More Pain to Come?

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 149;

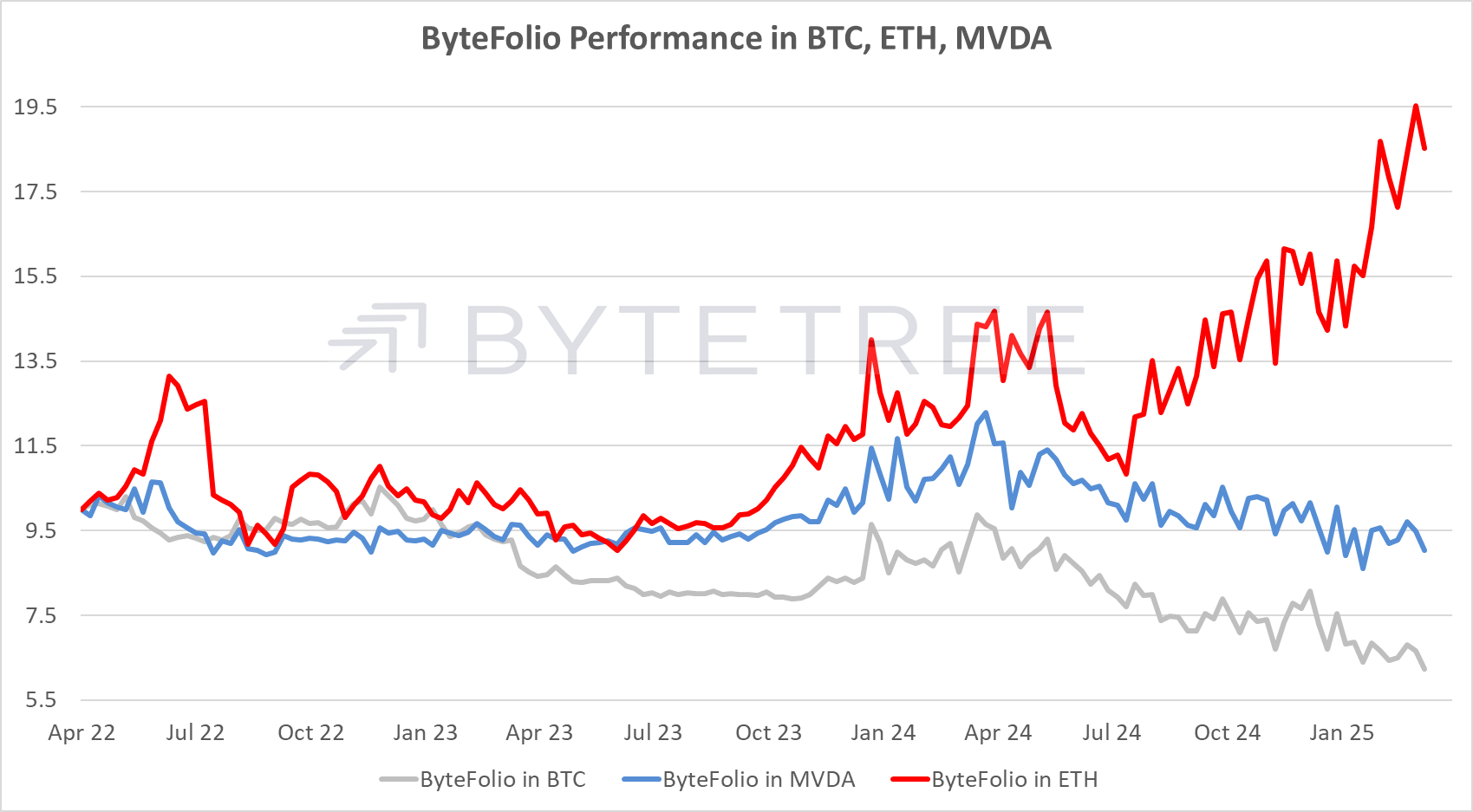

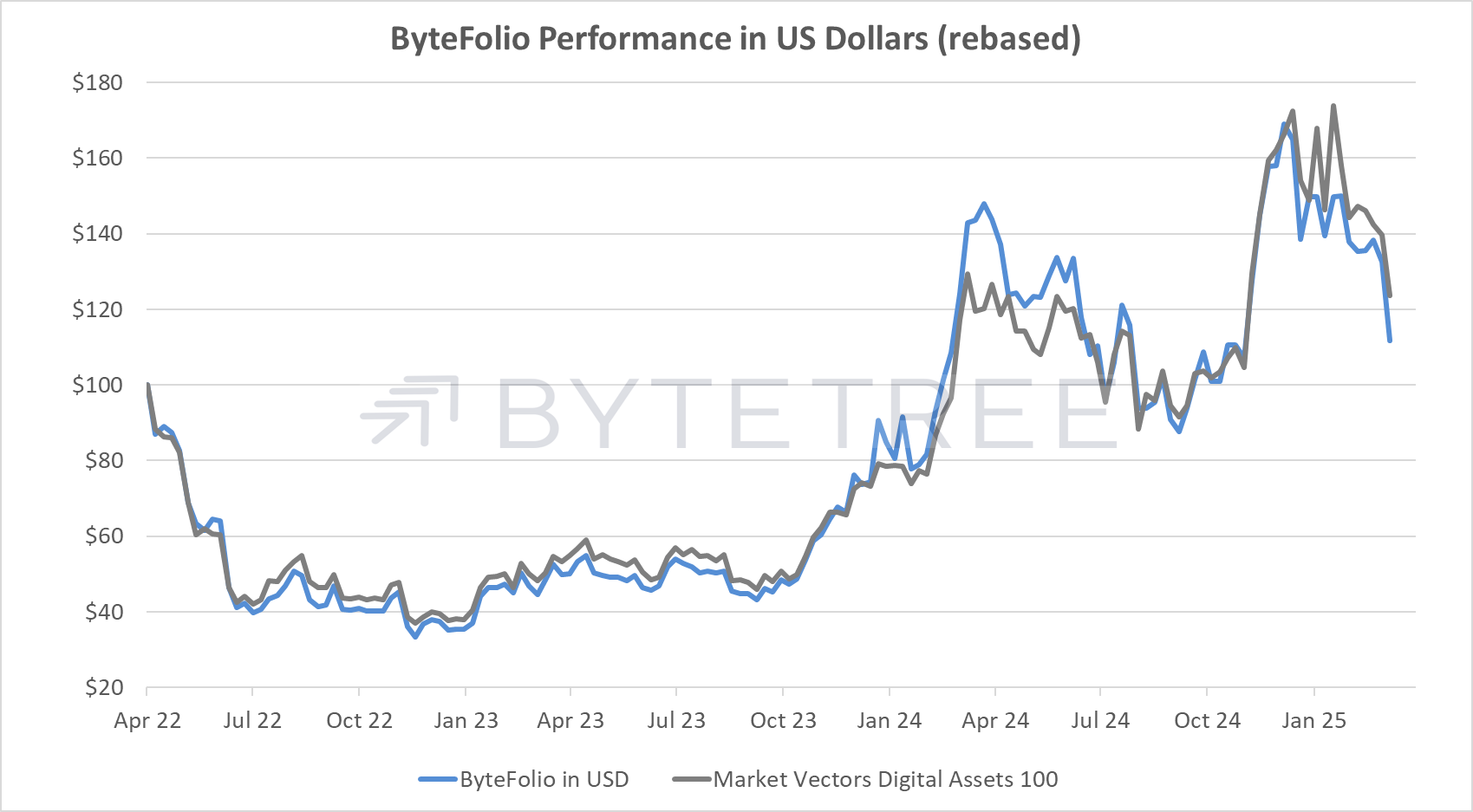

You’d think a US Bitcoin strategic reserve would send the price into the stratosphere, but investors don’t believe it. What’s more, it has even caused infighting among crypto investors as to who shares the spoils. Should it be Bitcoin only, or should the alts have a share? The alternative explanation is that this is an old story, and the benefits came after the election. We’re now giving them back.

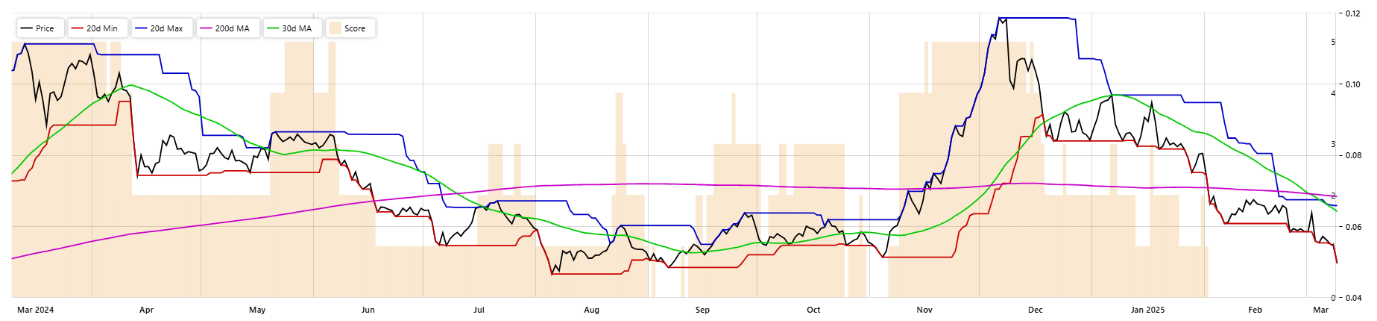

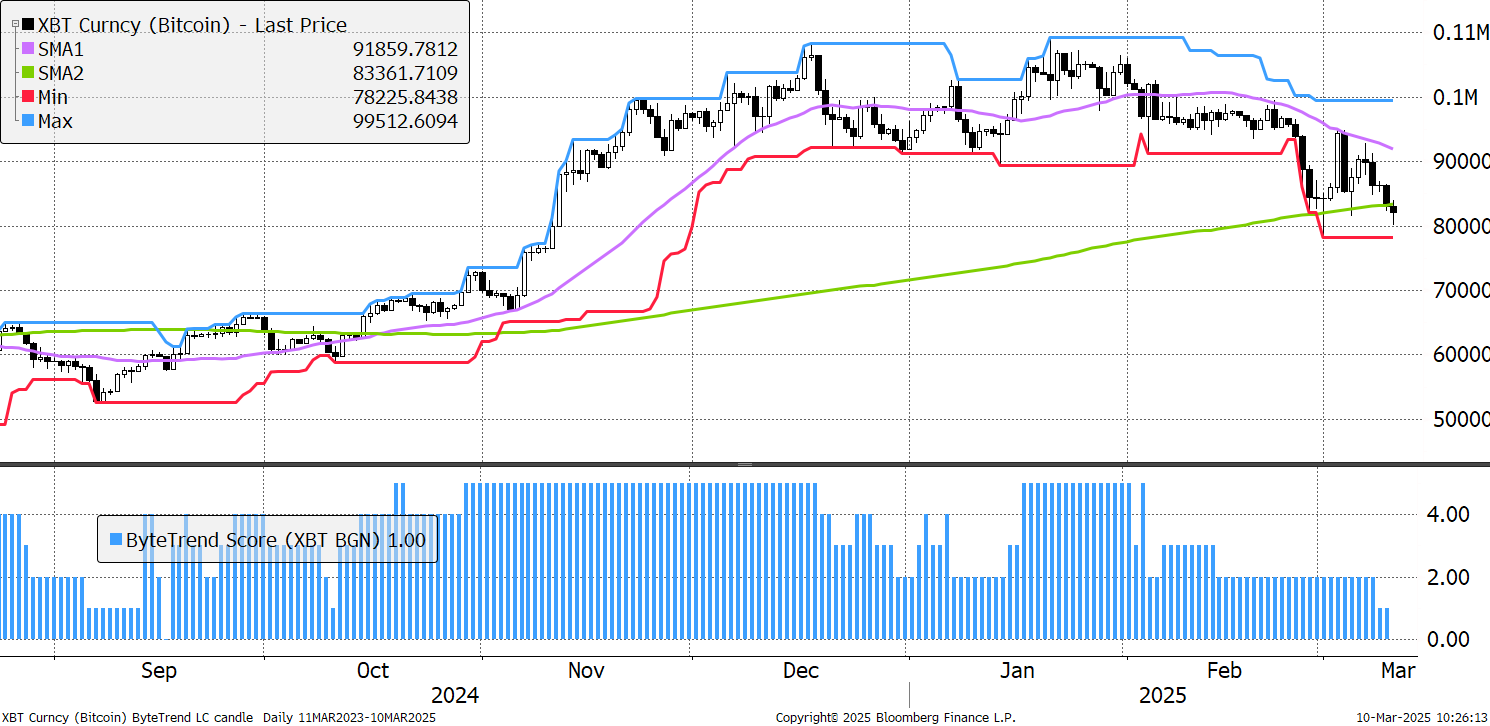

Bitcoin BYTE Score 1

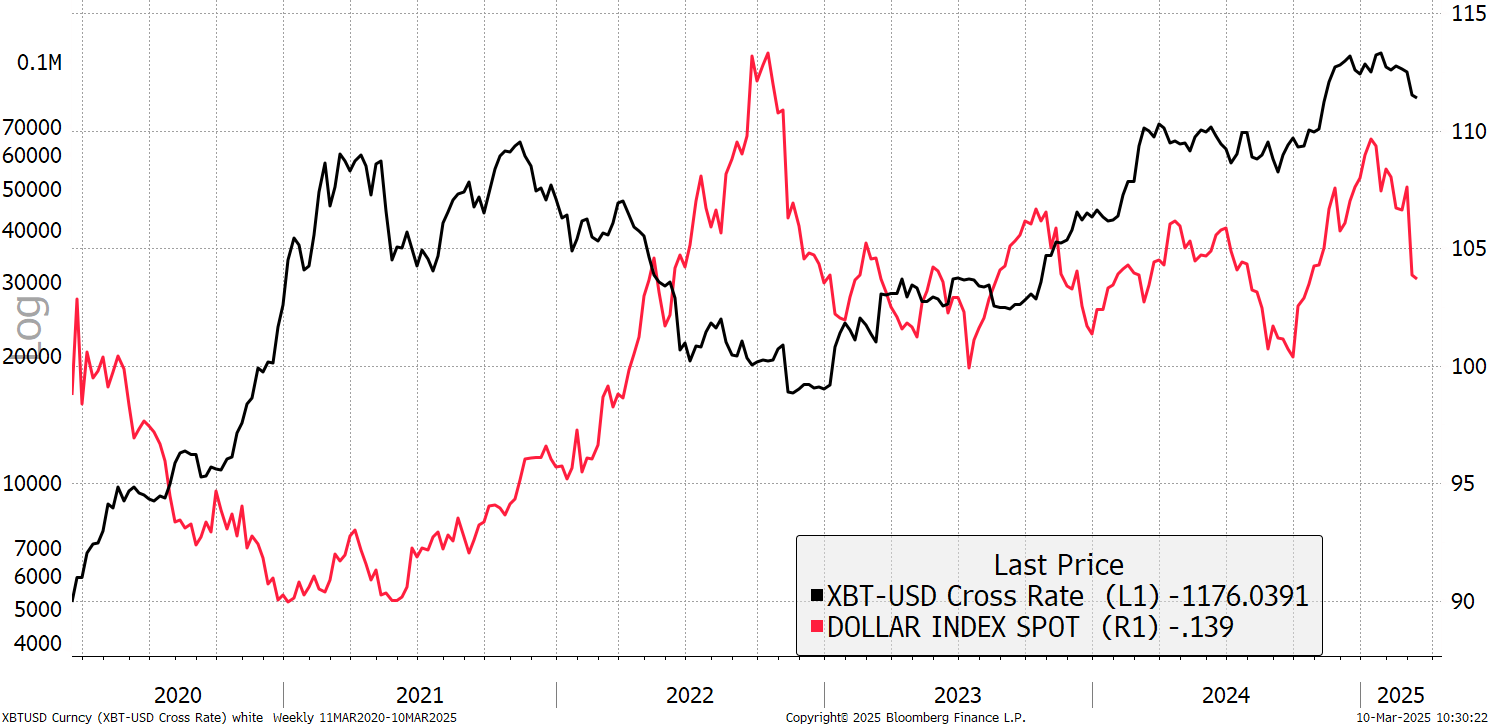

The other curiosity is that lately, the US dollar has been falling, and in sync with the price of Bitcoin.

Bitcoin and the Dollar

Historically, the dollar and Bitcoin were negatively correlated (generally moved in opposite directions). Recently they have been positively correlated which is unusual, but it has happened before. Looking at 2016/7, I sense it was coincidental. Yet this time it doesn’t seem to be that way.

Bitcoin and Dollar 90-Day Correlation

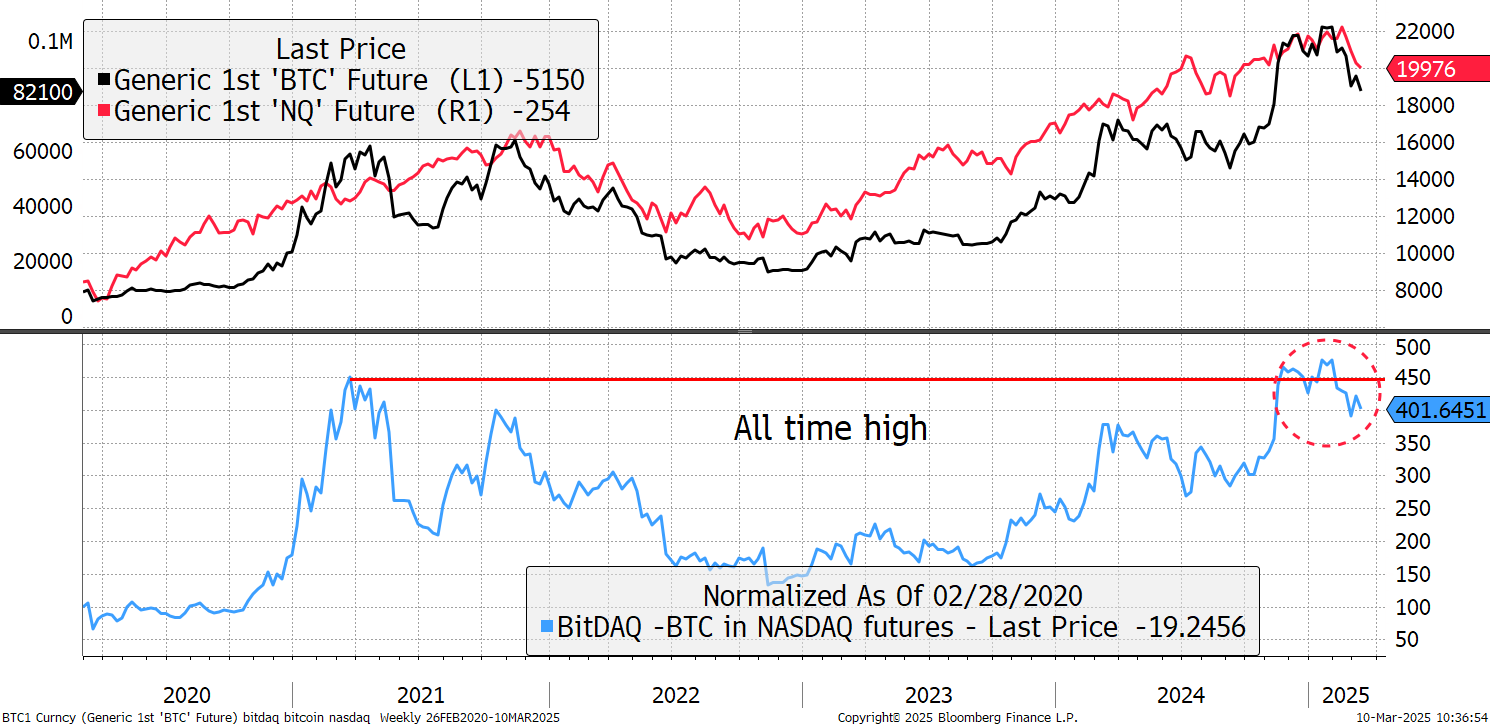

Bitcoin is falling with technology stocks. The hope was that it would fall less, but that isn’t happening. The hope will be that Bitcoin will make a new high in Nasdaq in the next phase of risk-ON for markets. In Trump’s words, “there is a period of transition”. Please don’t confuse that with a bear market, even though they might look and feel the same to a non-believer.

BitDAQ - Bitcoin in Nasdaq

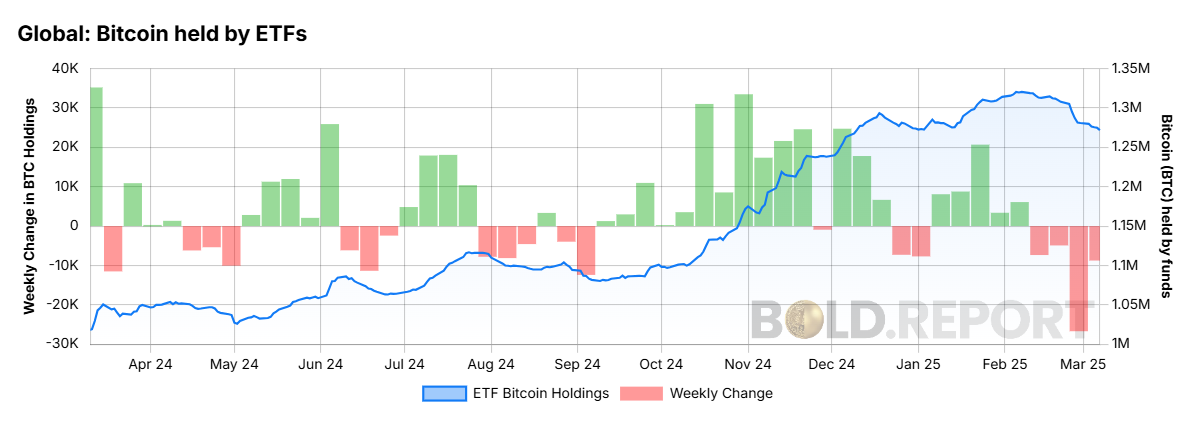

Bitcoin’s global ETF flows remains negative, with $4bn of outflows over the past month.

This is a big number that Bitcoin has never had to cope with before. The ETFs swing both ways. Not only do they let money in, but these days, they also let it out. Institutional investors also sell.

The best thing about a lower Bitcoin price is that it is easier to sustain. It costs the miners $13.5 bn to manage the Bitcoin network at a price of $82k in contrast to $16.4 bn at $100k. The Bitcoin sceptics forget that it is a self-correcting system. Throw anything you like at it, and it will always bounce back. The only question is price.

The contrarian buy will come from many things. There’s already strong fear on the various sentiment indicators, but maybe the current malaise isn’t about Bitcoin. Macroeconomic factors have taken over and we need to wait for better conditions to return. Things could get worse before they get better, and so the derisking continues. The ByteTree Crypto Average (BCA) continues its bearish spiral.

ByteTree Crypto Average -

BYTE Score Zero since end January