ByteTree BOLD Index Monthly Rebalancing Report;

The Vinter ByteTree BOLD1 Index (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

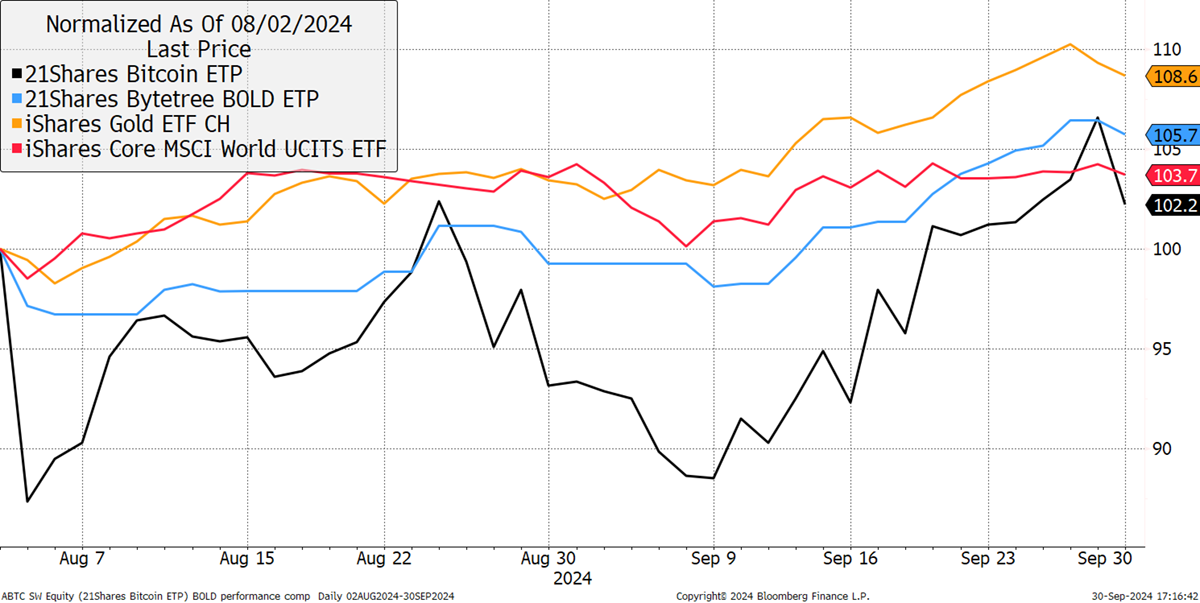

In September, BOLD rose by 5.3%, Bitcoin rose by 8.0%, Gold rose by 5.3%, while global equities rose by 1.8% in USD terms. The target weights last month were 25.0% and 75.0% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 25.4% and 74.6%. This means the latest rebalancing at the end of September has seen 0.8% reduced from Bitcoin and added to Gold to meet the new target weights.

Bitcoin, Gold, BOLD, and Equities – September 2024

BOLD Performance

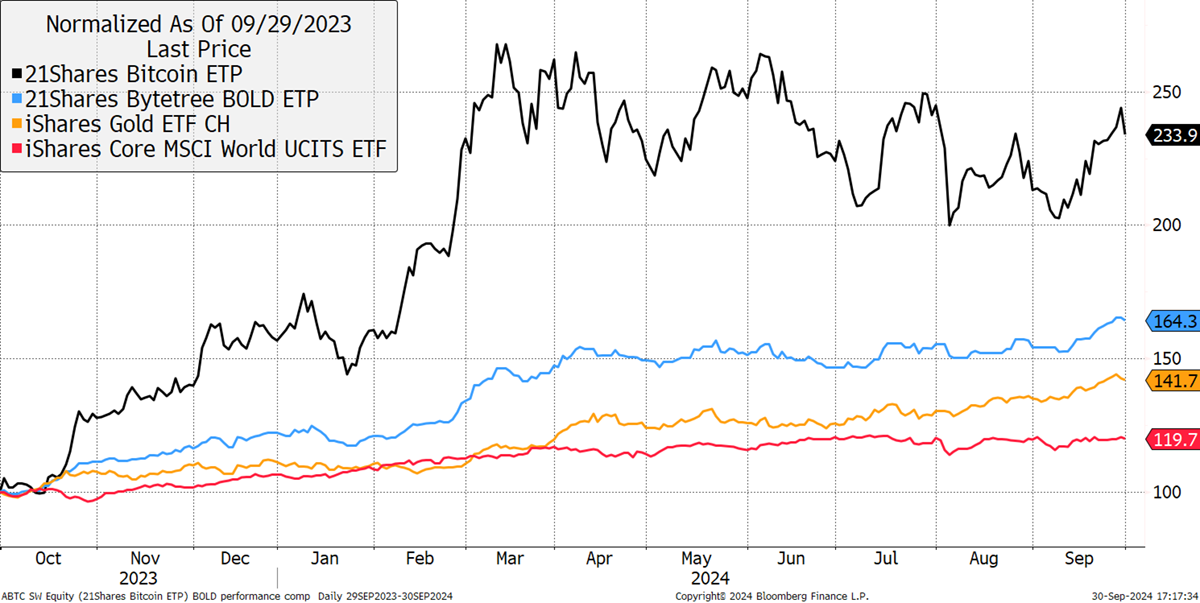

Over the past year, Bitcoin’s performance has returned +133.9%, in contrast to Gold with +41.7%, while equities rose +19.7%. BOLD has returned +64.3%.

Bitcoin, Gold, BOLD, and Equities over the Past Year

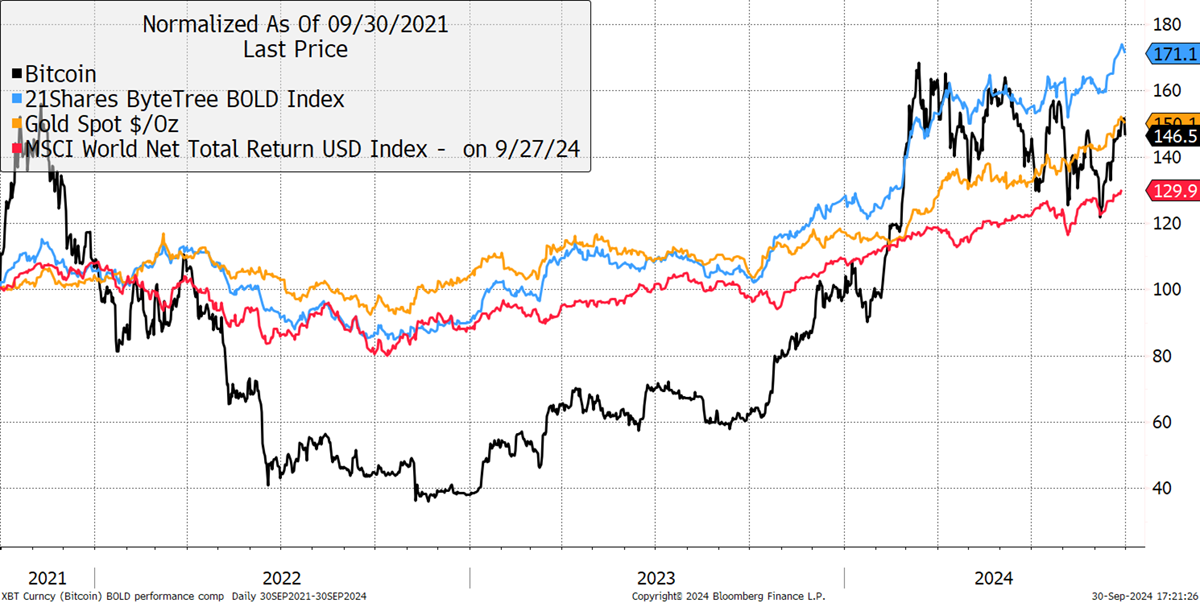

Over three years, since 30th September 2021, BOLD has shown its strength. Bitcoin is +46.5%, similar to Gold +50.1%, and above equities +29.9%. BOLD returned +71.7%.

Bitcoin, Gold, BOLD, Equities over the Past Three Years

BOLD has beaten both Bitcoin and Gold with no derivative or leverage. Moreover, the increase in volatility has been marginal for such a significant outperformance.

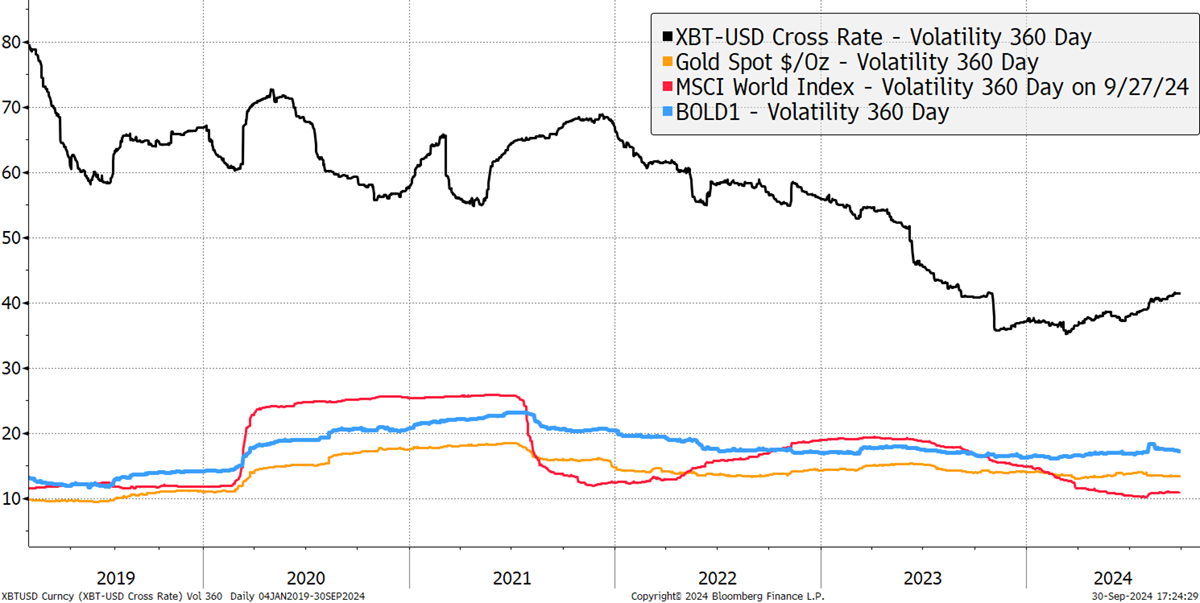

Bitcoin, Gold, BOLD Index and Equities Volatility

September Rebalancing of the BOLD Index

BOLD allocates Bitcoin and Gold on a risk-adjusted basis, using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.

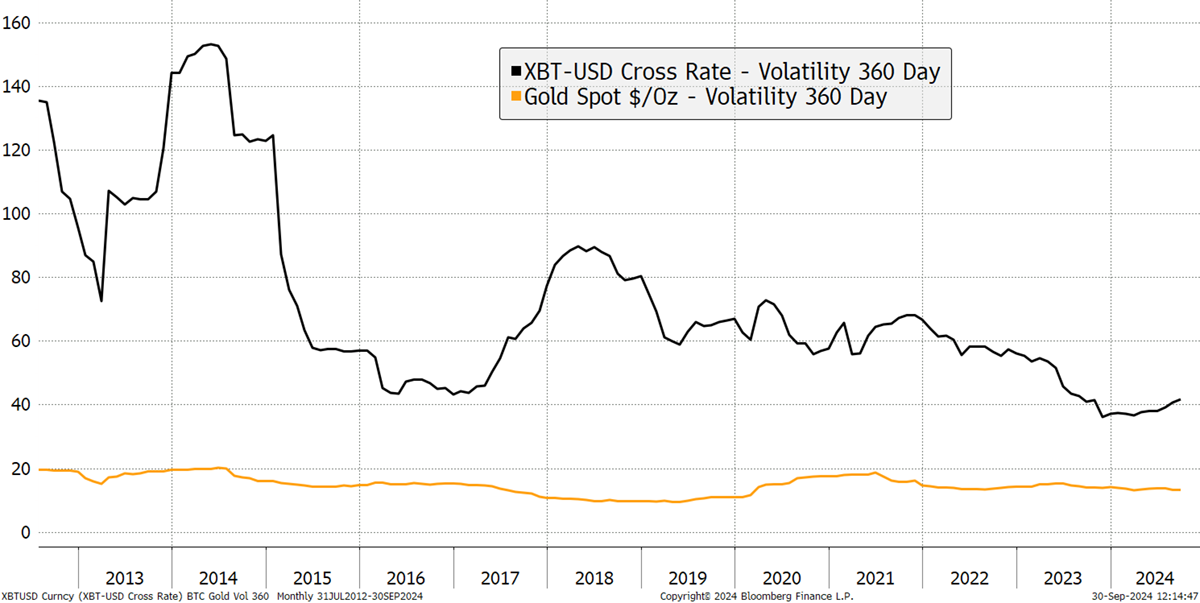

Bitcoin and Gold Volatility over the Past 360 Days

Rather than having the same amount of value invested in each asset, the BOLD strategy aims to hold an equal amount of “risk” in each asset and is hence “risk-weighted”. The volatility for Bitcoin and Gold over the past 360 days was observed to be 42.9% and 14.0%, respectively. In 2024, Bitcoin has seen a modest increase in volatility. If Bitcoin and Gold had the same volatility, there would be no difference and so the weights would be 50/50. Indeed, if Gold’s volatility was ever higher than Bitcoin’s, then Bitcoin would have a larger share of the BOLD Index.

The volatility measures have resulted in new target weights of 24.6% Bitcoin and 75.4% gold using this formula.