Venture: Portfolio Update

Issue 57;

In my latest Atlas Pulse on gold, I discussed gold’s super bull market, something of a step above a mere bull market. I called it a super bull because gold normally follows the bond market, and this time, it is riding high while bonds have been under pressure. The last time this happened was in the 1970s, the other super bull.

Yet investors couldn’t be less interested in gold. It has beaten the S&P 500 since the turn of the century and trades at an all-time high in most currencies, while in US dollars, it is down a mere 3% since October. Gold is booming, and investors ignore it. I can illustrate this with Seabridge Gold (SEA Canada), one of the most exciting gold exploration companies in the world. In their words, Seabridge has “a 20+ year track record of growing ounces of gold in the ground faster than shares outstanding”.

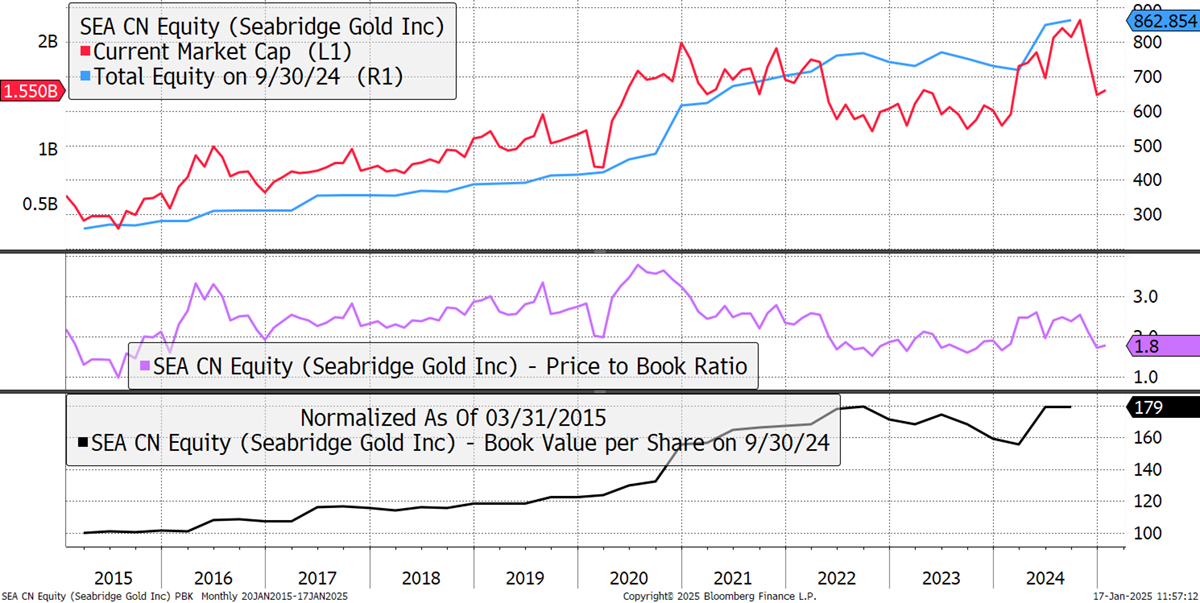

The value of their assets (blue) keeps on rising, while their market cap (red) has fallen back. The price-to-book (purple) is at the lower end of the range, and the book value per share has grown 79% over ten years.

Seabridge Gold Price-to-Book

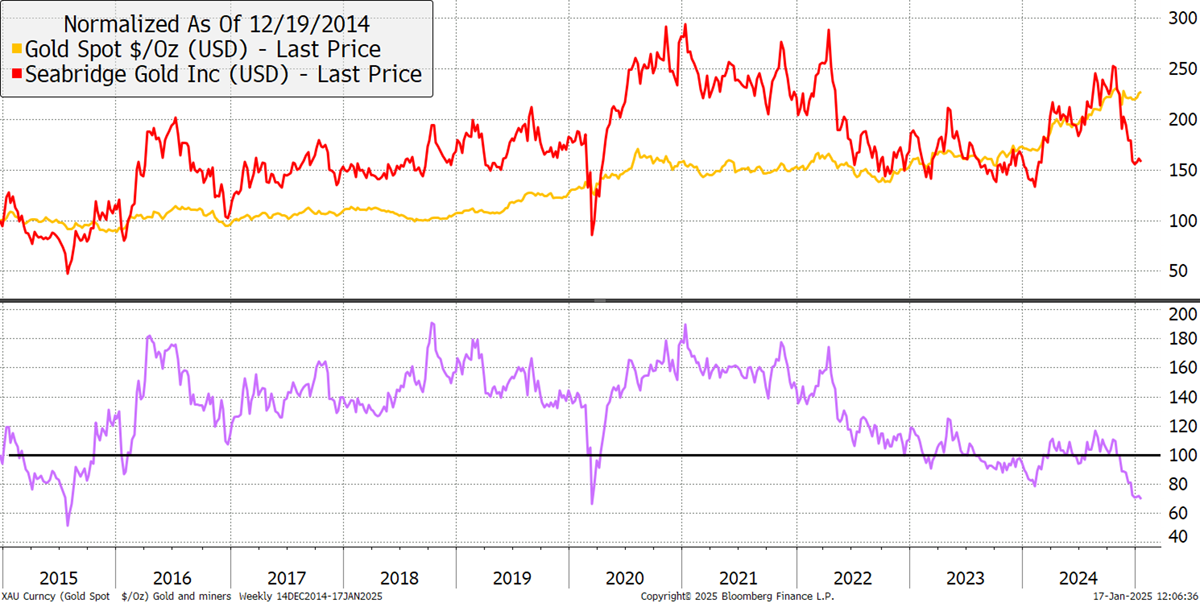

$100 invested in gold in 2015 is today worth $224, yet that $100 would have turned into $159 in SEA. An investor might reasonably expect SEA to be well ahead of the gold price, yet it has fallen behind. That was the case until 2022 when Western investors cooled on gold despite the price continuing to appreciate.

Seabridge Gold Compared to Gold Price

This is a market anomaly, and SEA, and many other gold miners, offer compelling value in the face of the gold super bull. This is one of those opportunities that comes around once every super bull cycle. As I said, the last one was in the 1970s.

Alliance Pharma

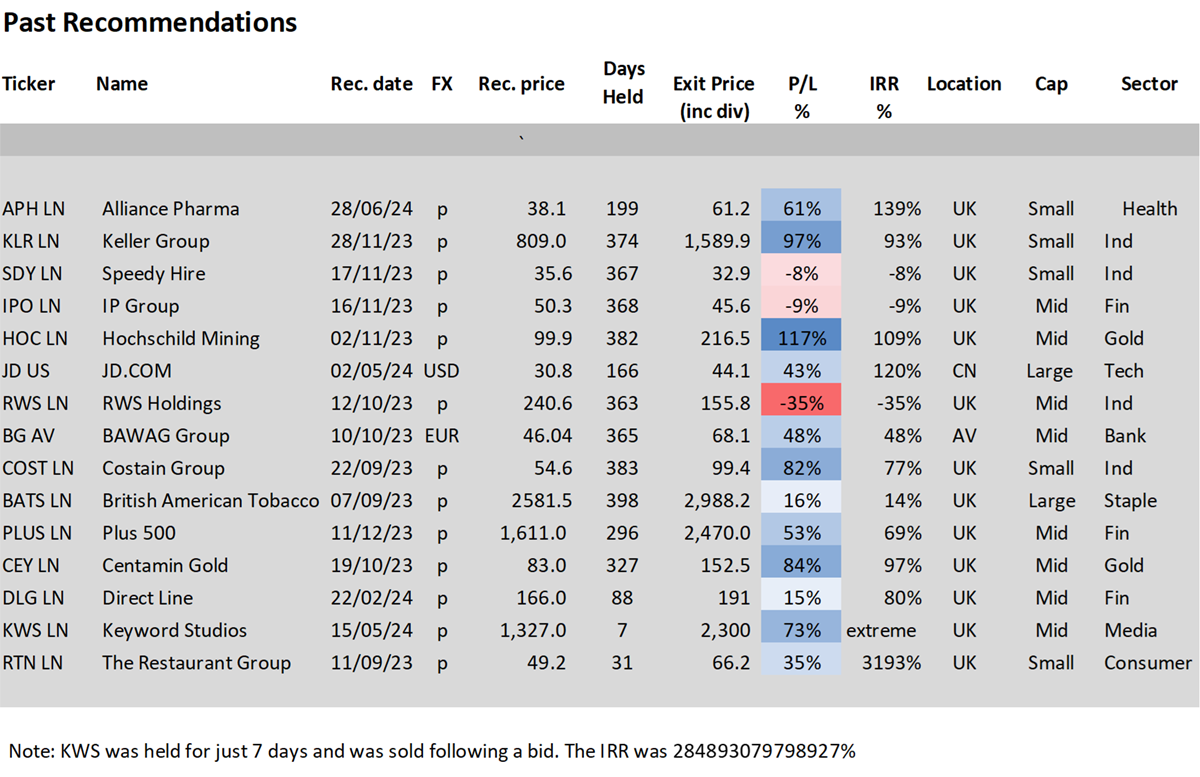

Alliance Pharma (APH) was added to Venture last June. There was a takeover approach last week, and the shares returned 61% over 199 days, equivalent to a 139% IRR.

The bid was very near the average analyst price forecast, a useful shorthand for private market valuations that has proven correct again.

Alliance Pharma Plc

Past Recommendations in Venture

Venture is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd