Trade in Whisky;

I wrote about gold last week in Atlas Pulse, Gold’s Super Silent Bull. That was a bullish piece looking at the silver and gold miners’ catch-up trade caused by the lack of participation from investors. I concluded that the main reason for this was investors’ enthusiasm for the stock market, highlighting a chart showing how much of gold’s strength, in real terms, coincided with equity weakness.

Since then, much has happened. Last week, the FT reported that gold is leaving London and headed for New York. Then, the US Treasury Secretary, Scott Bessent, announced a plan to “monetise the asset side of the balance sheet”. Then yesterday, China announced a pilot program to allow ten insurance firms to invest up to 1% of their assets in gold. This is potentially $27 billion of demand for gold, which is positive but not groundbreaking. Put it all together, and gold has made another all-time high.

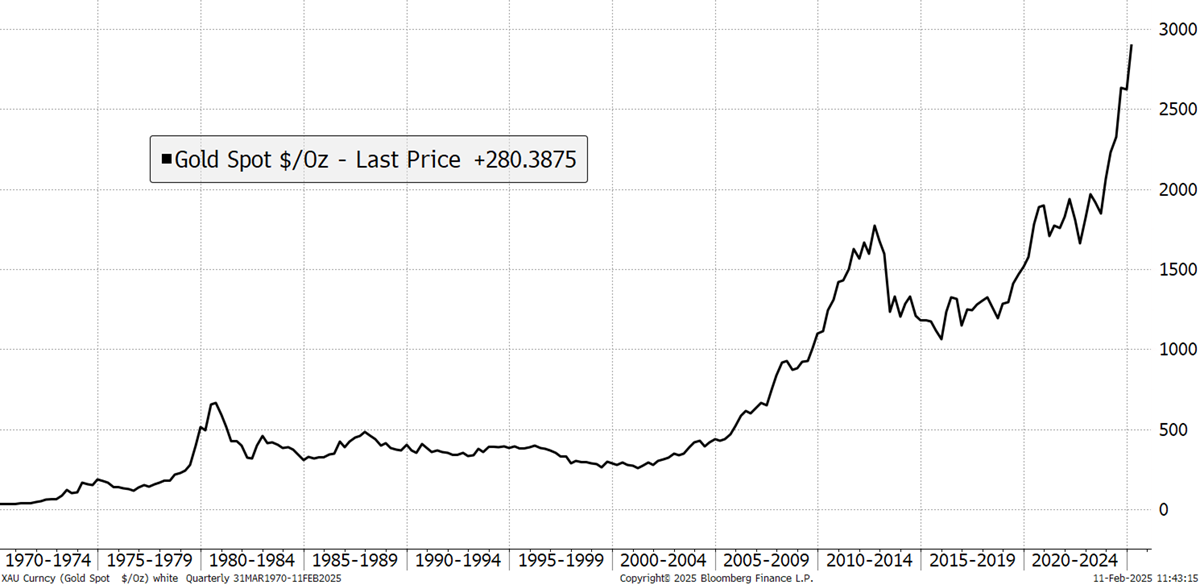

Gold Reaches $2,900 per Ounce

One thing has changed since last week: the gold bull market is no longer silent. One curious thing about the gold market is that while there is plenty of noise on social media, officials never talk about it. In that sense, it’s a bit like Fight Club. But now the USA and China are talking about gold, which puts it back into the global macroeconomic conversation.

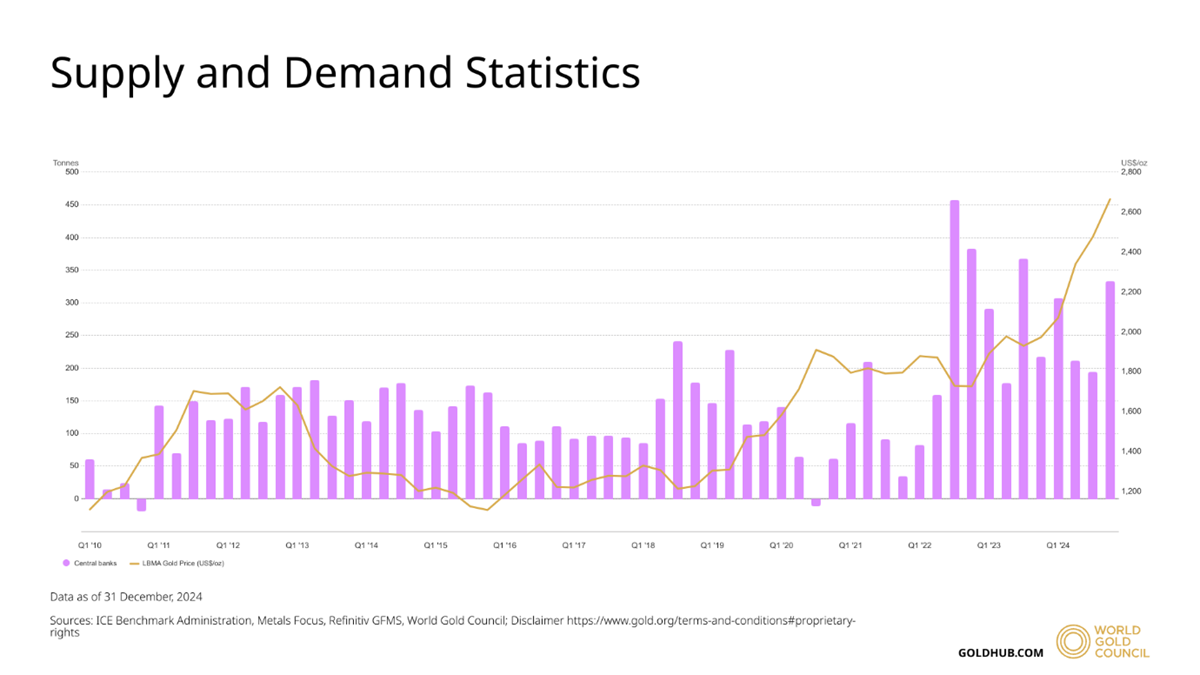

The big story in recent years has been the accumulation of gold reserves by the non-OECD central banks, with China in the lead. That is neatly displayed by this chart from the World Gold Council. Central bank demand is shown in purple and has taken off since 2022, when Russia was sanctioned.

The gold price peaked in 1980, and for the next two decades, gold seemed irrelevant. The European central banks formed an orderly queue to sell their holdings, led by the UK, but after 2000, that began to slow. Family offices and retail investors were the first in to pick up gold at low prices. Then, by 2009, in the aftermath of the financial crisis, the central banks began to accumulate, and in 2022, that began to accelerate. You only have to look at the debt, deficits, and geopolitical uncertainty to understand why.

Curiously, no one told the central banks to buy gold. It is not written down in the playbook, like so many things relating to official reserves. These days, gold holds no official role, but is a measure of the financial climate, which holds the financial system to account. The central banks drew their own conclusions, and this metal, which has sat at the centre of economic history, has returned to the front line with a vengeance.

I shall elaborate on the key events of recent days and answer the many questions that came into my inbox over the weekend as stories on X/Twitter went viral.

US Revaluation

The US holds 261.5 million ounces of gold (moz) worth $758 billion. These are held in the books at $42 per ounce, the 1971 price before the US came off the gold standard. The current market price is $2,900, which is a nice little uplift. This revaluation by Bessent comes as a result of looking for positives in the US balance sheet. It is well-known that the US government has $36 trillion of outstanding debt, but Bessent is on the hunt for assets. This $758 billion of revalued gold comes in handy and could be held in the “Treasury General Account”, as an IOU, which is basically the US government’s current account for day-to-day taxes and expenditures. This inclusion will take the pressure off bond issuance in 2025, while Elon Musk’s DOGE cuts spending.

It's bullish for gold because gold has lived in the shadows, and no one from the government ever talks about it. Now that Bessent has thrust this forgotten asset into the limelight, more financial institutions will be talking about it and putting it onto their agenda. The US gold reserves are no longer a “barbarous relic”, to quote Keynes, but centre stage.

Are Trump’s Tariffs Negative for Gold?

I would be very surprised if gold was negatively impacted by tariffs. Tariffs create uncertainty and tensions, so they are a positive for gold. The other question is whether Trump could place tariffs on gold transfers? I very much doubt it, as these would amount to capital controls. One of these days that could happen, but that would be a long way down the line. Despite Tariffs, the US thrives on being an open economy.

Is London Running Out of Gold?

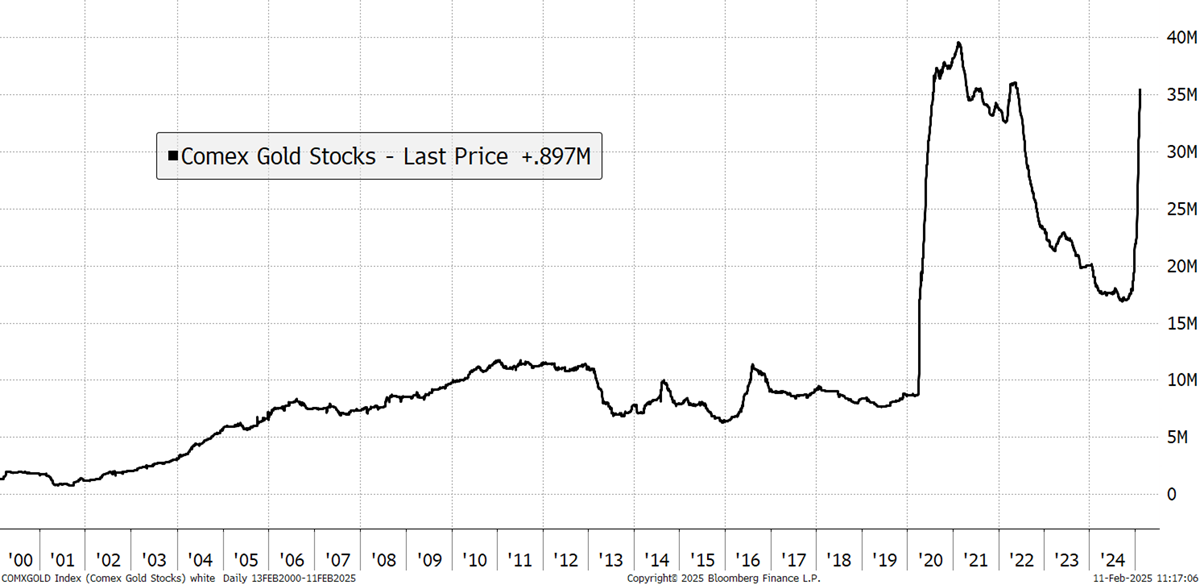

Some investors have chosen to move their gold from London to New York, and the US COMEX futures inventories have surged to 35.5 moz, worth $103 bn. Is this a lot? A jump of 17 moz ($50 bn) is more than usual, but remember that gold is a $20 trillion dollar asset class, which trades at around $150 billion each trading day. It resembles what happened during the pandemic, which I will come to.

US COMEX Gold Inventories

The US runs the main gold futures market, where vast sums of contacts are traded each day. In contrast, London runs the physical markets, where large amounts of gold are stored.

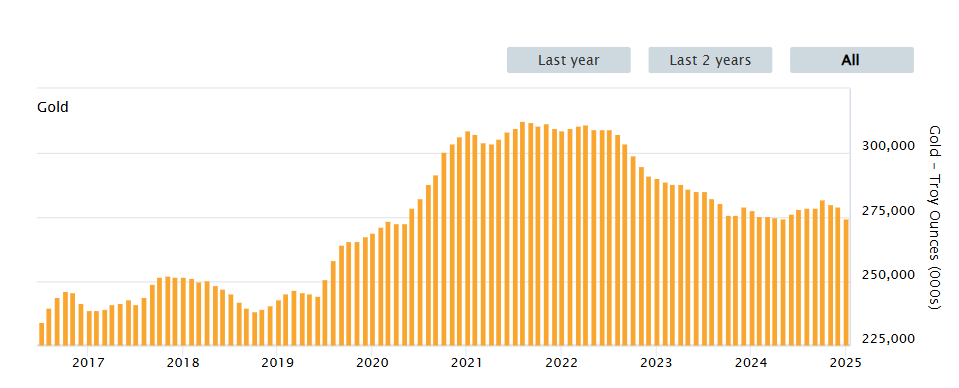

The London Metals Bullion Association (LBMA) is the trade body for the gold market that oversees standards and practices. For historical reasons, the London market has been the world’s largest but has seen holdings fall by 12% (37 moz, $108 billion) since 2022. Perhaps this reflects the demise of the City of London, or perhaps investors’ preference for repatriating gold since the Russian sanctions. In any event, the London vaults still hold a similar amount of gold as the US reserves.

Loco London Gold Held in Vaults

That does not include the Bank of England’s UK gold reserves, but the gold it holds on behalf of other central banks and clients, which adds another 170 moz to London’s total. In the recent request to shift some Bank of England-held gold to New York, there was a bottleneck, similar to the pandemic when the planes were grounded.

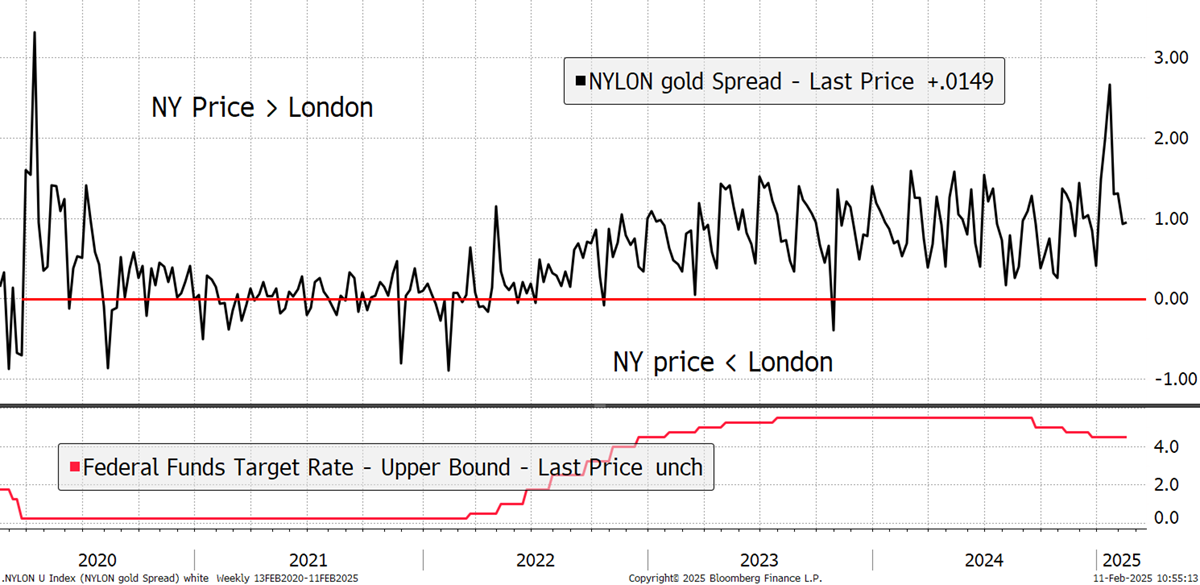

New York-London Futures vs Physical Gold Spread

I added interest rates to show their impact on the New York-London spread. In 2020 and 2021, when rates were near zero, there was no spread. In 2022, the spread rose as interest rates rose. London gold is physical and pays no interest. A futures contract is a financial instrument, and the time value of money comes into it. The gold still pays no interest, but the “future promise to deliver gold” does, and hence, the average spread between gold spot and gold futures follows interest rates.

The spikes in 2020 and recently were caused by delays in logistics. The Bank of England is an old building, and if you request 17 moz, three blokes in overalls go downstairs and start counting. Once done, there’s a herculean task ahead, as explained by Robert Armstrong in the Financial Times:

“Here’s the weird bit: physical settlement in Comex and in London require different sizes of gold bars. In London, it’s 400oz gold bars. Comex takes delivery either in 100oz bars, or bundles of three 1kg bars. Conversion of London gold bars for New York delivery can be done in short order at (wait for it) refineries in Switzerland. The gold is then flown to New York (Planes! To settle a financial transaction! In the 21st century!).”

Notice how the New York-London spread is returning to normal. I am not concerned by this, but in terms of logistics, this is one area where Bitcoin beats gold hands down.

Are the Gold ETFs Safe?

Many have written in asking if the ETFs are safe, following rumours on Twitter/X. Absolutely they are. The gold ETFs have “allocated gold”. I do not believe any of them use the Bank of England, but more modern facilities at the bullion banks, namely HSBC, UBS, or JP Morgan.

Allocated gold segregates the numbered bars and cannot be lent or pooled with other gold. Even if gold continued to move to the US, the ETF gold would stay put, as no one other than the owner is allowed to touch allocated gold.

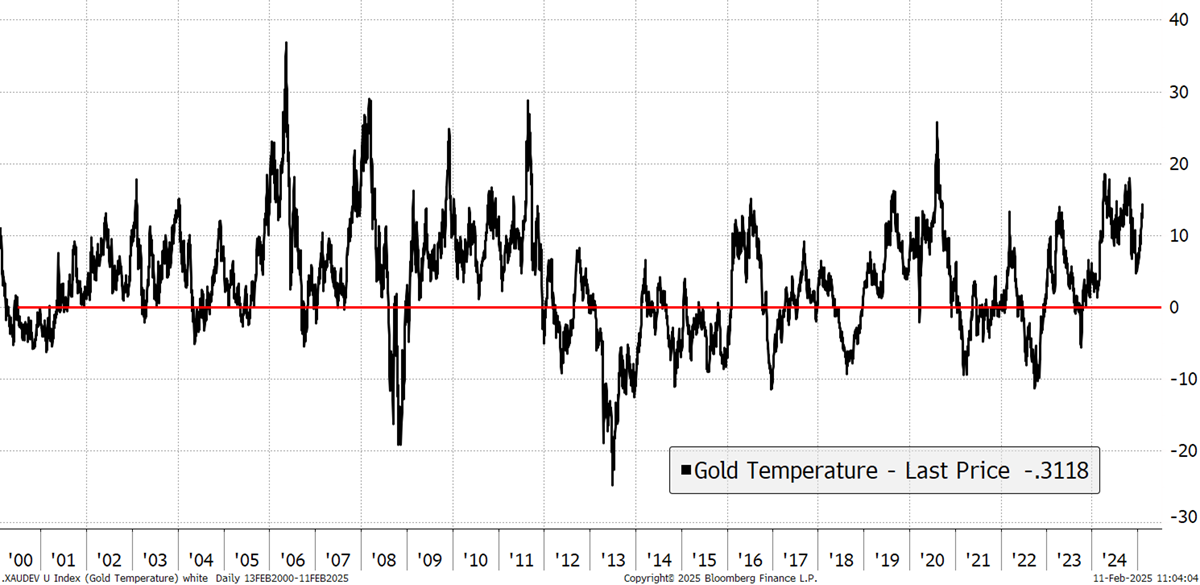

Is Gold Overbought?

It is, but not massively so. It currently trades 15% above its 200-day moving average. That reflects recent strength, and a short-term pullback is possible or probable. That said, the last one in October didn’t last long. The 2011 and 2020 overbought periods saw much higher readings and led to reversals.

Gold % Above or Below its 200-Day Moving Average

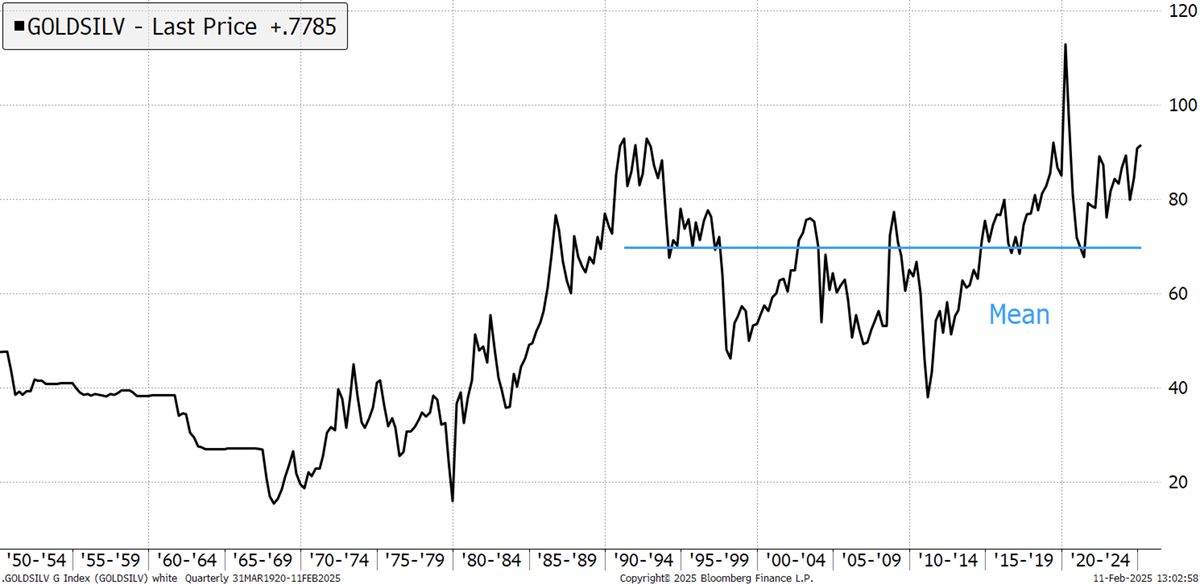

Does the Gold-to-Silver Ratio (GSR) Ever Revert to its Historical Mean?

It does, but the mean is rising over time, and so we should not think of it to be fixed. The current GSR is 92, which means one ounce of gold buys 92 ounces of silver. I would argue that in the post-1970 era, since gold traded freely, silver has lagged significantly because gold was underpriced and caught up. Going back to the 1990s, the mean sits around 70, implying a silver upside. It could be that in 50 years, the 30-year mean GSR is higher, and probably will be. But I believe silver fever comes around from time to time and is overdue.

Gold-to-Silver Ratio

What Is the Catalyst for Investors to Pile into Precious Metals?

As I wrote in Atlas Pulse, I think an equity bear market would see investors materially increase their allocation to gold. I’m not sure Trump likes bear markets, but there are some things out of his control.

The other elephant in the room is Bitcoin. Over the last 90 days, investors bought $10 bn of Bitcoin (and twice that a month ago), and just $3 bn of gold. Maybe a Bitcoin bear market would also help gold. As I keep saying, they take it in turns.

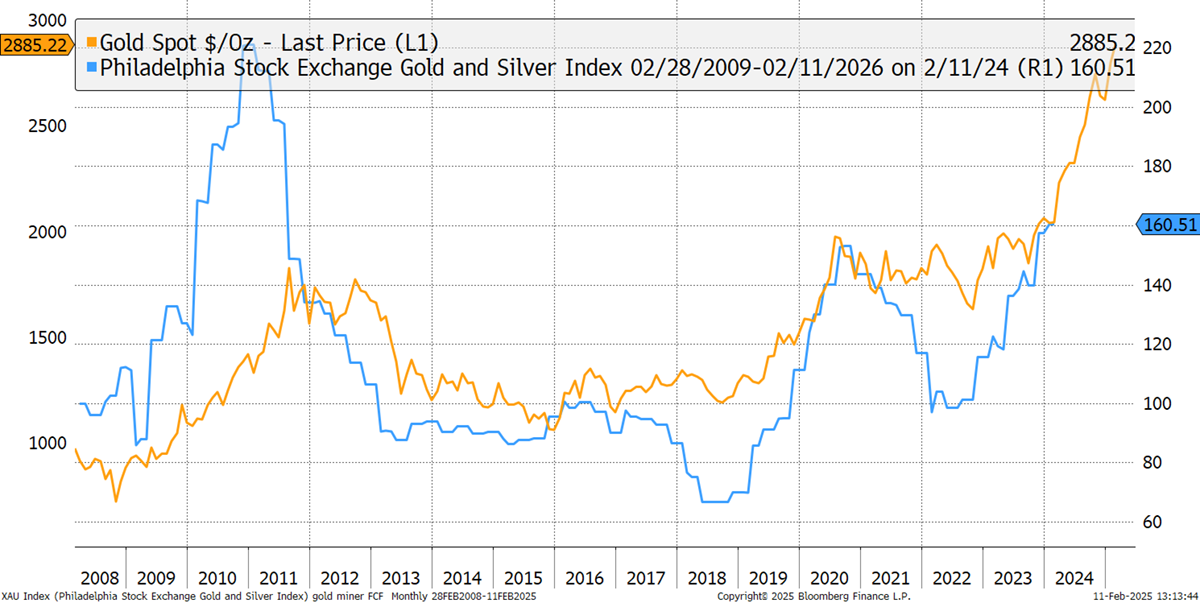

What Is the Catalyst for Investors to Re-rate the Miners?

I show the miners index gross profit margins pushed back one year. Profits will rise substantially, especially with the price of oil, a major input, so low. Investors are highly focused on earnings upgrades, and they will notice.

Gold Price and Miners’ Profit Margins

If We Are in a "Silent Super Bull" Market at the Moment - What Segments Are Traditionally the Best Performers at This Point? Majors or Juniors?

A week can be a long time in markets, and this bull market is no longer silent.

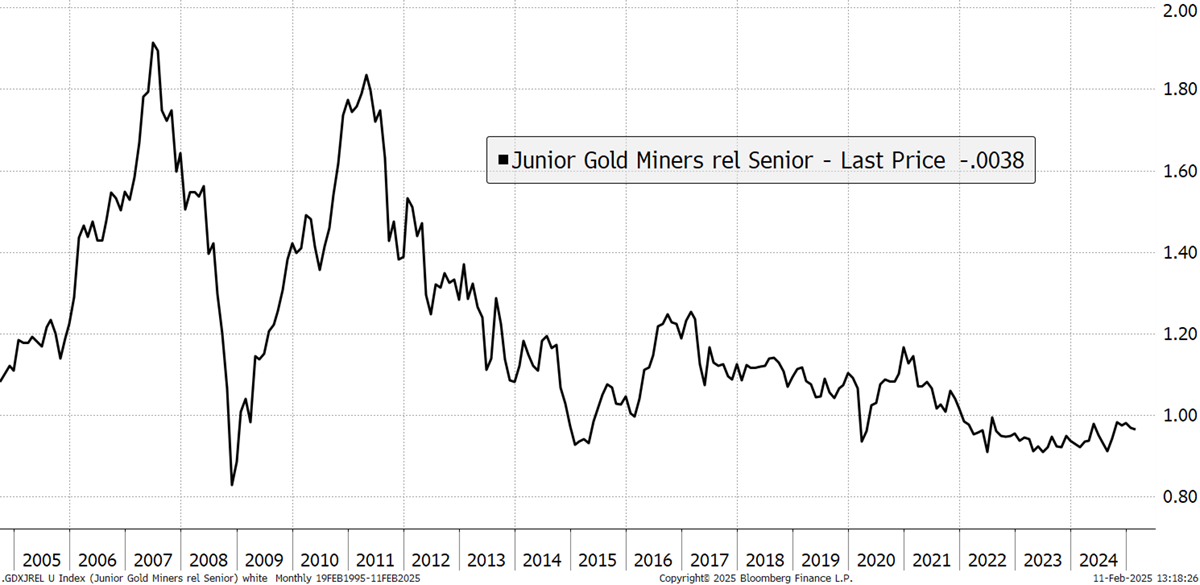

It’s a good question, and you would think the juniors would be firing on all cylinders, yet they aren’t. I am reasonably confident they have put in the low vs the majors but are yet to reach lift-off. When gold fever comes, the juniors ought to do twice as well as the majors, and the majors should run ahead of gold. This is why we own them.

Junior Gold Miners vs Majors

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd