“A government bond is a debt security issued by a government to support spending and obligations. Government bonds pay bondholders periodic interest payments called coupon payments. Government bonds issued and backed by national governments are often considered low-risk investments. Government bonds issued by a federal government are also known as sovereign debt.”

Source: Investopedia

Governments used to borrow money to finance wars and pay back their debts after declaring victory. These days, there are governments that borrow money to cover the day-to-day expenses of running the country and governments that live within their means. In this short piece, I shall attempt to describe the impact of these choices through the lens of the UK and Switzerland.

Last year, the UK government raised £1.1 trillion from taxes but spent £1.22 trillion. The taxes mainly come from income tax, national insurance, VAT, and corporation tax. Most of the spending goes to health, pensions, social security, education, and defence.

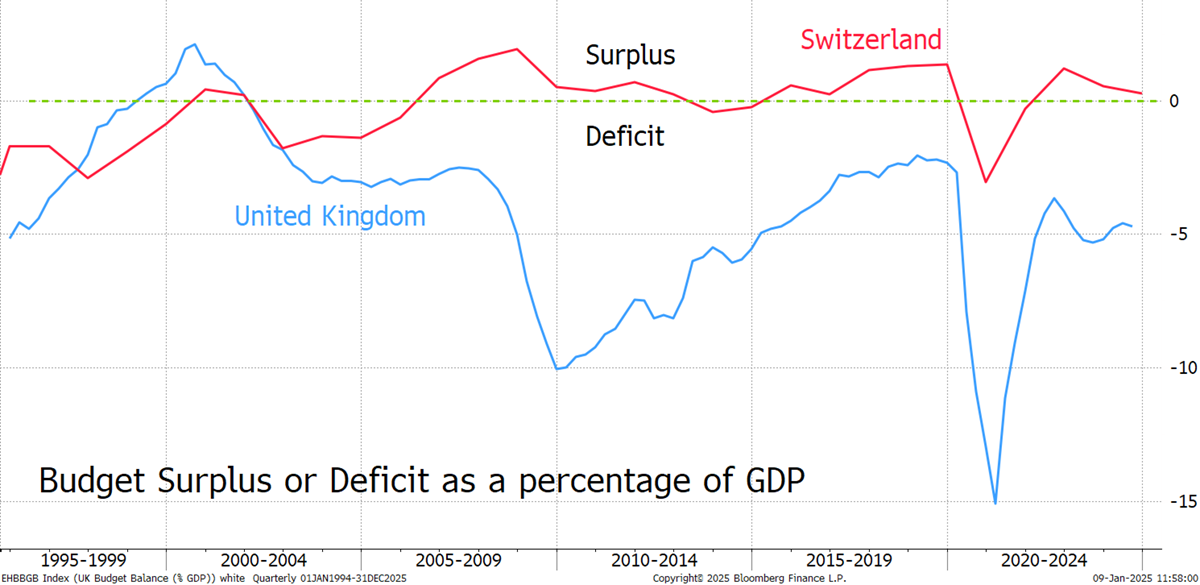

The difference between what the government receives and what it spends is the surplus or the deficit. In 2024, the UK spent more than it received, and so there was a £122 billion deficit. In Switzerland, the government spent less than it received and had a modest budget surplus.

Budget Surplus/Deficit

In 1997, the UK government, under John Major, managed to deliver a surplus. Tony Blair then took office, and by 2001, the UK budget had returned to deficit where it has remained ever since. The deficit ballooned in 2008, after the financial crisis, only to blow out again during the pandemic. Despite all of those years labelled “austerity” while George Osborne was the Chancellor of the Exchequer, the UK Treasury never even got close to a balanced budget. The result of successive deficits saw the level of borrowing increase.

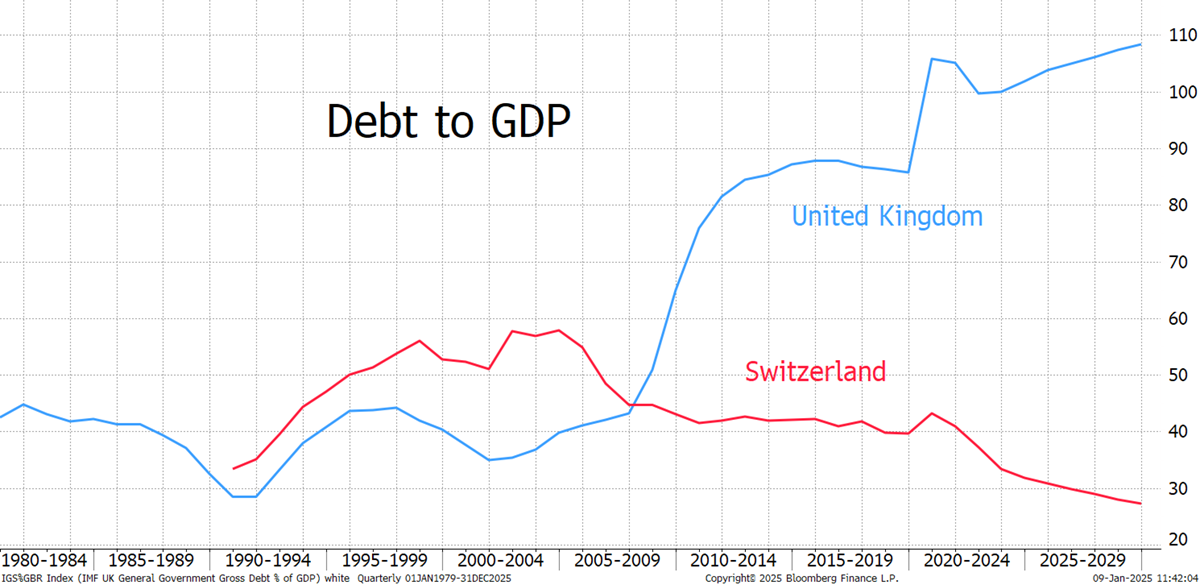

If a government has deficits year after year, they soon add up. The UK now has a national debt of £2.8 trillion, which is often shown as a percentage of the economy. The UK GDP was roughly £2.54 trillion last year, so the debt has grown to a size that is slightly larger than the economy.

Some believe that growing the nation’s debt was unavoidable, but by consistently balancing the budget, the debt-to-GDP ratio in Switzerland is below 30%.

UK vs Switzerland Debt-to-GDP

Many economists associate inflation with government deficits because they create money that goes into circulation. More money chasing the same number of goods and services sees prices rise. It is noticeable that UK inflation (using CPI, not RPI) has been consistently higher than Swiss inflation. Notice how UK inflation was briefly lower than Swiss inflation in the period when the UK had a budget surplus.