Glitter or GLTER

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report Issue 98;

The World Gold Council (WGC) has tackled gold’s long-term “expected return” (GLTER), a forecasting method for the returns of an asset class. Traditional financial assets have widely accepted expected return frameworks, and until now, gold has been the exception.

Highlights

| Expected Returns | Glitter or GLTER |

| Technicals | Boom |

| Flows | Gold and Silver Tight, Platinum Soft |

| Palladium | Short Squeeze |

| BOLD ETF | +61% Past Year with 14% Volatility |

Glitter or GLTER

Pension funds use expected returns to better understand their long-term assets and liabilities. That makes this work important because an asset with an accepted expected return framework is more likely to be recommended by the investment consultants than one that isn’t. In other words, a well-laid-out investment framework could lead to new demand for gold from institutional investors.

Global equities are generally thought to have long-term expected returns of 5% real, which means 5% plus inflation. For bonds, it’s 1.8%; for cash, it’s 0.8% (source: Robeco). Many, including myself, have suggested gold’s expected return is between 0% and 1%, which means it tracks inflation over the long term.

This idea originated from Roy Jastram’s book, The Golden Constant, published in 1977. The thesis was that the gold price kept up with the price of goods and services in the long run, leading to humorous measures such as Julian Baring’s price of lunch at the Savoy Grill priced in gold ounces or Incrementum’s price of a pint of Guinness in gold. Having a framework where gold’s expected return is above inflation means the cost of living is always falling when measured in gold.

The post-pandemic world has forced gold observers to adapt or die. My old valuation model was based on the idea that gold acted as a perpetual inflation-linked bond issued by god, which worked perfectly until the pandemic. In recent years, my views have changed, and I now sit in the money supply camp, which is also inflation plus.

The money supply looks at the amount of money in the financial system, whereas inflation reflects the cost of living. If the global economy and population are growing, it stands to reason that the gold price should participate in the general expansion of the system.

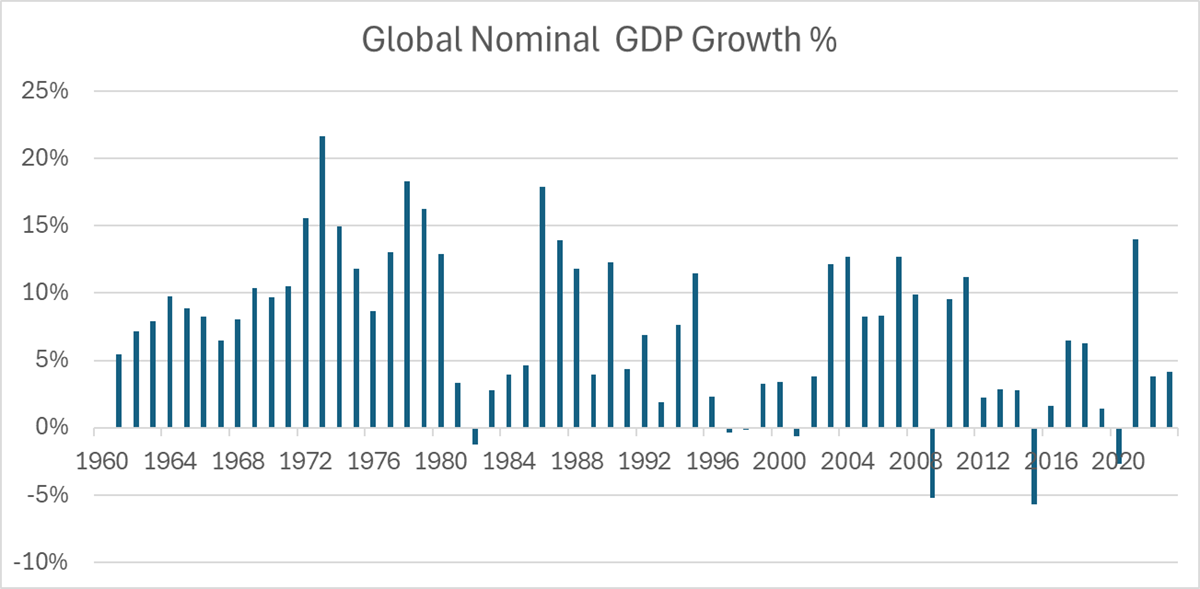

GLTER has landed in the nominal GDP camp. Nominal GDP is real GDP, which politicians talk about, plus inflation. It is a monetary measure of the size of the economy, which has grown at a trend rate of 7.1% p.a. since 1960.

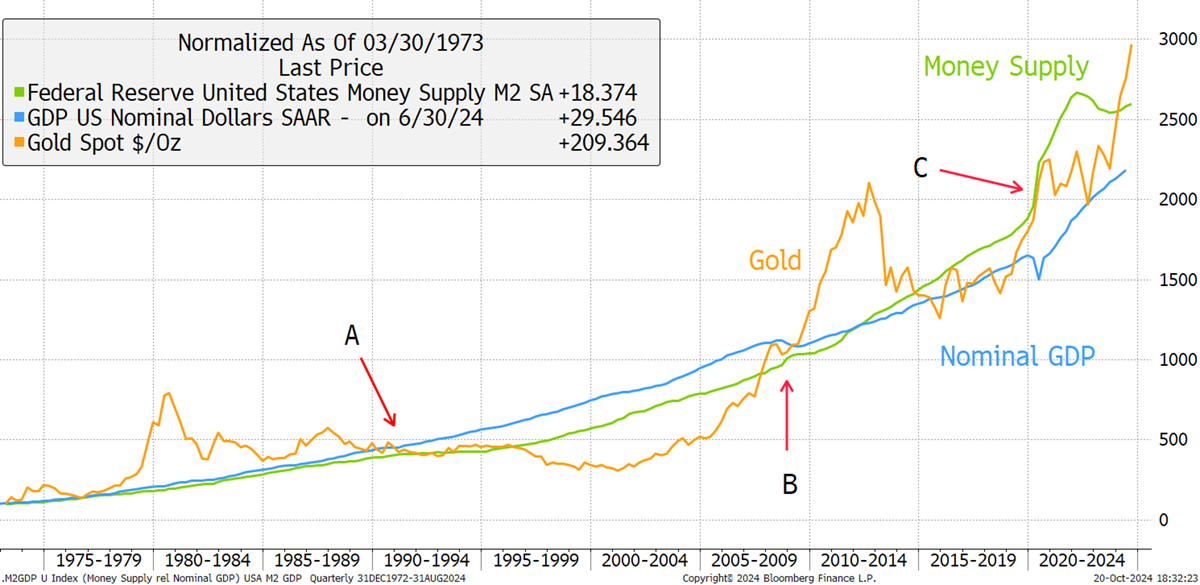

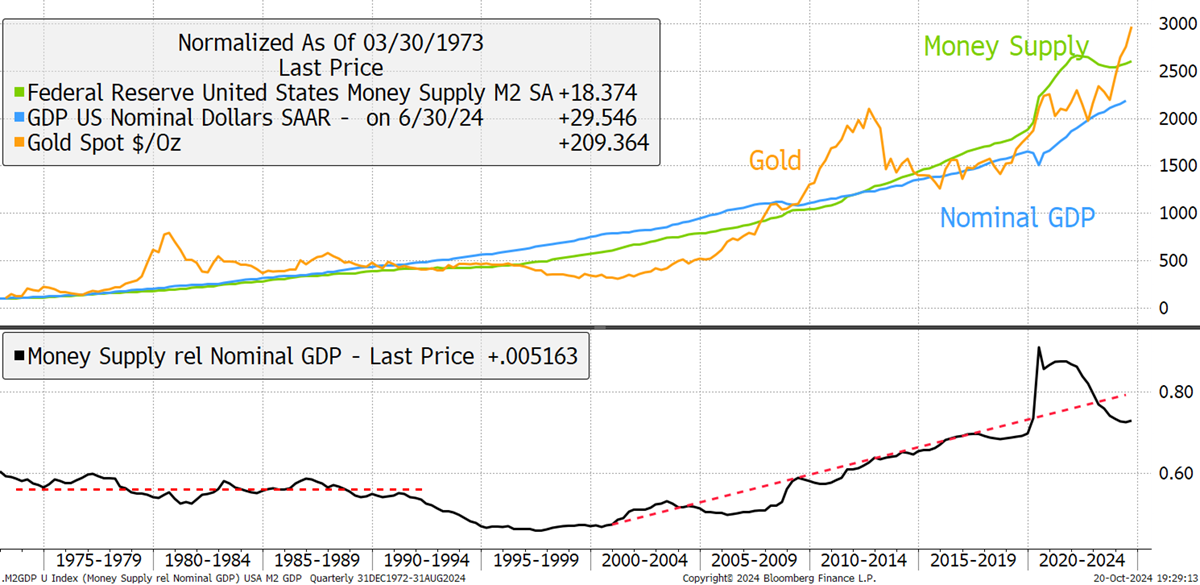

Other than the 14% growth reported in 2021, nominal GDP growth has been slowing since the 1970s. I would observe the past two years have been higher than many would think, but mostly due to inflation. Using US data, I show the nominal GDP and the money supply since 1960 alongside gold. The lower section shows the money supply against nominal GDP to highlight their differences.

Money Supply vs GDP

The esteemed economist Peter Warburton told me:

“Barring significant geopolitical events, there is a long-run relationship between broad money supply and nominal GDP. The velocity of money is GDP divided by money supply, so institutional changes in the use of money are picked up in the trend velocity.”

He reminds us about the velocity of money, something not much discussed these days. Given gold’s strength in the 21st century, this makes sense. Between 1960 and 1990, the money supply and GDP followed one another (black in the above chart) and was around 60% of GDP. Then, it fell in the early 1990s before surging ever since. Many put this down to “the Greenspan Put”, the idea that every financial crisis since the Asian Crisis in 1998 has been laid to rest by increasing the money supply. There were further boosts in 2001 for the 9/11 attack, 2009 for the financial crisis, 2011/12 for the Eurozone crisis, and the biggest of all in the recent pandemic.

The point here is that the money supply and GDP follow one another, and so both are credible. But I think the money supply has the edge over GDP because gold is resilient during times of economic stress when GDP goes down. Looking at the gold price against GDP and money, I highlight periods A, B and C.

Gold, Money Supply, and GDP