Consolidation Phase Continues

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 147;

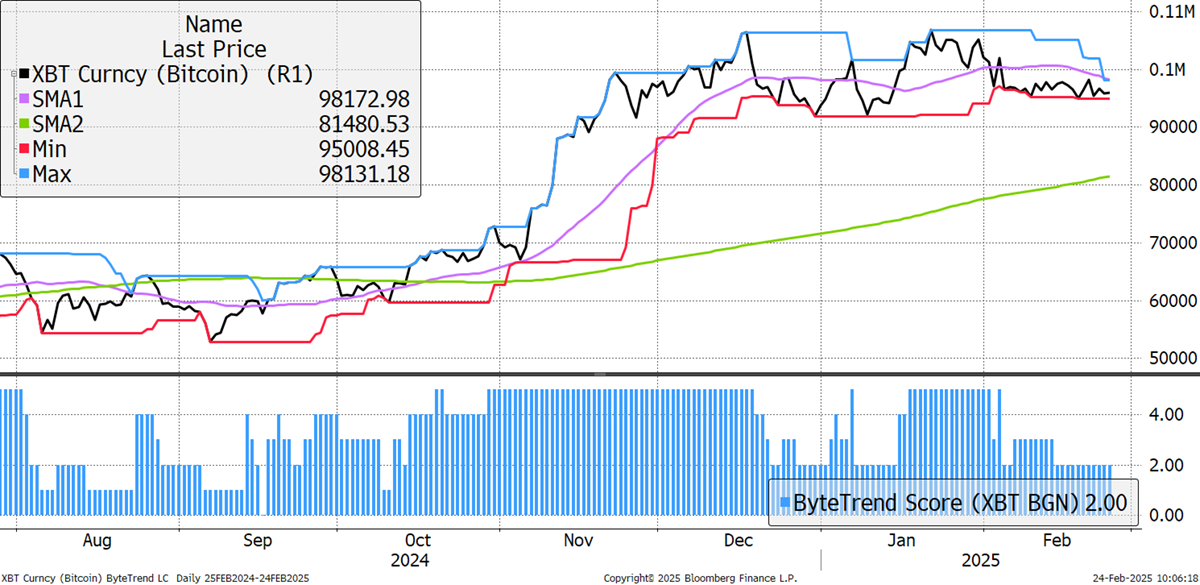

The last push above $100k was three weeks ago, which is too long. The rally late last week soon faded, and the trend score is 2/5. The 200-day moving average remains strong and is in an uptrend; maybe it will be retested at some point. While the message is soft in the short term, the long-term outlook remains positive, as Bitcoin is consolidating within a long-term uptrend.

Bitcoin Trend Score 2/5

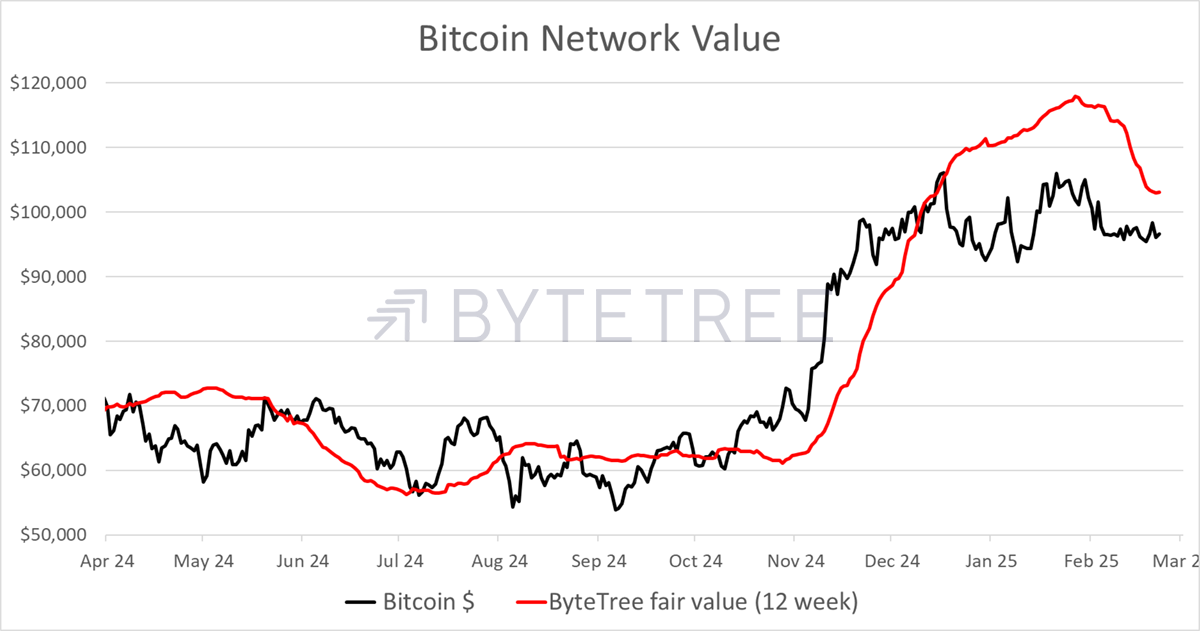

The network value, or the number of dollars flowing around the Bitcoin network, has eased back but has found support and turned up. We use this to estimate Bitcoin’s fair value using a calibration. This is a good indication that current levels of network activity are in line with the current price, which should be supportive. If the network was declining, I’d be worried, but it isn’t.

Bitcoin Fair Value

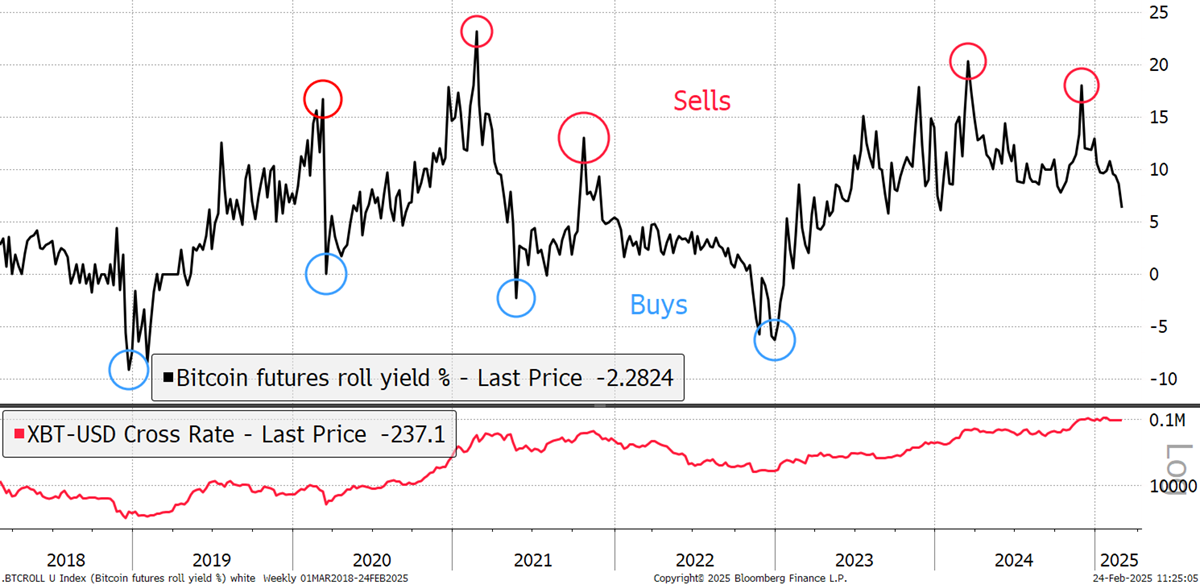

I would also highlight the CME Bitcoin futures market roll yield. I compare the spread between the second and third months, which are a useful sentiment indicator. Notice the spikes with red circles when the futures curve was steep, implying high demand for Bitcoin contracts. These high readings turned out to be good selling opportunities. Contrast that with the times when there was sluggish demand for Bitcoin futures, as shown by the blue circles. These turned out to be great buying opportunities.

Sentiment from Bitcoin Futures

Bitcoin futures suggest we are back in the neutral zone, where sentiment has swung from uber-bullish back to neutral. It could easily be the case that most of the price damage has already been done. The collapses in sentiment from here have typically already seen much of the price impact.

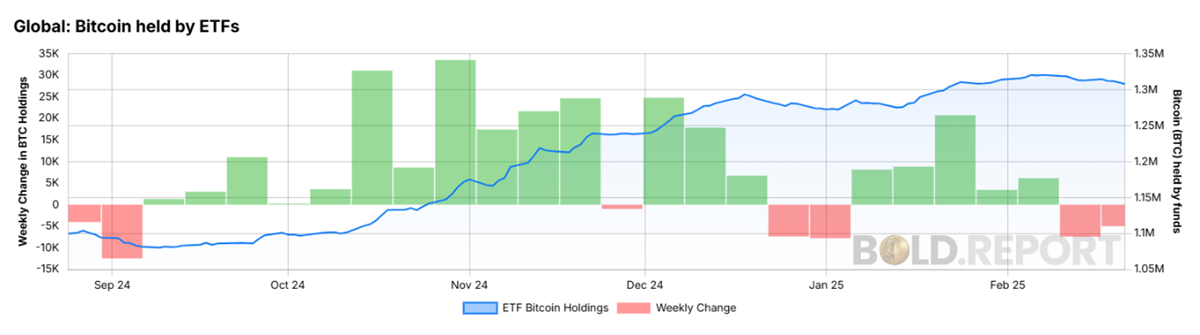

This shift in sentiment is confirmed by the softness in the ETF flows.

Bitcoin Held by ETFs

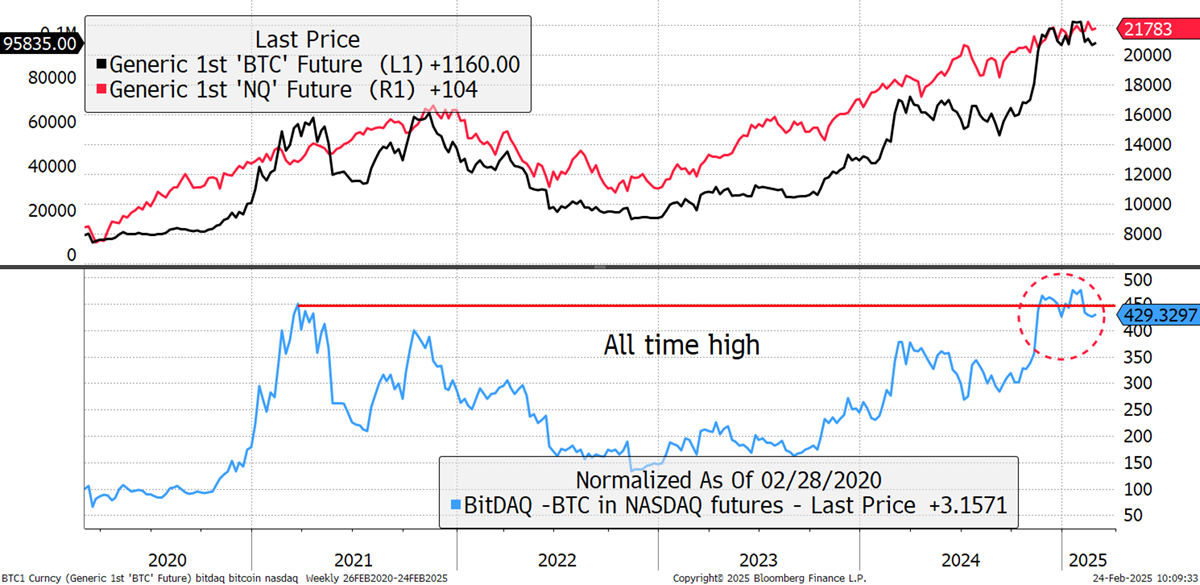

But it’s not just Bitcoin feeling the pinch. Tech has been soft, with the NASDAQ flat this year and Bitcoin up just 2%. Meanwhile, Europe is up 11% and gold 12%. Bitcoin has lagged the stockmarket, but is narrowly in front of tech. I see this as a long-term positive because, while Bitcoin will likely remain correlated with tech, it has the potential to overtake big tech because global investors are heavily invested in tech yet hold virtually zero Bitcoin. This is the long-term bull case.

Bitcoin vs NASDAQ

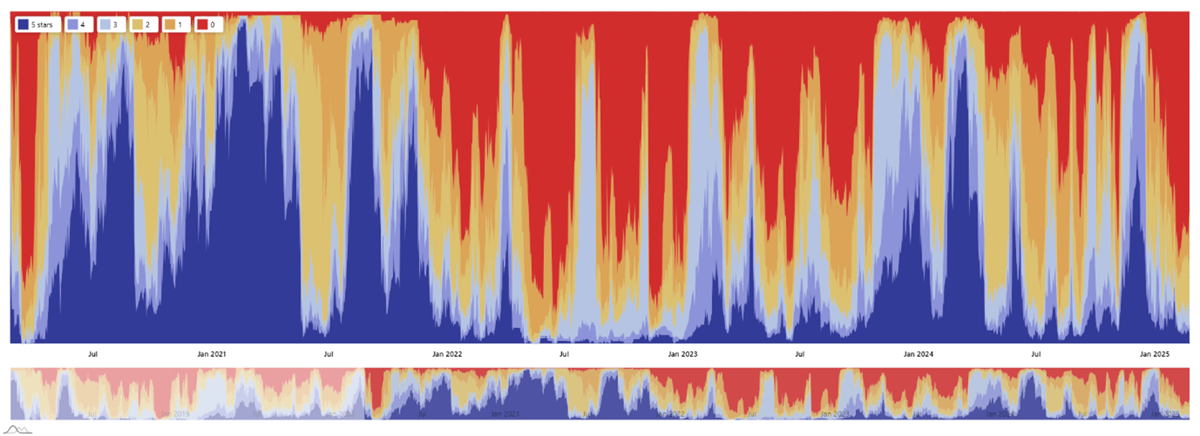

Yet, in Tokenland, things remain miserable. There’s as much red (weak trends) as there was in the bear market of 2022, which seems extreme but true. Not many tokens are rising, and even fewer are beating Bitcoin. One day, that will change, but not yet.

Top 100 Token Breadth in USD (blue strong, red weak)