Trade in Soda;

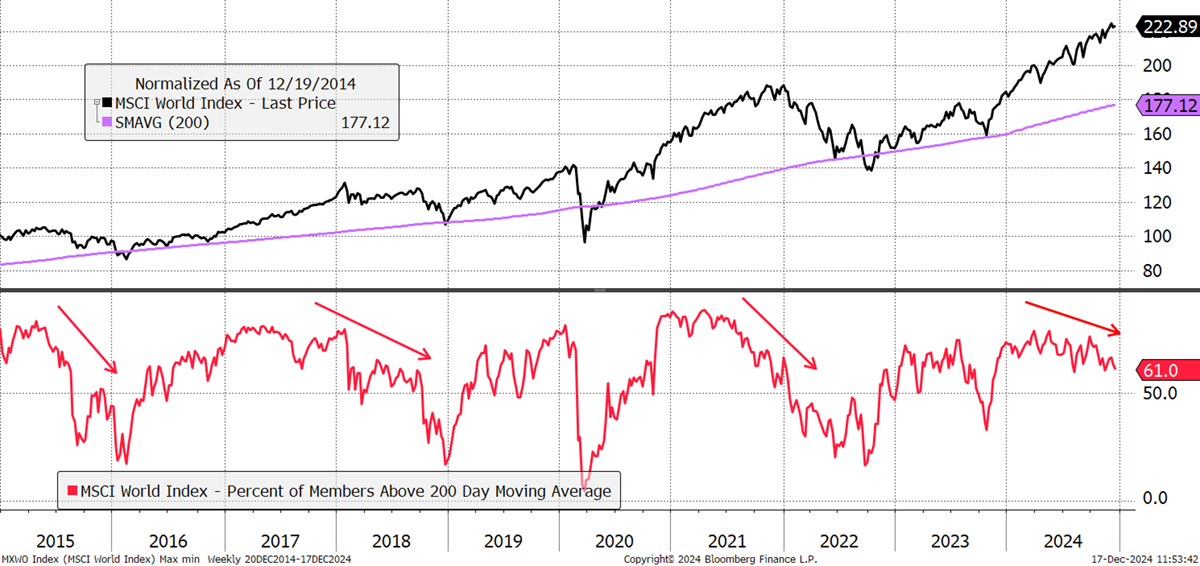

Before we get to bonds, I highlight the global stockmarket, which has been riding high this year but now faces deteriorating breadth. That is, the number of stocks in an uptrend is falling. The current reading is 61%, which is workable but falling. Fewer stocks are supporting this bull market, and it is time to take notice. I would also highlight the World Index (black) is quite stretched against its 200-day moving average. This week, I will be cutting some risk at the margin.

Global Equities See Falling Breadth

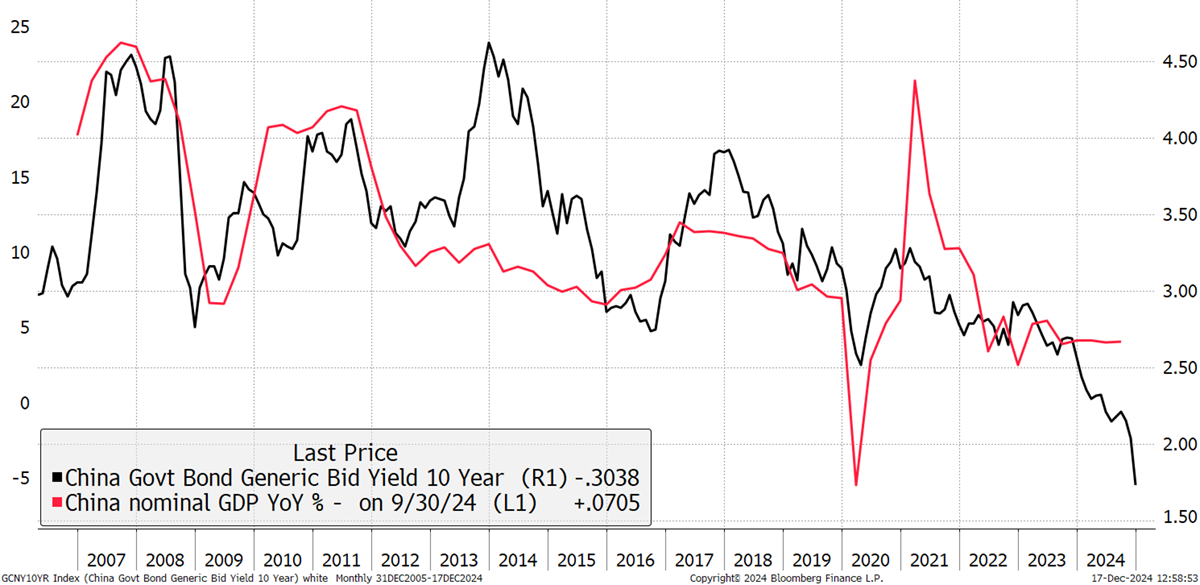

Before we come to that, I want to look at the bond market, starting in China. The problems with China’s property market first surfaced in late 2018, and bond yields have fallen since, reflecting the economic slowdown. The issue with a large property bubble is the debt deflation that follows, something Japan is just emerging from today, following its own bubble in the 1980s. This means that China’s property market is gridlocked. The banks are unwilling, perhaps unable, to lend as they nurse losses as prices fall. This year, Chinese bond yields have collapsed to alarmingly low levels, and investors should take notice.

China 10-Year Bond Yield

The People’s Bank of China has slashed interest rates and is drumming up stimulus packages. It’s still too early to tell, but the early market reaction was positive in the summer when our Emerging Market Internet Stocks (EMQQ, EMQP) rallied sharply, but it has been cool since. The additional risk is that President Trump’s administration will move hard and fast on China, and potentially cripple the economy in the process. The result would likely see China devalue the Renminbi and send a shockwave of deflation around the world.

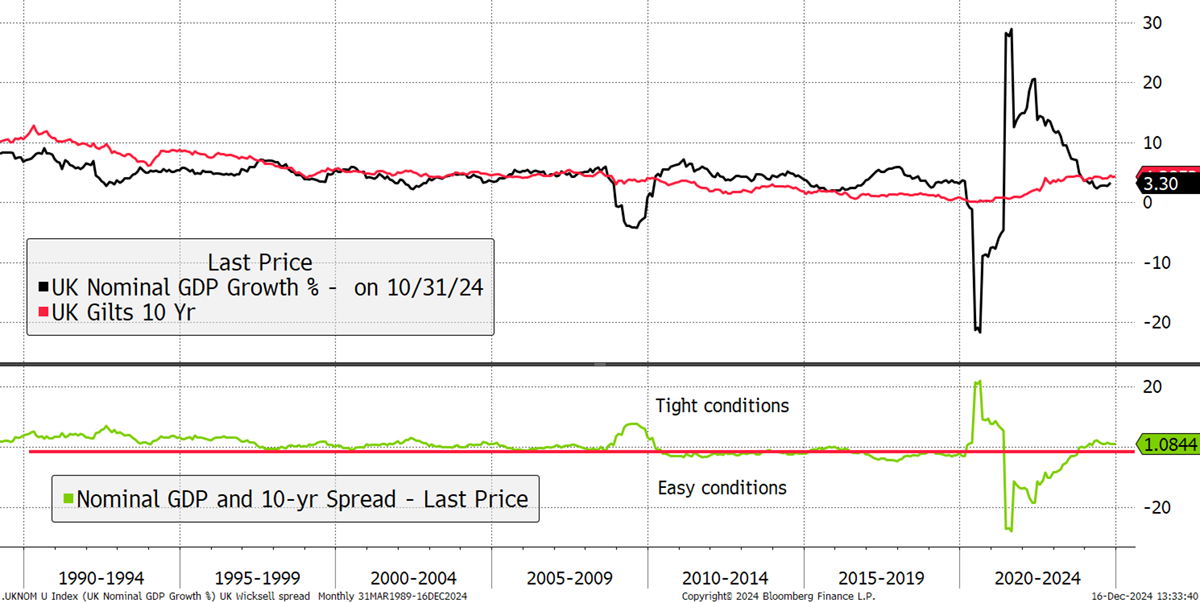

This is another reason why I bought the long bond, which was added to Soda a few weeks ago. Long-time readers will know my attachment to the Wicksell Rule, which suggests the 10-year bond yield should approximate the rate of nominal GDP growth. In the UK, the 10-year gilt yield (red) is now slightly higher at 4.5% against nominal GDP growth at 3.3%. With a positive difference of 1%, there is room for rate cuts next year, even if they don’t come this Thursday.

The UK Wicksell Spread

The Bank of England is worrying about wages, largely due to public sector pay awards, but they shouldn’t. The jobs market is softening, and the more the Chancellor learns about economics and budgetary constraints, the less likely it is that these will continue. In the post-pandemic economy, the only remaining inflationary pressure has been wages, which deservedly held out for a catchup, but this is unlikely to last for much longer.

Back to China, I show the Wicksell spread, and although the y-axes are different and the government remains committed to a 5% growth target, the bond market is sending a very different message. China’s growth could disappoint, and this could make inflation a forgotten dream.

The China Wicksell Spread

Indeed, this is Russell Naper’s view, broadcast in an interview with Bloomberg’s Merryn Somerset Webb, where he is convinced the long-term solution remains financial repression, whereby inflation eats away government debt, but we have another deflationary shock first. It’s a plausible scenario in which the authorities respond to a slum with continued economic stimulus and “state capitalism”. It is worth a listen, even if he thinks Bitcoin is a liquid baseball card.

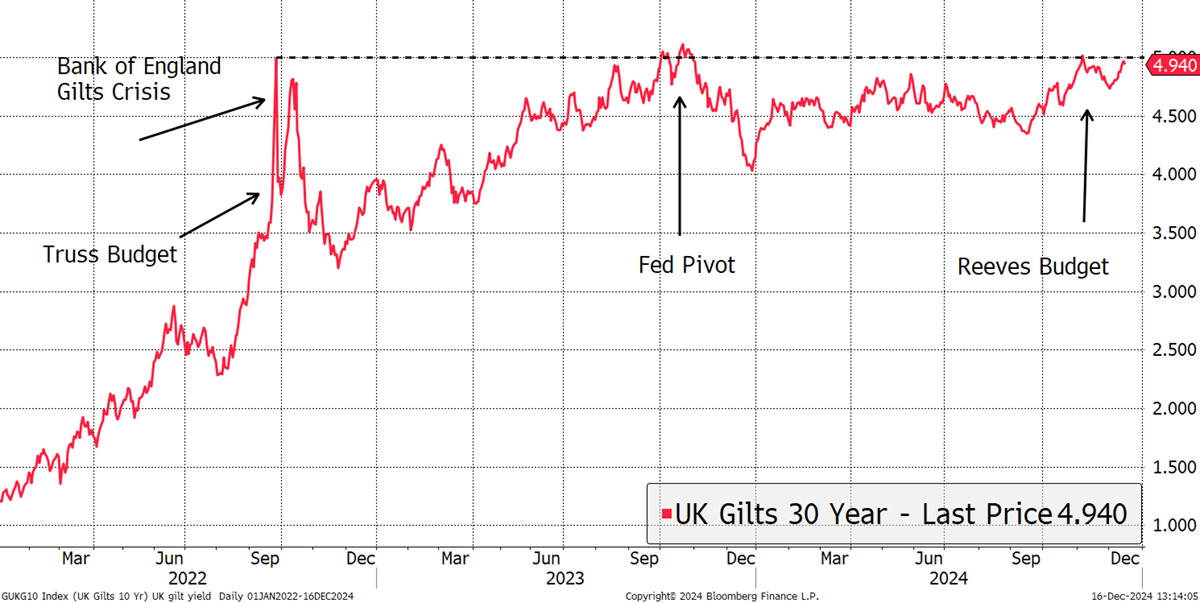

The UK long-dated gilt market pays 5%, a level not seen since the early noughties. UK gilts are at odds with Chinese bonds and sending a very different message. We cannot be certain if the current high yields are a result of higher expected inflation, a very positive growth outlook, or higher government issuance. I believe we can eliminate a very positive growth outlook, as it seems unlikely.

UK 30-Year Gilt Yield

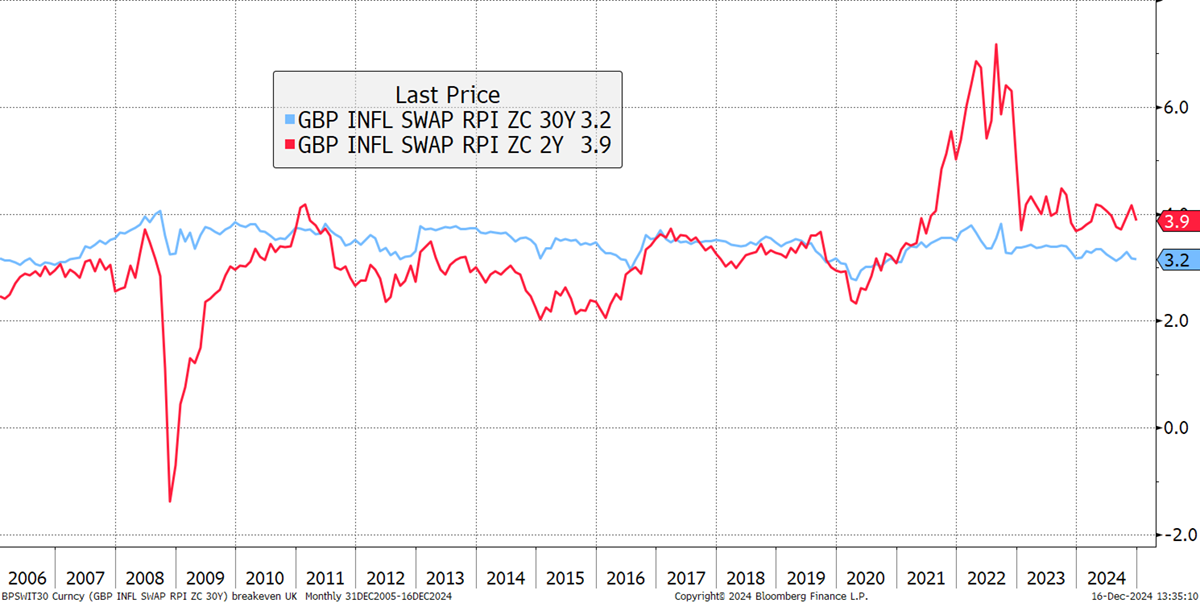

Yet UK inflation forecasts, derived from index-linked (inflation-linked) gilts, are not suggesting that inflation is returning. That has been a consistent message since early last year.

UK Inflation Expectations

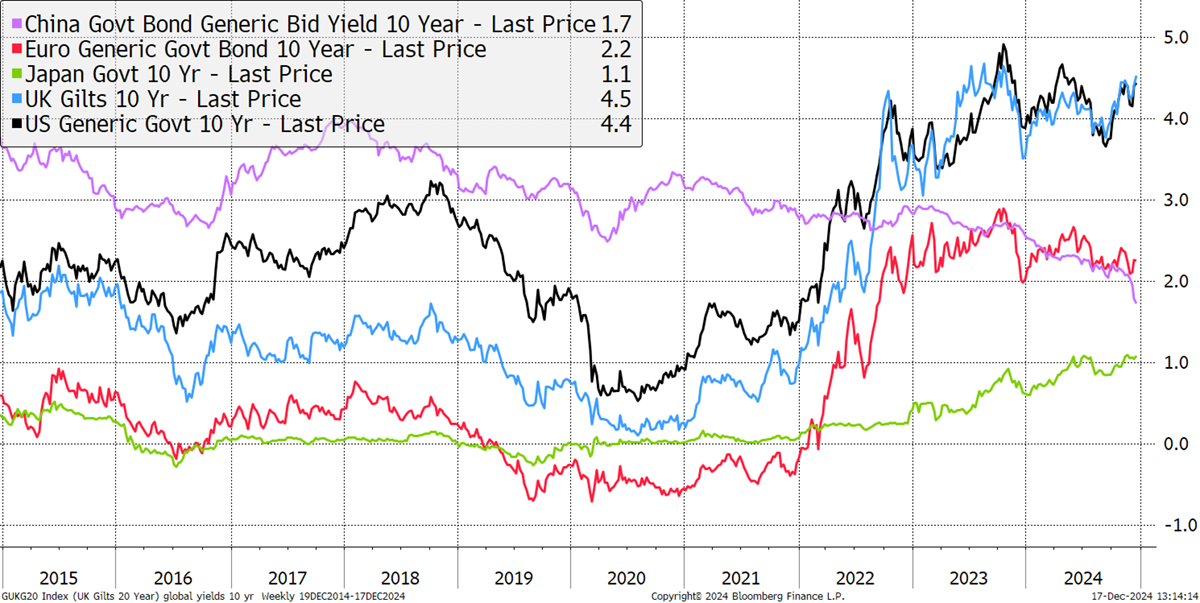

I believe that means gilt prices must be falling to offer higher yields, as next year’s funding will need to be met. This is the risk for the long bond, which is evident in both the UK and the USA, where yields are higher than elsewhere. As we have established, Chinese yields are falling, as are European (France is another matter). Japanese yields are on a different path and rising. The yen is also significantly underpriced against the Chinese Renminbi, and that is very likely to reverse.

Global 10-Year Bond Yields

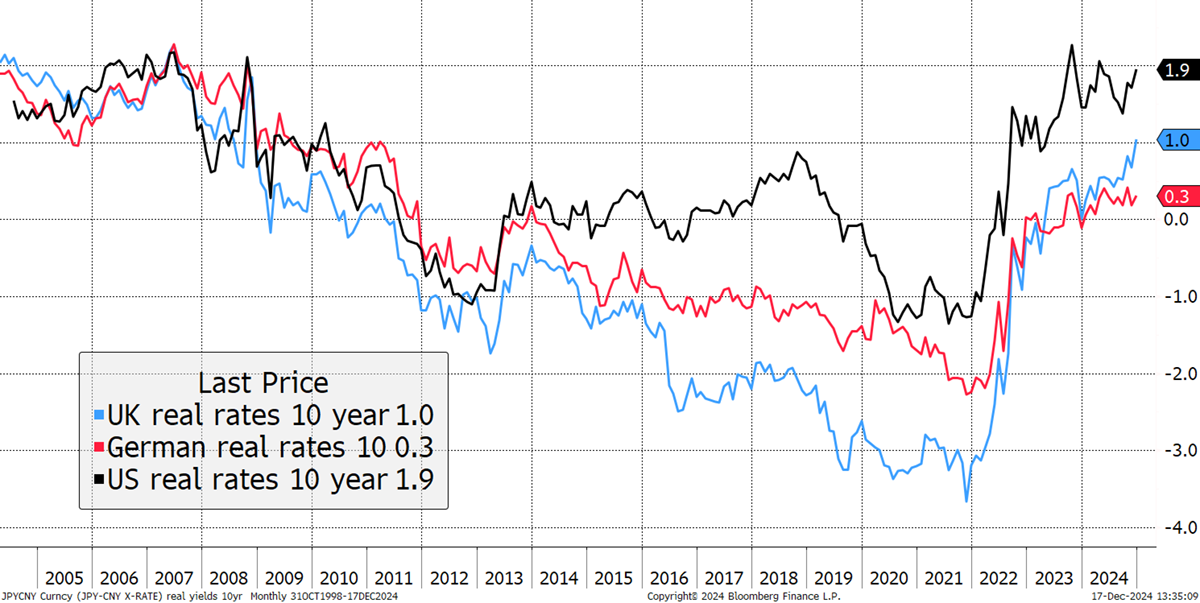

When you subtract inflation expectations from interest rates, you get real interest rates, which are currently high. The UK uses RPI rate than CPI for historical reasons, so you could add around 1% to UK real yields to get a clearer picture and compare them with the US and Europe. Real yields are historically high in the US and the UK, at around 2%. In theory, that should make gilts and treasuries attractive to foreign investors, and hence my recent purchase. That was a modest start, and when it starts working, I will likely increase exposure, but need more confidence first.

USA, UK and Europe 10-Year Real Yield

The rise in real yields since October has put downward pressure on the price of gold, aka “government Bitcoin”, despite it being resilient due to other factors, such as the large-scale purchases by global central banks, including China. Moreover, when real rates start falling again, which can’t be too far off, gold will have another rocket booster.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd