Trump’s $36 Trillion Inheritance

Trades in Soda and Whisky;

During the inauguration speech, European markets were already closed, and the US stock and bond markets were closed for Martin Luther King Day. That left FX, Bitcoin, gold, and Latin American stocks as the only available price signals. Gold rose, and Bitcoin fell, having spiked in the morning. The dollar fell, while the Mexican currency and stockmarket both rose. The early implications are that markets were expecting thunder and only got a murmur.

Trump said a few things. He discussed the Department of Government Efficiency, US borders, taking back the Panama Canal, there are two sexes, the US would drill baby drill, exit the Paris Climate Accord, boost manufacturing, and put a man on Mars. He will oversee the inflation fall.

Trump failed to mention a few things and gave little detail on tariffs. He didn’t mention crypto even though expectations for a strategic reserve were high, and he didn’t mention Ukraine or Russia, and China got off lightly. He didn’t mention NATO. In fact, he barely mentioned the rest of the world, as the main point was “America First”.

Overnight, Asian stockmarkets were broadly flat, but notably, Hong Kong was up. In Europe this morning, markets are flat. I sense we are still waiting for more details on US policies. Yet he has already said that 25% tariffs would be applied to Canada and Mexico next month. Mexican futures are up 1%, and Canada’s have risen since the news was delivered. The implication is the tariffs were not as bad as expected. The yen rallied, and the Bank of Japan may hike rates on Friday because if they don’t, Trump will label them a currency manipulator, and it’ll be straight to the naughty step for their regional ally.

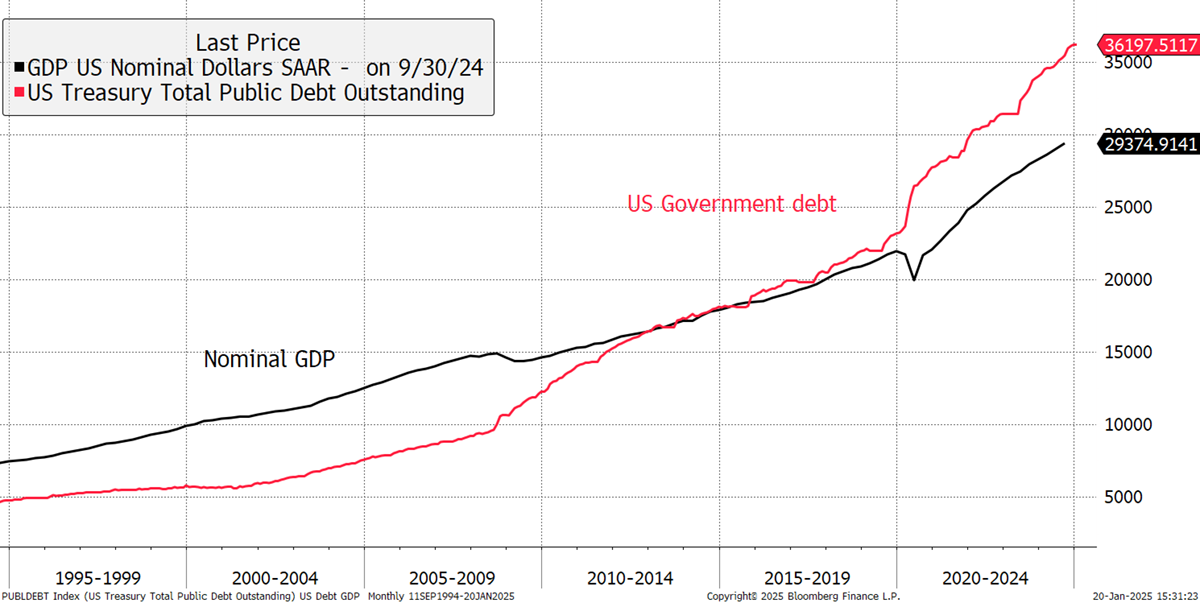

One of the highlights of the new administration is that Scott Bessent, from Soros fund management stock, heads the US Treasury, and it’s going to be one hell of a job. When Trump became president in 2017, the national debt was $20 trillion. When he handed over to Biden in 2021, it had grown to $27 trillion, with $4 trillion as the result of the pandemic. Trump has returned to office with a national debt of $36 trillion, which is an 80% increase, while the economy has grown 56%. The last trillion was added to the pile since September. It is a big number that is out of control.

US National Debt

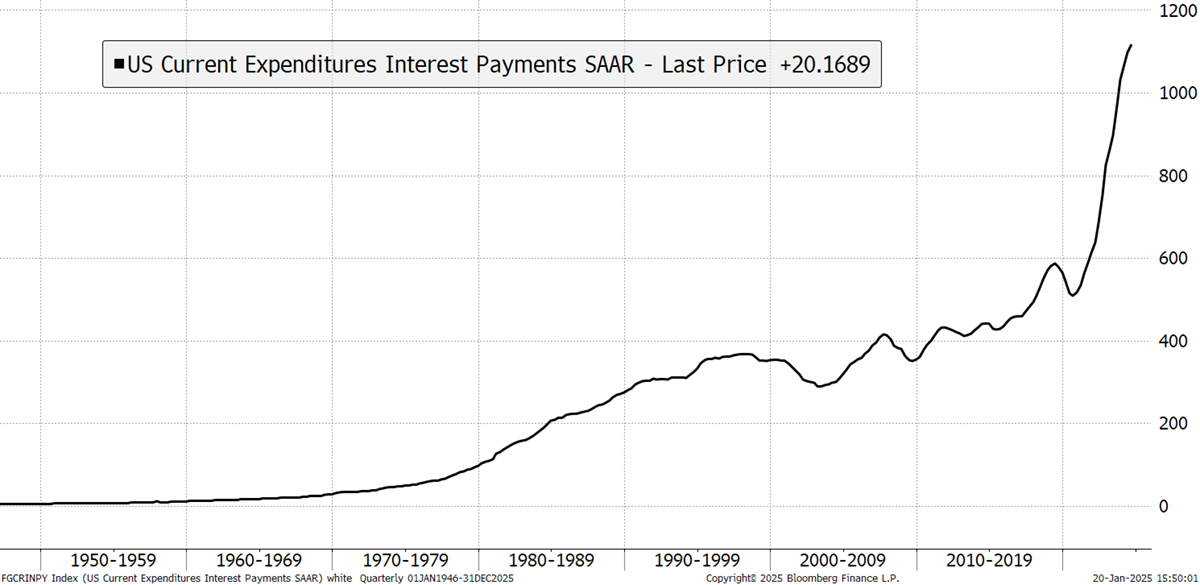

The real and more immediate problem comes from the growing cost of servicing the debt. The debt has been growing while interest rates have been rising, making it a double whammy. When Trump first took office, debt interest was $460 billion per year. Today, it has grown to $1.1 trillion, with an overall interest rate of 3.8%. The longer rates stay high, the more refinancing will have to take place at higher yields, and this cost will escalate. A large and growing debt at higher rates is a problem, both in the US and here in the UK.

US Debt Interest Bill

The issue for efficiency is that if debt interest keeps on rising, it will be hard to make savings elsewhere. I believe this is why he is so focused on cheap energy because he wants to see inflation fall. He believes cheap energy will reduce inflation, which will pave the way for lower rates, cheapen the debt refinancing, and Make America Great Again. Add in Musk’s efficiency, and it might just work.

But it’s not just about cutting costs. Trump wants to boost revenue from tariffs and export oil and gas on a grand scale, especially to Europe. That’s where the Panama Canal comes in because it doesn’t want US ships paying high fees for access. He wants to cut not only the budget deficit but also the trade deficit (or current account), i.e. “the twin deficits”.

With lower costs and higher revenues, the plan may work, but lower rates could also lead to a weaker dollar, and that wouldn’t be favourable for US stocks over the rest of the world. Could this administration see the rest of the world’s equities beat the US? I think the chances of that are quite high because it’s long overdue, and his desire for lower interest rates could sink the dollar, which is also richly priced.

It is a highly plausible scenario because the enormous expansion of the debt has been fuelling the economy and stock market, taking it to historically high levels that many would call a bubble. That is a terrible place to start from, and it would be hard to win from there. It also stands to reason that if fiscal folly caused a stockmarket boom, what would fiscal prudence do? It would presumably drain money from the system. There has been much debate about Trump’s policies, but soon we will find out what they are, and the market will respond quickly and dispassionately.

I am interested in Trump’s policies towards China because it is a dynamic economy offering good value, especially Hong Kong, but I want to see how things pan out. I am also keen to see his relationship with Putin and negotiate peace in Ukraine. An outbreak of peace and coexistence would be most welcome.

What’s the UK’s plan? Demonise the oil and gas industry, increase business taxes and industrial decline, and hand over the Chagos Islands with a high fee attached. It’s not pretty, and the real problem is the two regimes have no common ground. The US will look down on the UK and humiliate our government.

Stanley Druckenmiller, Bessent’s former colleague, said on CNBC that the US will shift from the most anti-business administration to the opposite. His biggest fear is the bond market, where he remains short, and he believes inflation will remain a problem. He is hopeful about Musk’s DOGE but is “too old and too cynical” to believe it will make a difference. He fears rate cuts when the economy is “running hot” because that will stoke inflation. His focus is not on the market but on individual companies.

On that note, I am recommending an investment firm with an 89% upside according to the last reported net asset value. I am less enthused by the outlook for oil and will further reduce exposure following the cuts last month.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd