My Journey in Finance;

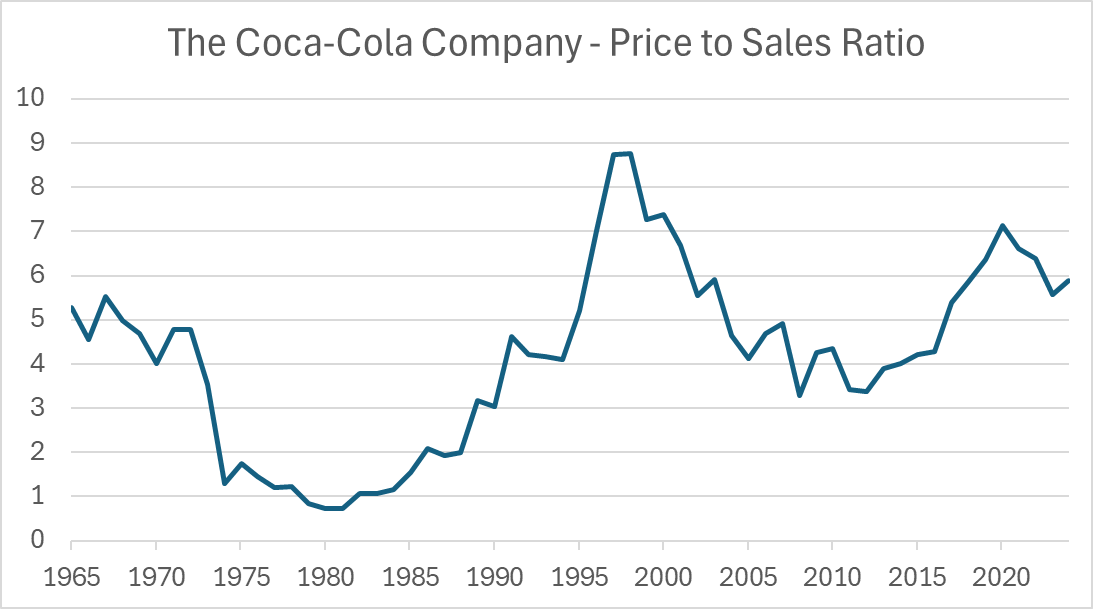

The price-to-sales ratio (PSR) for Coca-Cola (KO) demonstrates how a stable company with similar products over the years saw the valuation range between 0.7x sales (cheap) in 1980 and 11x sales (rich) in 1998 (note the intra-year 11x peak is not shown on the annual chart). This valuation range is wide with completely different investor perceptions of the company held at different times.

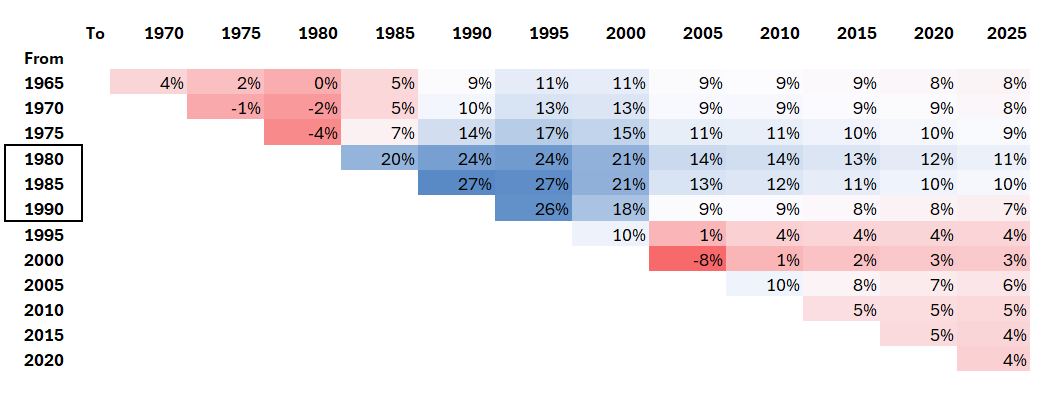

Investors had different outcomes depending on when they bought KO, not so much due to time, but price. The best time was when it was dirt cheap, which was when the PSR was below ~1.5x between 1980 and 1990. If they did that, annualised returns would have been over 20%. If, on the other hand, KO was purchased when it was expensive, from 1995 to 2000, returns were much lower.

Coca-Cola Returns (capital only)

Warren Buffett and the late Charlie Munger bought KO in 1988 after the 1987 stock market crash. It went on to do very well and Berkshire Hathaway still owns 9.3% of the company to this day. The price you pay will heavily influence future returns, and this is an important investment principle. If you get a good price like Berkshire did, returns are likely to be high, but pay too much for a great company, and the chances of being disappointed remain high.

Looking beyond PSR, which is a simple and timeless measure of value, it is important to recognise that the specific level of the PSR is not particularly relevant. Highly profitable companies, such as software, will naturally have high PSRs and deservedly so, in contrast to lower margin businesses, such as supermarkets, which will have lower PSRs. That’s because higher margins mean higher profits, and the stockmarket loves profits above all else.

I like the PSR because sales are much more stable than profits, and so it works as a valuation constant. But I do not target companies at specific levels or anything like that. The PSR shows how much the market is willing to value the company’s sales over the years, and that fluctuates. One piece of useful information is the long-term average which for KO is 4.2x, which can be compared with the level today, 6x. For long-term investors, KO is more likely to be a good investment if acquired below its long-term average than above.

If you bought a stock at a particular level of PSR and held it for ten years, the bulk of your capital return would be the company’s growth plus or minus the changes in the PSR. In other words, if you sold it for the same PSR as you bought it, your return would equal the company’s sales growth. If the PSR doubled, your return would double - and halve if it halved. There are also dividends, which are added to the capital return to make up the total return.

I believe this is a very simple way to think about equity returns, and because the future sales are unknown, as is the future valuation, the price you pay is the only thing an investor controls.