Action Over Words

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 150;

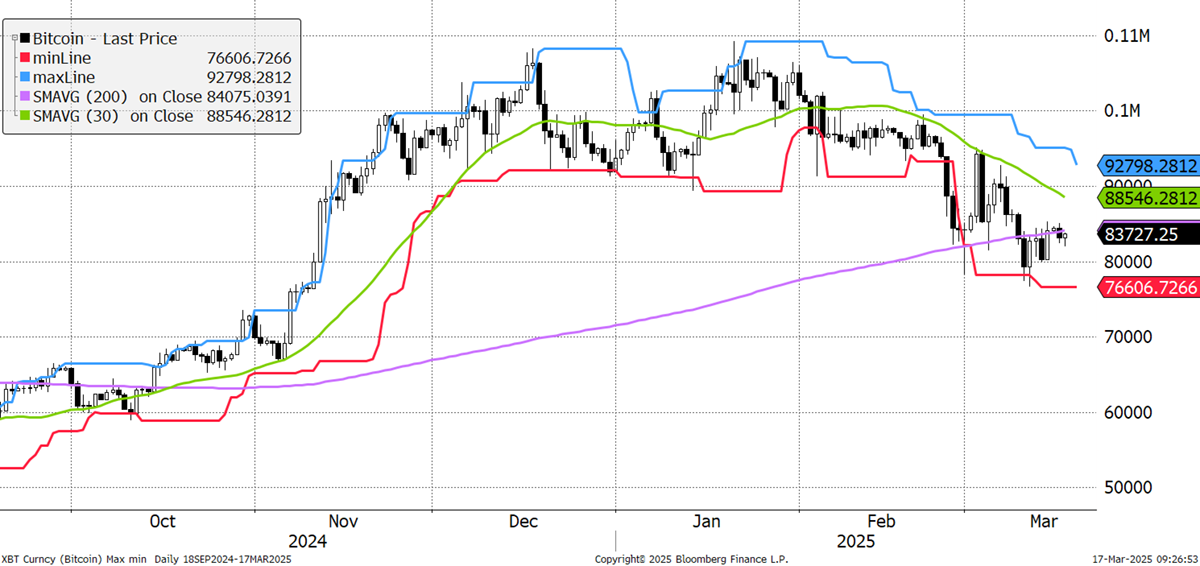

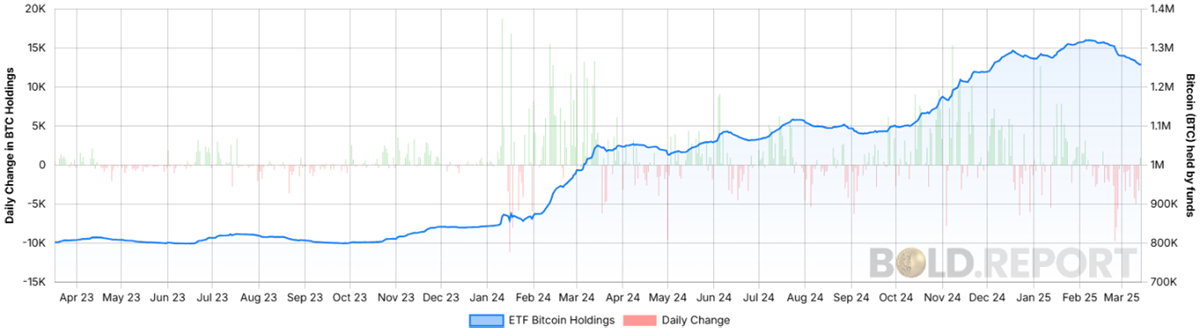

With continuing noises about the US strategic crypto reserve, it is odd that the price action is so soft. Clearly, the market doesn’t believe it. The entire growth in Bitcoin ETFs since the run-up to Blackrock’s launch last year has accumulated 457,000 BTC, causing the price to rise from $26k in late 2023 to $109k at the peak. The strategic reserve is rumoured to acquire one million Bitcoin at a cost of hundreds of billions of dollars, depending on the price impact.

Bitcoin BYTE Score 2

If 457k Bitcoin caused a 4x move in the price, and we’ve had a halving since, I would think the US strategic reserve buying a million Bitcoin would see the price settle around $150k, with a short-lived spike to $250k. Remember, the miners’ revenue is 0.9% of the market cap, which, at high prices, soon gets expensive.

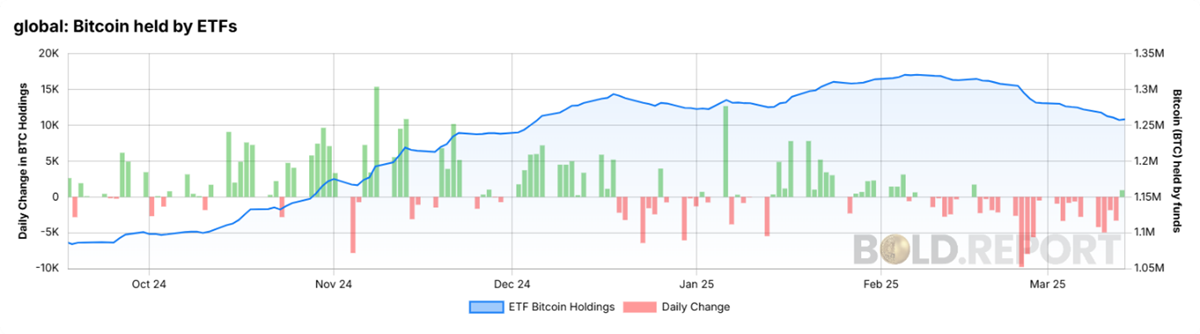

It’s a bullish story, but the trouble is that the flows have turned down, and ETF investors have sold 62k Bitcoins. That is the largest quantity ever seen in Bitcoin’s history, and the fact it is holding the $80k level is a sign of resilience. If Bitcoin was still a flaky asset, it would have collapsed under these circumstances. Just as gold can shake off ETF outflows, so can Bitcoin.

Bitcoin Held by ETFs Since March 2023

Although one swallow doesn’t make a summer, last Friday saw the first day of inflow for a month. It is hardly a celebration or proof of a change in the trend, but it is a positive piece of news, nevertheless. If confused, it’s the small green bar on the right that we’re looking at.

Bitcoin Held by ETFs Since September 2024

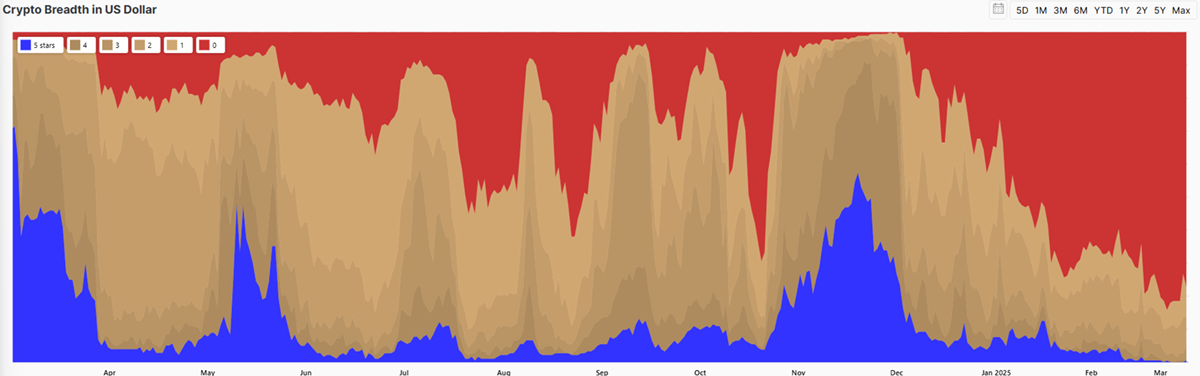

As for the rest of crypto, it’s dire out there. Just one token has a 5-star BYTE score, and that’s BinaryX (BNX), which Ali isn’t excited about. It is rarely this bad, and we haven’t even got a crisis of a scandal but a President threatening to invest hundreds of billions.

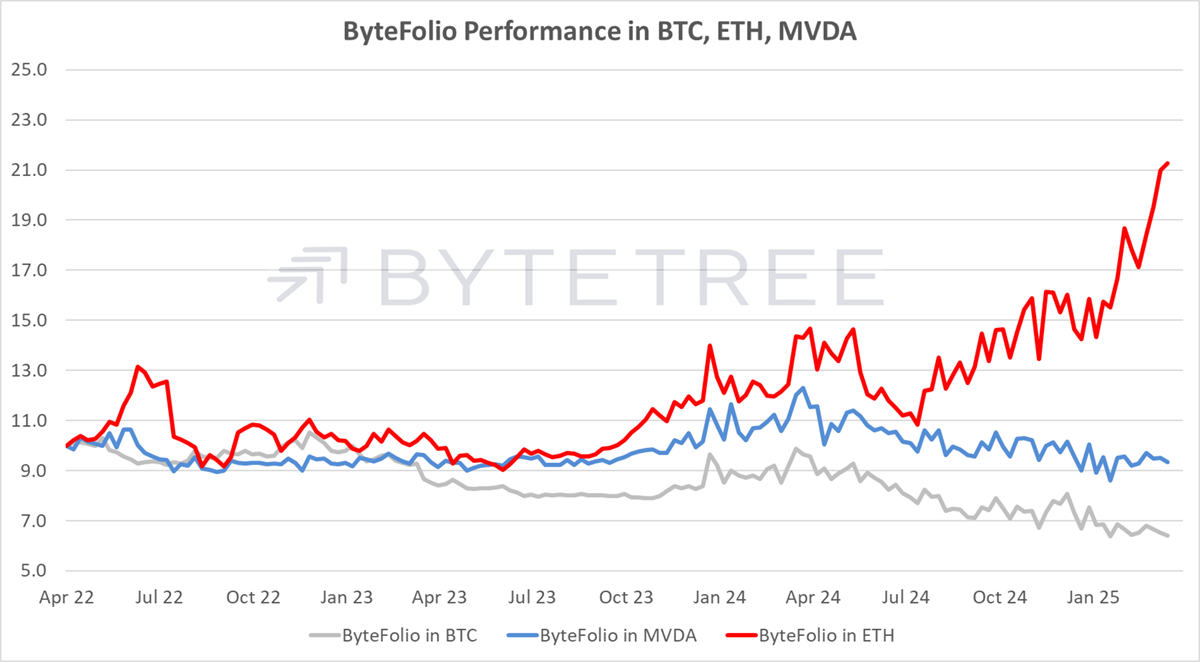

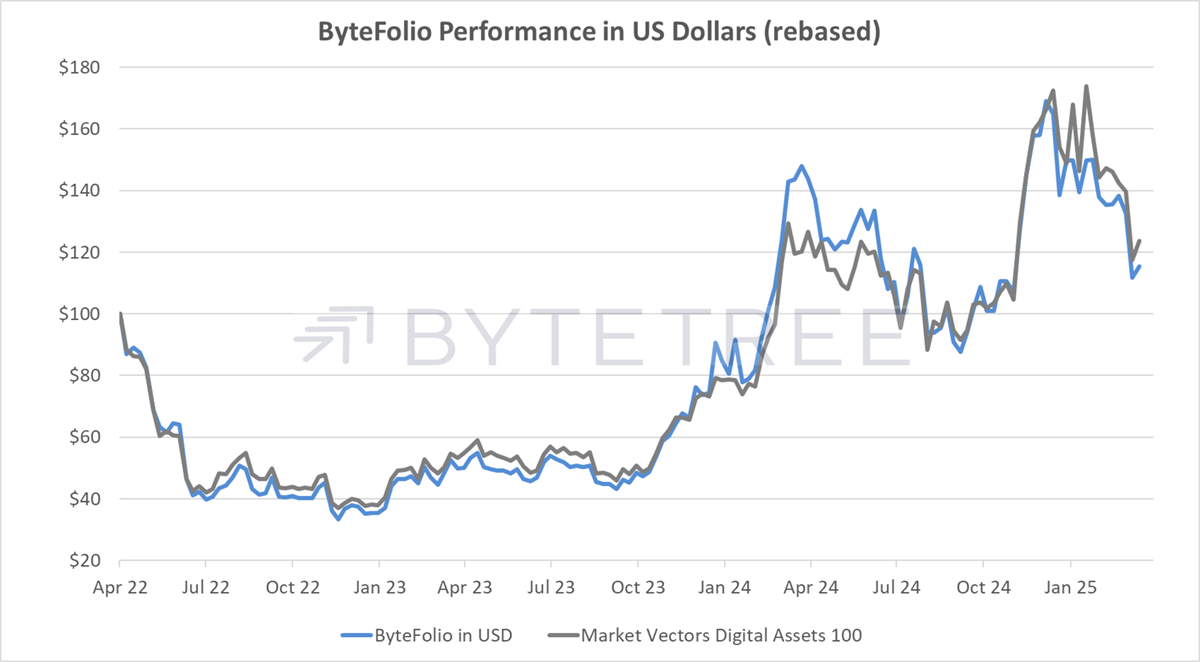

As the market has been sinking, ByteFolio has continued to cut exposure, so it now stands at 83% Bitcoin, which is as high as it’s ever been.

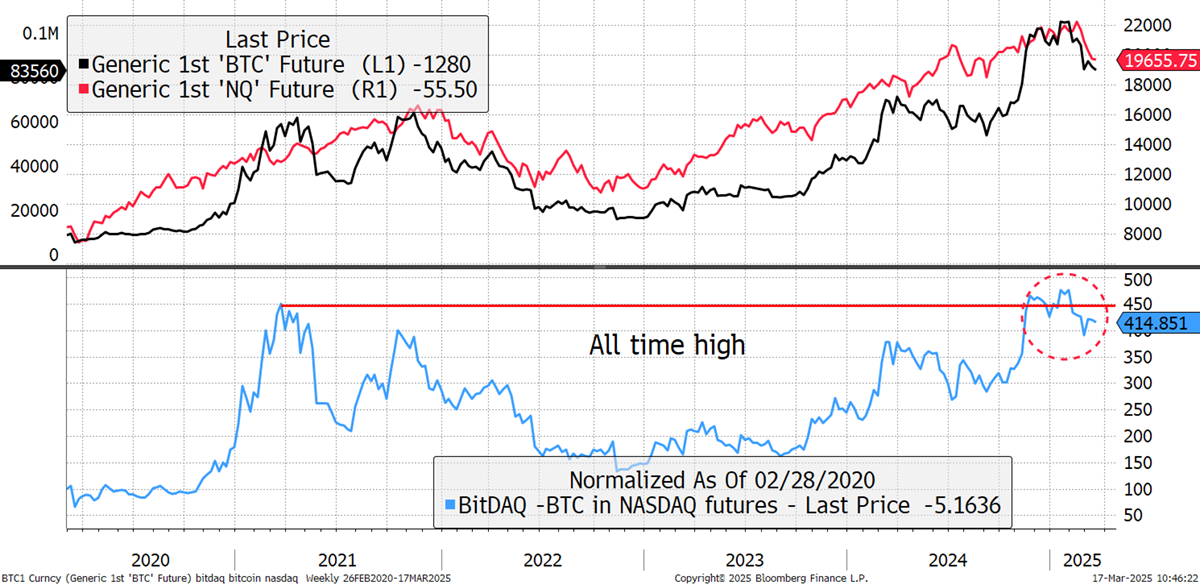

It’s hard to pass this as good news, but $80k Bitcoin is a very high number, one never witnessed before November. Moreover, the selling is largely macro as the tech sector is under pressure. Compared to the Nasdaq, Bitcoin is doing well in managing to stay close to the relative highs.

Bitcoin vs Nasdaq

While the bull has stalled, the market somehow feels underpinned; assuming it’s not much worse than the Nadaq gives you comfort.