Trades in Whisky and Soda;

There are two trades this week, so let’s get straight to it.

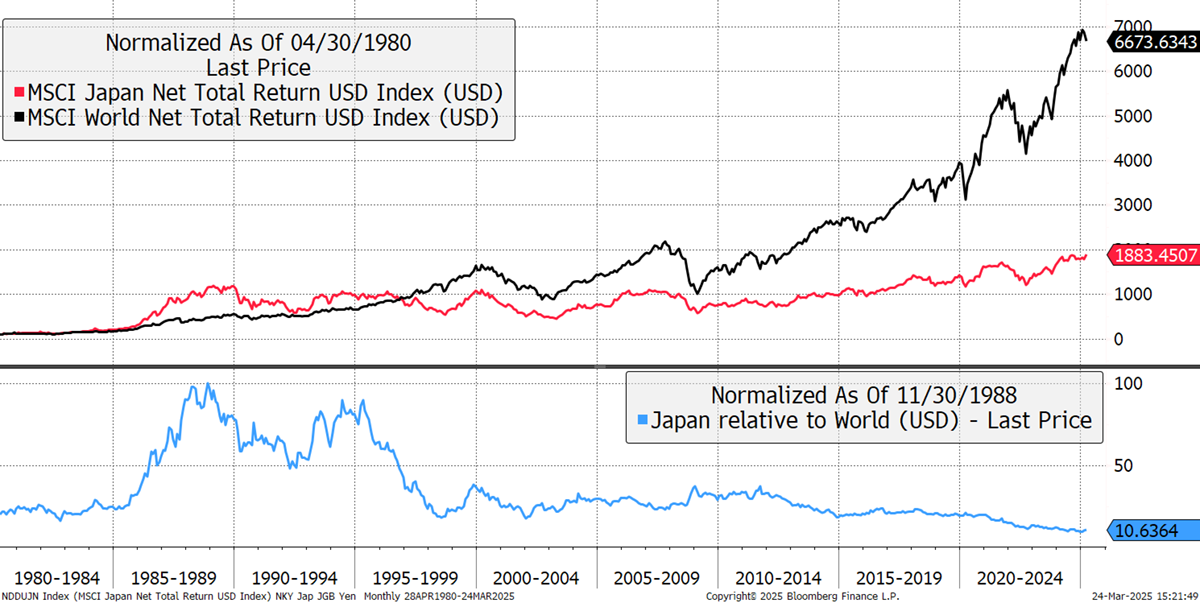

The Japanese stockmarket peaked relative to the world in 1988, as shown below against the world index. Since then, it has underperformed by 90.5%, as shown in blue. Could it be that the index bottomed relative to the world on 17 January? It really could.

Japan versus the World since 1980 (Rebased to 100 at the 1988 peak)

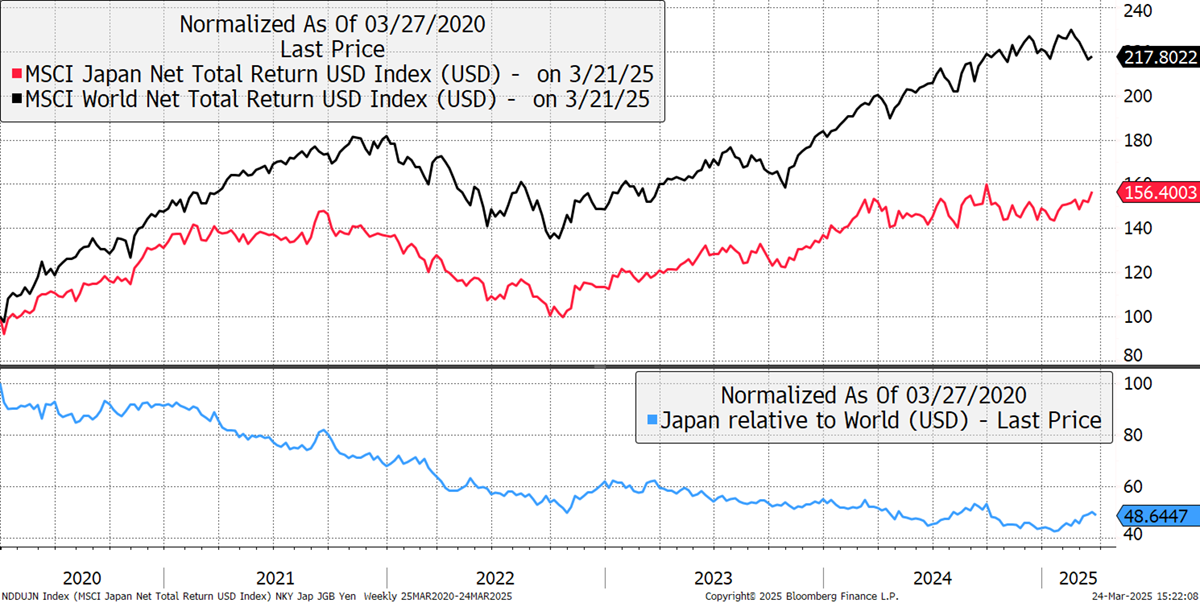

Zooming in on the last five years, Japanese stocks are starting to catch up after a post-2021 stall.

Japan versus the World since 2020 (Rebased to 100)

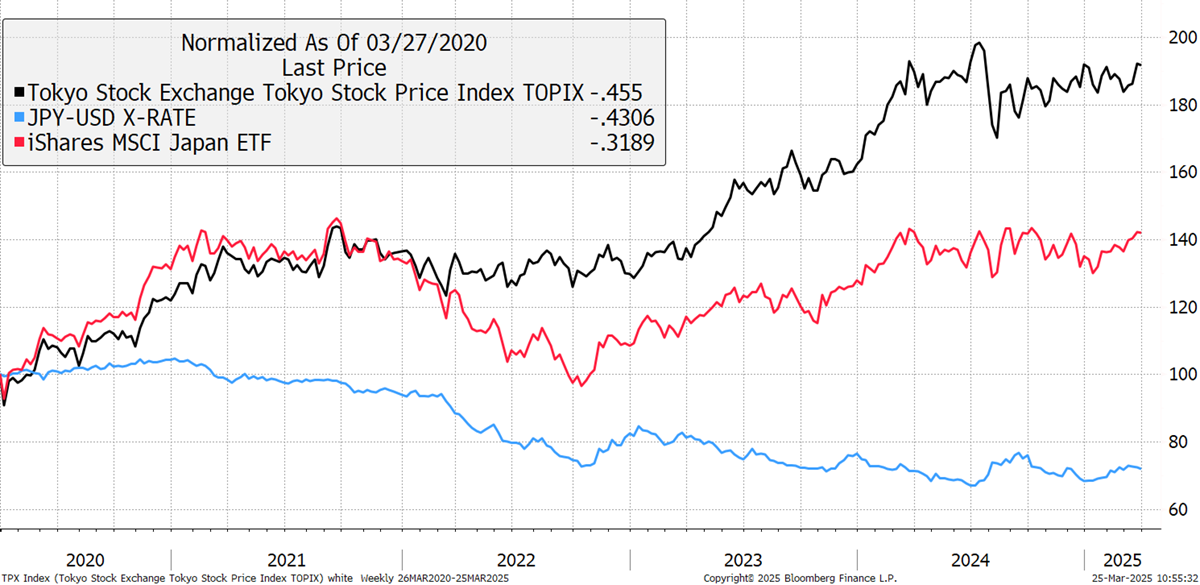

The local index has done better than this, but that is down to the weak yen. The TOPIOX Index has flown while the yen has sunk. I had believed the yen to be significantly undervalued in mid-2022, but it continued to fall as the Bank of Japan failed to raise interest rates alongside the rest of the developed world. They will take their time, meaning the Japanese economy continues to enjoy easy monetary conditions.

Japanese TOPIOX Index, Japanese stocks in USD and the Yen since 2020 (Rebased to 100)

My view had been that the yen would surge when a global recession came, but continued signalling from the BOJ means this will take a long time. More likely from here is that the yen stabilises, no longer rising nor falling, which is a good place for their stockmarket. More to the point, although Trump enjoys disruption, I suspect the global money machine carries on.

Japanese equity valuations are attractive compared to the rest of the world, although some companies are dirt cheap. A Japanese company typically has a strong balance sheet, often with a positive cash balance, and I believe the market is an attractive place to have a modest allocation in the Soda Portfolio.

Soda is now flush with cash, and I will put it back to work in good time. There is a temptation to add to cash-like instruments, but I am hoping to do better than that. The trouble is that we continue to live in a world where medium-risk investments (safe stocks, etc.), which are highly suited to the Soda Investment objective, offer poor value. There are, of course, exceptions, and I plan to embrace them, but in the meantime, I will add a modest position in Japan.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd