Trades in Soda and Whisky;

On 4 December 2024, just a few weeks ago, the Bank of England pointed to four rate cuts this year as inflation would come down faster than we thought it would. Much has changed since then, and UK inflation expectations have shot up. What looked like a slam dunk for a lower interest rate environment has sharply reversed.

UK Inflation Expectations

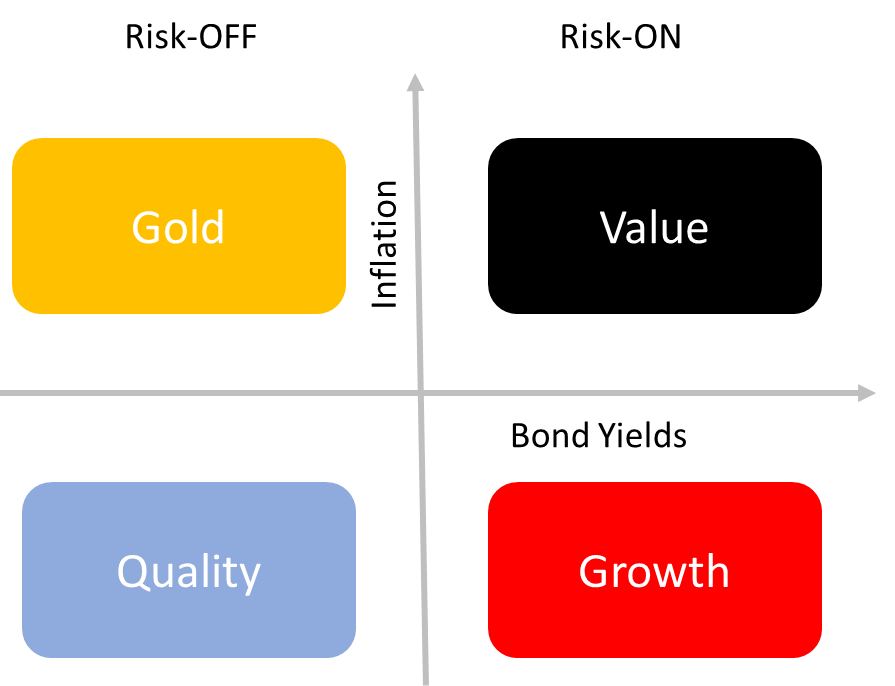

With rates staying higher for longer and inflation expected to rise, we are firmly back in the top right quadrant of the Money Map.

The Money Map

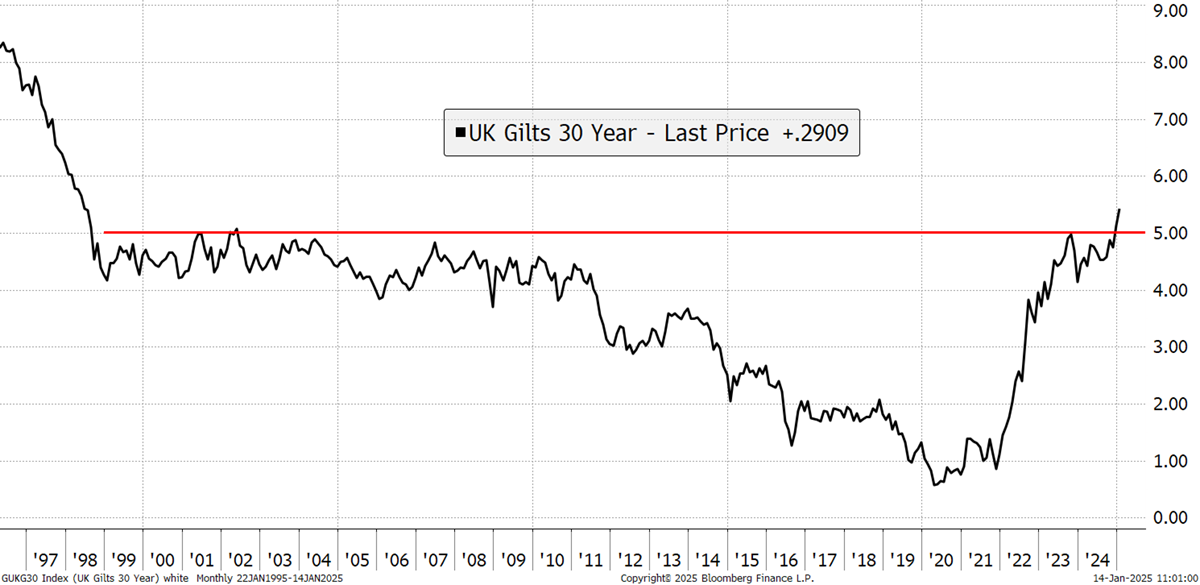

Just a few weeks ago, the expectation had been a shift towards quality, as both rates and inflation had been expected to fall. My take had been the long bond, which is highly sensitive to falls in interest rates. My thesis was that 5% had become a firm line for gilts that was unlikely to be crossed. Had yields fallen to 3%, those gilts would have made sizeable gains of nearly 50%. But once that 5% level was broken, which had held since 1998, something had changed.

The UK 30-Year Gilt Yield

I wasn’t buying the long bond for a 5% yield, as we can achieve that with the iShares $ TIPS 0-5 UCITS ETF (TI5G) without much volatility at all. I was being greedy and bought it for the capital gain, which would have been close to 20% if the yields had fallen to 4% and 50% if they had fallen to 3%. Is 3% low for the 30-year? In Germany, they are 2.8%, in Japan, 2.4%, and in China, 1.9%. With low inflation forecasts from the Bank of England, it seemed likely. What can we learn from this? That the Bank of England are less competent than we had hoped.

Gilts are falling, and that is partly due to the recent budget, but more importantly, it reflects that the national debt is too large to accept that budget. It is no time to be a big spender. That has knocked confidence, and the pound has fallen slightly. I say slightly because the moves in FX have been more about the US dollar strength into inauguration than sterling cross rates.

To illustrate that, the pound has fallen 6.5% against the US dollar since the US election but 4% against the yen and just over 1% against the euro. Had it sunk evenly across all, then that would be a sterling problem. Gilts aren’t working, which means the government isn’t working. The next move is to change with the times and diversify away from the UK.

There are a few areas within markets that thrive when inflation and rates are rising. One is financials (including Bitcoin), and the other is commodities. Oil jumped into the new year as new sanctions were imposed on Russia in one of Biden’s final acts as President. As Trump sets out his stall as a peacemaker, I suspect he may have resisted these latest sanctions. It is odd how outgoing governments leave poison pills behind in search of mischief.

The other area that is thriving is the banks, especially in Europe, where the post-2008 recovery has taken longer to come through. But It’s here, and having held European banks (inc. UK) for much of last year, I feel it is time to return to the sector as they benefit from a steep yield curve whereby long-term interest rates are higher than short-term interest rates.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd