Clearing the Decks

Trade in Whisky;

Last week, I wrote about China, and the key takeaway is that China has been allocating, in some cases misallocating, vast amounts of capital for a very long time. We have all seen the ghost developments, bridges, dams and high-speed rail. Much of it is impressive, and their engineers deserve praise. As for their financiers, they deserve the Gulag.

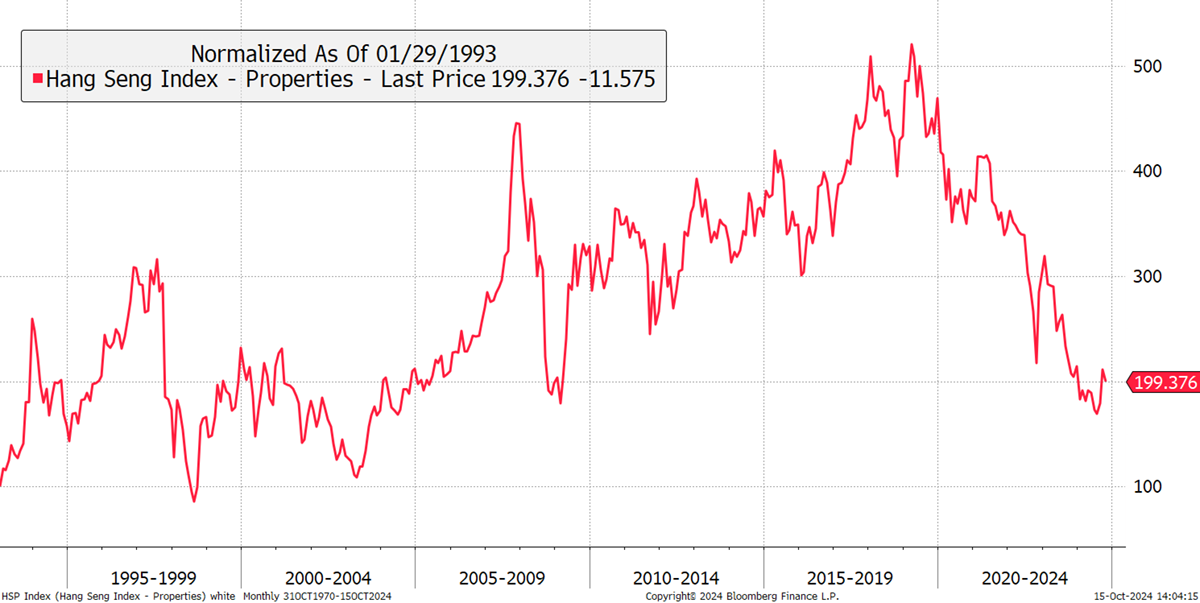

The growth of the Chinese economy has been incredible. The time from the day that Hong Kong sent over its first ship to be scrapped after Deng’s reforms to the present day has been “glorious”. Yet, it has hit a wall with the issues facing the property market, as we have been following for some time. The China EverGrande 2025 bond trades at $2.25, having been issued at $100, and has defaulted on payments. Many bonds are in a similar state, and the Hang Seng Property Index, which reflects many projects in China, is trading at the same level seen in 1993.

Hong Kong Property

Back in the 1980s and 1990s, Hong Kong Property was one of the great trends. It periodically came unstuck but always seemed to recover. The recent fall of 67% differs from the ones seen in 1998 (-73%) and 2008 (-60%), as it has lasted for 64 months while the other corrections lasted for 13 and 15 months, respectively. The problem here is that China has become a deflationary force for the world, and until we see a devaluation, that will continue.

Money Week Summit

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd