Opposites Attract – Gold Can No Longer Ignore Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report Issue 99;

The US Government holds 261.5 million ounces of gold worth $680 billion and 203,222 Bitcoin worth $18.9 billion. Is that enough to start a strategic reserve? President-Elect Trump thinks it is. The confiscated Bitcoin will no longer be held at the crime bureaus but by the US Treasury, presumably in Fort Knox. Bitcoin and Gold will sit side by side.

Highlights

| Digital Gold | Opposites Attract |

| Technicals | Past Gold Peaks and Corrections |

| Macro | Real Rates, Dollar |

| Flows | Why Are the Germans Selling Gold? |

| BOLD ETF | Balancing Risk |

Opposites Attract

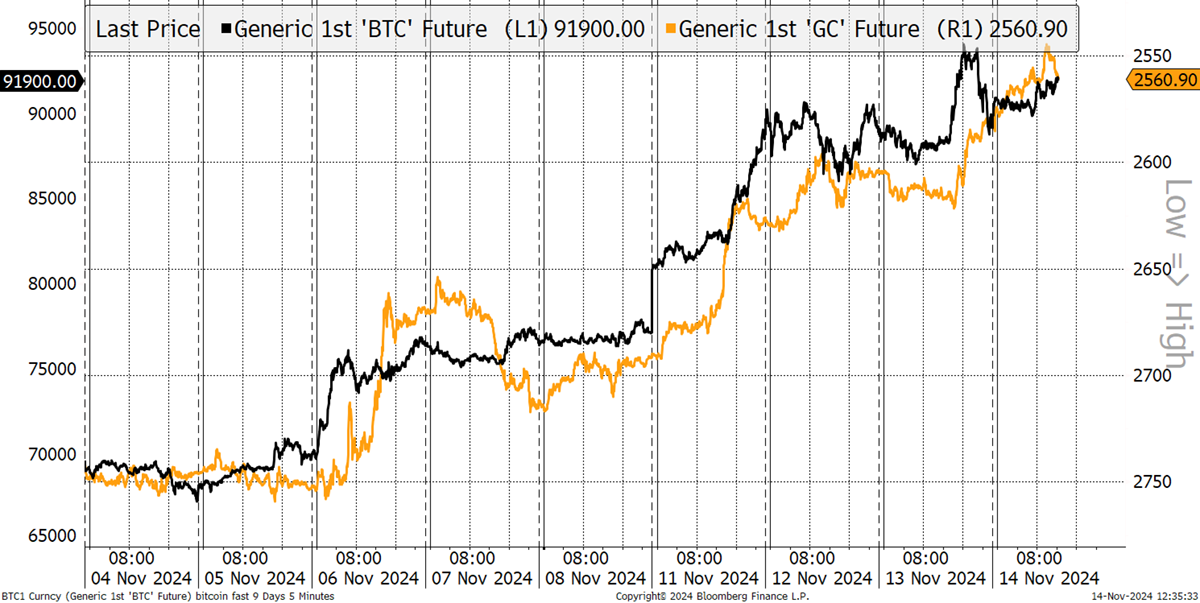

Since the end of October, the gold price has fallen by 7% in dollars and 4% in euros as the dollar has surged. While gold is giving back some of this year’s spectacular gains, Bitcoin has taken over. As I have long said, these assets take it in turns, and the baton has been handed back to Bitcoin. The inverse moves between Bitcoin and Gold in November have been remarkable.

Bitcoin and Gold – 10 Days with Gold Inverted

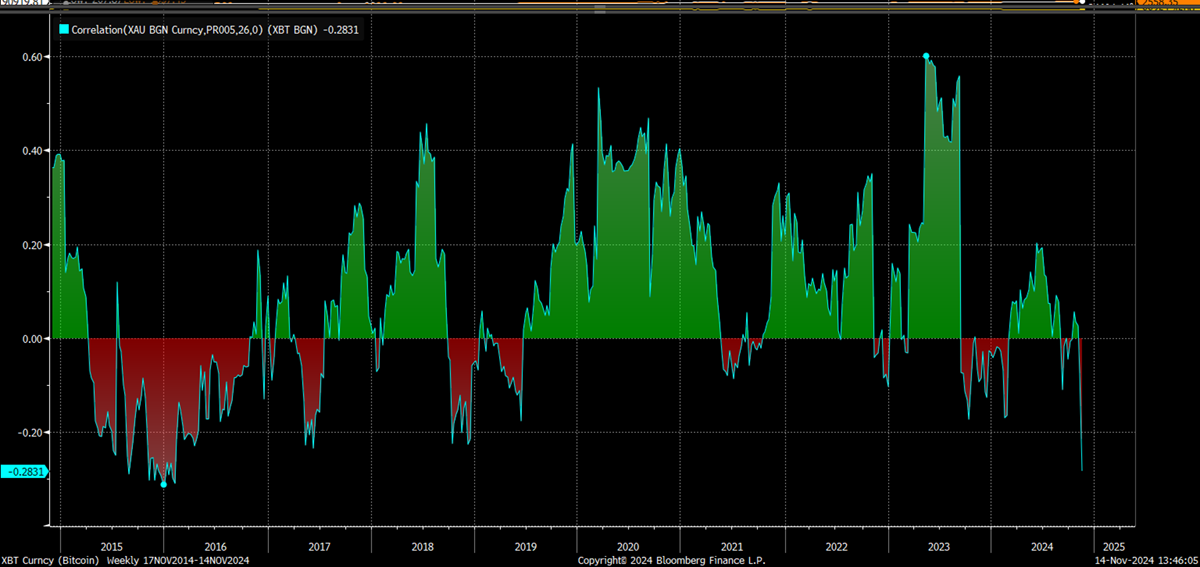

Bitcoin and Gold do not have a perfect negative correlation but a persistent low correlation. That is sometimes positive when the dollar had decisive moves in years such as 2018, 2020, and 2022. The correlation has occasionally been negative, as it is now, but less frequently. The ten-year average correlation was 9%, which is minimal. This is why Bitcoin and gold are such a natural pairing, as holding uncorrelated assets side by side provides natural diversification.

Bitcoin and Gold Correlation Over 26 weeks – Past Decade

The Trump administration is pro-business and pro-fintech, which is why the payments companies have rallied. Alternative money, stablecoins, and cross-border transactions will be made easier under Trump, and capital markets will benefit from less regulation. This means Bitcoin and crypto now have a country they can call home, and it’s no longer El Salvador but the USA.

This is important for the gold market and should not be deemed as a threat. The growth in global equity issuance never killed the bond market; indeed, it thrived. My point here is that in alternative assets, gold is the bond, and Bitcoin is the equity. They sit well together, and as investors realise this, both markets will benefit. The $128 trillion wealth management industry is underweight gold, as I have covered in recent issues. Their exposure to Bitcoin is approximately zero. The Bitcoin and gold partnership has a long way to go.

Technicals – Past Gold Peaks and Corrections

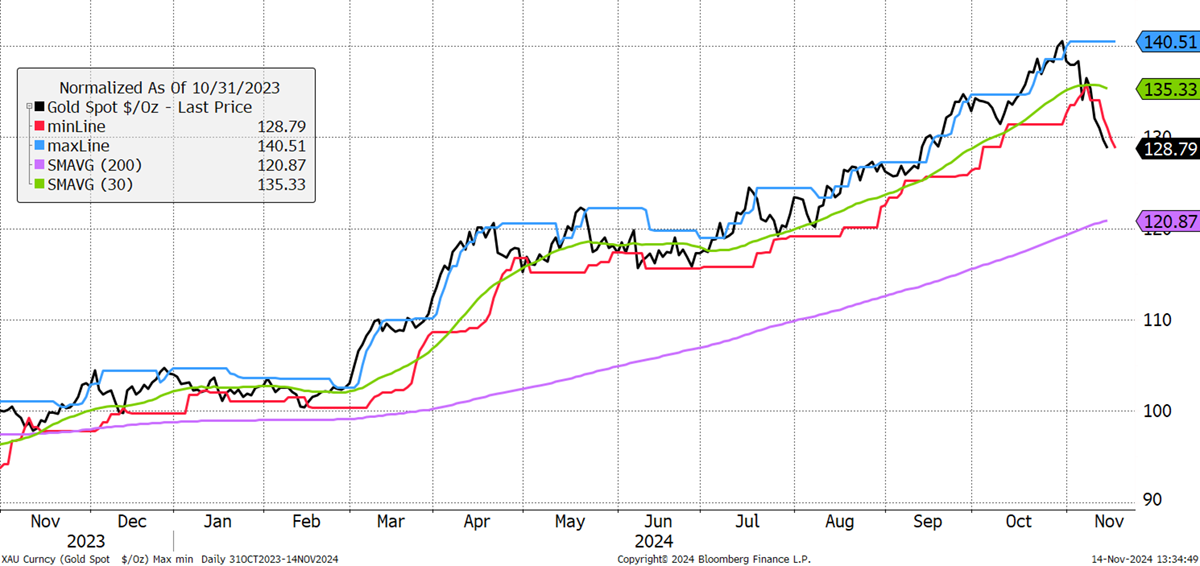

A 7% correction rarely makes the headlines, but this one is event-driven, with much of it coming after the US election was declared. I will dig into why later. In the meantime, gold was up 40% over the past year, but now 29%. The 200-day moving average (200 MA) remains in a strong uptrend, but the short-term trend has broken. Gold was 18% ahead of the 200 MA at the end of the October peak, with just 11% volatility (30-day), which is low. The chart starts at $100, making it easier to gauge the price changes.

Gold – Starting from a Year Before the Peak

The high was 40% over a year, which is a good run for the Gold price. I compare that to previous peaks (if, indeed, this is one).