Fresh Air

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 138;

Over the weekend, Bitcoin moved beyond the $100k level after its first attempt last month. The point is that the price of Bitcoin is trading in fresh air, i.e. territory never previously seen, which means no resistance and that is bullish. Last month’s stall would likely be due to psychological selling pressure around big round numbers, and a large number of options positions, which needed to be cleared out, were liquidated. That is now done, but don’t be surprised if $100k is revisited at a later date, even if it is two years from now. Still, bullish times.

The near-term risk is that Bitcoin becomes too overbought, too quickly. Steady trends are the best trends, and if it shoots off to the races, the risk of a pullback increases. The 200-day moving average sits at $69,400, as the price is 50% higher. That is the same level as seen in late 2021 and twice in 2023. A higher reading of 85% was recorded in March 2024, which led to a six-month consolidation.

Bitcoin and the 200-day Moving Average

Being overbought isn’t necessarily bearish, as it is fundamentally a sign of strength. But it can lead to a reversal and, very often, a stall. The hope is that Bitcoin has matured and builds at a sustainable pace. Too much too soon will lead to a repeat of the four-year cycle. The less hype we face today, the less brutal the crypto winter that follows. Long-term holders should hope for that.

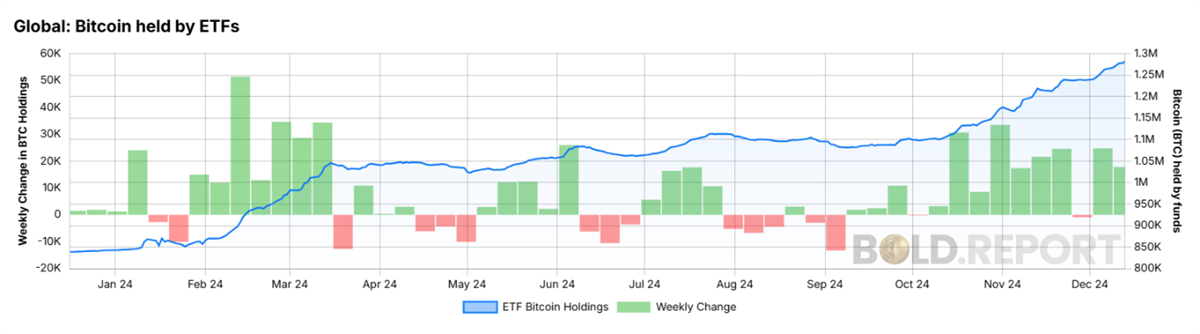

Flows are the most important thing. The new supply has shrunk but is still large in monetary terms. At current prices, the miners are forecast to earn $18 billion over the next year. That money must come from somewhere. Currently, with things going well, that funding is relatively straightforward.

Bitcoin Held by Global ETFs

I would highlight that on-chain transactions are falling. There can be many reasons for this, such as rising transaction fees. So far, it isn’t a problem, but it will be if it falls too low.

Bitcoin Transactions

A healthy Bitcoin Network balances an active blockchain with sustained and growing monetary flows. Take one of those away, and the growth case faces a challenge. The second high in late 2021 saw fewer transactions, which didn’t sustain the price. Something to keep an eye on.