MANTRA: Taking Real-World Asset Tokenization to New Heights

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: OM;

MANTRA is a cutting-edge Layer-1 blockchain platform that bridges the gap between traditional finance (TradFi) and decentralised finance (DeFi) through tokenization. It has made waves in the industry with major partnerships, while its native token, OM, has been among the sector’s top performers. But is this rise solely driven by strong platform fundamentals, or is it an event-driven rally fuelled by the broader Real-World Asset (RWA) trend? This Token Takeaway will examine the intricacies of MANTRA, explore the RWA tokenization sector, and analyse the value proposition of OM.

Overview

Introduced in June 2020, MANTRA was founded by John Patrick Mullin with a vision to lead the real-world asset (RWA) tokenization sector. Mullin is also one of the co-founders of SOMA.finance, a US-regulated DeFi platform currently conducting the sale of its native token SOMA, a legally issued digital security. Interestingly, a MANTRA blog post highlights that MANTRA leverages licenses obtained by SOMA.finance to ensure compliance, indicating that their connection extends beyond simply sharing a founder. This strategic alignment underscores MANTRA’s commitment to regulatory compliance while benefiting from SOMA’s established legal framework.

As (indeed) the leader of the RWA tokenization sector, MANTRA is committed to creating a fully compliant blockchain ecosystem that addresses regulatory challenges and security risks. It aims to bridge the gap between traditional and decentralised finance by not just ensuring strict adherence to financial regulations but also offering highly customizable solutions for the transition of RWA into the digital world, making tokenization more secure and accessible.

In March 2024, MANTRA secured $11m in a funding round led by Shorooq Partners, a leading emerging technology investor based in Dubai. The round also saw participation from key industry firms, including Three Point Capital, Forte Securities, and Fuse Capital. This recent funding round underscores growing confidence in MANTRA’s mission to revolutionise RWA tokenization and expand its ecosystem.

Before diving deeper into MANTRA, let’s cover the basics of RWA tokenization.

What Are Real-World Assets (RWA)?

Real-World Assets refer to tangible or financial assets in the physical world (outside of the blockchain). These assets include real estate, government bonds, private credit, commodities (like gold) and even art. The process of tokenising RWAs allows investors to trade them digitally, just like cryptocurrencies, but with the added benefit of backing from physical or financial instruments.

What Is Tokenization and How Does It Work?

Tokenization is the process of converting real-world assets into digital tokens on a blockchain. These tokens represent ownership or a stake in the asset, allowing investors to buy, sell, or trade them more efficiently than in traditional markets. The process typically involves:

- Asset Identification and Legal Structuring: Determining the asset to be tokenised and ensuring compliance with regulations.

- Token Creation: Using blockchain technology to issue digital tokens that represent ownership or value. This breaks down large, illiquid assets (e.g. real estate) into smaller, tradable tokens.

- Smart Contracts and Automation: Enabling automated transactions, such as revenue distribution and ownership.

RWA Tokenization Sector Key Metrics

RWA tokenization emerged as one of the most transformative trends of 2023–2024, mirroring the rapid rise of AI. Beyond individual users, institutional giants like BlackRock and Franklin Templeton have fuelled this sector’s expansion by actively exploring and investing in blockchain-based asset tokenization. Their involvement has significantly accelerated mainstream adoption and legitimacy.

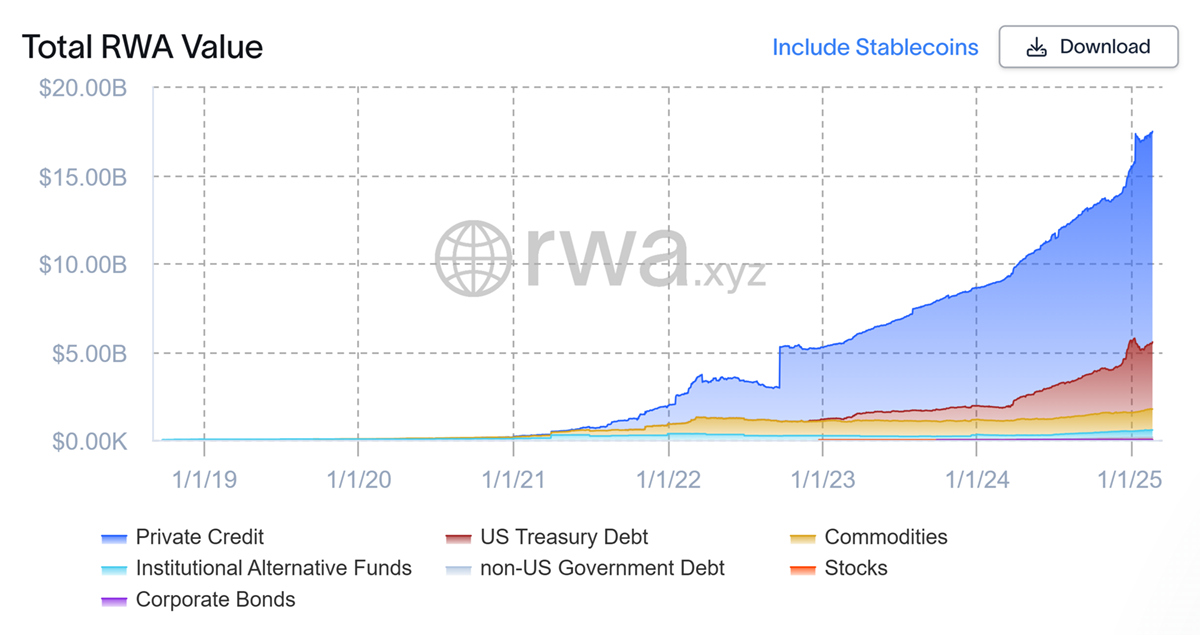

Tokenized RWA Marketcap

Since early 2023, the market capitalisation of tokenized RWAs has surged from $5.2bn to over $17.4bn today, a remarkable 234% increase. As illustrated in the chart above, Private Credit and U.S. Treasuries dominate the space, with market caps of $11.9bn and $3.7bn, respectively. Interestingly, real estate is absent from the chart, emphasising that its tokenization is still in its early stages.

Monthly On-chain RWA Issuance

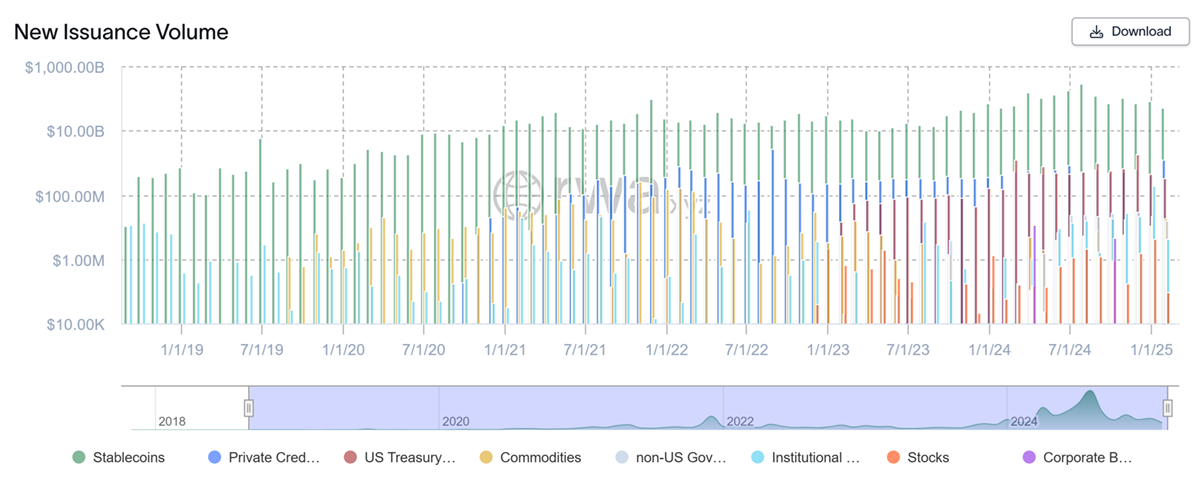

The issuance of tokenized RWAs across various blockchains has shown steady growth since 2019. Notably, the above chart also includes stablecoins, which, as tokenized representations of fiat currency, are inherently a form of RWA.

Currently, the total tokenized RWA market cap, including stablecoins, stands at $238bn, a staggering figure that underscores the sector’s potential. Several research reports from leading institutions predict that this industry could evolve into a multi-trillion-dollar market.

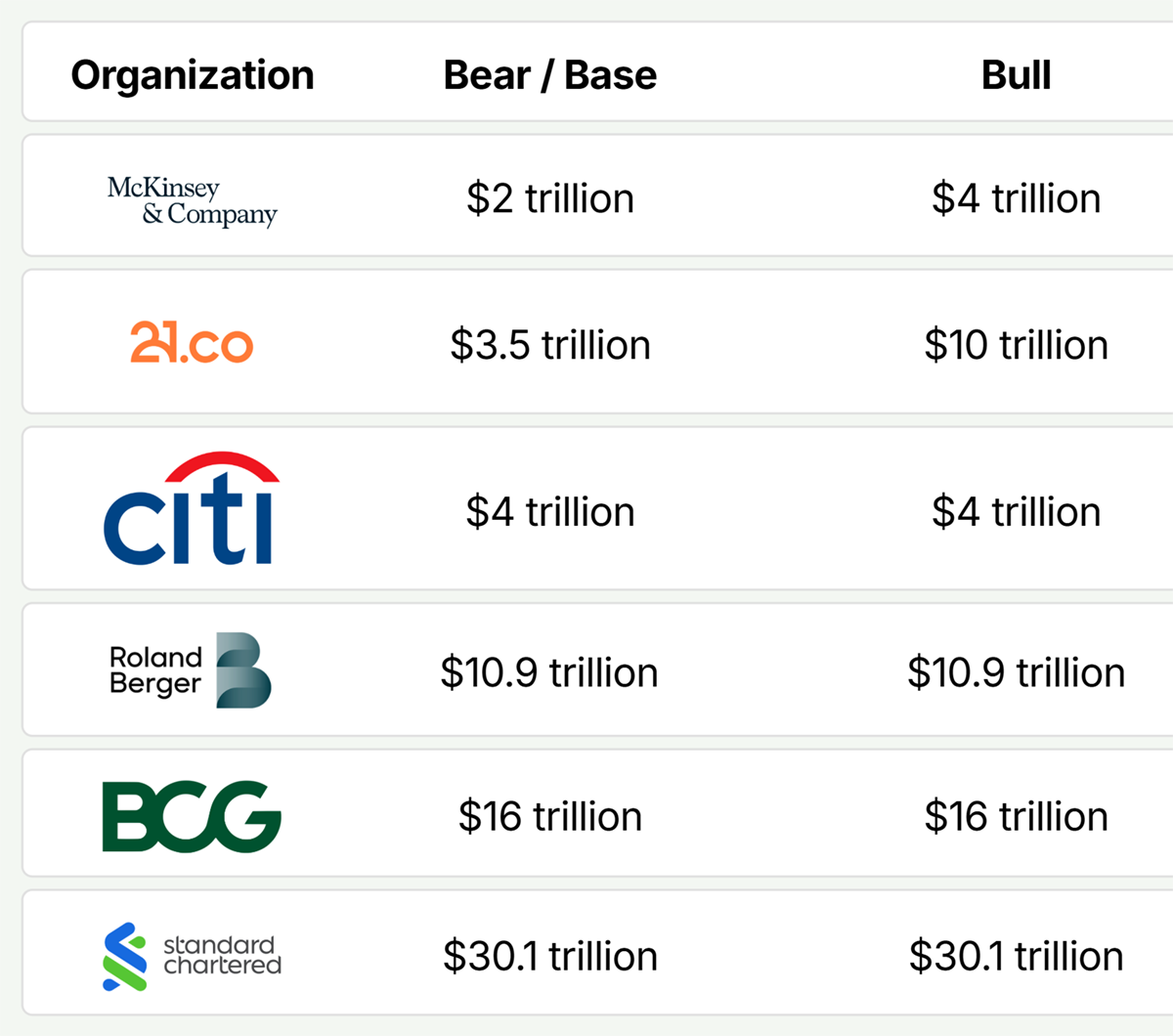

Sector Predictions

As seen in the projections above, McKinsey estimates that the tokenized RWA market could grow to $2–$4 trillion, while Standard Chartered sets an upper limit of over $30 trillion, which certainly highlights the sheer scale of this emerging sector. With such immense growth potential, MANTRA’s strong positioning in the space provides a compelling outlook for its future expansion.

MANTRA Architecture

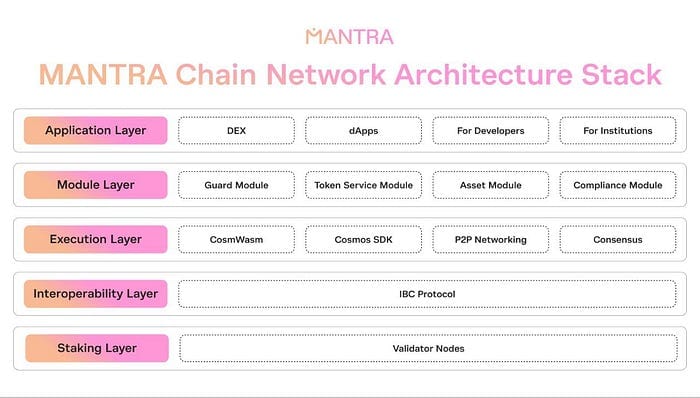

Built using the Cosmos Software Development Kit (SDK), MANTRA is a fast, secure, and highly interoperable blockchain designed to support seamless asset tokenization. The Cosmos SDK is one of the most widely adopted frameworks in the blockchain industry, providing chains like MANTRA with modularity, scalability, and flexibility.

By leveraging Cosmos' robust infrastructure, MANTRA offers a developer-friendly environment that enables the creation of a diverse range of decentralized applications (dApps) and financial services. This architecture ensures efficient cross-chain communication, allowing MANTRA to integrate with other Cosmos-based networks and beyond, enhancing liquidity and utility across the broader blockchain ecosystem.

The MANTRA Chain architecture is built on a five-layer structure, with each layer playing a crucial role in shaping MANTRA into a highly efficient and unique Layer-1 blockchain. These five layers are Staking, Interoperability, Execution, Module, and Application.

MANTRA Architecture