Issue 45;

The bull market in precious metals continues. In recent weeks, gold has shrugged off both rising bond yields and a recovery in the dollar. This is a change of behaviour from the years past, as investors come to realise they are underweight in a sector they need to own. As governments keep spending, preventing inflation from returning to target, the metals have found their bid. Gold has a limited supply, but so does silver, platinum and palladium.

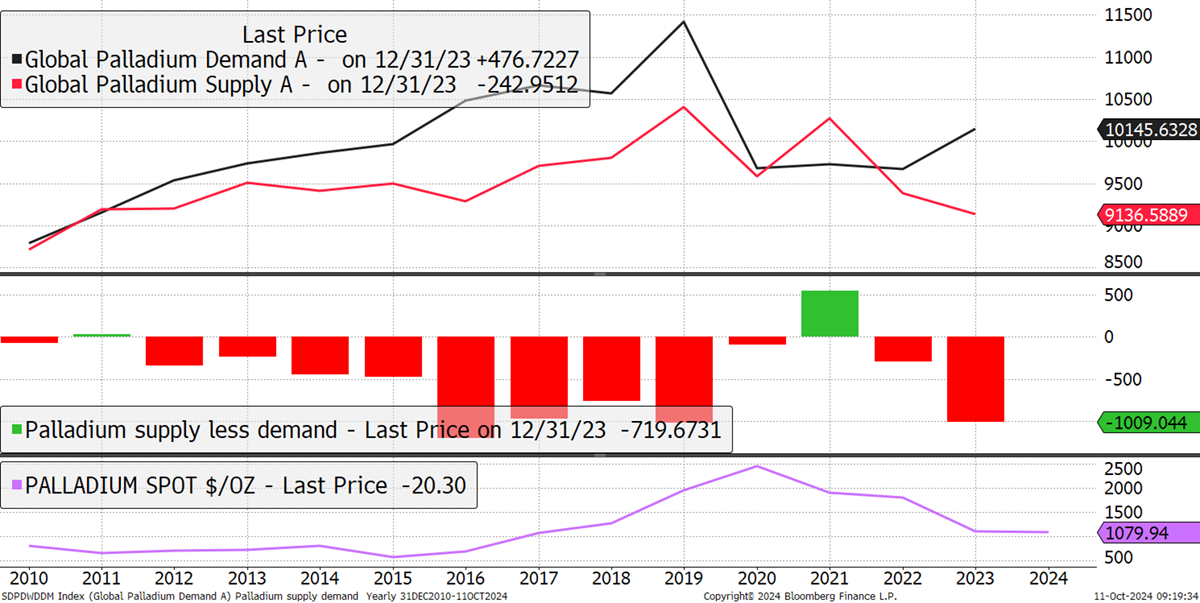

The palladium market is a good example, as it is back in deficit, meaning demand exceeds supply. This isn’t new, but it has in the past been support for the price. This is happening as the auto industry shifts to EVs, but perhaps this will take longer than we thought, meaning the low expectations are overdone.

The Palladium Deficit

I have identified an opportunity to capture what I believe could be one hell of a squeeze.

Palladium ETF (PALL USA)

“Palladium is a chemical element; it has symbol Pd and atomic number 46. It is a rare and lustrous silvery-white metal discovered in 1802 by the English chemist William Hyde Wollaston. He named it after the asteroid Pallas (formally 2 Pallas), which was itself named after the epithet of the Greek goddess Athena, acquired by her when she slew Pallas. Palladium, platinum, rhodium, ruthenium, iridium and osmium form a group of elements referred to as the platinum group metals (PGMs). They have similar chemical properties, but palladium has the lowest melting point and is the least dense of them.”

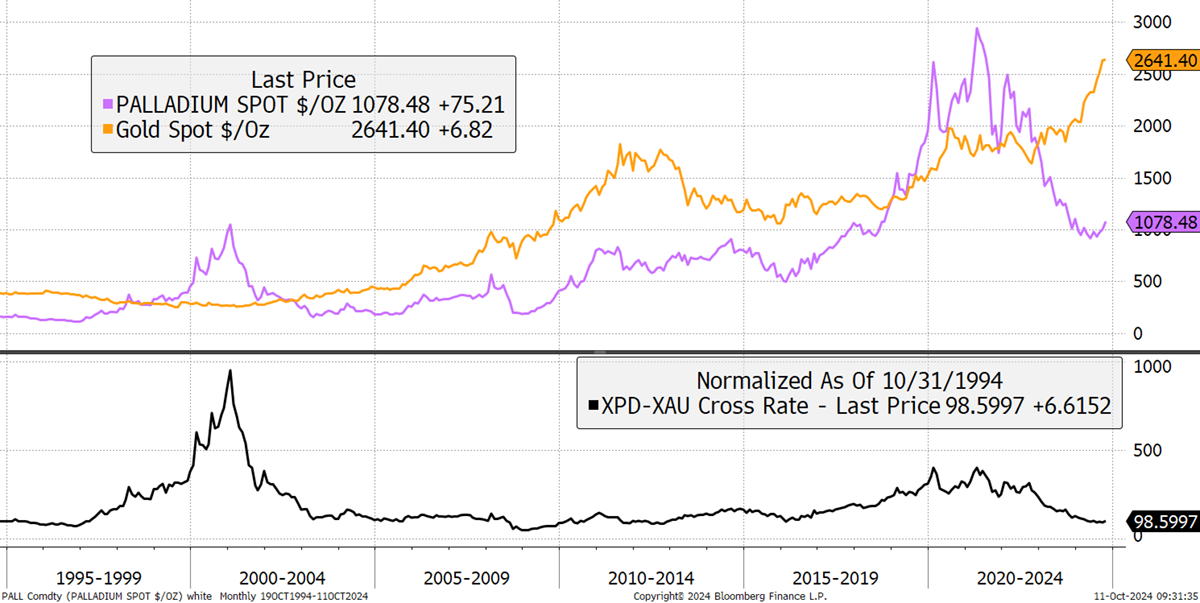

The investment case for palladium is relative value in a gold bull market, a supply deficit, and a net short position within financial markets. Prices were high in 2021 but have since collapsed to 2017 levels, which were also seen at the 2000 peak. The palladium vs gold price rebased at 100 back in 1995 is at 98, meaning the metals have performed in line over 30 years. The lowest reading was 50 in 2009 after the financial crisis.

Gold and Palladium

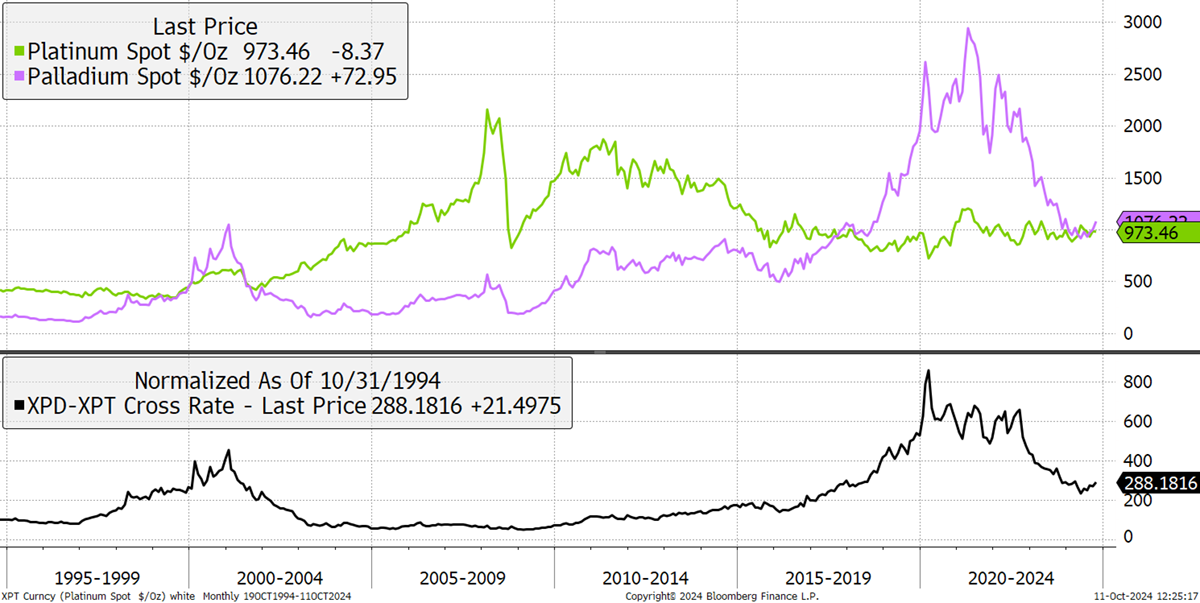

I also highlight palladium’s relationship with platinum, which it is often substituted with depending on price. Palladium has come back down to meet platinum, and both trade close to $1,000, last seen in 2017 and 2001. The cross rate (black) now favours palladium, which has been the long-term outperformer.

Platinum and Palladium

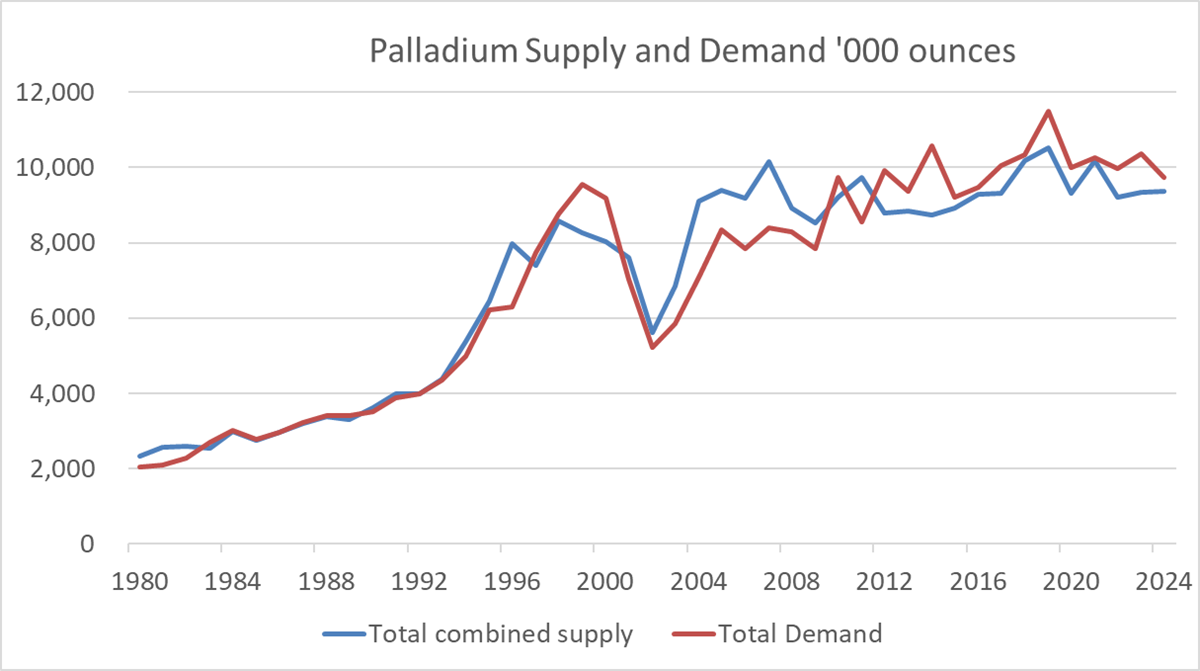

Using longer-term and, potentially, more accurate Johnson Matthey data, supply has been somewhat stable while demand is expected to fall, resulting in a deficit. The question is whether the outsized price fall has more than compensated for the relatively modest fall in demand.

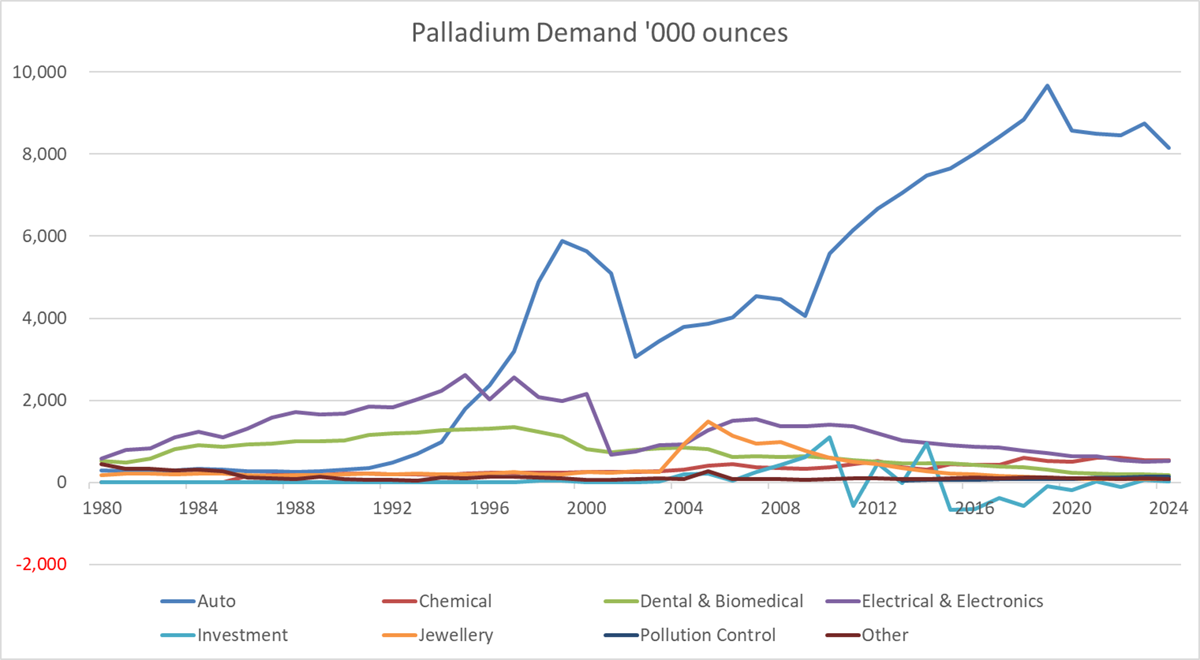

The demand story is the key, and the overwhelming source comes from the auto industry, which is undergoing a transformation to EVs. Yet high prices have quashed demand from other sources. There is always a lag, but lower prices will likely see other sources of demand rise.

Looking at the change between 2023 and 2024, demand is lower in most categories. It is not a pretty picture, but it explains the heavy short-selling by hedge funds.

| Demand by Application | 2023 | 2024 | Change |

|---|---|---|---|

| Auto | 8745 | 8145 | -7% |

| Chemical | 543 | 535 | -1% |

| Dental & Biomedical | 193 | 185 | -4% |

| Electrical & Electronics | 511 | 524 | 3% |

| Investment | 61 | 29 | -52% |

| Jewellery | 86 | 85 | -1% |

| Petroleum | 135 | 140 | 4% |

| Pollution Control | 97 | 88 | -9% |

| Demand | 10371 | 9731 | -6% |

Source: Johnson Matthey. Data in 1,000 ounces.

In the Johnson Matthey PGM Market Report published in May, they said:

“The shortfall in the palladium market is expected to shrink significantly, to around 360,000 oz in 2024. Demand is forecast to fall by 6% to 9.7 million oz, the lowest level since 2016. Although industrial consumption will hold up well, supported by some modest gains in the electronics and pollution control sectors, automotive use will slip to 8.1 million oz, an eight-year low. This reflects expectations of a 4% contraction in gasoline car output, amplified by continued heavy thrifting by Chinese automakers. On the supply side, a 4% gain in secondary palladium recoveries is predicted to offset a slight decline in primary metal sales.”

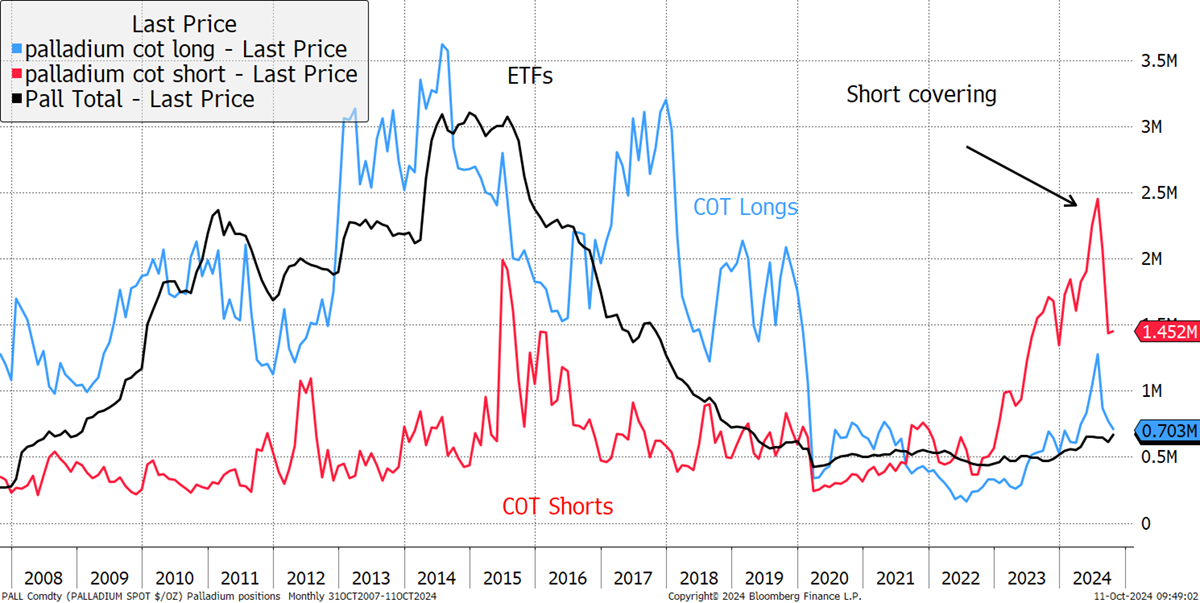

The bad news has had time to be fully absorbed by the market. The positive surprises could come from investment, where positioning is low. Investment demand was just 29,000 ounces this year, down from 1,095,000 ounces in 2010. The bear story on palladium has seen the ETFs (black) cut from 3 million ounces in 2014 to a mere 0.7 million ounces today. The positive is that inflows have returned, and with a market in deficit, they have the power to turn the market. The futures market has just started to retreat from record shorts (red) and weak longs (blue).

Financial Positioning in Palladium Is Low

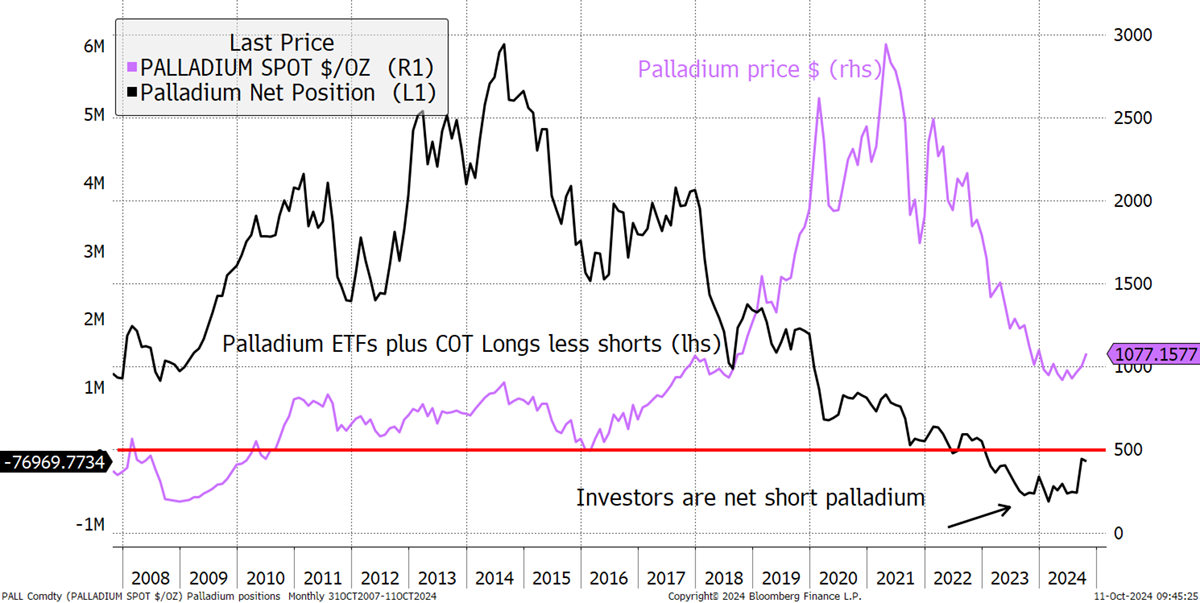

I show the price against the net positions, i.e. ETFs + longs - shorts. Remarkably, the combined total comes to -76,000 ounces, which is presumably unsustainable. The price has turned up for the first time since positioning has been negative, implying a short squeeze is underway. I reiterate that the ETF accumulation could happen quickly as it is driven by financial investors. There is significant room for growth in investment demand as the world's ETFs hold palladium worth $720 million, down from $2.6 billion in 2014.

Palladium Price vs Net Financial Position

Technicals

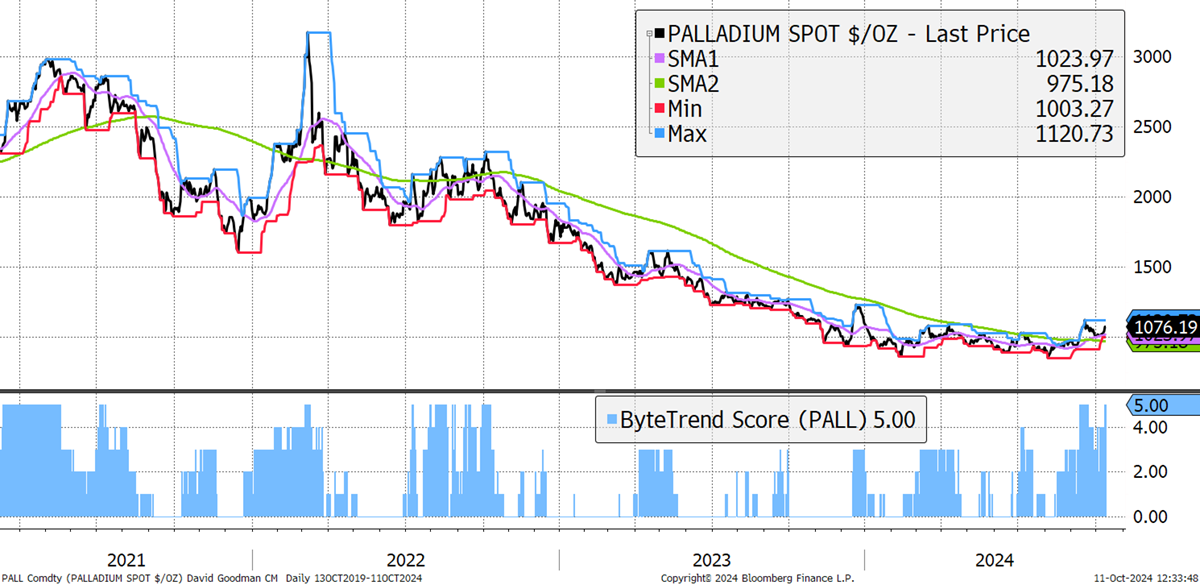

Palladium has a ByteTrend score of 5, something rarely seen since 2022. The 200-day moving average is also rising. With the market so tight, a strong move is likely to follow any strength seen in precious metals.

The Palladium Uptrend Begins

The Aberdeen Physical Palladium ETF (PALL USA) has an average daily volume of $7 million, making it liquid. It can also access further liquidity, if acquired, through the physical and futures markets. It has $356 million in assets and charges 0.6% p.a.

An alternative in the UK would be the WisdomTree Physical Palladium ETF (PHPD UK), which trades $158k per day, holds $113 million of assets and charges 0.49%. It can also access the palladium market, so the lower liquidity should not be a cause for concern.

Both are fine, but I highlight the liquid one. This is another opportunity to diversify around the bull market in precious metals. There is the potential for a fast move, but it is by no means guaranteed. Commodities won’t feature often in Venture, but a historical setup like this is hard to ignore.

Risk

Palladium is a relatively liquid market with volatility of 35%, slightly higher than silver (30%). Physical metals can fall, but not to zero. I deem this trade to be medium to high risk, albeit somewhat speculative.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd