Gold and X-ray Machines

Trade in Whisky;

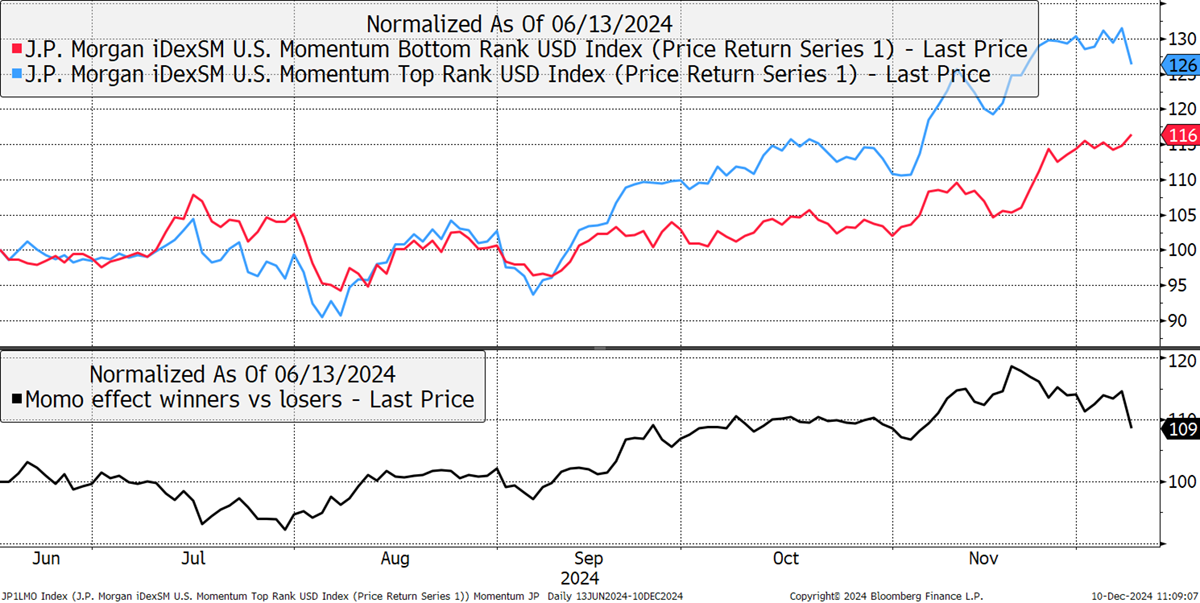

Syria falls, and they have lost their entire air force since Sunday. Gold inched higher, along with the dollar, yet oil shrugged it off. There was also a modest momentum crash as the prevailing winners in the stockmarket stalled while the losers rallied.

The fact that the losers rallied is a good sign for markets because, if they were falling, it would be a warning of an impending bear market. Instead, value is fighting back, which is likely a positive sign for the economy next year. This is true in Europe as well.

US Momentum Wanes

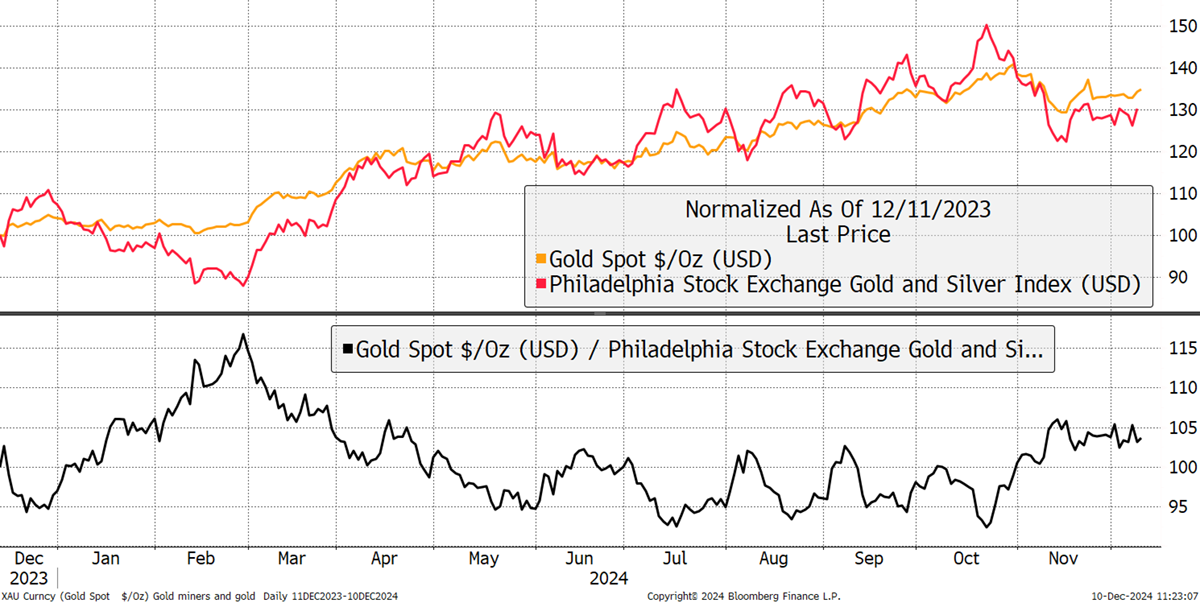

I was pleased to see the gold miners catch a bid after a soft patch. The gold price hasn’t fallen very much at all, but the miners took it badly. It works in reverse, and with cheap oil and high gold prices, I believe the miners have much more to give.

Gold and the Miners

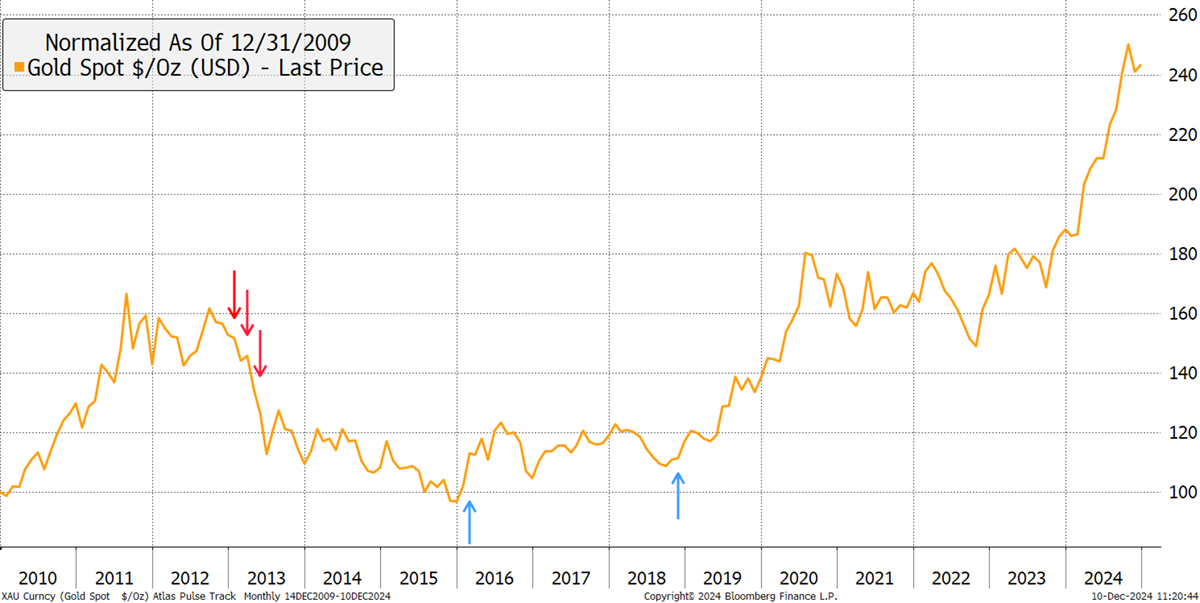

Tomorrow, I will be writing the 100th issue of Atlas Pulse, my publication on gold. I wrote the first one in 2012, and my priority was to warn of a gold bear market. At the time, the gold bugs were on fire, akin to today’s Bitcoin maxis, and what I was saying was treachery. Still, I made the call and gold slumped, not making a new high until 2020. Real interest rates were rising in a crowded market, and it was time to get out of the way.

Atlas Pulse Track Record

In early 2016, I called the low just as I started writing the Fleet Street Letter at Southbank and turned properly bullish in late 2018. The first call was based on market exhaustion and a likely dollar peak. The second was a likely peak in real rates. That track record is good. What I am the most proud of is not having called the bear in 2022, which was widely predicted but never happened.

In the lean years, I wrote about Bitcoin, banging the drum in late 2015 at $250. Now it is hovering near $100,000, so it wasn’t such a bad call. But it’s been one hell of a rocky ride, which is probably why I still enjoy the calm world of value investing to balance things out. Watch out for my 100th issue of Atlas Pulse.

Speaking of value, this week, I turn to an industrial conglomerate that has faced its challenges. It is a class act that has lagged the FTSE 100 for 25 years, and its time has come.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd