Venture: Portfolio Update

Issue 54;

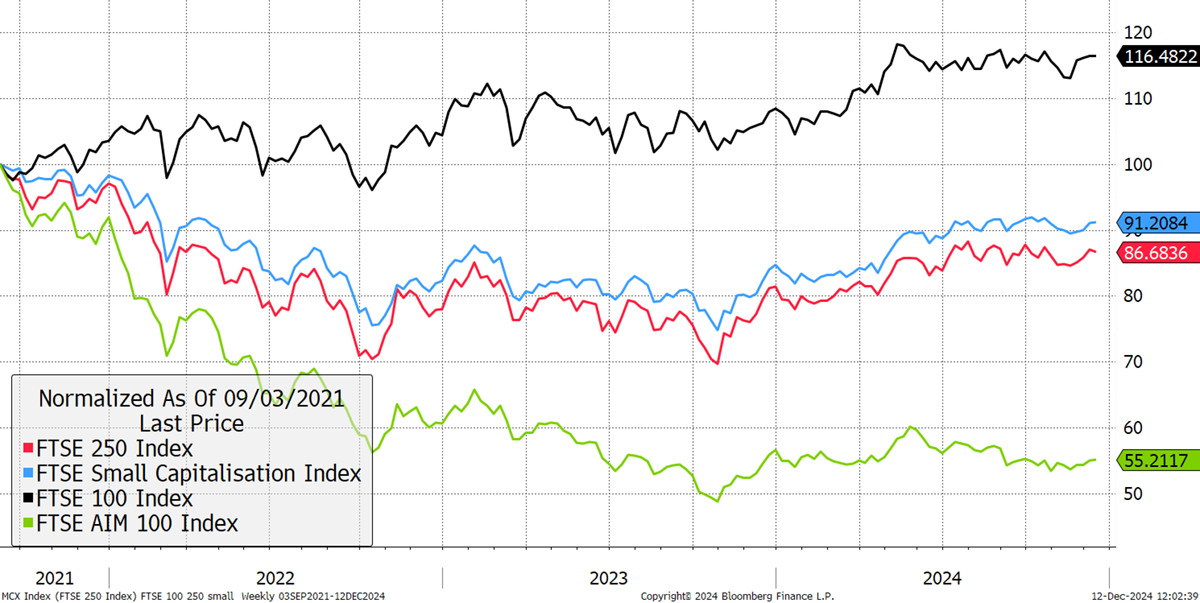

It has been a strong month for ByteTree Venture, with most stocks performing well. The modest recovery in AIM stocks is welcome, which have been sliding since the summer. Looking at the UK market, where 20 of the 29 current holdings reside, there has been a huge divergence since the 2021 peak. The FTSE 250 and small caps have lagged the FTSE 100 significantly, and the AIM 100 even more so. There is plenty of catch-up yet to come.

UK Stockmarket Indices

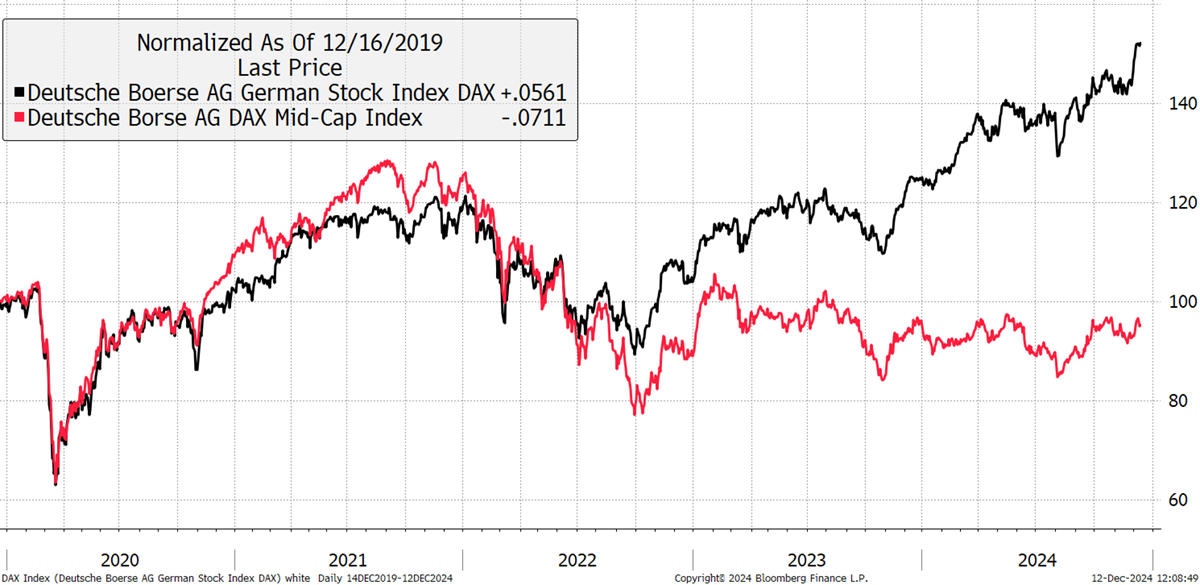

This is evident in the German market as well, where there are three holdings in Venture. European small and mid-cap stocks also offer compelling value in Europe, and our job is to find them.

German Market Indices

There are also several turnarounds and cyclical stocks where we believe we have an advantage over the analysts as they follow valuation methods that focus on the current situation at times when change is inevitable. With Europe out of favour, there continues to be rich pickings.

Venture is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd