Deeply Seeking a New Bitcoin High

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 143;

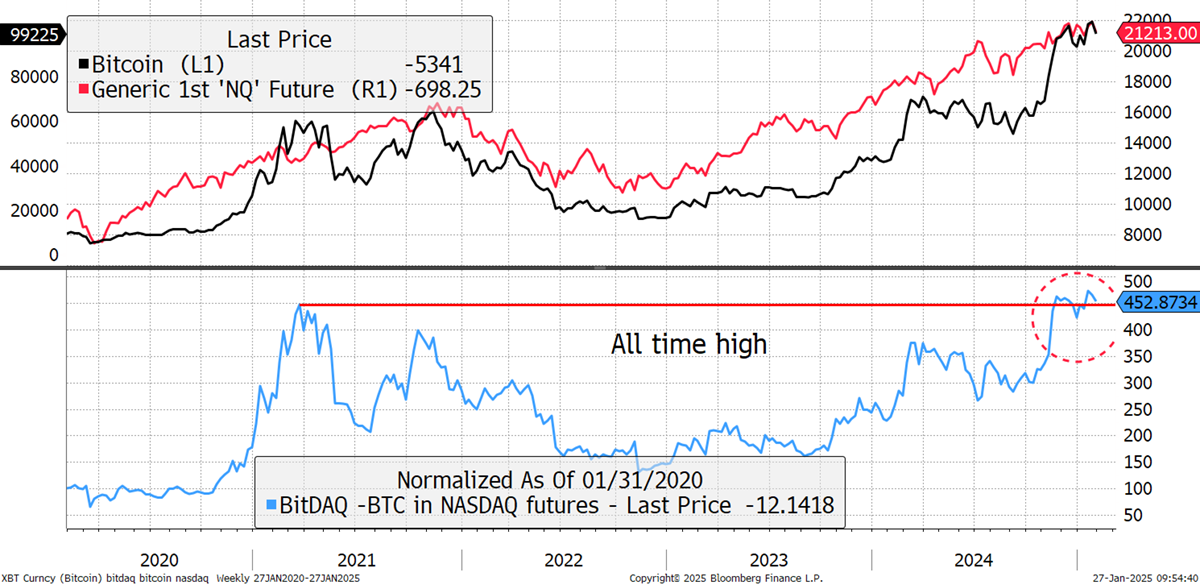

Bitcoin $100k is becoming tedious. Trump has been president for a week and has signed the executive order, yet the price of Bitcoin falls, alongside the US dollar and technology stocks.

Bitcoin Hourly – 90 days

Two things are going on here. The first is that on Friday, Marc Andreessen, the Silicon Valley VC star, stated that DeepSeek R1 was the most impressive breakthrough he’d ever seen. It is China’s answer to AI and is an open-source project. It has spooked the markets because, being open source with the code published on Github, it is freely available. It has also damaged the idea of US exceptionalism because China has achieved more than Chat GPT at a fraction of the time and cost. That means it challenges the NASDAQ valuations, and the NASDAQ futures are down 4.5% since Friday.

Consider that AI has been the driver of tech stocks since the 2022 upturn, creating $8 trillion of value in the NASDAQ alone. Now we know that AI no longer commands a premium, as the code is freely available to the world. That is a painful boot in the face for big tech valuations, and for whatever reason, Bitcoin remains highly correlated to the NASDAQ and is down over the weekend too. As Howzer from Munich told me,

“Everyone is hanging on FOMC, Mag 7, US economic data. Might as well invest in stocks.”

He makes a good point, and it is getting harder to distinguish between Bitcoin and big tech, but the hope was always that Bitcoin would carry on where big tech left off.

Bitcoin and the NASDAQ

The other point is Trump, the dollar, meme coins and general hype. We’ve seen the executive order, and the dollar is falling, yet Bitcoin can’t make a new high. We have also seen nonsense season return with meme coins and the like, which is indicative of the peak hype cycle. Market guru @hkuppy hit a nerve.