Two weeks ago, the People’s Bank of China launched a stimulus package to boost the economy in order to counter the slowdown associated with the property sector, weak consumption, and excessive debt. They cut interest rates, reduced the reserve requirements for the banks, and lowered borrowing costs for $5.3 trillion in mortgages to bring relief to the housing sector. There was also $113 billion of liquidity support for markets and a plan for a stockmarket stabilisation fund.

There has been much debate about this, but with the Chinese markets closed last week, there has been even more speculation. But before the markets shut, President Xi’s Politburo pledged action to stabilise the property sector. Markets have interpreted this as a “whatever it takes” moment, to paraphrase the then ECB chief, Mario Draghi, when he stabilised the eurozone a decade ago.

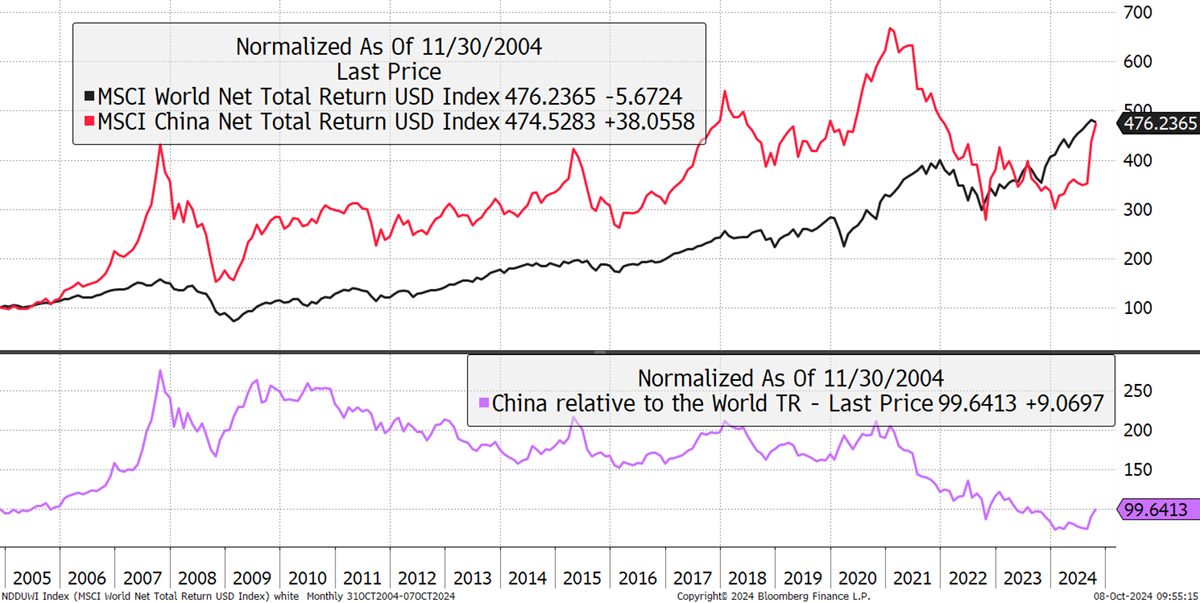

Chinese equities have soared and caught back up with the world over 20 years. Many commentators would be surprised by this, but as with many emerging stockmarkets, the highest returns came in the noughties, and it has been a slog ever since. Chinese equities (red) peaked against the world (black) in late 2007 and have eased back since (purple).

China Versus the World

Using the theory that long-term market returns are supposed to mean-revert and not reflect GDP growth, here is another example. Chinese equities got ahead of themselves and are now back on track. Naturally, over five or ten years, investors in Chinese equities have just seen red.

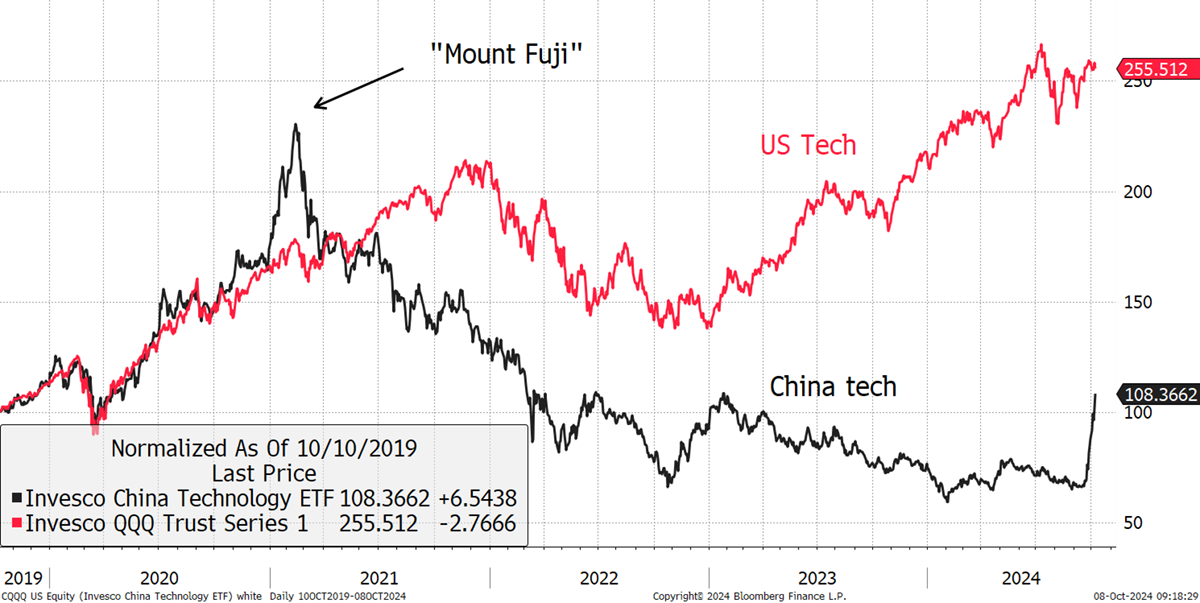

But it hasn’t all been gloomy for Chinese equities because one of the widely followed sectors is tech. Up until 2021, China tech raged ahead, making a “Mount Fuji” price pattern, something recently added to my financial vocabulary. The companies are world-class but hit a wall after Alibaba’s (BABA) Jack Ma disappeared from view in late 2020 after he criticised the government. US and Chinese tech have diverged ever since. China tech stocks have recently rallied and still represent good value.

US Versus Chinese Technology Stocks

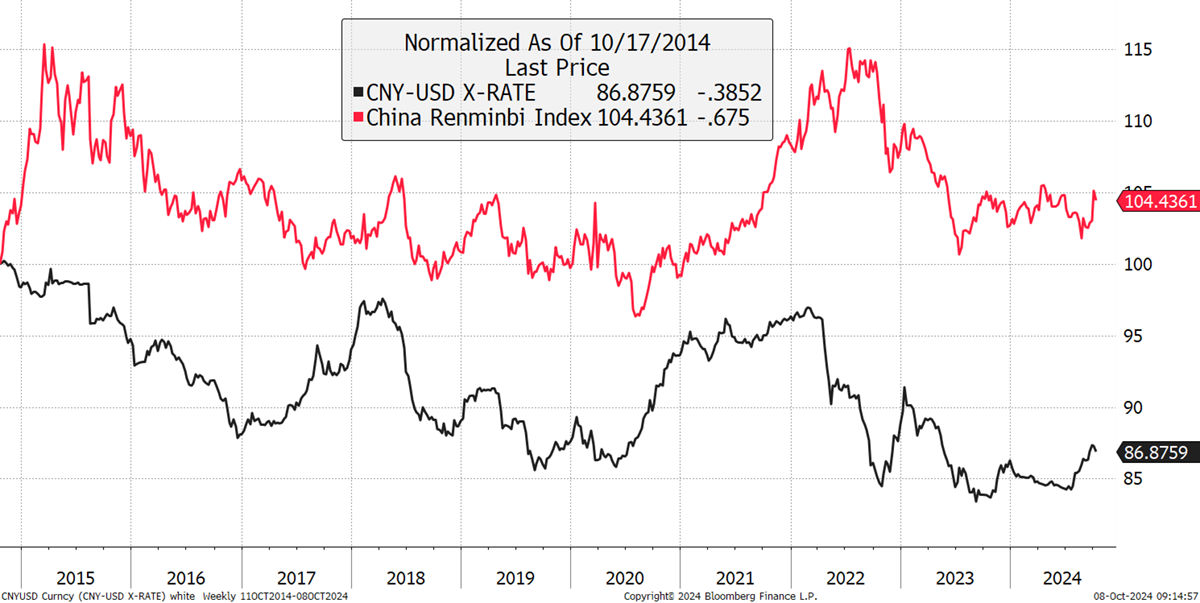

The recent surge in Chinese markets is a reaction to the stimulus and panic closing by short sellers. As they cover their short positions, they have created high demand and have also boosted the currency. I show the Renminbi against the dollar (black), which has fallen 14% over the past decade, and against a global currency basket (red), which is up 4%.

Chinese Currency

The exchange rate is important, and as the stable red line shows, it has been managed. The esteemed market strategist Russell Napier wrote:

“The reflation of China would come this year but that it could only come if the authorities prioritised a growth in broad money over the stability of the exchange rate.”

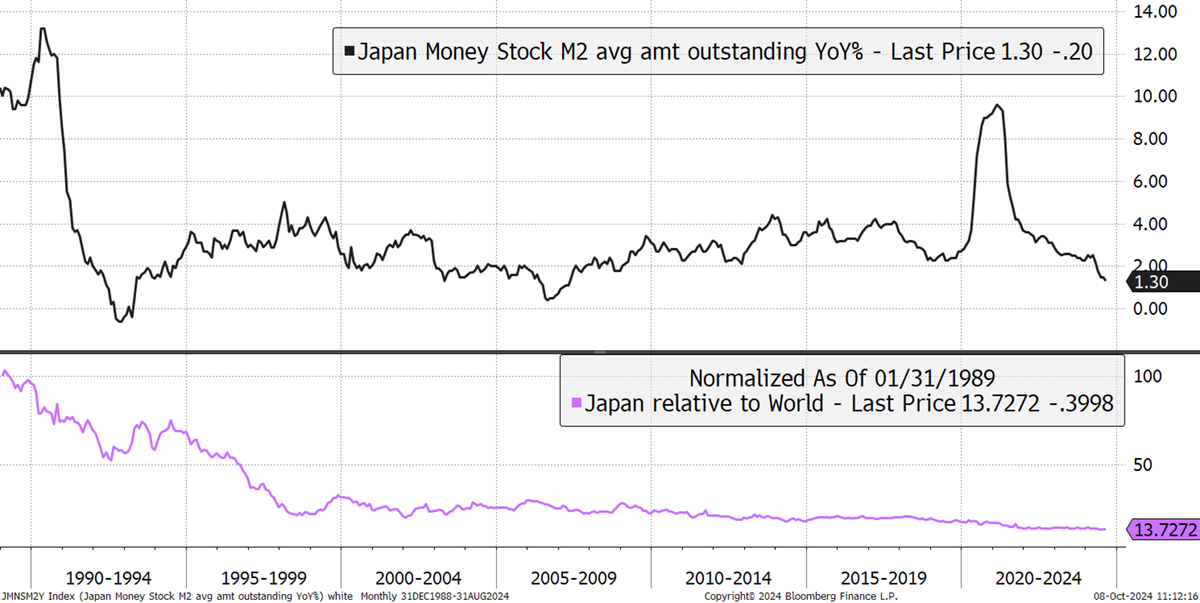

His point is that something must give, and if China wants to avoid a post-1990 Japanese-style deflation track, they should let go of the currency and see it trade freely. The Chinese money supply has slumped, which has restrained economic growth, and a boost would potentially force a devaluation.

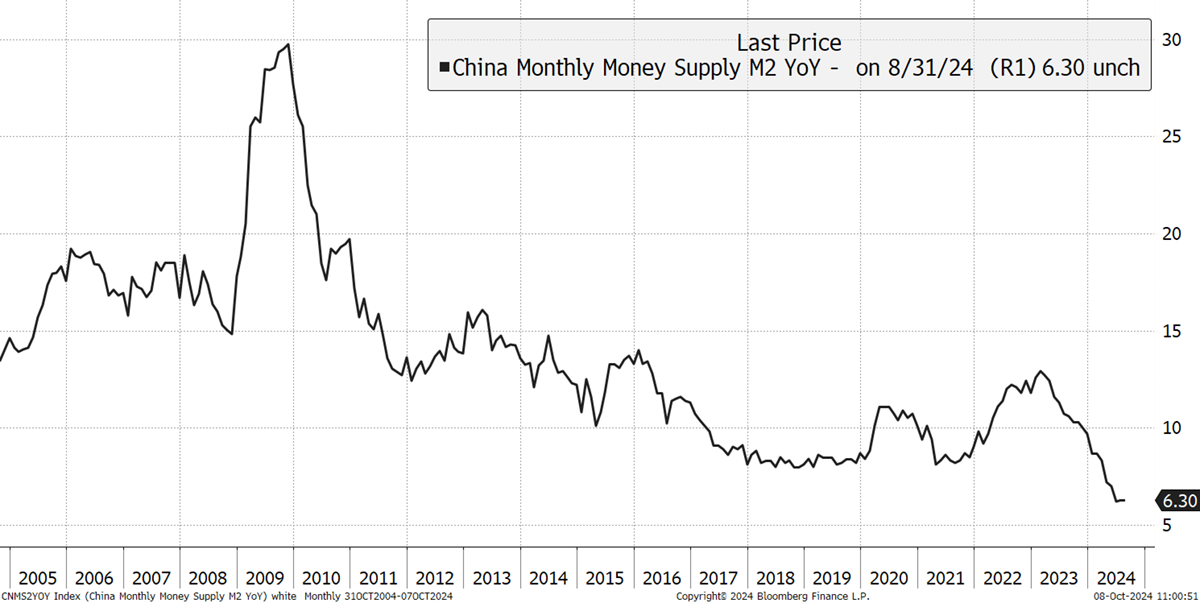

Chinese M2 Money Supply YoY

For reference, I show Japan’s money supply growth after the peak in the late 1980s. The collapse in the money supply caused the yen to surge and the stockmarket to lag the world for three decades, falling 87% behind. This is the situation China plans to avoid.

Japanese Money Supply

Napier continues:

“In the opinion of your analyst what we are witnessing in China is no evolution but a revolution. It is a revolution in which China focuses on targeting domestic reflation without reference to the exchange rate. The central bank balance sheet will now expand through the purchase of local currency government bonds to increase the supply of base money as Xi has already demanded. At the same time, it seems, the government will inject capital into the so-called commercial banking system to allow it to fully utilise the increase in PBOC created reserves and expand their balance sheets to boost the growth in broad money. These are targets that are highly unlikely to be compatible with a managed exchange rate regime. They are the targets we know and understand of central banks working within flexible exchange rate regimes. The world of money, credit and asset prices has fundamentally change and not just in China but across the world.”

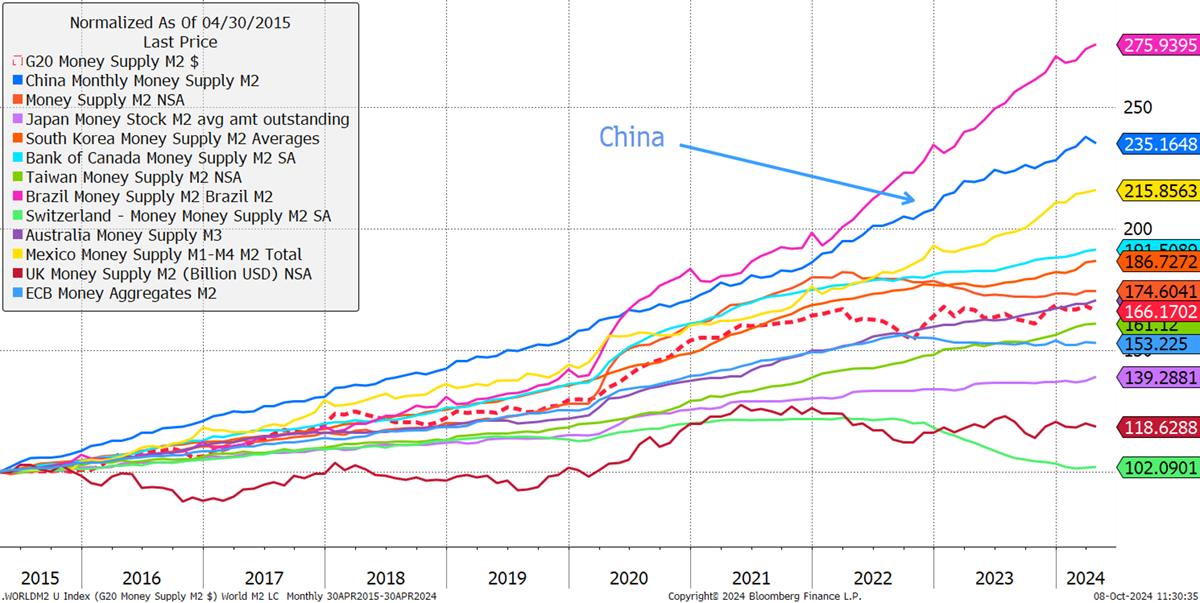

China’s money supply has been among the highest, which is expected given its high level of growth. Recently, it has been slowing down. These actions may see it reaccelerate.

World Money Supply

Napier sees the near-term risk of spreading a deflation shock, and a long-term inflation burst further down the road. Ultimately, growth targeting is a form of financial repression where monetary conditions remain loose compared to the level of growth. That puts Napier firmly in the gold bull, bond bear camp.

Mark Tinker, of Market Thinking and a China watcher, takes a different view. He sees Chinese policy as a way of achieving strategic objectives. He wrote:

“The crisis is not in property, it is in property developers and the government is bringing in policies to clear the excess inventory that does not involve free money for Wall St. A lot of western investors speculated that the Chinese would come in and rescue the developers last year and bought the debt at 7c on the $. The smart ones got out at 70c a few months later, while the rest are back at 7c. In the meantime 150m have moved from the countryside and been housed. That was the policy. New cities have been built, people have moved, the infrastructure is there and there are no favellas.”

He writes well on Chinese matters and believes investors should own the stockmarket, because it offers good value. “It’s about building a Capital Market with Chinese Characteristics.” I can see that.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd