The Rise of XRP: Navigating Regulation and Market Dynamics

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: XRP;

XRP, the native token of the XRP Ledger, has established itself as a top performer in the industry. Rapidly ascending the ranks, it is now the third-largest cryptocurrency after Bitcoin and Ethereum, boasting a market capitalisation of over $177bn. But what drives XRP's high valuation, and is it truly justified? In this article, we’ll explore the on-chain metrics, look back at XRP Ledger’s journey, analyse the ecosystem value proposition, and evaluate how XRP fits into Ripple’s plan of revolutionising payments.

Overview

Launched in 2012 by Jed McCaleb, David Schwartz, and Arthur Britto, the XRP Ledger (XRPL) is a Layer-1 public blockchain built to go beyond traditional peer-to-peer cryptocurrency use cases. XRPL is designed to serve as a high-performance digital payment infrastructure for financial institutions, including banks and major payment processors.

In its early days, the project was called Ripple, and its native token, XRP, was referred to as "ripples". The company behind the project later rebranded from OpenCoin to Ripple, while the blockchain itself became known as the XRP Ledger, with its token simply called XRP. Ripple, as the primary developer of XRPL, continues to drive its mission of revolutionising cross-border payments alongside key contributors such as the XRPL Foundation and XRPL Labs.

The creators of XRPL sought to address the limitations of Bitcoin’s Proof-of-Work (PoW) consensus mechanism, which they criticised for being energy-intensive and lacking scalability. Consequently, they developed XRPL using a unique consensus mechanism called Proof of Association (PoA). This innovative approach was significantly faster and far more energy-efficient than PoW at the time. More on PoA later.

Today, XRPL processes approximately 20 transactions per second (TPS) with the capacity to scale to up to 2,000 TPS. With over 6 million XRP wallets and millions of online community members (some very dedicated), the adoption of XRP has been astronomical. To date, Ripple has facilitated the movement of over a trillion dollars’ worth of XRP between counterparties, solidifying XRPL's position as a leading blockchain for financial transactions.

However, it has not been a smooth ride for Ripple, mainly due to the regulatory scrutiny it faced in the US. It has been the target of multiple US regulatory bodies for many years now, translating to years long decline and stagnancy in XRP price. To better understand it, let's take a closer look at the ecosystem’s past.

History and Regulatory Challenges

The foundation for XRPL can be traced back to 2004 with the launch of RipplePay, a payments network aimed at streamlining payment processes. This early vision laid the groundwork for what would eventually become the XRP Ledger.

Fast forward to May 2015, a few years after XRPL’s launch, Ripple faced its first major regulatory challenge. The Financial Crimes Enforcement Network (FinCEN) fined Ripple $700k, alleging that the company sold XRP without registering with FinCEN and failed to comply with several requirements of the Bank Secrecy Act.

The regulatory scrutiny intensified in 2020 when the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple and two of its top executives. The SEC accused Ripple of conducting an unregistered securities offering through the sale of XRP. According to the complaint,

“Ripple; Christian Larsen, the company's co-founder, executive chairman of its board, and former CEO; and Bradley Garlinghouse, the company's current CEO, raised capital to finance the company's business. The complaint alleges that Ripple raised funds, beginning in 2013, through the sale of digital assets known as XRP in an unregistered securities offering to investors in the U.S. and worldwide.”

This would become one of the longest, most gruelling, and widely discussed regulatory battles in the crypto world. It ended when the District Court for the Southern District of New York confirmed that Ripple’s institutional sales were, in fact, unregistered securities. However, they also ruled that all other sales (including retail sales) and distributions were not offers and sales of investment contracts, and imposed a $125m penalty.

But the fight is far from over. On 15 January 2025, the SEC formally appealed the July 2023 district court ruling, which was in favour of Ripple, thereby continuing the legal battle. Ripple and its executives are still navigating uncertain waters, with no resolution in sight just yet.

However, on a positive note, as of 20 January 2025, Gary Gensler has stepped down as the Chairman of the SEC. Gensler, widely regarded as anti-innovation and a staunch critic of crypto, has been replaced by crypto-friendly Hester Peirce and Mark Uyeda. Uyeda will be the acting SEC chairman until the Senate approves newly re-elected Donald Trump’s pick, Paul Atkins (also crypto-friendly).

With the most crypto-friendly president now in office, market sentiment appears largely unshaken by the SEC’s appeal. This optimism was reflected in XRP’s price, which surged by as much as 20% from its opening price on 15 January 2025, underscoring investor confidence in Ripple’s future amidst changing regulatory tides.

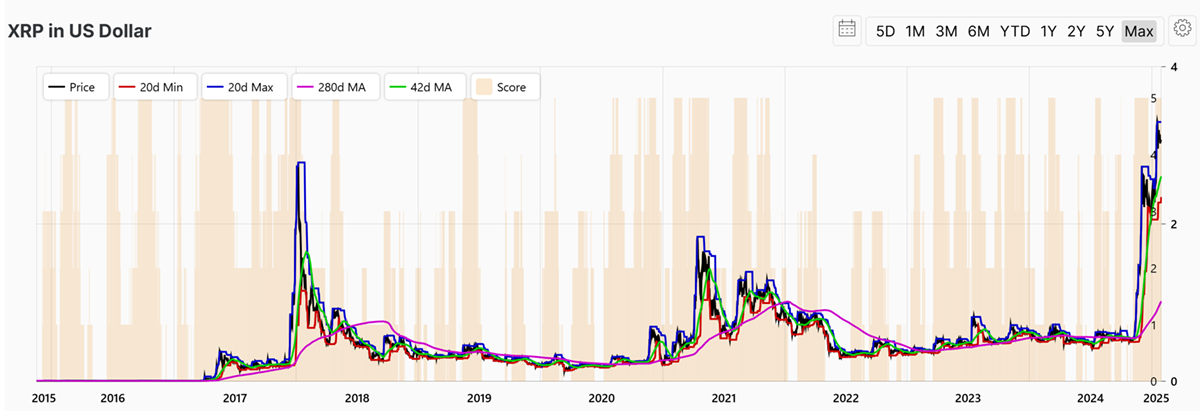

XRP in USD on ByteTrend.io

As illustrated above, the long-term XRP price action has been choppy. The token was down over 90% at some point from its last high on 1 January 2018. The price did improve in the following years but dropped again following the Terra (LUNA) and FTX collapse and Ripple’s ongoing battle with the SEC.

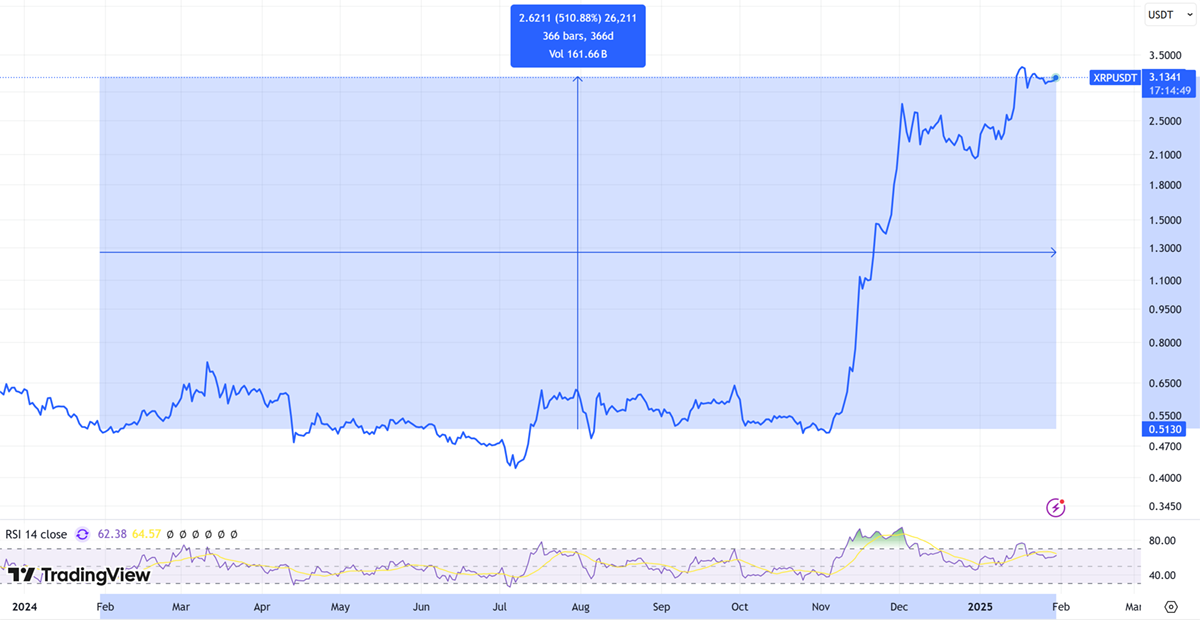

XRP Price

XRP has skyrocketed 510% from 30 January 2024 to 30 January 2025. Notably, most of this surge, around 500%, occurred between 1 November 2024 and 30 January 2025, mirroring a broader rally among US-based cryptocurrencies. This surge was fuelled by factors such as the rise of ETFs, the "Trump effect," and easing regulatory pressures.

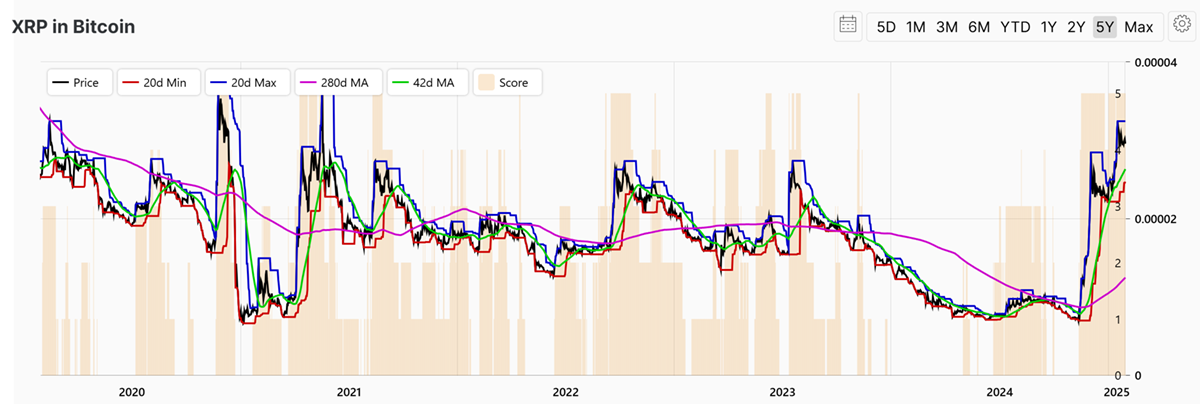

XRP in BTC

Currently, XRP is trading at an all-time high and holds a bullish 5-star ByteTrend score against both USD and BTC, meaning it is outperforming both.

What is XRP Ledger’s Unique Selling Proposition (USP)?

Ripple built XRP Ledger to revolutionise global financial systems by creating a more efficient, scalable, and cost-effective payment infrastructure. Traditional cross-border payment methods are slow, expensive, and error-prone, relying heavily on intermediaries like third-party banks. XRP Ledger seeks to overcome these inefficiencies through blockchain technology and its native digital asset, XRP, enabling near-instant, low-cost international transactions.

Ripple’s ultimate goal is to bridge the gap between traditional finance and blockchain, promoting decentralisation and improving access to financial services. Despite facing regulatory hurdles, Ripple envisions XRP and XRPL as integral components of a modern, interconnected global payment system, addressing the limitations of legacy systems and enabling seamless, borderless value transfer.

Ripple Products and Services

Ripple offers three main services: Ripple Payments, Custody and a Stablecoin.

Ripple Payments

Ripple Payments is a near-instant settlement, cross-border payment service offered by Ripple. It uses the XRP Ledger and XRP as the main components to facilitate the payments.

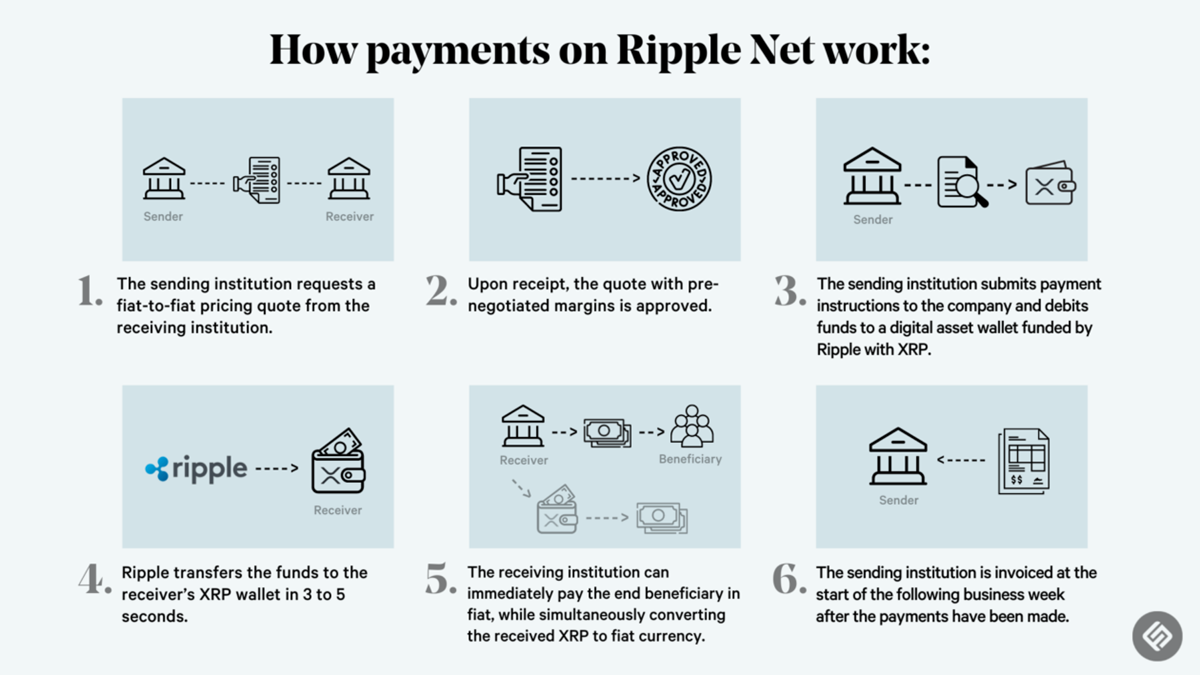

Payments on Ripple

These payments work by streamlining cross-border transactions using XRP. First, the sender's bank requests a pricing quote from the recipient's bank. Once the quote is approved, the sender submits payment instructions, and funds are debited into a digital wallet funded by Ripple with XRP. Ripple then transfers the equivalent XRP to the recipient’s wallet within 3 to 5 seconds. The recipient's bank instantly converts the XRP into local currency and pays the final beneficiary.

Custody

Launched in October 2024, Ripple Digital Asset Custody is a secure crypto custody solution designed for institutions to store and manage digital assets, including XRP and other cryptocurrencies. It provides enterprise-grade security and seamless integration with financial institutions, enabling them to safeguard their digital holdings while facilitating efficient transactions.

Ripple USD (RLUSD) Stablecoin

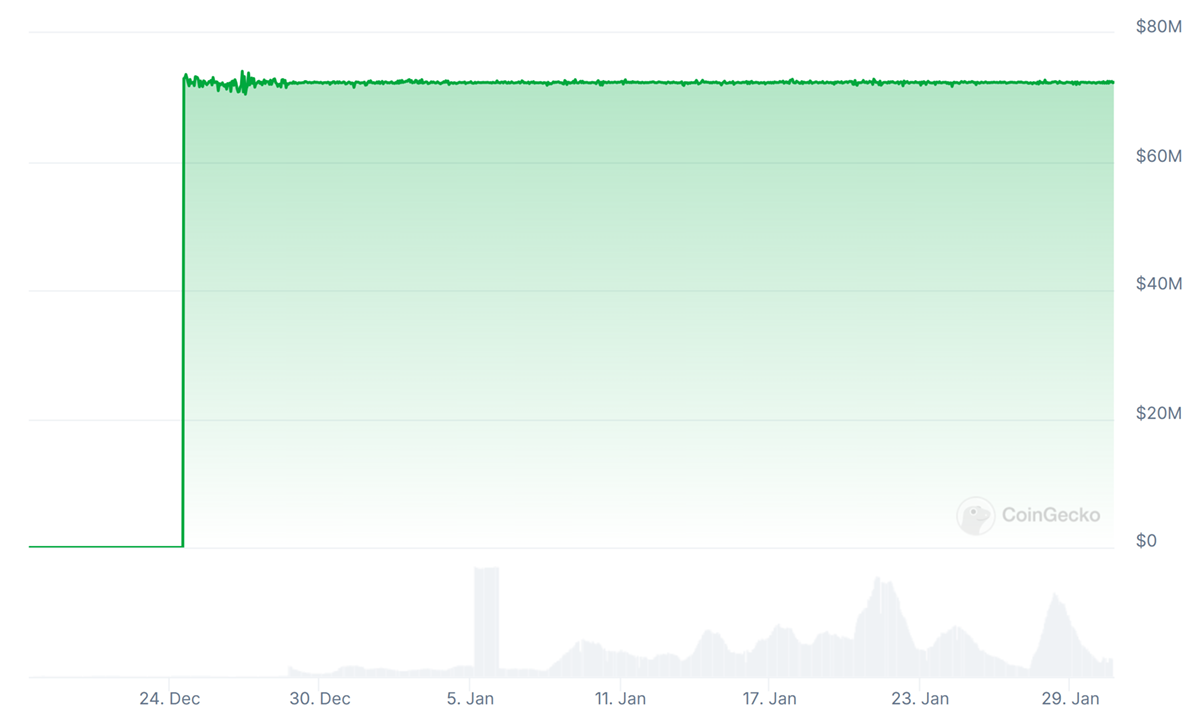

Ripple introduced its own stablecoin, Ripple USD (RLUSD), on 17 December 2024, following approval from the New York Department of Financial Services (NYDFS). Unlike XRP, which experiences price fluctuations, RLUSD is fully backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents, ensuring price stability, liquidity, and reliability. Built on XRP Ledger and Ethereum, it is available to the users of both ecosystems. RLUSD currently holds a market capitalisation of $72m.

RLUSD Marketcap

Stablecoins like RLUSD can revolutionise digital payments by eliminating the volatility associated with cryptocurrencies like XRP. Their price stability makes them ideal for everyday transactions, cross-border remittances, and institutional settlements, enabling businesses and financial institutions to adopt blockchain-based payments without the risk of value fluctuations.

With RLUSD offering price stability, its adoption for payments and settlements could reduce reliance on XRP, which remains volatile. Businesses and institutions may prefer RLUSD for transactions, potentially lowering demand for XRP as a bridge asset. Since XRP’s value is partly driven by the utility as a bridge asset in Ripple Payments, a decline in its usage could impact its value. However, RLUSD also operates on XRPL, meaning every RLUSD transaction still requires XRP to cover network fees. While this ensures continued utility for XRP, its role may shift more toward a transactional gas token rather than a primary asset for payments and liquidity.