BOLD: 2024 in Review

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD Index Monthly Rebalancing Report;

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

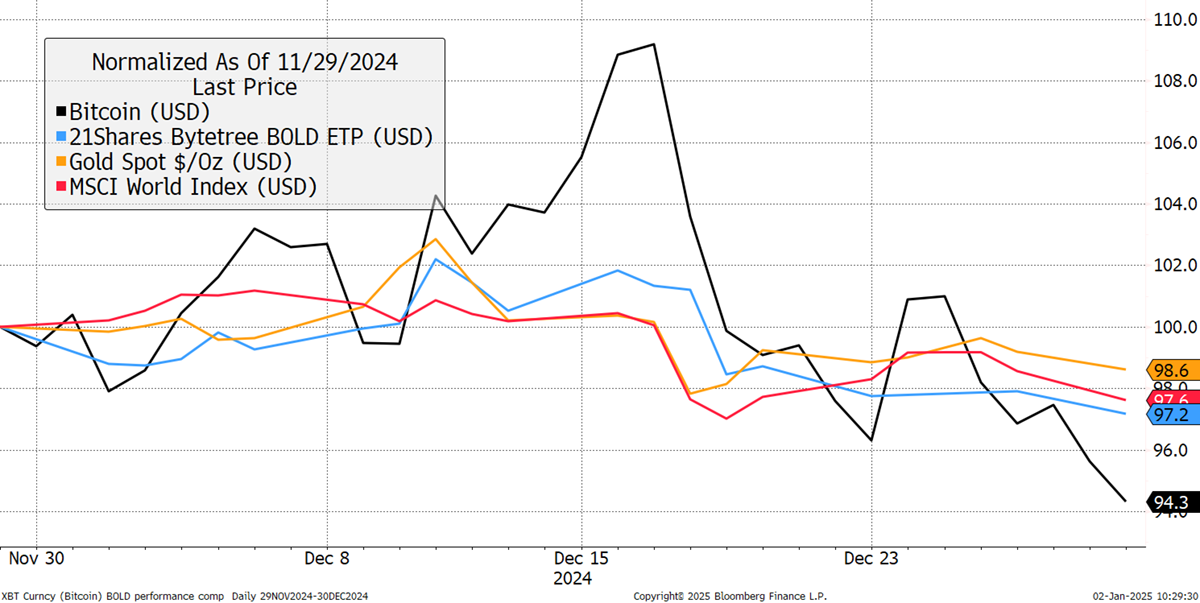

In December, BOLD fell by 2.8%, Bitcoin fell by 5.7% (trading calendar month), Gold fell by 1.4%, and global equities fell by 2.4% in USD terms. Note that the US dollar index rose 2.6% in December and 7.7% over the quarter, which has weighed on prices.

The target weights last month were 25% and 75% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 76% and 24%. This means the latest end-December rebalancing has reduced 0.5% from Gold and added to Bitcoin to meet the new target weights.

Bitcoin, Gold, BOLD, Equities and in USD – December 2024

BOLD Performance

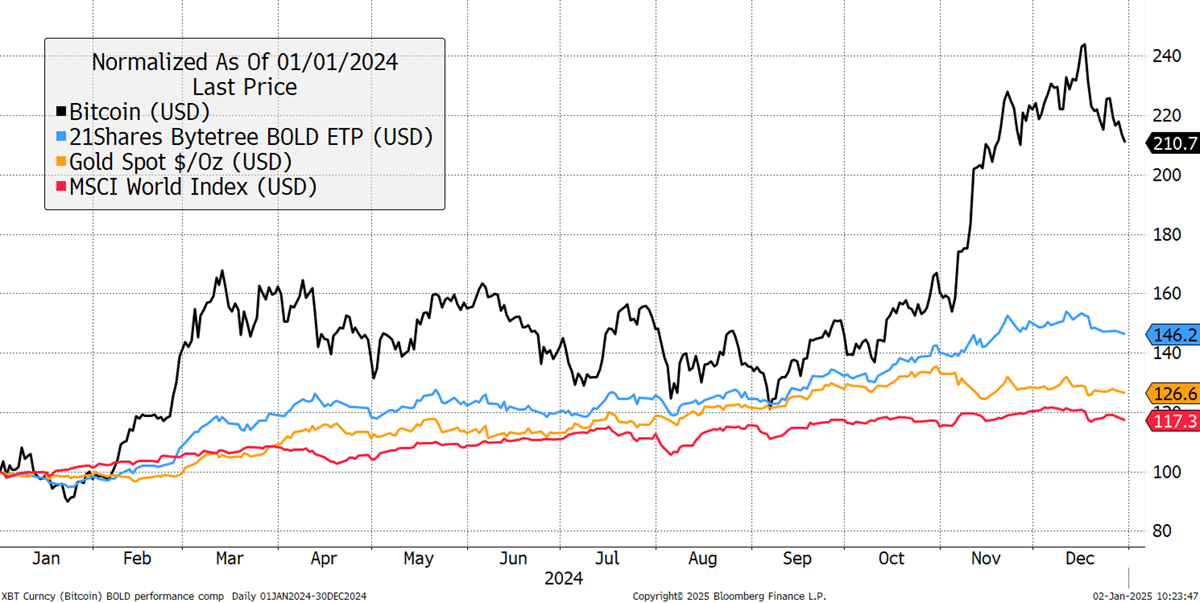

Over the past year, Bitcoin has returned +110.7%, in contrast to Gold with +26.6%, while equities rose +17.3%. BOLD has returned +46.2% in US dollars.

Bitcoin, Gold, BOLD, and Equities - Past Year

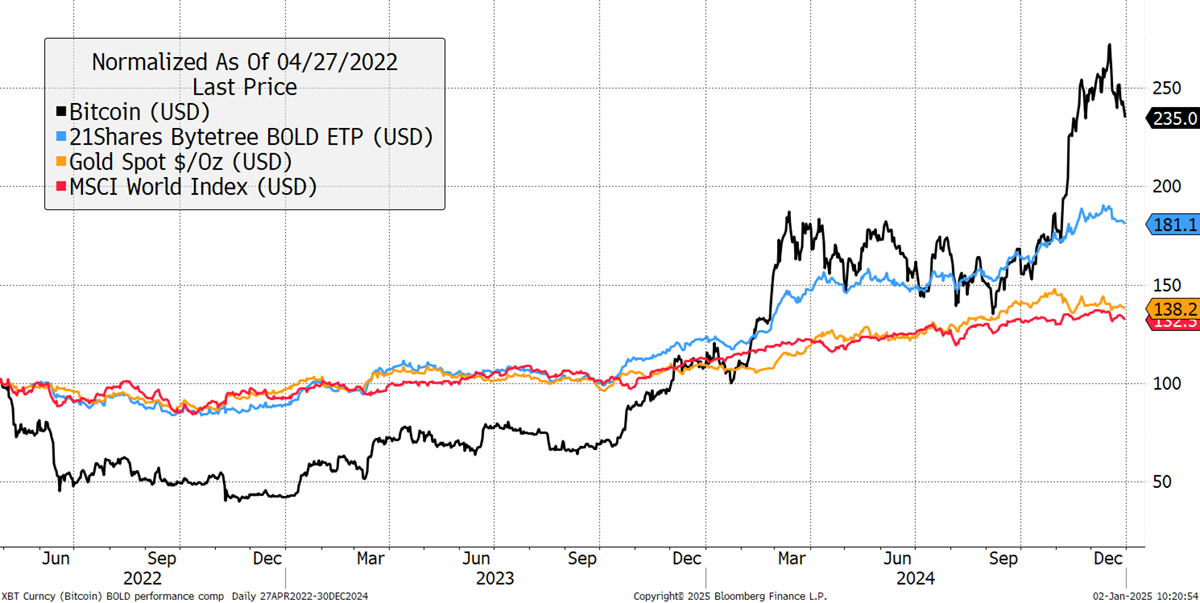

Since the inception of the BOLD ETP on 27th April 2022, Bitcoin is +135%, Gold is +38.2%, and equities are +32.5%. BOLD has returned +81.1%. A fixed 75/25 Gold/Bitcoin strategy would have returned 62.4%, demonstrating the benefits of embracing monthly rebalancing transactions.

Bitcoin, Gold, BOLD, Equities – since inception

A BOLD Year for Bitcoin and Gold ETFs

In 2024, the Bitcoin exchange-traded funds (ETFs) saw record growth, fuelled by new product launches in the USA. Total Bitcoin held by ETFs grew from 843k BTC to 1.288m BTC, now worth $121 bn. In contrast, the Gold ETFs fell from 87.4 moz to 86.9 moz, a modest fall. Still, the total Gold held by the ETFs amounts to $229 bn. The total held in Bitcoin and Gold ETFs now amounts to $350 billion. These assets are becoming an important allocation for global investors.