Gold Breaks $2,800

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD Index Monthly Rebalancing Report;

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

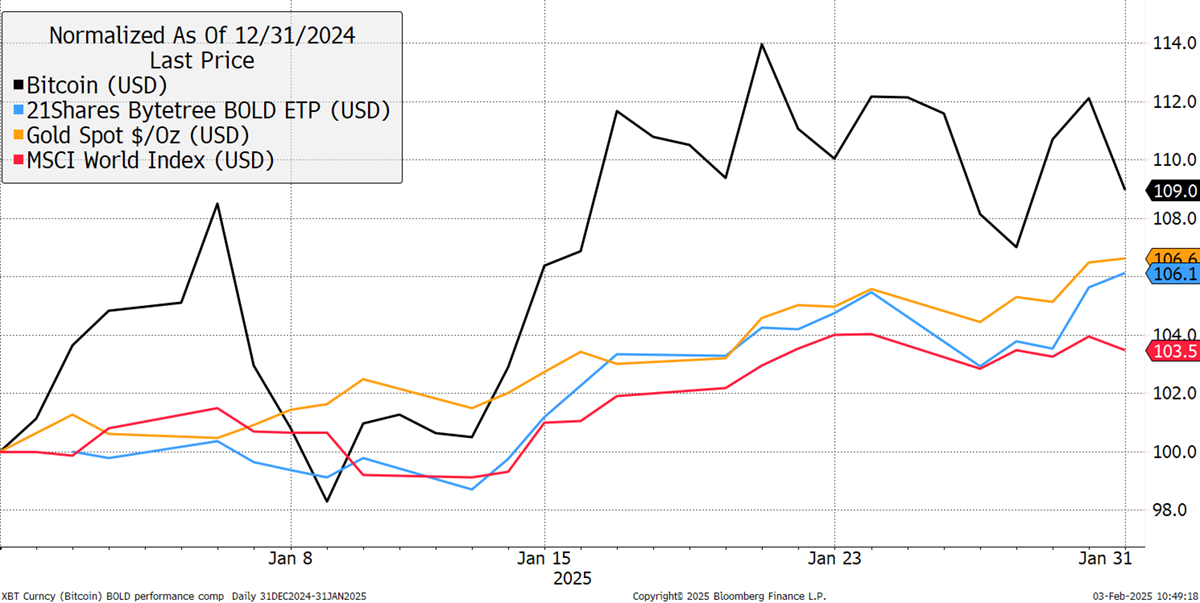

In January, BOLD rose by 9.0%, Bitcoin rose by 9.0%, and Gold rose by 6.6%, while global equities rose by 3.5% in USD terms. Note that the US dollar index fell by 0.1% in January, bringing relief to financial markets.

The target weights last month were 24.5% and 75.5% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 25.6% Bitcoin and 74.4% Gold. This means the latest rebalancing has seen 0.7% added to Gold and reduced from Bitcoin to meet the new target weights.

Bitcoin, Gold, BOLD, and Equities in USD – January 2025

BOLD Performance

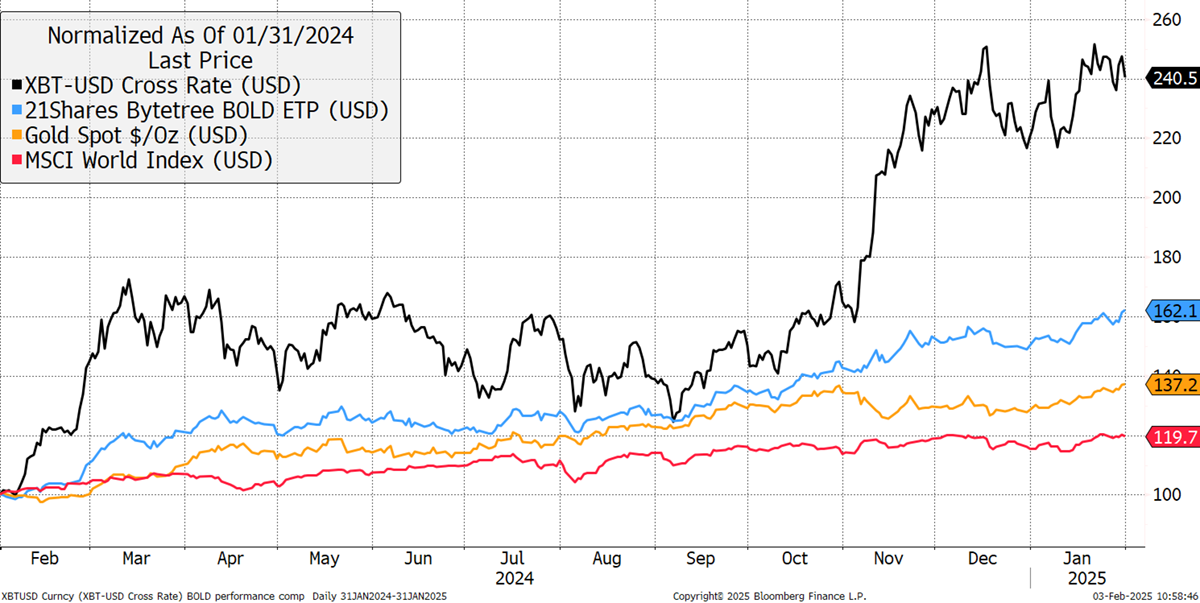

Over the past year, Bitcoin has returned +140.5%, in contrast to Gold with +37.2%, while equities rose +19.7%. BOLD has returned +62.1% in US dollars.

Bitcoin, Gold, BOLD, Equities - Past Year

Since the BOLD ETP inception on 27th April 2022, Bitcoin is +161.1%, Gold is +48.4%, and equities +36.7%. BOLD has returned +85.7%. A fixed 75/25 Gold/Bitcoin strategy would have returned 76.2%, demonstrating the benefits of embracing monthly rebalancing transactions.