Trade in Whisky;

The world has sat back and watched President Trump thrust his agenda, including tariffs, Ukraine, Gaza, Europe, DOGE, Greenland and more. There is pushback building in all areas, and it is unlikely he’ll get his way. Still, he’ll have a go, and the disruption is welcome and overdue. Whatever you think of Trump, we should acknowledge that the current system is failing most people, and his lobbing of hand grenades is shaking things up. We need to embrace change if we wish to follow another, more prosperous path.

Some of his policies are conflicting. Slashing government spending is essential to secure US long-term prosperity, but in the short-term, it means mass layoffs, which could create a recession. If the vast US deficit is cut back, corporate profits will follow. The US can’t balance the budget, balance trade, have a booming economy and stockmarket, and a strong dollar all at the same time. Economics has rules, and something has to give.

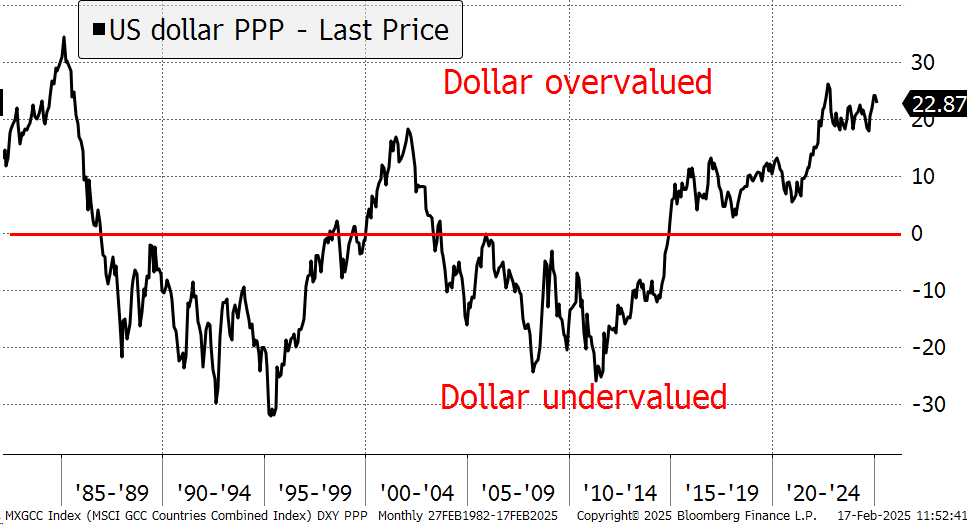

The one policy tool the US administration has to offset the shrinking deficit is the US dollar. It remains highly priced, and a weaker dollar would ease the pressure of prolonged higher interest rates and reduced government spending. This would have a significant impact because the dollar is overvalued on a purchasing power basis. It has been a long time coming, and I sense Trumponomics would welcome a lower dollar, especially as he aims to rebalance global trade.

US Dollar Purchasing Power

There are two areas that would benefit from a weaker dollar. The first are non-dollar countries, which would see increased capital flows. That includes Europe, Asia and the Emerging markets. A weaker dollar will likely see these stockmarkets outperform the USA and high time. I would expect Japan to benefit the least as it is an export-driven economy, and currency strength will harm its terms of trade. I would expect the emerging markets to do well, as a weaker dollar softens their debt burden, boosts commodity prices, and drives capital flows.

The other countries to benefit are pegged to the dollar but will feel the benefits of a weaker dollar without the fiscal pain. These include Hong Kong, parts of the Caribbean and the dollar zone in the Middle East. I would also include China, which has close ties with the US dollar. It’s ironic that Trump’s tough stance on China already seems to be creating a bull market in Chinese stocks. The Middle East is the other area I am interested in. Some parts are war-torn, but other parts are booming.

The Gulf Cooperation Council

The Gulf Cooperation Council (GCC) comprises Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates, and Bahrain. They are all pegged to the US dollar and are an alliance of monarchy states. They are the wealthy nations of the region, and the GCC is a counterbalance to Iran. Countries such as Iraq, Syria, Jordan, Yemen, and the North African Islamic states are not GCC members.

The GCC countries have good security, are growing economies, and are desirable places for expats to settle in search of a better life. They could be doctors, teachers, engineers, lawyers, or in finance. I understand it’s not for everyone, but many people are prepared to give up freedom of speech for a better life and lower taxes. Even Saudi Arabia is becoming more liberal and has a growing tourist industry. The GCC is the new Hong Kong.

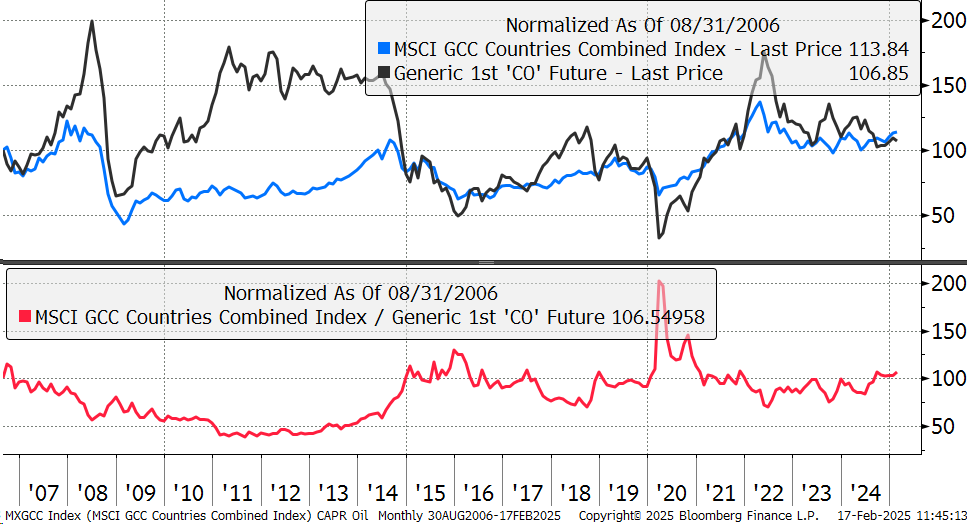

The GCC countries made their money from oil, but these days, there are vast revenues from tourism, banking, and industry as they have sought to diversify. Indeed, attracting skilled expats has been key to this strategy. Their success is still linked with oil, but less so than in the past. I show the link between the MSCI GCC Index and the oil price. For starters, the stocks are much less volatile than oil.

The GCC and Oil

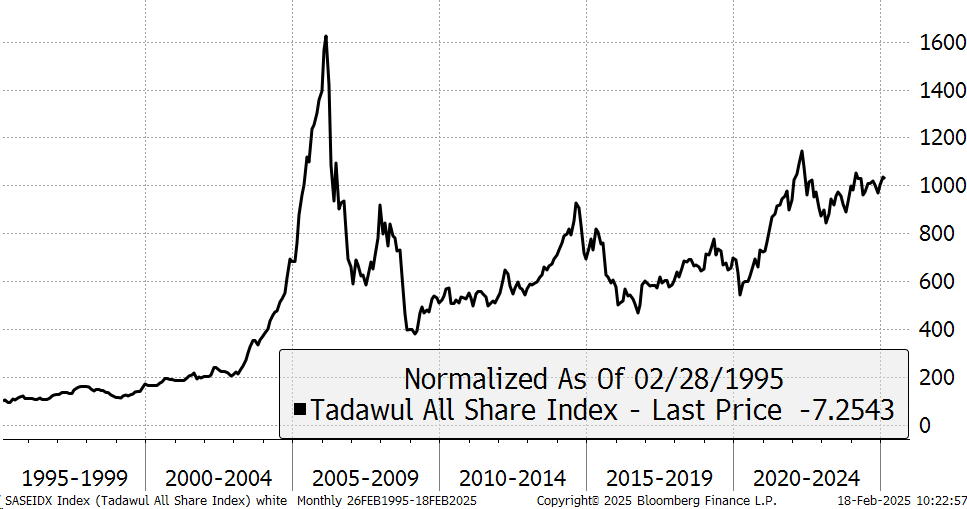

In 2006, just before the GCC index began, there was a huge bubble in the regional stockmarkets, with the banks and real estate stocks off the charts. That was 19 years ago, which ought to be enough time for the excesses to have been flushed out. The post-2008 GCC recovery was slow as the post-bubble recovery takes time to resolve. I show Saudi Arabian equities since 1995. The 2004 to 2006 boom coincided with a slump in the US dollar and a bull market in oil.

Tadawul Index (Saudi Arabia) Since 1995 Rebased to 100

This time around, I believe the GCC stockmarkets will continue to do well, even with a strong dollar, because they have moved on. Yet when that turns into dollar weakness, returns will accelerate. In addition, a weak dollar will likely boost the oil price, which will help too. Although most GCC oil is state-owned, high oil prices boost the regional banks and real estate and flow through the regional economies.

There are also the sovereign wealth funds, which have become vast. They are estimated to control over $4 trillion of capital, are invested all over the world, and provide a buffer for when things go wrong. I cannot reiterate enough that the GCC are wealthy nations, and are significantly underrepresented in global equity portfolios.

This is a global growth zone, which is fairly priced and poised to perform. What’s more, the region has been gaining status by hosting peace talks and other geopolitical roles. There is value in political neutrality.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd