Gold’s Super Bull Market

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report Issue 101;

The gold price used to follow the bond market, yet with bonds plummeting, gold has shown resilience. In this piece, I explain why gold provides shelter from a deteriorating bond market. If bonds are the benchmark, gold is not just in a bull market but in a super bull market.

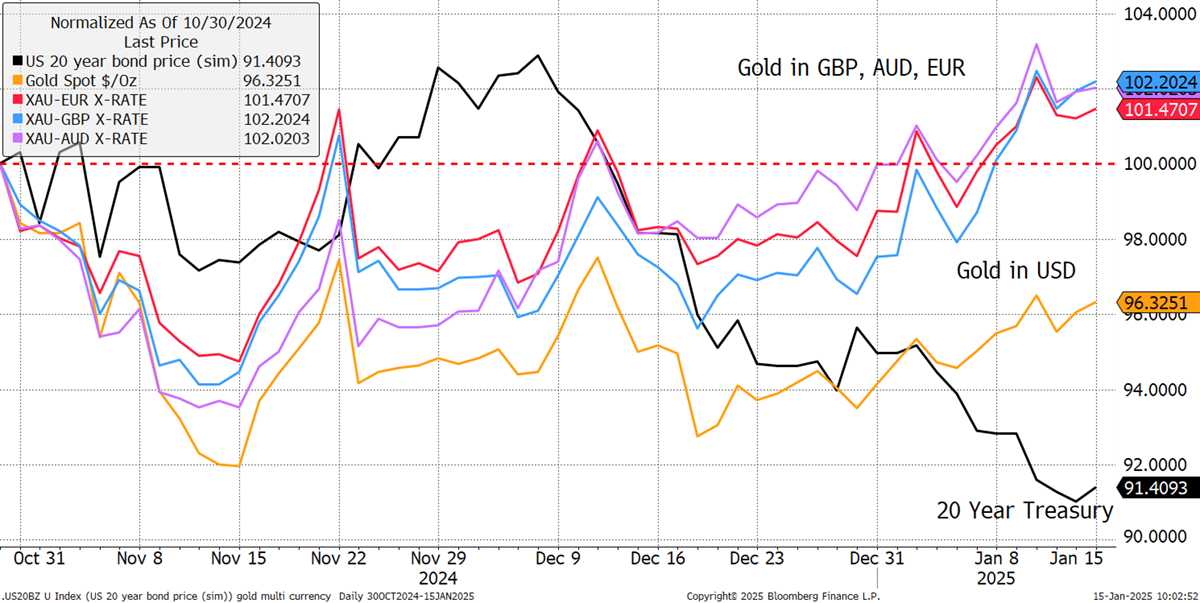

While gold is down 3.7% in USD since the October 2024 peak, gold is trading at an all-time high in pounds, Aussie, and Euro, suggesting the severity of this gold correction has been overstated. Yet the US 20-year bond has slumped by 9% and gold has shrugged much of it off.

Gold in Currencies and Bonds Since October 2024 Peak

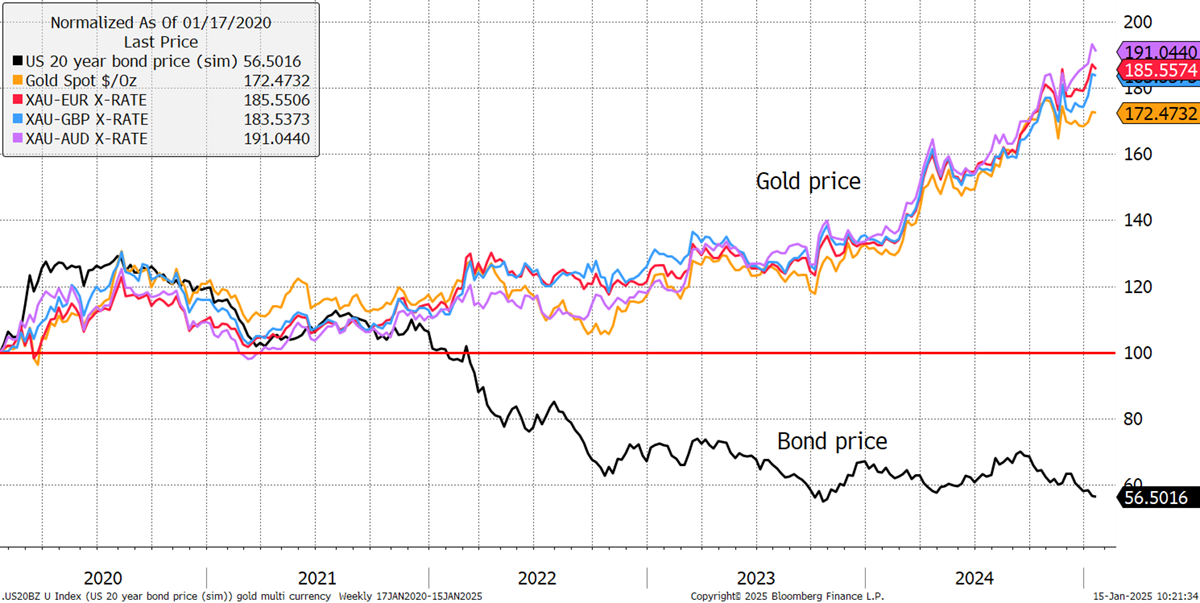

Looking a little further back to the beginning of the pandemic, gold has risen by 72% in USD and 91% in AUD, while the 20-year constant maturity treasury has fallen by 44% on a capital return basis. You can even see how gold and the bond were trading in sync for much of 2020 and 2021.

Gold in Currencies and Bonds Since 2020

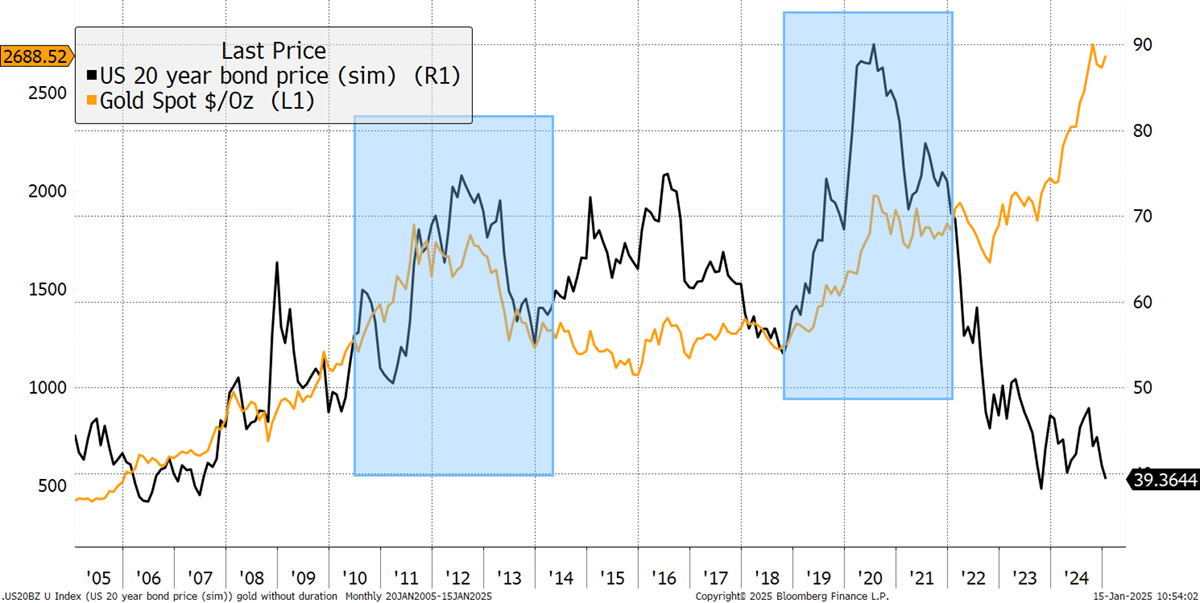

Looking back 20 years, gold and bonds moved together much of the time. There was a gold slump between 2011 and 2015 when bonds were ahead, which was largely due to the unwinding of prior exuberance and a low inflation environment. The blue squares show how the peaks in the gold price coincided with the strength in bonds. Then, in 2022, as interest rates started to rise, it was all change. The gold bull market resumed, while bonds crashed.

Gold and the Long Bond Since 2005

The standard answer is the war in Ukraine and the confiscation of Russian assets, which has boosted the demand for gold. That is no doubt true, but there is also a macroeconomic angle that is becoming increasingly apparent because what happened in the 1970s is being repeated.