Value Investing: Introducing Enterprise Value

Disclaimer: Your capital is at risk. This is not investment advice.

My Journey in Finance;

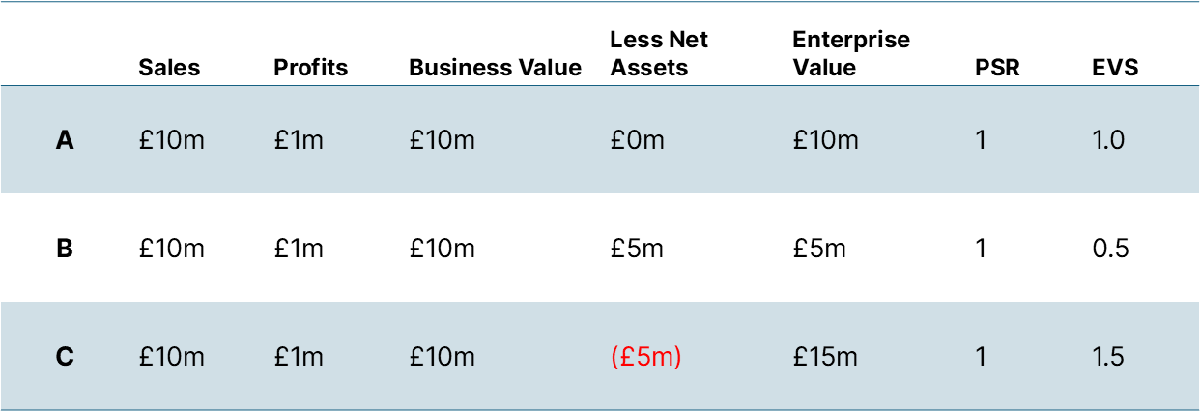

Following on from the price-to-sales ratio (PSR), we move on to the enterprise value-to-sales ratio (EVS). It is similar but takes the balance sheet into consideration.

Imagine a business with £10m in sales. On a PSR of 1x, it is worth £10 million. Now bring in the balance sheet. If the company had no cash or assets, it would still be worth £10m. If it had £5 million in cash and assets, it would become worth £15 million. Conversely, if it had £5 million in debt, it would become worth $5m. If you are confused, swap the company for a house. One has cash in the attic, and the other has a mortgage.

Under B, a buyer would get the cash, which would reduce their purchase price. Under C, they would get the debt which would increase their purchase price. EVS provides more information than PSR, so I prefer it. I have them side by side in my company valuation spreadsheet so I can see the state of the balance sheet at a glance. I will go through some examples.

Severn Trent

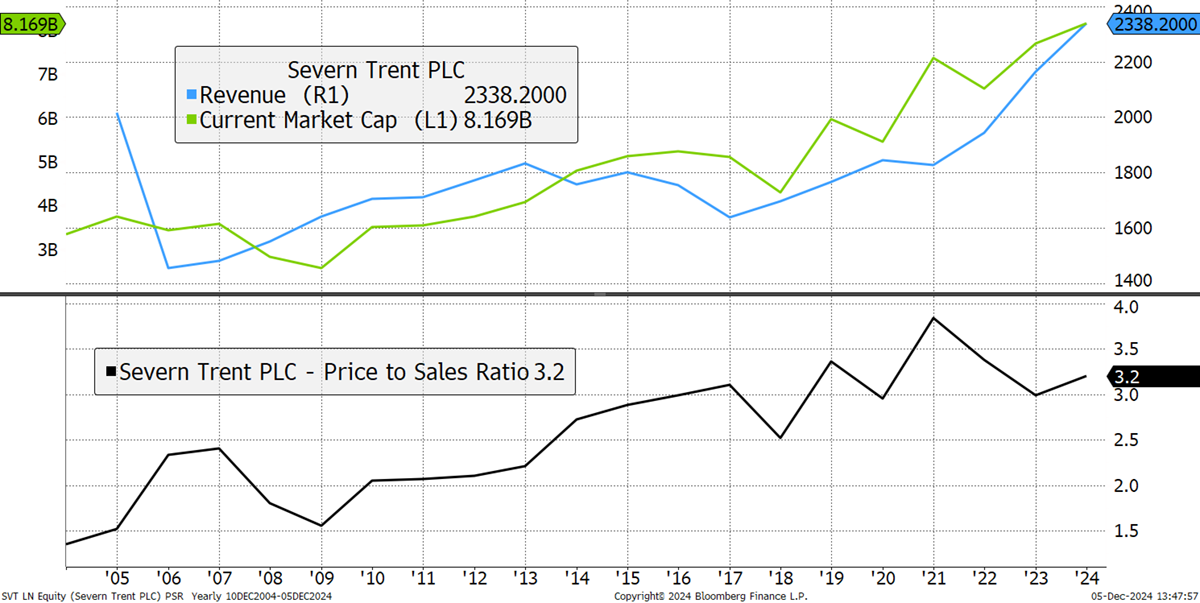

Severn Trent (SVT) is a UK-based water company. I plot the sales (blue) and the market cap (green). Sales are £2.4 bn, and the market cap is £8.2 bn. The PSR (black) is 3.2x, having risen from 1.5x in 2005. The valuation, i.e. the amount investors are prepared to pay for SVT’s sales, has doubled according to PSR.

Severn Trent Price-to-Sales Ratio

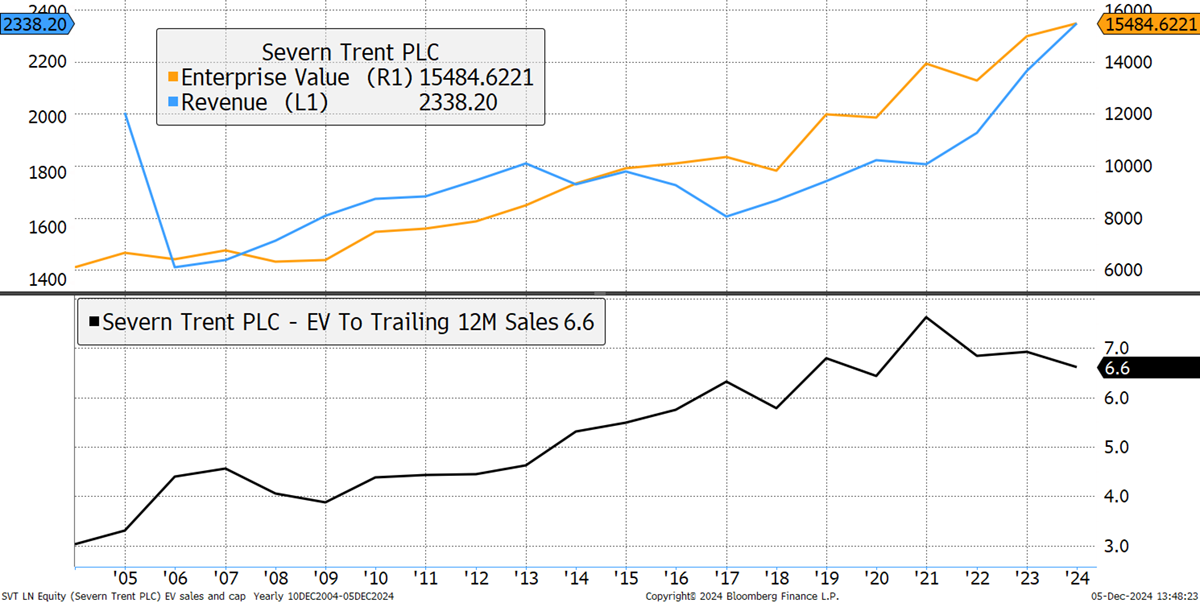

Looking at enterprise value (EV), SVT has £1 bn of cash and £8.8 bn of debt, making the EV £16 bn. This is similar to option C in the example above because a buyer would have to assume the debt. For SVT, the EVS is twice the PSR.

Severn Trent Enterprise Value-to-Sales Ratio

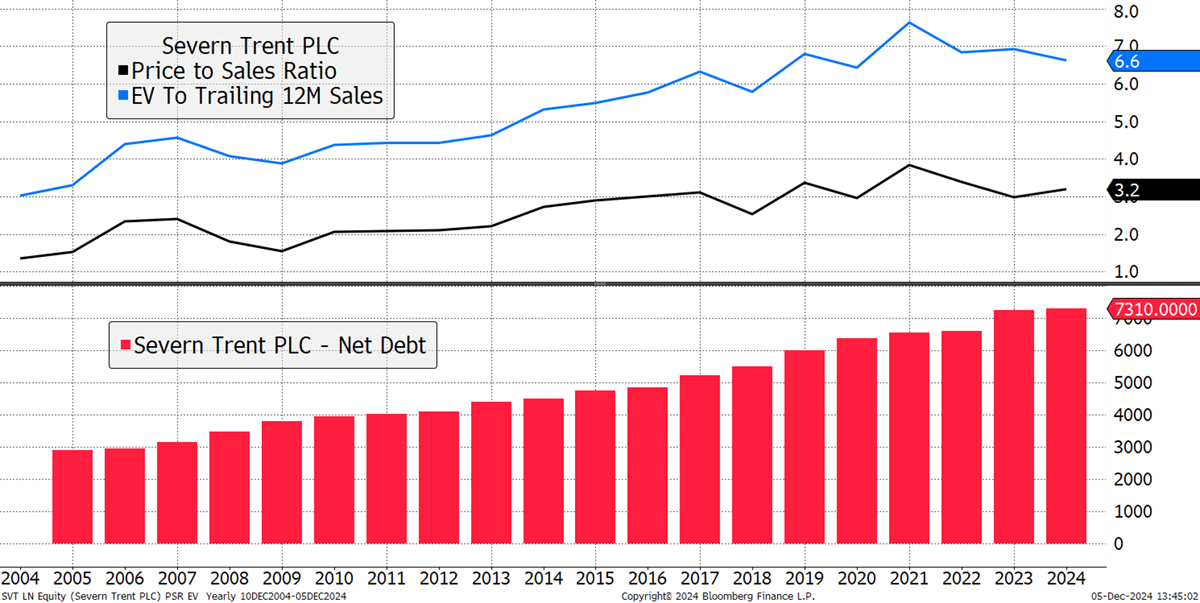

Next, I put the PSR alongside EVS and show the net debt below, which has more than doubled over the period from £3 bn to £7.3 bn. This explains why the EVS is twice the value of the PSR. Had SVT been debt-free, the PSR and the EVS would have been the same.

Severn Trent Enterprise Value-to-Sales, Price-to-Sales and Debt

Dassault Aviation

I now move to an example similar to option B, where the company is not only debt-free but also sits on a cash pile.