Sui: The Fastest Growing Layer-1 Platform

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: SUI;

Sui is a high-performance, Layer-1 (L1) smart contract development platform designed for exceptional scalability and robust security. As one of the fastest L1s in the industry, Sui has made remarkable strides in the highly competitive smart contract space, outpacing several major competitors since its launch last year. This Token Takeaway delves into Sui's core fundamentals, evaluating its position within the competitive smart contracts landscape and unpacking the tokenomics of its native token, SUI.

Overview

Launched in May 2023 by Mysten Labs, Sui addresses the scalability and security limitations of current L1s to promote the mass adoption of blockchain technology. Although Sui is open source with many different contributors, Mysten Labs is the original developer who created Sui and built the platform from scratch.

Sui was founded by Evan Cheng (CEO), Sam Blackshear (CTO), Adeniyi Abiodun (CPO), Kostas Chalkias (Chief Cryptographer) and George Danezis (Chief Scientist). Notably, all Sui founders used to work on Meta’s digital currency project, Diem (previously Libra).

According to Crunchbase, Mysten Labs secured $36m in a Series A funding round led by Andreessen Horowitz in December 2021, followed by an impressive $300m Series B round led by FTX Ventures. This brings their total institutional funding to an astounding $336m. Notably, Mysten Labs bought back FTX’s entire Sui stake for $96m as part of FTX’s bankruptcy proceedings.

Today, Sui has grown into a behemoth with millions of users and billions in on-chain transactions, a remarkable achievement for such a young protocol.

Total Active Accounts on Sui

As illustrated above, Sui has over 35 million active accounts (accounts with at least one transaction). These accounts collectively have executed over 7.7 billion transactions on mainnet in just one and a half years.

Sui Liquidity Flows

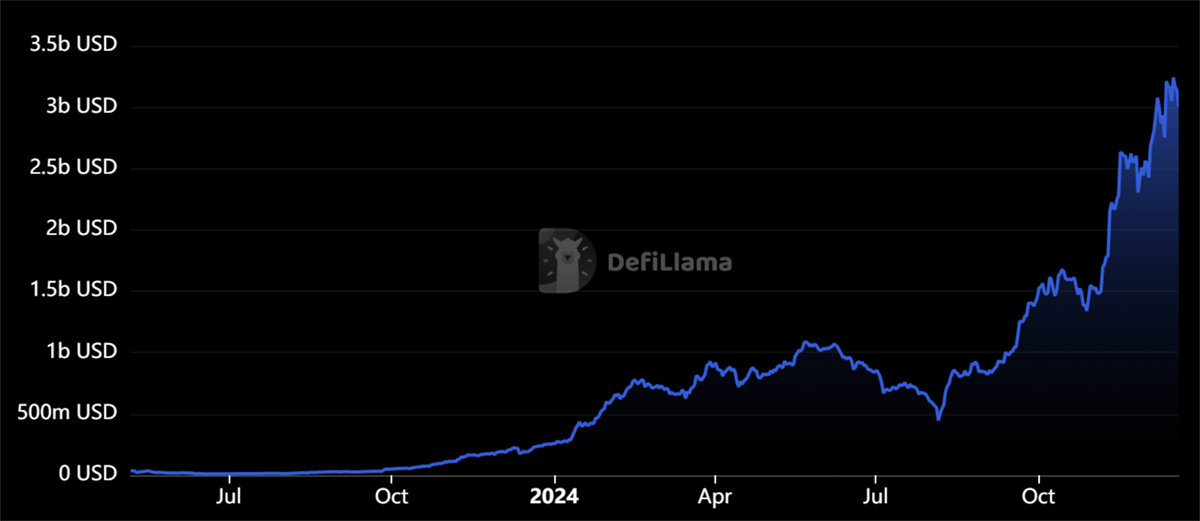

Since inception, the total value locked (TVL) on Sui has experienced an astronomical rise, growing from $32.7m on 6 May 2023 to over $3bn as of 19 December, registering a 9074% growth rate.

TVL on Sui

The majority of this liquidity came from its competitors, Ethereum and Solana.

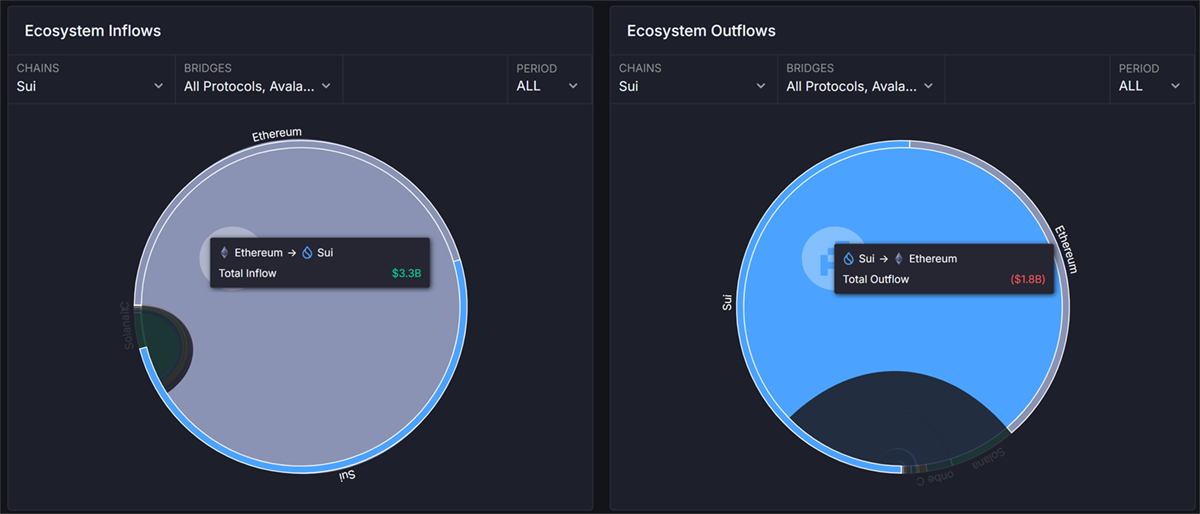

Sui Liquidity Inflows and Outflows

As shown above, over its lifetime, Sui recorded the largest inflows and outflows to and from Ethereum. It received $3.3bn from Ethereum, while only $1.8bn returned, resulting in a net inflow of $1.5bn from Ethereum alone. Solana was the second-largest contributor, transferring in nearly $250m but withdrawing $317m, leading to a net outflow of $67m.

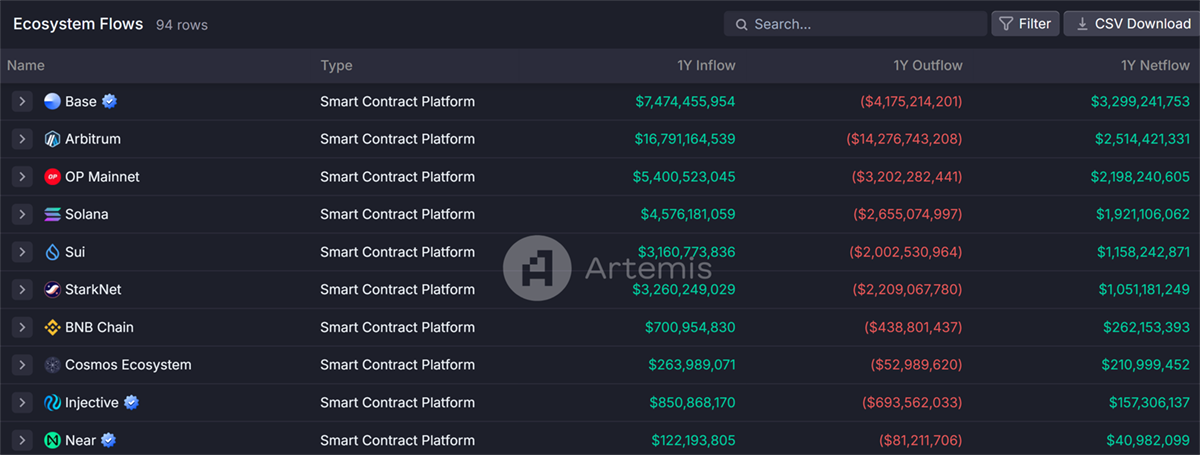

Top 10 Platforms by Net Ecosystem Liquidity Flows

Looking at the rankings, Sui is currently the fifth-largest smart contracts development platform, with over $1.15bn in net ecosystem flows in the past year.

This highlights the transforming L1 landscape where Ethereum, despite being the largest Layer-1 platform, is gradually losing market share to emerging platforms like Sui, which offer superior scalability and performance. This underscores the importance of scalability as a defining factor for success in this highly competitive space. These shifts in market dynamics are reshaping the landscape as platforms like Sui continue to attract liquidity and users by prioritising speed and developer friendliness.