Tokenization: Revolutionising TradFi with Blockchain

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 146;

The tokenization of Real-World Assets (RWA) has emerged as one of the most transformative trends in the industry. By leveraging blockchain technology, tokenization allows traditional assets, such as real estate, bonds, and private credit, to be represented digitally on-chain. This innovation enhances liquidity, transparency, and accessibility.

What Are Real-World Assets (RWA)?

Real-World Assets refer to tangible or financial assets that exist in the physical world (outside of the blockchain). These assets include real estate, government bonds, private credit, commodities (like gold) and even art. The process of tokenising RWAs allows investors to trade them digitally, just like cryptocurrencies, but with the added benefit of backing from physical or financial instruments.

What Is Tokenization and How Does It Work?

Tokenization is the process of converting real-world assets into digital tokens on a blockchain. These tokens represent ownership or a stake in the asset, allowing investors to buy, sell, or trade them more efficiently than in traditional markets. The process typically involves:

- Asset Identification and Legal Structuring: Determining the asset to be tokenised and ensuring compliance with regulations.

- Token Creation: Using blockchain technology to issue digital tokens that represent ownership or value. This breaks down large, illiquid assets (e.g. real estate) into smaller, tradable tokens.

- Smart Contracts and Automation: Enabling automated transactions, such as revenue distribution and ownership.

In 2023, RWA tokenization gained significant momentum, capturing the attention of both institutional and retail investors. Leading financial institutions like BlackRock and Franklin Templeton have recognised its potential, driving increased adoption.

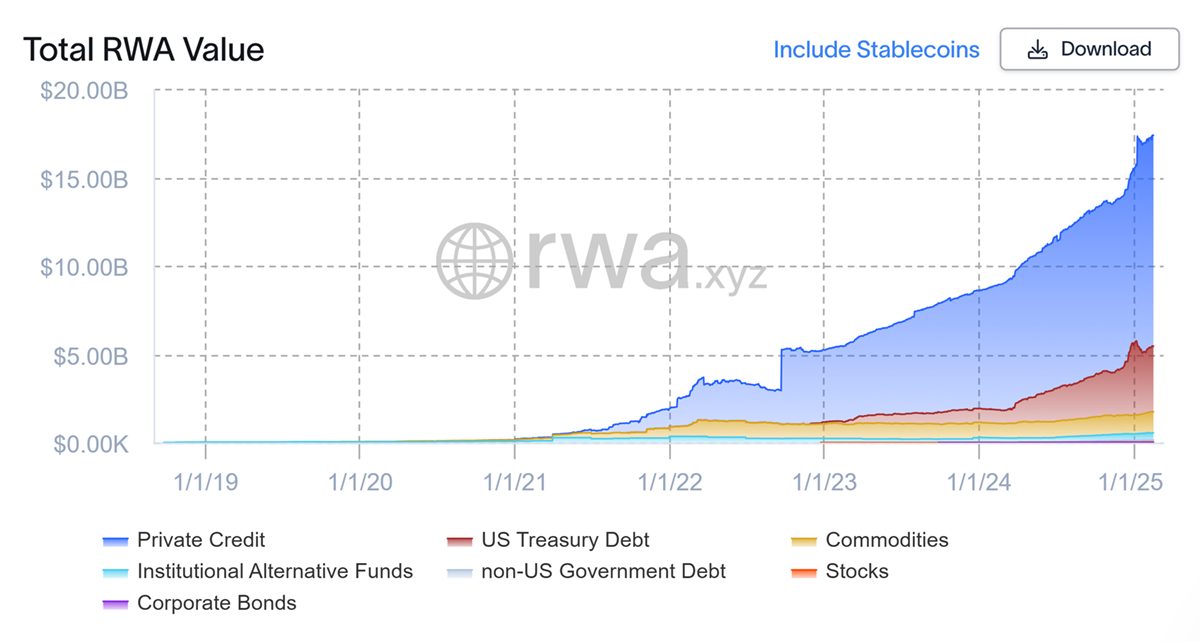

Tokenised RWA MarketCap

At the start of 2023, the tokenised RWA market was valued at $5.2bn, a figure that has skyrocketed to $17.3bn today, marking a staggering 232% growth.

Currently, the sector includes over 110 issuers and more than 84k on-chain asset holders, demonstrating rapid institutional and retail adoption. Ethereum dominates the market, accounting for nearly 52% of all tokenised assets. Among the most popular categories of tokenized RWAs are:

- Private Credit: Offering new on-chain lending opportunities.

- U.S. Treasury Bonds: Providing stable, low-risk investment exposure.

- Real Estate: Enabling fractional ownership and yield-generating investment models.

- Commodities: Bringing assets like gold on-chain for on-chain store of value and/or seamless trading.

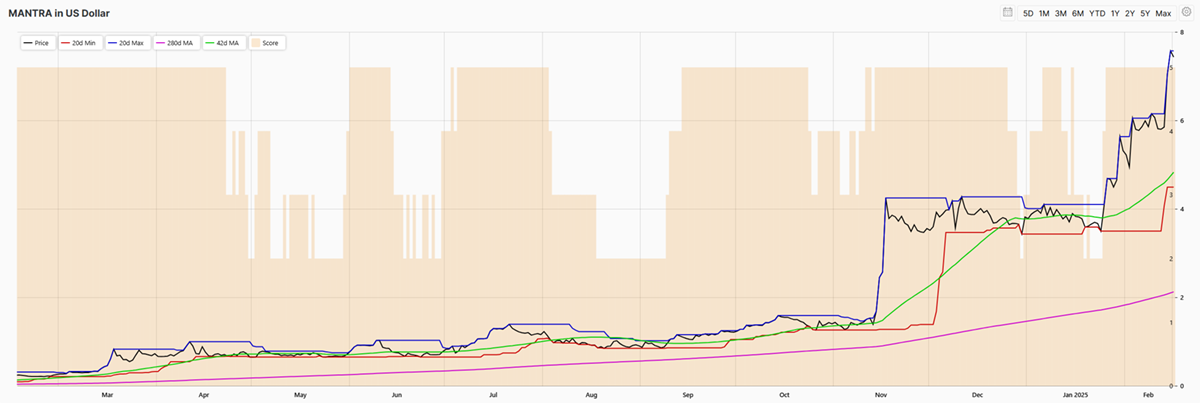

A prime example of RWA tokenization in action is MANTRA (OM), a blockchain platform focused on real estate tokenization in the United Arab Emirates and the broader Middle East. By digitising high-value real estate assets, MANTRA allows investors to participate in fractional ownership, generate passive income from rental yields, and access previously illiquid markets.

OM Scores a 5-star on ByteTrend in USD

MANTRA has secured two major partnerships that highlight the scale of this transformation:

- MAG Group Partnership: In 2023, MANTRA announced a partnership to tokenise $500m worth of real estate, making property investment more accessible to global investors.

- DAMAC Group Partnership: Just last month, MANTRA partnered with DAMAC Group to tokenise an additional $1bn worth of real estate, further expanding opportunities in digital property ownership.

By introducing yield-bearing accounts funded by rental income and fractional ownership, MANTRA is redefining real estate investment, offering secure, transparent, and global access to property-backed digital assets.

With the rapid growth of tokenised assets and increasing institutional interest, RWA tokenization is set to reshape financial markets. As blockchain adoption continues, tokenised assets could unlock trillions of dollars in liquidity, providing investors with borderless access to once-exclusive asset classes. Whether it’s real estate, government bonds, or commodities, tokenization is not just an emerging trend but could very well be the bridge that will attract trillions of dollars in TradFi RWAs on-chain.