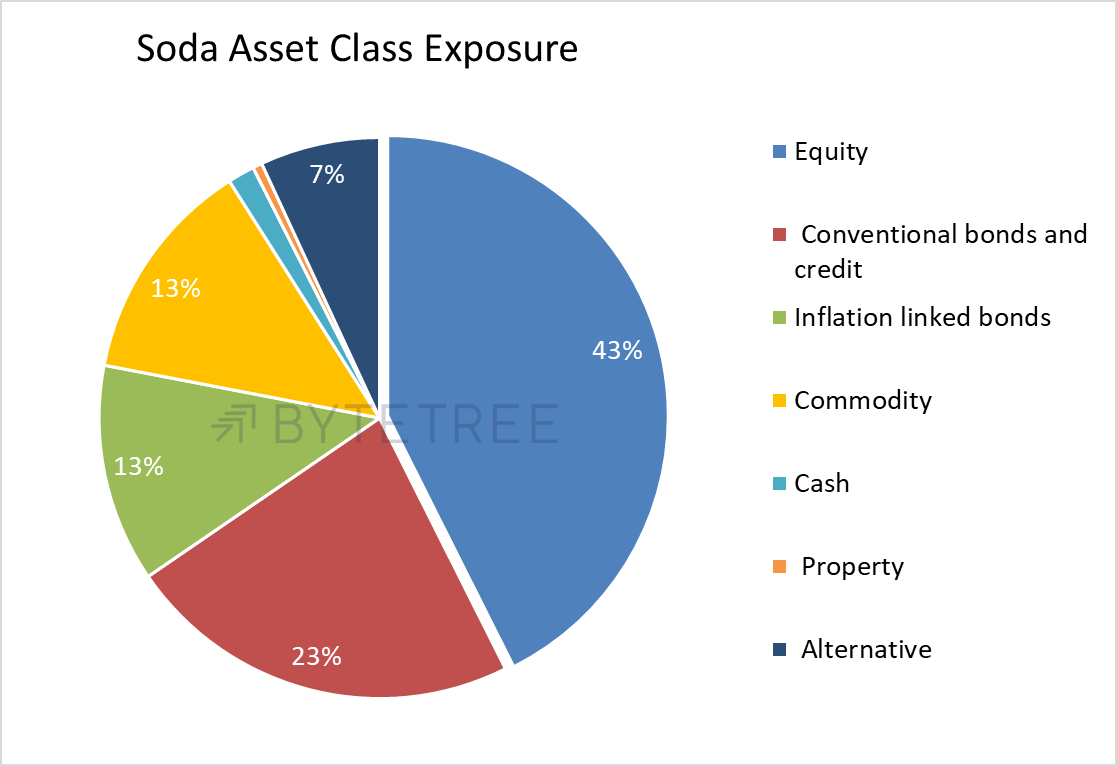

I say that because the Soda portfolio has been somewhat defensively positioned, as it normally is. The equity exposure, at 43%, is 17% below the 60/40 portfolio, but with much of the exposure held via discounted investment trusts, there is more potential upside. Furthermore, there is a hard asset bias, including gold, energy and miners, which will do well in a soft dollar environment, which is seemingly a US policy objective.

Soda’s defensive nature has often held it in good stead, especially in the more chaotic years. I believe the current asset mix will see market-beating returns will resume. The portfolio has been less volatile than the market despite the 60/40 holding many thousands of investments (shares, bonds, etc.). This is down to the absolute return nature of the portfolio, which focuses on efficient diversification and value-oriented opportunities.

The post-2016 results still see significant outperformance, but I won’t be content until Soda is, once again, widening the lead over the market. This is not just a matter of finding profitable investments but avoiding bad ones. The last two years have seen asset prices rise across the board, making it hard for active investors to differentiate themselves. With the benefit of hindsight, the only trick would have been to have held a meaningful position in the NASDAQ index, which I failed to do. I very much hope that not owning the NASDAQ will be fruitful from here. Valuations truly are jaw-dropping. Soda has done well to preserve capital during times of financial stress. That remains a core objective.

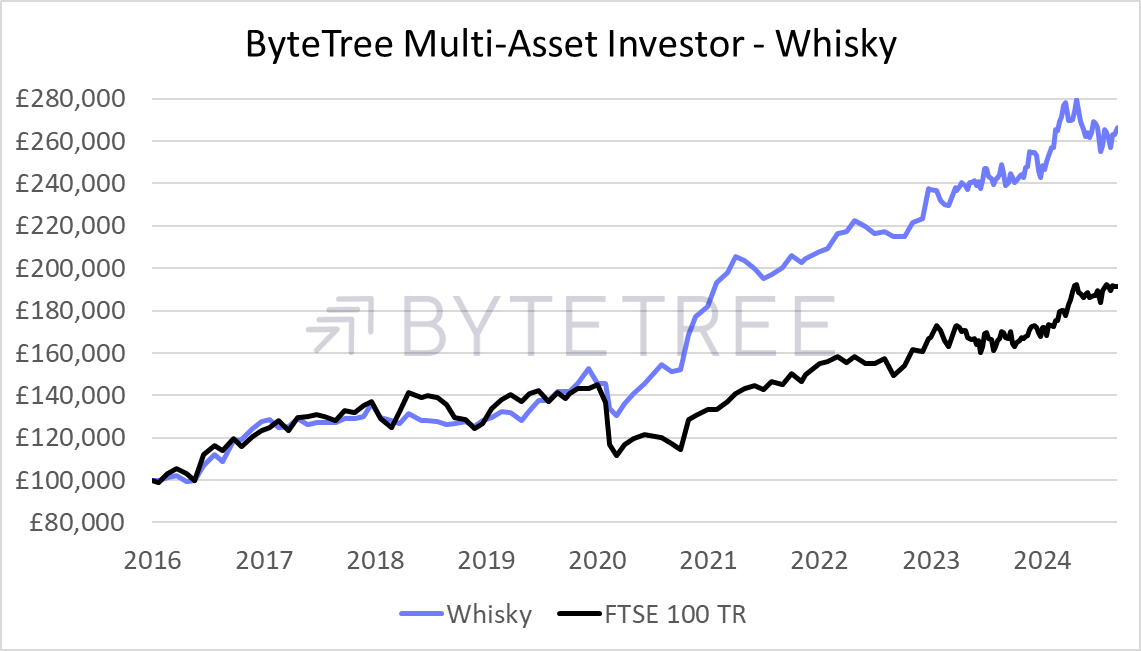

The Whisky Portfolio

The Whisky Portfolio was +10% in April before giving it back over the summer. This happened despite high exposure to gold miners and silver. Remarkably, they made no money over the summer as the pound rallied at the same pace. The cyclical stocks, many of which were highflyers in the first quarter, turned down, and despite a strong start to the year, Whisky fell 3% behind the FTSE100 at the end of September.

This occurred when the portfolio held some of the biggest market stories of the year, such as the yen, precious metals, Latin America, crypto, undervalued cyclicals, and, most recently, Chinese technology. Whisky has bounced in recent weeks, and I believe it is well-placed to capture significant upside over the coming months.

The FTSE 100 was driven by banks and stocks, such as Rolls Royce and Marks and Spencer, which I sold too soon. As ByteTree clients have come to expect, Whisky has tended to find winners. So far this year, that has proved to be elusive.

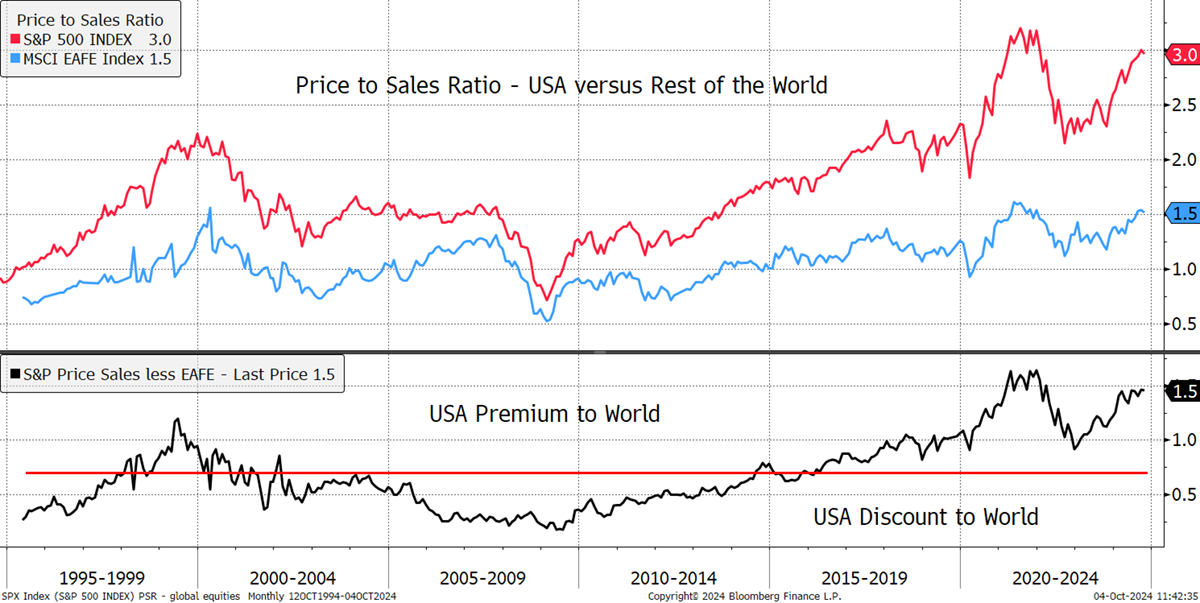

It has been painful being underrepresented in US equities, but valuations are historically extreme, combined with high-profit margins, which historically have always reverted to the mean. I recall the 2000 to 2010 era when the rest of the world was the place to be. I believe those days will return.

Additionally, note how the rest of the world is also towards the top of the range, but there are value situations to be found, and that is where we focus.

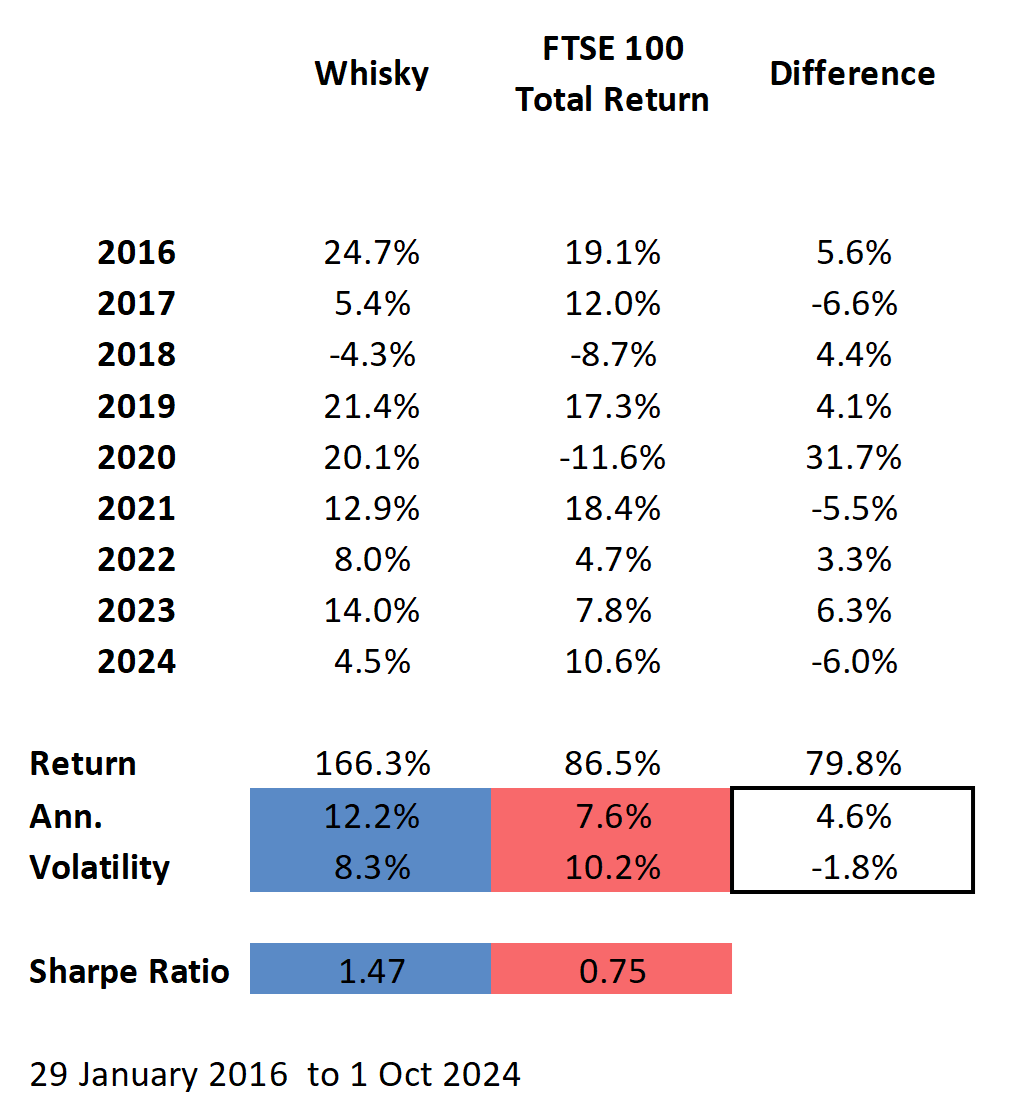

Despite a challenging year, the long-term record remains resounding, with solid outperformance in most years. 2020 was the outlier when the portfolio started out defensive in the face of the pandemic. Whisky preserved capital and took advantage of the value that later materialised. I very much look forward to being able to repeat that in due course.

The long-term record is nearly double that of the market, with greater capital preservation and consistently lower volatility (which helps our clients sleep at night. This is the culmination of many small decisions based on sound financial analysis, which have compounded into a very satisfactory result.

The Multi-Asset Investor

The Multi-Asset Investor is a weekly newsletter containing two portfolios: Whisky (medium to high risk) and Soda (medium risk). Subscribe today and bring Charlie's best ideas into your investment portfolio.

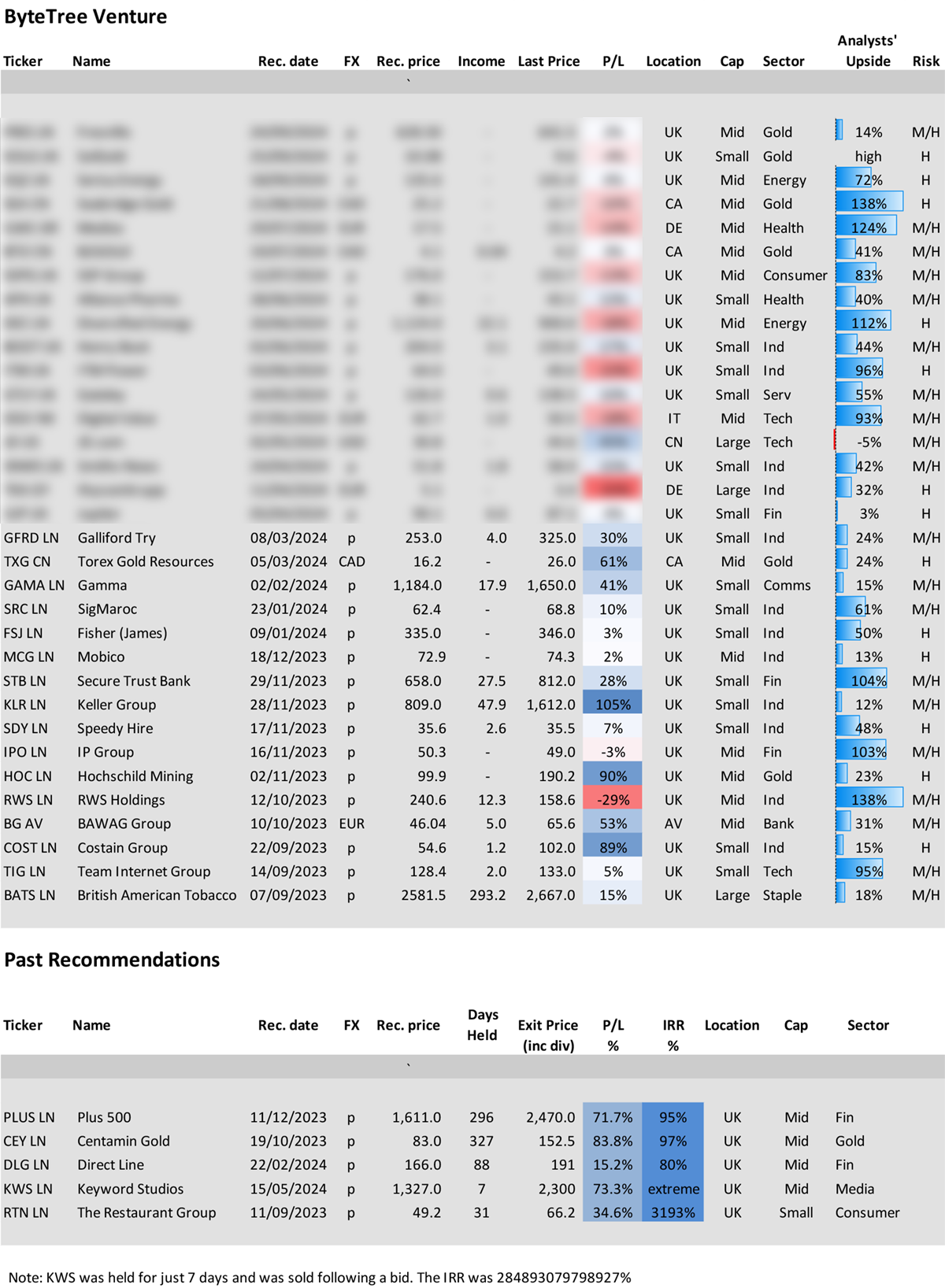

ByteTree Venture

The Venture service was launched just over a year ago, and it has been a success. As I researched stocks, I came across many interesting opportunities that were unsuitable for the Whisky Portfolio because they might be too volatile, less liquid, or a little off-piste. There was clearly an opportunity, and Venture was created for clients who wanted a wider range of attractive investment ideas.

Being essentially global, albeit with a UK/European home bias, there was a sufficiently wide net to identify many deep-value special situations. It just so happens that most of the ideas have cropped up in the UK and Europe because that is where the value has been found. I suspect that over time, this will balance out. Indeed, with the UK market being historically undervalued, it was an opportunity that jumped off the page, and so Venture was born.

There have been 38 stocks so far, with three bids, a failed bid and a sell. Keywords Studios (KWS) was bid for within a week of my note. Some have suggested I knew something; I really didn’t. I just saw the same thing that the bidder (a Swedish private equity fund) saw; that is, KWS was undervalued, and they swooped. The same was true for the other bids; they simply took longer to come to fruition.

Yet there are several high-return stocks that have done well, mainly because they shouldn’t have been so undervalued in the first place. UK equities have seen indiscriminate selling as global funds have reduced their allocation due to overstated political risk. What they missed is that the UK press loves nothing more than bashing Britain.

In addition to the UK, we have identified opportunities in Austria, Canada, Germany, Italy, and China in industrial, technology, healthcare, energy, mining, and financial sectors. In all cases, there seemed to be a compelling opportunity. I will highlight three different examples of companies that are still held in Venture. Each of them presents value in different ways.

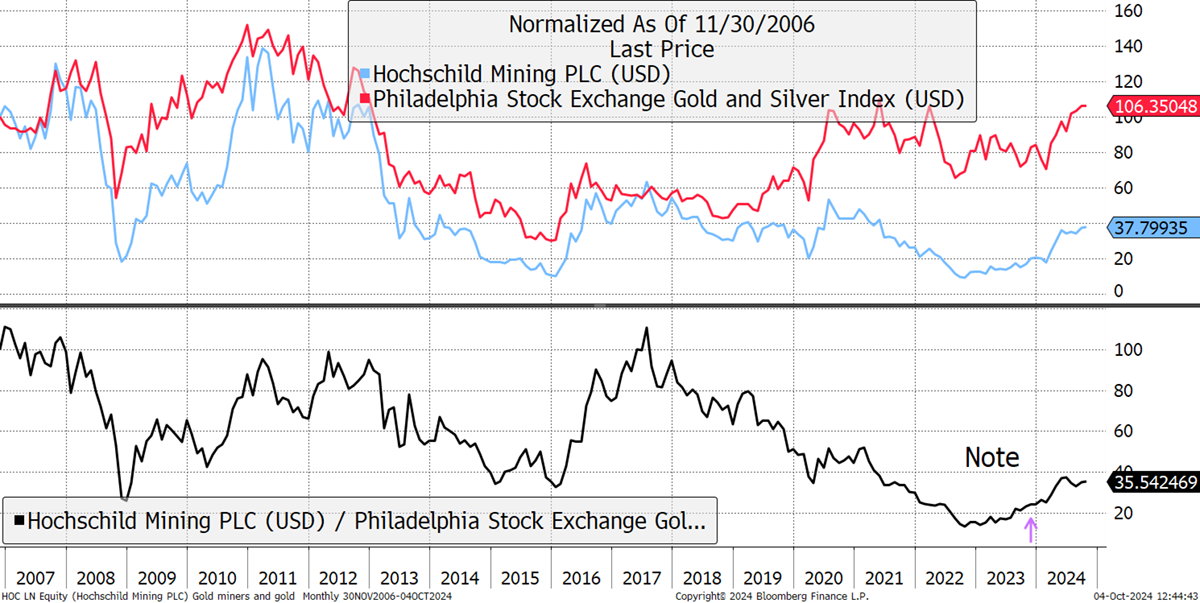

Hochschild Mining (HOC UK)

Here’s an extract from my note last November:

A Leveraged Recovery Play on a Rising Gold Price

“Hochschild (HOC) is a London-listed gold mining company, with mines in Chile, Brazil and Peru, and exploration elsewhere in Latin America. With Federal Reserve signaling peak rates, the outlook for gold has improved, and this recommendation for HOC follows my recent piece on Centamin (CEY).”

“Yesterday, Panmure Gordon upgraded to buy as the Immaculada mine in Peru has extended its life for another 20 years, which means there is plenty of gold to be mined in the future. Furthermore, they added that the Mara Rosa mine in Brazil will move into production early next year. Their price target is 121p, which does not allow for much upside, but the analysts are not factoring in the potential for a higher gold price. Adding that would be a gamechanger… Should gold break much above $2,000, and capture the world’s attention, then all that matters is that a miner can produce enough gold to enjoy the rally.“

Hochschild Lagged the Gold Miners Since 2017

Gold was trading below $2,000 per ounce at the time, and I was bullish. Today, gold trades at $2,660. HOC wasn’t one of the great producers, but it was undervalued on several measures, and that would give it high operation gearing into a higher gold price. An upbeat note on production was a bonus. Today HOC trades 90% higher and has outperformed the gold mining sector by 72%. We hold five other gold stocks, and all of them present interesting opportunities.

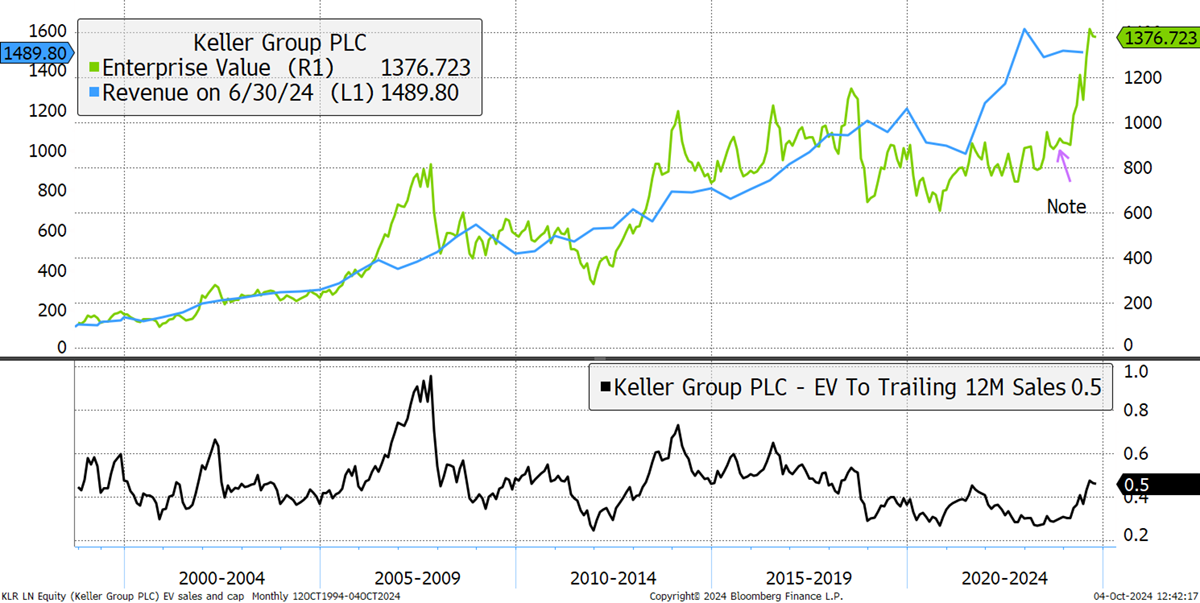

Keller Group (KLR UK)

From my note last November:

“Keller was founded in 1860 and specialises in geotechnical engineering, which basically means the unglamorous part of civil engineering that lurks below the surface. It sits well within the undervalued group of UK small and mid-caps stocks. I picked up on the enterprise value-to-sales ratio, which is historically low, while long-term sales seem to grow steadily… The shares yield 4.7%, and they have grown the dividend for 28 years, which is impressive. The shares trade on 6.2 x ’24 earnings, and the analysts value them at 1247.5p, 51% above the current price. The earnings forecasts have been rising, which is reassuring in an uncertain economic environment.”

Keller Is Back on Track

Not only have the shares recovered, but the analysts’ forecast has increased to 1,807p, a significant upgrade. After 47.9p in dividends, the shares are up 105%. The stock is still in a healthy uptrend, and I will let that run its course.

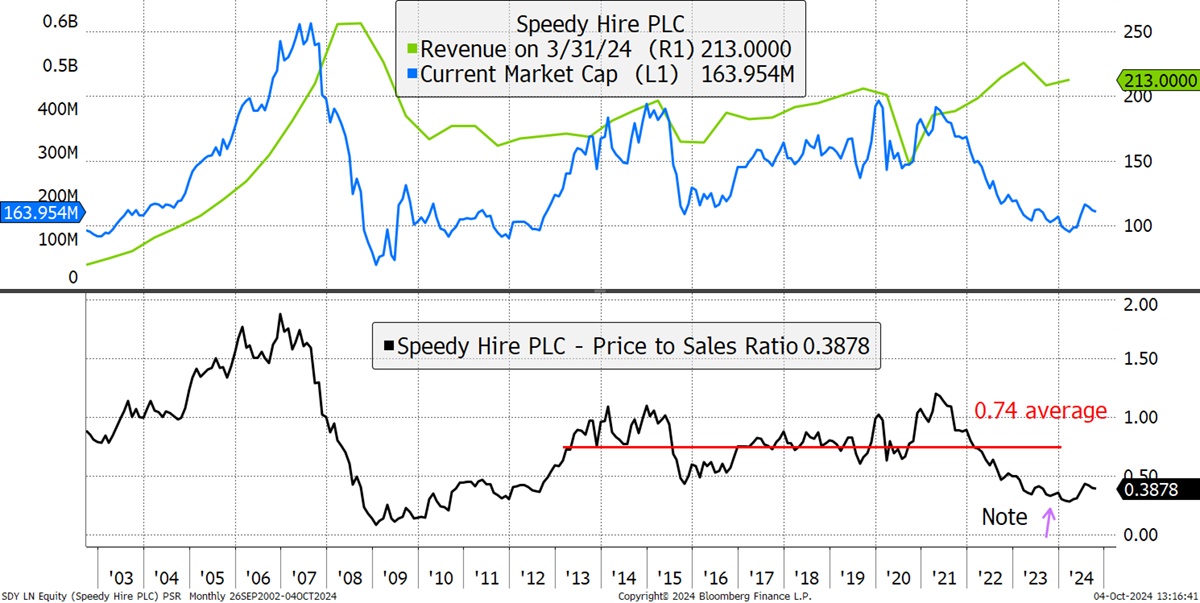

Speedy Hire (SDY UK)

Also, from last November, SDY isn’t racy or exciting. It is simply a cheap UK small cap. From my note:

“SDY is cyclical and dirt cheap. The shares have fallen around 70% since the pandemic despite the business managing to deliver growth. We have seen this before. Before the financial crisis in 2008, they had too much debt going into a recession, and business slumped. There was a discounted rights issue, but they survived. This time, debt is lower, and the company is delivering free cash flow. In the below chart, I show enterprise value to sales over 25 years.”

Speedy Hire is Back on Track

Post-pandemic recovery situations have been a recurring theme. Businesses either go bust quickly or slowly, but if it’s neither of those, they recover. In recent months, the forecasts have improved, and the analysts are all buyers. The company has a strong market position but is cyclical. A return to the 10-year average would see the shares double from here. That might not happen in the near term but seems to be very likely in the future. So far, the shares are up 7%, including dividends, having been underwater for a while. The underlying case is relatively straightforward but requires patience.

Venture

Venture is exclusively included in our Pro subscription tier. Upgrade your subscription today for immediate access to all Venture recommendations. There is no lock-in period, and you can change or cancel your subscription at any time.