Time to Revisit China

Trade in Whisky;

Last Friday, Silicon Valley Venture Capitalist Marc Andreessen told the world that DeepSeek R1 was one of the most amazing and impressive breakthroughs he’d ever seen. DeepSeek is an open-sourced AI tool created by a Chinese company, which has matched or exceeded the capabilities of the US equivalents and has done so by getting much more out of their chips than the Silicon Valley giants. Being an open-sourced project, they have gifted the code to the world. This has made investors question why the big US technology stocks involved in AI are so expensive.

Since 2022, the US tech sector has increased in value by $24 trillion, largely on the back of the prospects for artificial intelligence. The DeepSeek announcement has caused a stir, especially in downgrading the future for chip maker NVIDIA and the outlook for data centres and energy supplies. The joke is this is the second time in recent years that something released from a Chinese lab has knocked the US stockmarket.

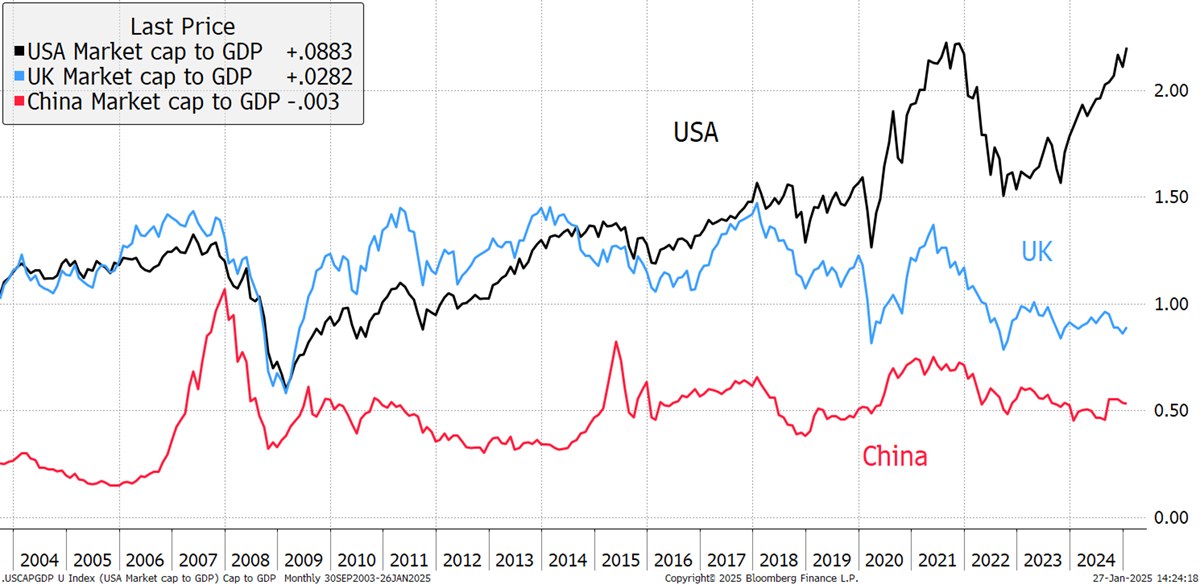

One simple measure of stockmarket valuation is market cap to GDP, supposedly used by Buffett. It looks at the value of the stockmarket and compares it to the size of the economy. Between 2004 and 2017, the UK and US traded in line between 1x and 1.5x, with a dip in 2008 for the financial crisis. Since 2017, the US has taken off like a rocket, while the UK fell back. This post-2017 era has divided those who are good at generating profits from technology and those who aren’t.

Market Cap to GDP

In the US, the stockmarket is valued at over 2x the size of the economy. In the UK, it is less than 1x, which is historically cheap. In China, it is 0.5x, and the economy, and more importantly some of its companies, are growing faster than in other major countries.

According to the author of Hacking Growth, Morgan Brown (@morganb), the current AI projects use huge data centres and spend hundreds of millions on computing power. DeepSeek has just done the same task for $6m. It has done the job much more efficiently, taking the training costs from $100m to $5m. The number of GPUs has fallen from 100k to 2k; the API runs 95% cheaper and can run on gaming GPUs rather than data centre hardware.

I reiterate that this project is open source, and the code is available to the public at no charge. This means that AI is no longer exclusive to the big tech companies, and you don’t need billion-dollar data centres. DeepSeek has less than 200 staff. The implications are that as AI development becomes more accessible, competition increases dramatically, the "moats" of big tech companies dry up, and hardware requirements (and costs) plummet.

I phoned a friend who runs a large tech fund, and he told me the US had shot themselves in the foot. They imposed AI chip restrictions on China. The result has seen China find efficiencies never thought possible and release the results on open architecture for all the world to see.

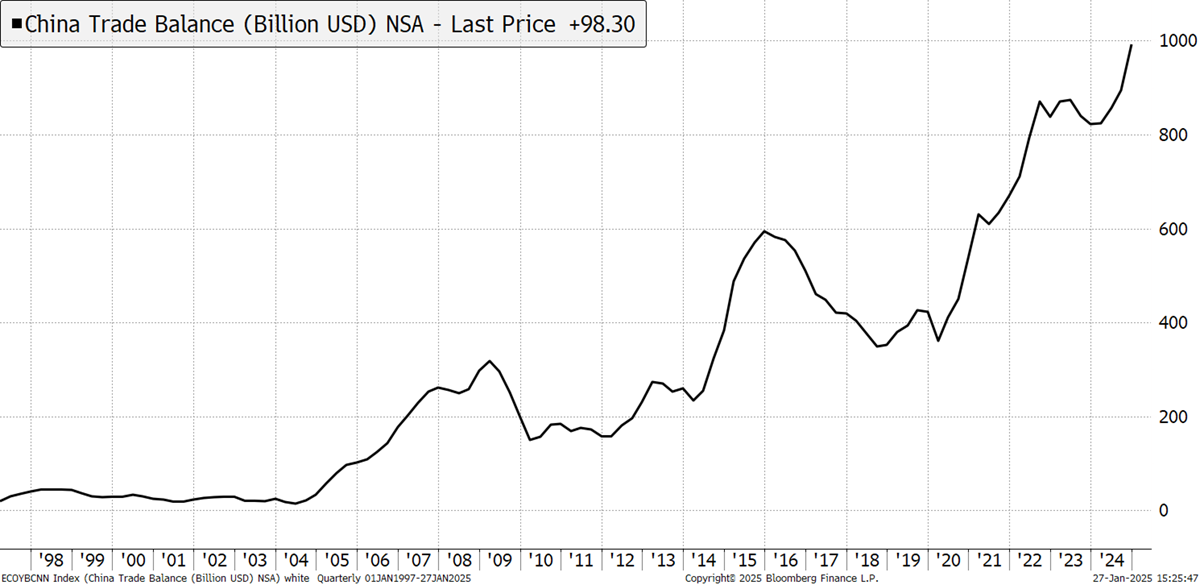

China has the largest trade surplus in history, on the verge of a trillion dollars per year, which is gargantuan. China has been the world's manufacturing powerhouse for over a decade and is projected to maintain this dominance. By 2030, China could account for 45% of global manufacturing measured by added value. This recent improvement in the surplus began in 2015 with the “Made in China 2025 Initiative”, which aimed to transform China from a low-cost manufacturer to a high-tech, high-value production leader. That plan worked.

China’s Trillion Dollar Trade Surplus

Notice how, in 2015, the trade surplus fell until 2020 before surging again. During this period, there were shifts in the currency, diplomatic trade wars, and an emphasis on domestic consumption. There were also tariffs imposed by Trump, which were not resolved until 2020 when China committed to buying $200 billion of goods over the next two years. Some of that was food such as soybeans. Then, during Biden’s Presidency, Chinese exports took off again.

China has targeted ten key industries and today, Chinese companies are either leaders or credible competitors in each.

- Information Technology

- Numerical Control Tools and Robotics

- Aerospace Equipment

- Ocean Engineering Equipment and High-tech Ships

- Railway Equipment

- Energy Saving and New Energy Vehicles

- Power Equipment

- New Materials

- Medicine and Medical Devices

- Agricultural Machinery

It is remarkable what can be achieved in a decade in these key industries; Europe and the US are terrified that Chinese companies will eat their domestic suppliers for breakfast. Having sat in the back of a high-end Chinese electric car, they are right to worry. And it doesn’t end there as they have fifth-generation fighters, the Chengdu J-20, and their passenger jet the Comac C919, which will serve the Asian market taking share from Boeing and Airbus.

China went further and announced that a nuclear fusion reaction lasted for 18 minutes, a new world record. That broke the previous six-minute record, also held by China. As DeepSeek-type announcements come thick and fast, it is time for investors to take China seriously.

From an investment perspective, it is odd that China has managed to become so successful in high-end manufacturing yet is so undercapitalised compared with other markets, as I showed in the first chart above.

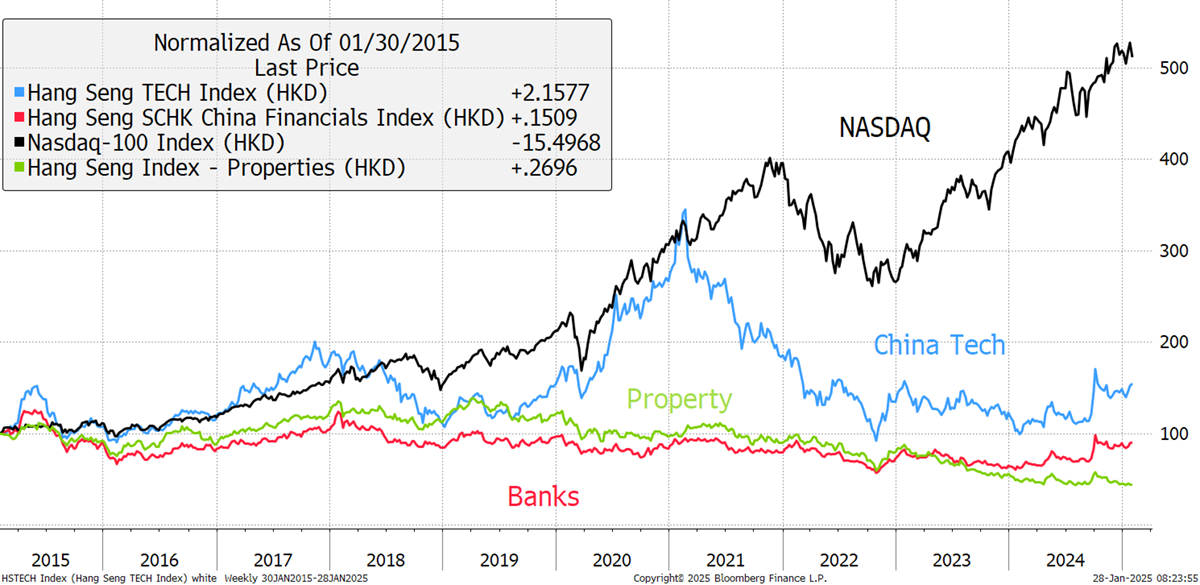

Chinese technology companies broadly followed US tech companies until the pandemic. Then China’s lockdown was particularly harsh, and news of the property bust was spreading. For reference, China’s property developers peaked in 2019, and the bonds collapsed in 2021. It’s not over, but the cat is out of the bag.

Hong Kong Chinese Sectors and NASDAQ

I use the Hong Kong market because it will soon formally be a part of China and will continue to grow as the outward-facing financial hub. That works for China and the rest of the world because both sides would rather deal with Hong Kong, where the property laws are more agreeable for international trade and investment.

While the Chinese property sector remains troubled, and some are predicting a repeat of the Japanese-type banking crisis of the late 1980s, it is worth highlighting that the large Chinese banks are not collapsing like the property developers did. That may not be a full and fair reflection of reality, but the banks are agents of the state and therefore backstopped by the state. An investment in Chinese real estate or financial services may not be a very good idea, but this is their technology and export sector, which leads the world in free trade.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd