Raydium: Leading Decentralised Trading on Solana

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: RAY;

Raydium is the largest and fully decentralised exchange (DEX) on Solana. With Solana attracting significant interest this year, liquidity on Raydium has also seen an astronomical rise. Although competition poses a threat, its economic output and growth potential make it a fascinating project. This Token Takeaway will delve into the intricacies of Raydium, explore the broader DEX sector and analyse the value proposition of its native token, RAY.

Overview

The initial development of Raydium began in 2020, led by a pseudonymous developer who goes by the name AlphaRAY. The protocol was officially launched in February 2021 with a mission to lower trading costs and increase speed. Today, Raydium has grown significantly and ranks as the fourth-largest across DeFi in terms of liquidity.

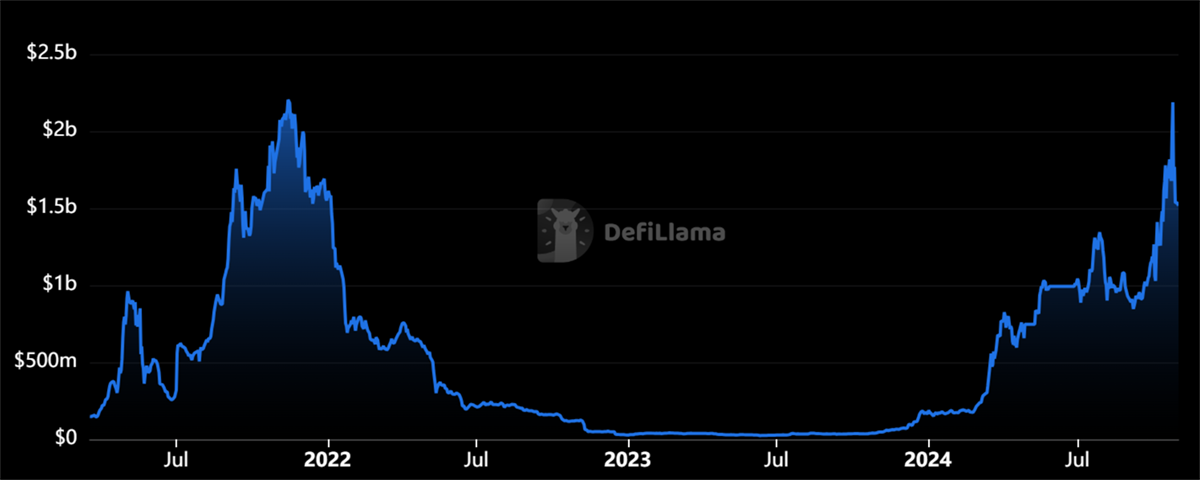

TVL on Raydium

Raydium’s total value locked (TVL) has surged from $164m at the beginning of 2024 to over $1.5bn today, marking an impressive 814% growth this year. The earlier dip in liquidity was largely due to the collapse of FTX, which had strong ties to both Solana and Raydium, as well as the broader industry downturn. However, 2024 has been a remarkable year for Solana and its ecosystem, drawing substantial user interest and liquidity from various platforms. This appeal spans individual users, projects from other chains like Ethereum, and institutional investors, fuelling Raydium’s growth to new highs.

DEXs like Raydium lie at the heart of DeFi. These platforms facilitate many things, including swapping, liquidity provision and yield farming. Let’s take a closer look at the crypto exchange sector.

Crypto Exchange sector

Centralised exchanges (CEXs) like Binance and Coinbase serve as the primary entry points for many newcomers to the crypto space. While CEXs cater to a sizable market with notable spot and derivatives trading volumes, they require users to give up custody of their funds and undergo lengthy sign-up processes, adhering to strict AML and KYC requirements. Despite these safeguards, major exchanges like FTX have still collapsed, resulting in billions of dollars lost for users.

Decentralised exchanges (DEXs) like Raydium offer a solution by providing fully permissionless trading in a transparent, secure manner, where users maintain complete control and ownership of their funds. Among various DeFi ecosystems, Ethereum was the first and remains the largest.

Uniswap, Ethereum’s leading DEX, has become the most prominent DEX in the sector, achieving an all-time trading volume of $2.2tn and generating $3.4bn for liquidity providers. However, it faces significant limitations, largely due to Ethereum’s constraints.

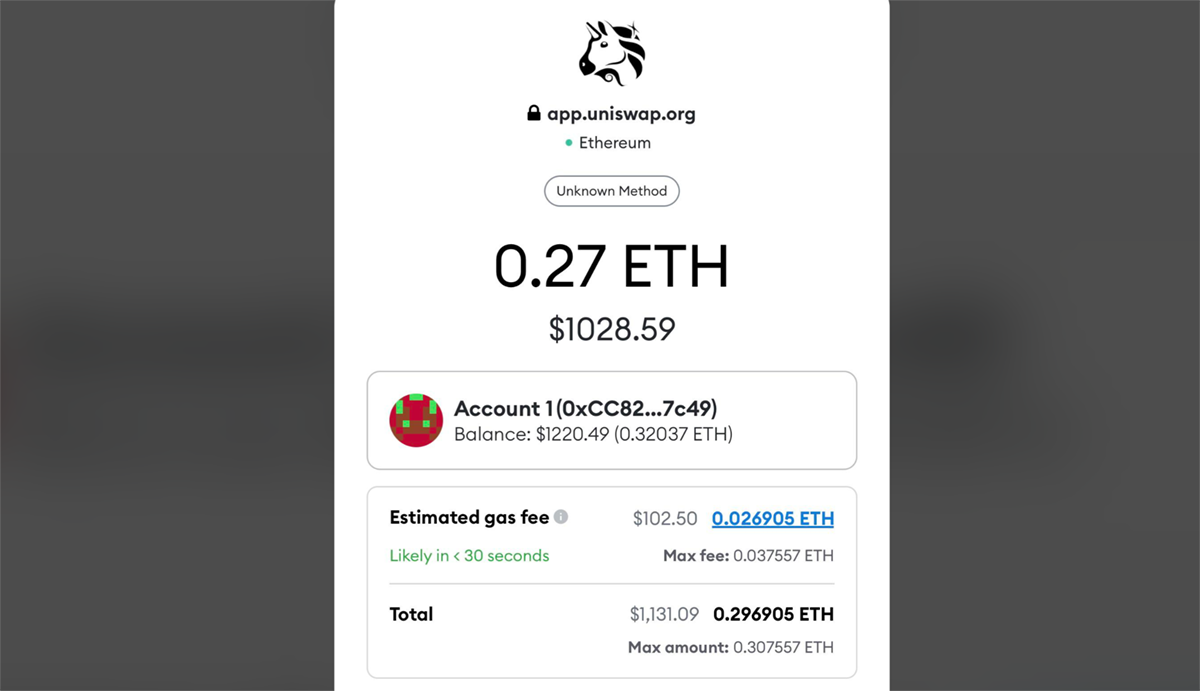

High Gas Fee for Uniswap Trades

During periods of high activity, gas fees can soar above $100 per transaction, reducing accessibility. Additionally, until recently, all trading fee revenue went to liquidity providers, while gas fees went to Ethereum validators, leaving UNI token holders with no direct benefits.

To overcome these issues, Raydium was built as a high-performance DEX on the fast and cost-efficient Solana blockchain. Today, Raydium handles around $1.7bn in daily trading volume, more than its TVL. Raydium generates millions in fees daily, more than Uniswap despite being smaller, while also rewarding RAY token holders with a portion of the total fee generated. More on that later.

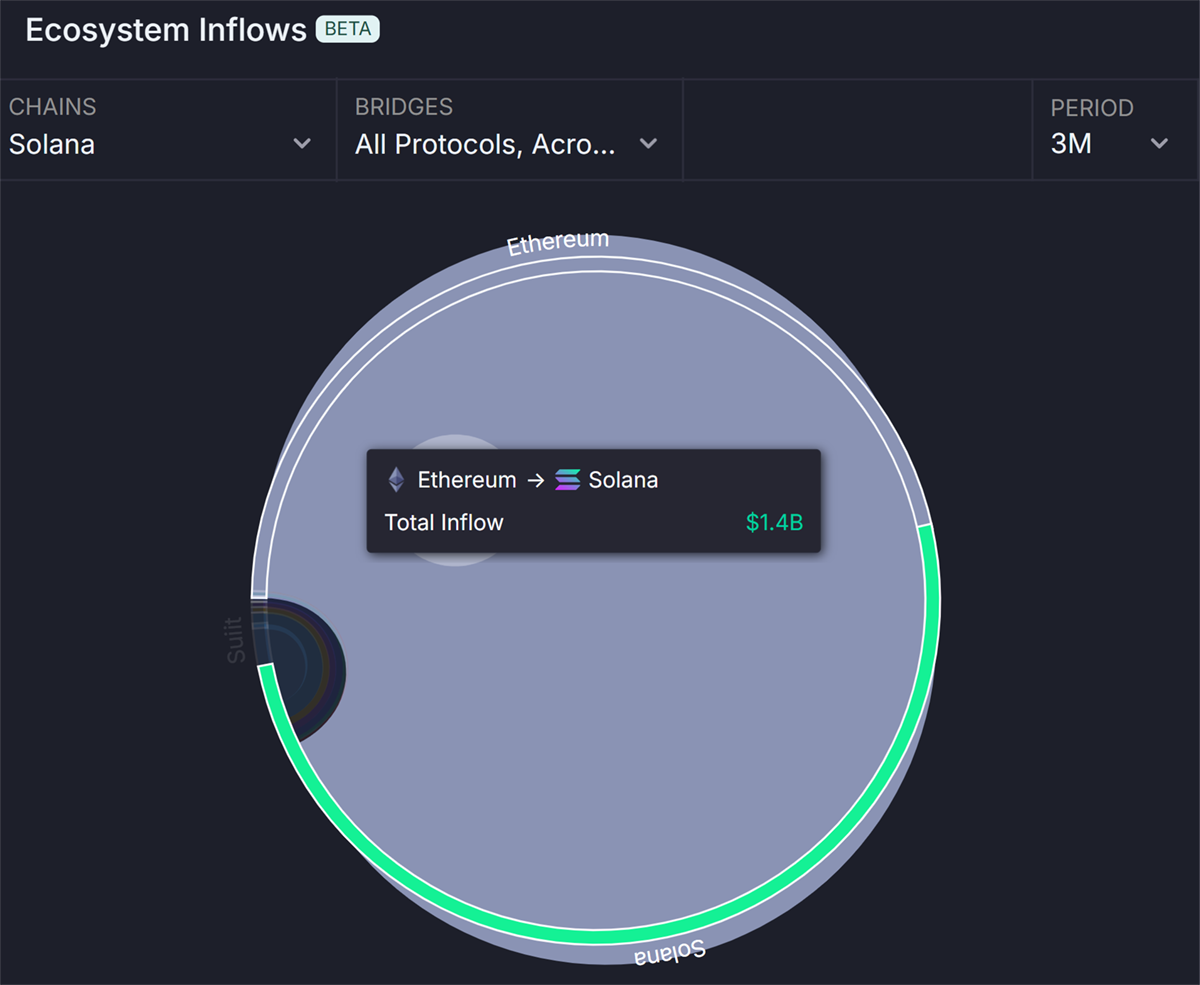

DeFi Liquidity Flows

In the last 3 months, Solana has gained $1.56bn in liquidity and lost $503m, bringing the net flow to over $1bn. Of the total gain in liquidity, $1.4bn or 90% derived from Ethereum, as shown below.

Solana Liquidity Inflows

On the other hand, Ethereum gained $7.8bn in liquidity in the same period but lost over $8bn, bringing the net flows to a negative $200m. This shows that there is user migration taking place in search of high-performance chains. Despite its many flaws, Solana seems to be one of the benefactors. This influx of liquidity is directly fueling the user interest in Raydium. Let’s take a deeper dive into how Raydium facilitates permissionless trading.