Trade in Soda;

Since the UK Chancellor’s recent budget on 30th October, there has been much focus on the UK cost of borrowing. That follows the two previous attempts for the UK 30-year gilt yield to cross above 5%, a level not seen since 1998. It seems that 5% is proving to be a key level because the last three attempts have failed to break. That doesn’t mean 5% can’t break; it most certainly can, but it hasn’t yet, and that comes after three very public and notable opportunities to do so.

The Truss/Kwarteng Budget, which the Bank of England later admitted the associated gilt moves were two-thirds their fault, peaked at a 5% yield. That level was challenged again the following year as interest rates had been expected to keep rising, but they didn’t. The central bank rhetoric then changed as they deemed the battle against inflation to have been won, at least over the medium term. Then, recently, we had a high-spending UK budget and a Trump landslide victory, and the reaction from gilts was more restrained than it might have been.

The UK 30-Year Gilt Yield

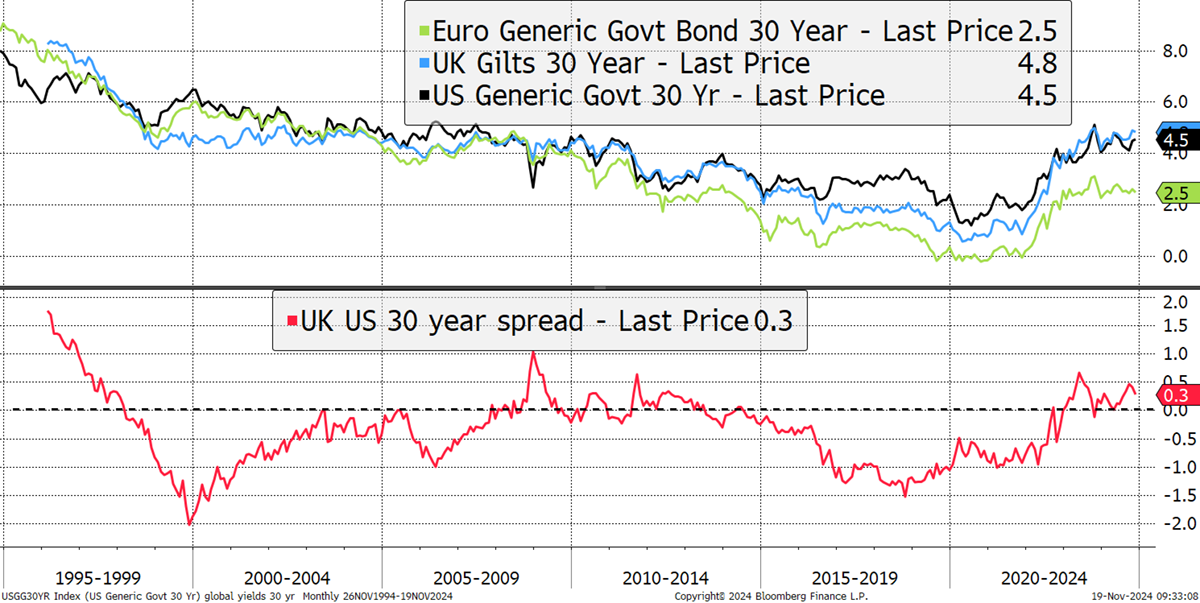

The long gilt is telling us that high-spending governments will be funded and that inflation is under control. Looking at Europe and the US, that message is reiterated, with US and UK 30-year yields moving in step, as they have for much of the past three decades. European yields are lower, implying an even worse outlook for growth than in the US or UK. The UK-US yield spread (the difference) has been widening after the budget, but not materially. In summary, the Reeves budget may have peeved us, but it hasn’t broken the gilt market.

Global 30-Year Bond Yield

With a corporate bond, the yield is an indicator of the company’s ability to repay the debt. With a government bond, the yield is more of an indication of policy (base rates) and expected inflation. Provided the bond is issued in the currency the government can print, there is no credit risk. For the UK, the Bank of England can print pounds ad infinitum, so there is no risk of default. The more important question is whether the pound will have value in the future, measured by inflation, because the bond will do exactly what it says on the tin.

France, Italy, Spain, etc., have high debts and cannot print euros, so they have credit risk.

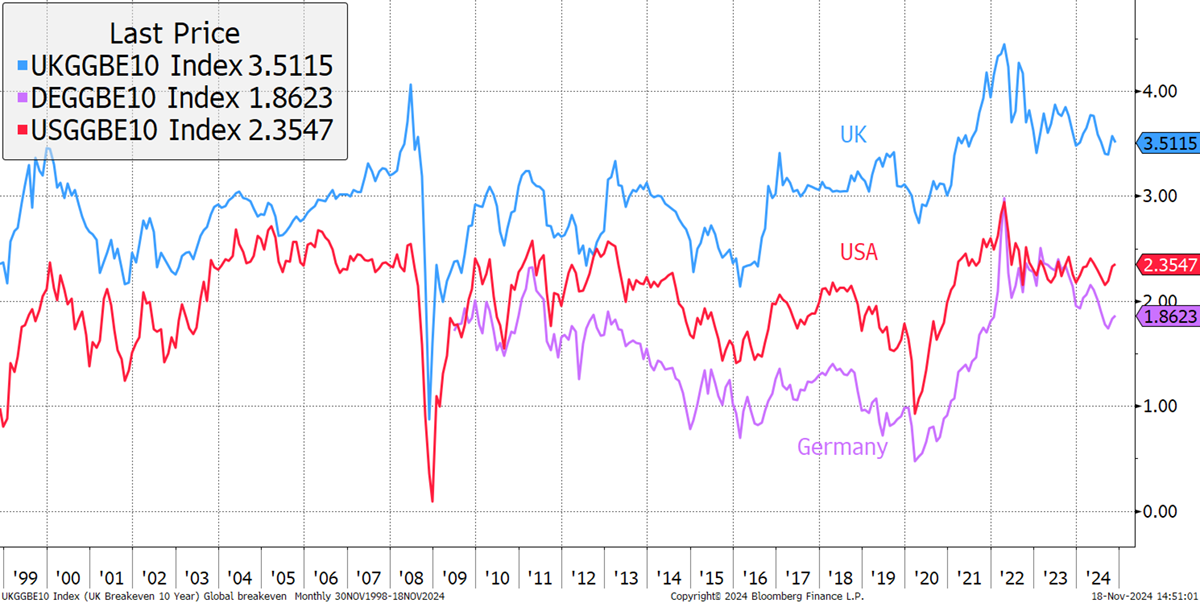

The message from inflation is that it’s back to DEFCON 3 from DEFCON 1 in 2021. Recall that the defence readiness condition score of 1 implied nuclear war was imminent, and 5 reflected peacetimes. Inflation at DEFCON 3 is not low, and it may well resurge in the future, but the current risk is tolerable. The shift from DEFCON 1 to 3 has boosted equities and may now boost government bonds.

Global 10-Year Inflation Expectations

Equities have had one hell of a run in recent years, while bonds have been left behind. I believe it’s time to add to oversold bonds and become more cautious on equities.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd