Opposites Attract

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD Index Monthly Rebalancing Report;

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

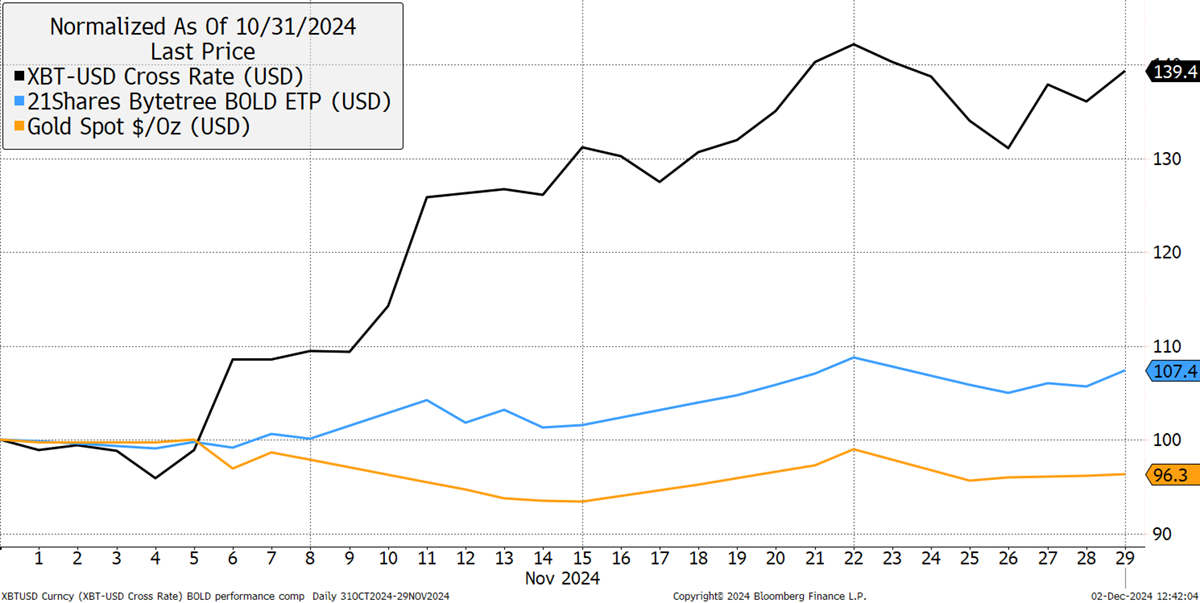

In November, BOLD rose by 7.4%, Bitcoin rose by 38.5% (calendar month), and Gold fell by 3.7%, while global equities rose by 4.5% in USD terms. The target weights last month were 24.6% and 75.4% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 31.9% and 68.1%. This means the latest end-November rebalancing has seen a 6.9% reduction from Bitcoin and added to Gold to meet the new target weights.

Bitcoin, Gold and BOLD (USD) – November 2024

It was a particularly interesting month for Bitcoin as it challenged the $100k level for the first time. Surprisingly, it reached $99,728 before reversing. Yet, when you look back, Bitcoin stalled at every round number, each marking a 10x move. The stalls in 2011 ($1) and early 2013 ($100) were brief. But the pause in 2012 ($10) lasted well over a year, and the later ones in 2013 ($1,000), and 2017 ($10,000) both lasted for around three years.

Bitcoin Stalls at $100k

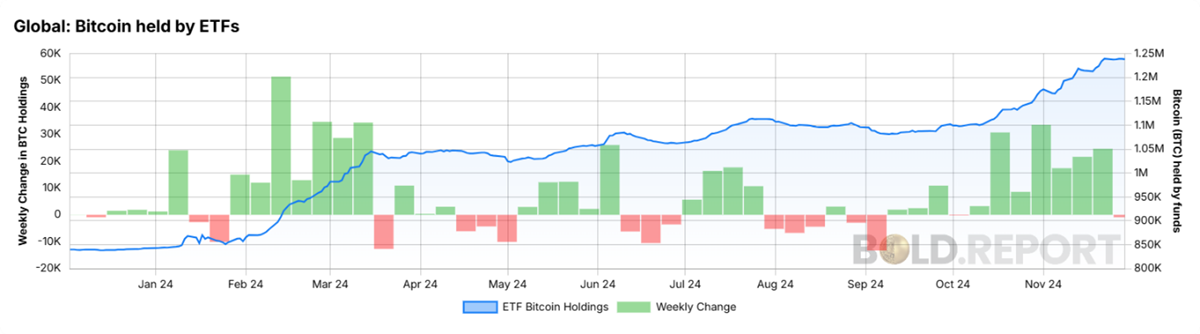

Bitcoin will likely pass $100,000, but it may take a little time for the recent high expectations to cool. The US election was positive for Bitcoin, but less so for Gold. There has also been heavy buying from Bitcoin evangelist Michael Saylor. His company, MicroStrategy, has acquired 402,000 BTC by issuing new shares along with convertible bonds. This is possible due to a high share price. Despite high Bitcoin demand, with additional support from the ETFs, Bitcoin has stalled at $100k. This suggests there are natural sellers in the network, which may take a little time to overcome before we see the next new all-time high.

Bitcoin Held by ETFs

Bitcoin and Gold Research

ByteTree Research publishes research on Bitcoin and Gold. In the latest issue of Atlas Pulse, Opposites Attract – Gold Can No Longer Ignore Bitcoin, I looked at the correlation between the assets.

In the powerful surge in November, Gold was left behind as Bitcoin surged, with periodic inverse moves almost point for point, especially after the election.

Bitcoin and Gold Intraday in November

I covered the Bitcoin and Gold correlation, which has averaged just 14% since 2018. Contrast this with Gold and Silver, or Bitcoin and Ethereum, and the answer would be close to 80%. That means those pairs tend to move together. In contrast, Bitcoin and Gold do not, making them a naturally diversifying pair. This is a key point in understanding the benefits of rebalancing Bitcoin and Gold to enhance the outcome for the BOLD Index.