The Tariff Man

It has been an eventful weekend. Trump has upset the Mexicans, the Canadians, the Colombians, the European Union, the Chinese a little, and the South Africans who were branded racist. He would have upset the United Kingdom, but rumours have it that the Trump administration was struggling to see what Britain produced.

Many of the sanctions have been withdrawn, and China’s were surprisingly light. The Hang Seng Index broke out and is set for a new bull run after the stimulus moves announced in September.

Hang Seng Index

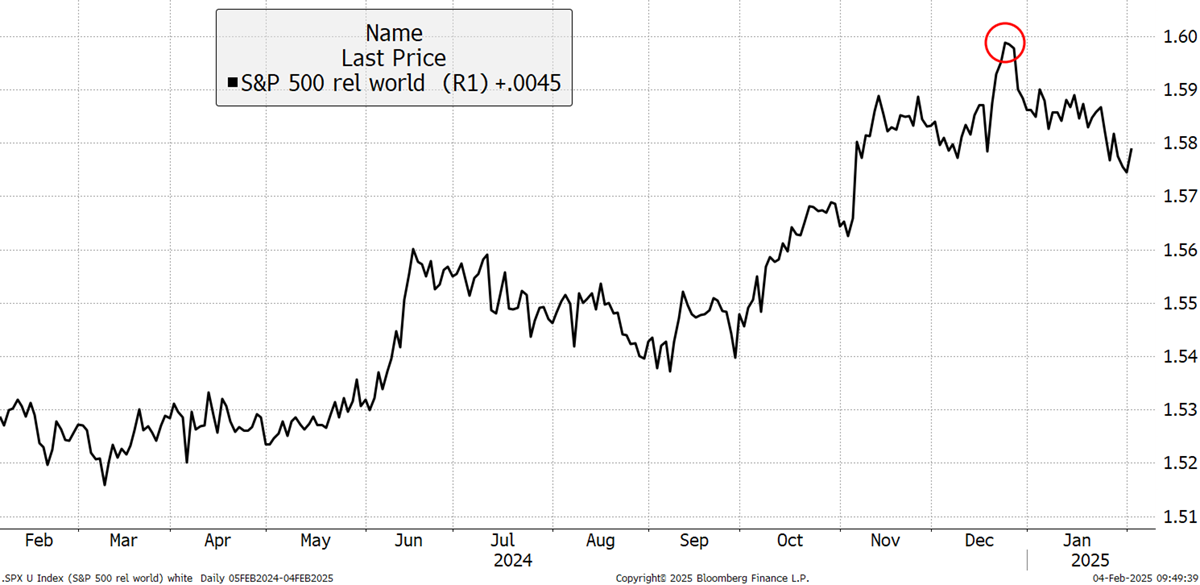

It’s not just China. Latin America, especially Brazil, is doing well this year, as is Europe. The laggard is the US and not just in big tech. It would surprise many investors that since Christmas Eve, the US has started to lag the world. It’s early days for sure, but a weaker dollar will see this continue. When CAPR rises, US stocks beat the world and vice versa. Might US exceptionalism have finally peaked?

S&P 500 Currency Adjusted Price Relative (CAPR)

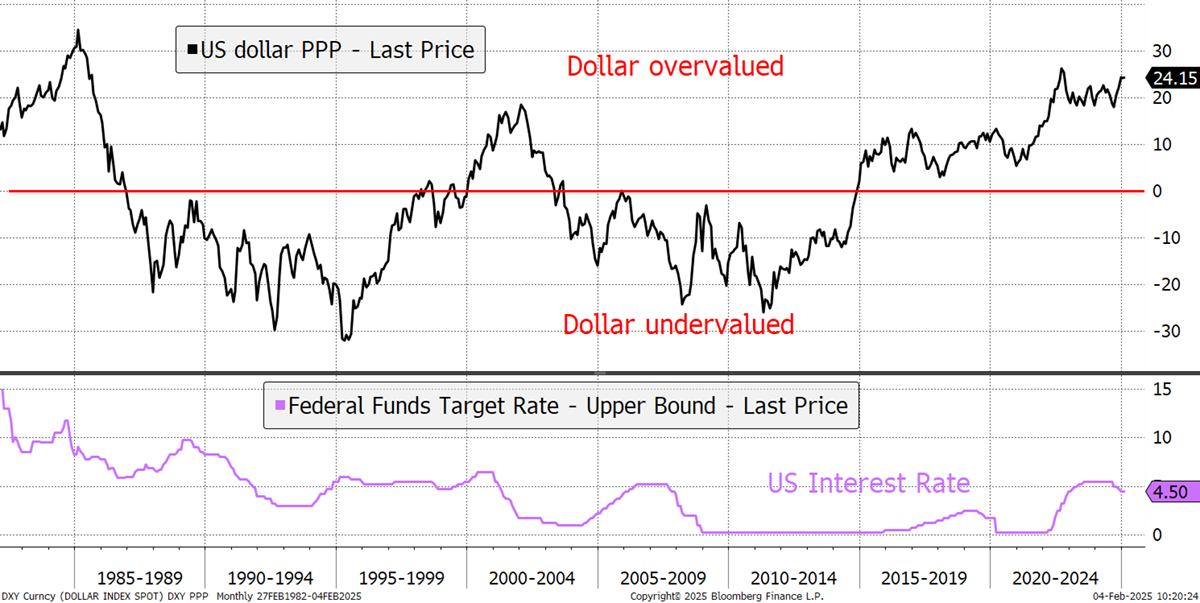

It would be ironic if true, but consider that Trump has inherited one of the greatest stockmarket bubbles of all time, combined with an overvalued dollar. The US is a good place to do business, and no doubt the economy will outperform other developed countries, but the economy is not the stockmarket.

Despite tariffs boosting the dollar in the short term, I believe Trump secretly wants a weaker dollar because it is the lever he can pull that US citizens won’t notice. He wants to see lower interest rates, which will boost the economy, and with that, the US dollar weakens. I have been saying this for some time, and sooner or later, I might even be proven right.

The US Dollar Remains Rich

This is non-consensus but is the view that follows the logic and the facts. I have no doubt the best and lasting opportunities are where the value lies. After all, what is the price of gold telling us, which just made a new all-time high? I sent a flash note last week, and here’s why.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd