Ondo Finance: Bringing Financial Markets On-chain

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: ONDO;

Ondo Finance is a leading player in the rapidly expanding Real-World Asset (RWA) tokenization sector. It bridges traditional finance (TradFi) and blockchain technology by offering tokenized exposure to U.S. securities, catering to both individual and accredited investors. With multiple products designed to bring institutional-grade assets on-chain, Ondo has positioned itself at the forefront of the RWA narrative.

However, despite its strong platform growth, its native token performance has lagged, raising questions about its utility and investor confidence. This Token Takeaway will delve into Ondo Finance, the broader RWA space, and the ONDO token’s role within the ecosystem.

Overview

Founded in July 2021 by Nathan Allman, Ondo Finance aims to revolutionise TradFi markets by enabling global investors to trade and invest in U.S. stocks, ETFs, and bonds using blockchain technology. By leveraging tokenization, Ondo Finance revolutionises how traditional capital markets work, making US securities more accessible, liquid, and transparent.

The project secured its initial funding through a $4m seed round led by Pantera Capital in August 2021. In April 2022, it raised an additional $20m in a Series A funding round, with Founders Fund and Pantera Capital as key investors. Since then, Ondo Finance has emerged as a dominant player in the RWA tokenization space, becoming the largest RWA platform by TVL.

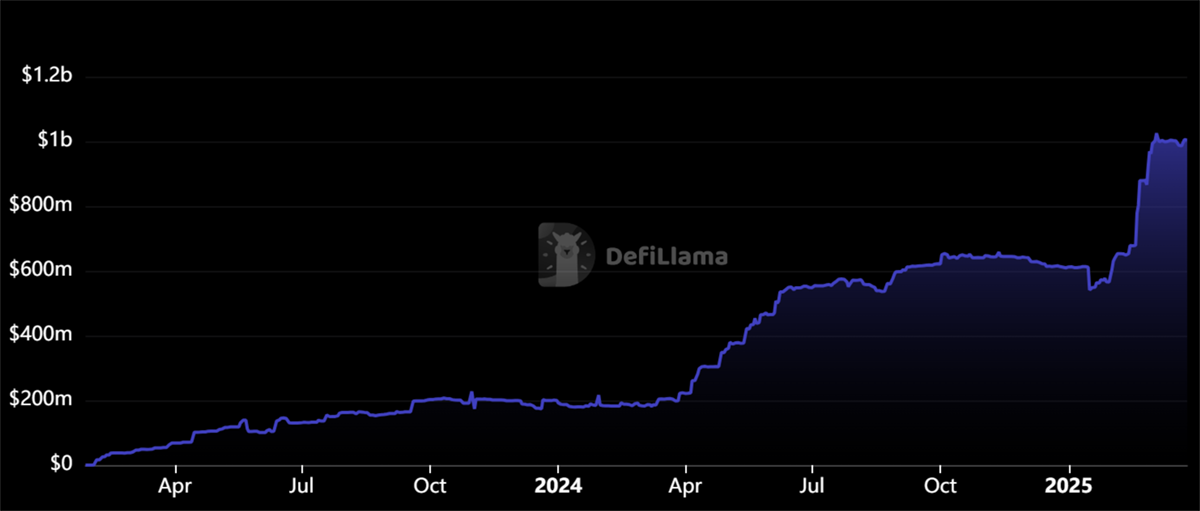

Ondo Finance TVL

Driven by the broader institutional adoption of RWAs, Ondo Finance’s TVL has surged significantly. As traditional financial giants increasingly explore blockchain-based fund structures, Ondo Finance has benefitted from the trend, leading to a 422% increase in TVL from $192m in January 2024 to over $1bn today.

Before delving deeper into Ondo Finance’s role in the market, let’s establish the context by examining the broader RWA sector and its key players.

What Are Tokenized RWAs?

Tokenized Real-World Assets (RWAs) refer to stocks, bonds, real estate, commodities, and other traditional assets represented as digital tokens on a blockchain. The fundamental proposition of tokenization is to enhance liquidity, accessibility, and efficiency, enabling 24/7 trading, fractional ownership, and seamless cross-border transactions.

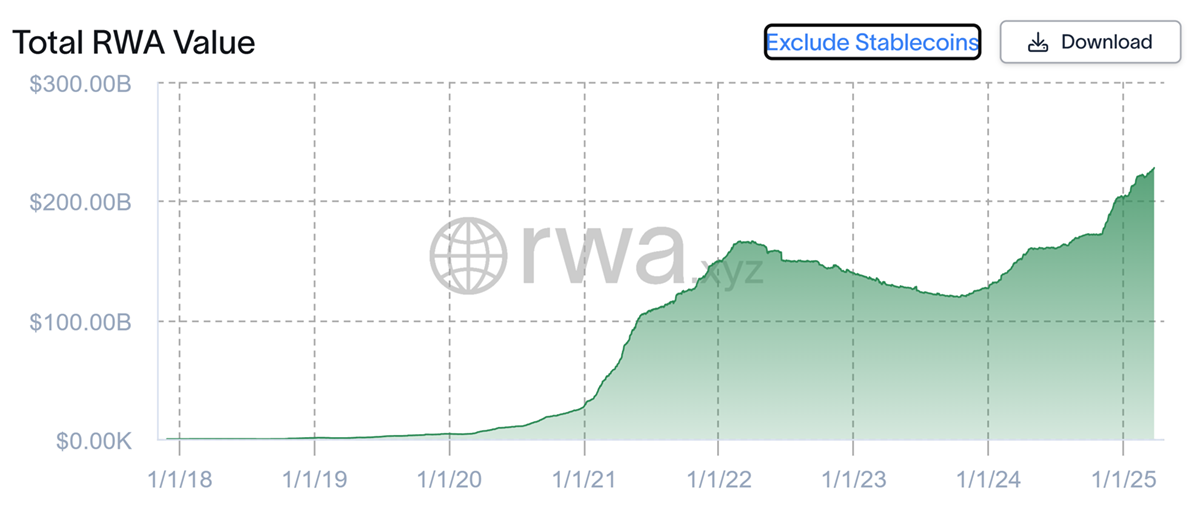

Stablecoin Supply

The largest and most established tokenized RWA is the U.S. dollar in the form of stablecoins. As of today, the stablecoin market exceeds $227bn, and it continues to expand as stablecoins serve as the foundation for on-chain finance.

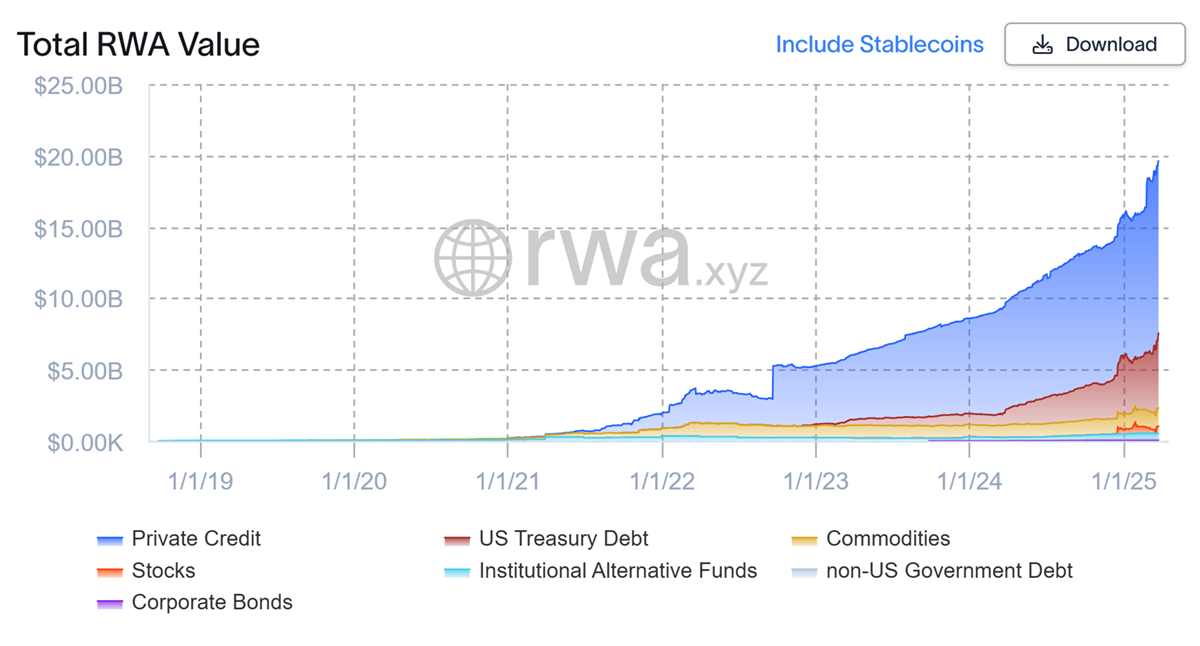

Beyond stablecoins, the second-largest tokenized RWA category is private credit, which currently holds a $12bn market cap. It is followed by U.S. Treasuries ($5.2bn) and commodities ($1.2bn). Overall, 174 issuers have brought nearly $20bn worth of RWAs (excluding stablecoins) on-chain across multiple blockchains.

Blockchain Distribution of RWAs (Excluding Stablecoins)

Ethereum dominates the tokenized RWA space, accounting for 54.1% of the market, with 140 issued tokens valued at $5.2bn. Other key networks include ZKsync Era (21%), which hosts 33 tokens worth $2bn, and Algorand (5.2%), with a single token valued at $503m.

Overall, there are over 91,000 holders of on-chain RWAs across these networks. The largest tokenized RWA to date is BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), valued at $1.9 billion.

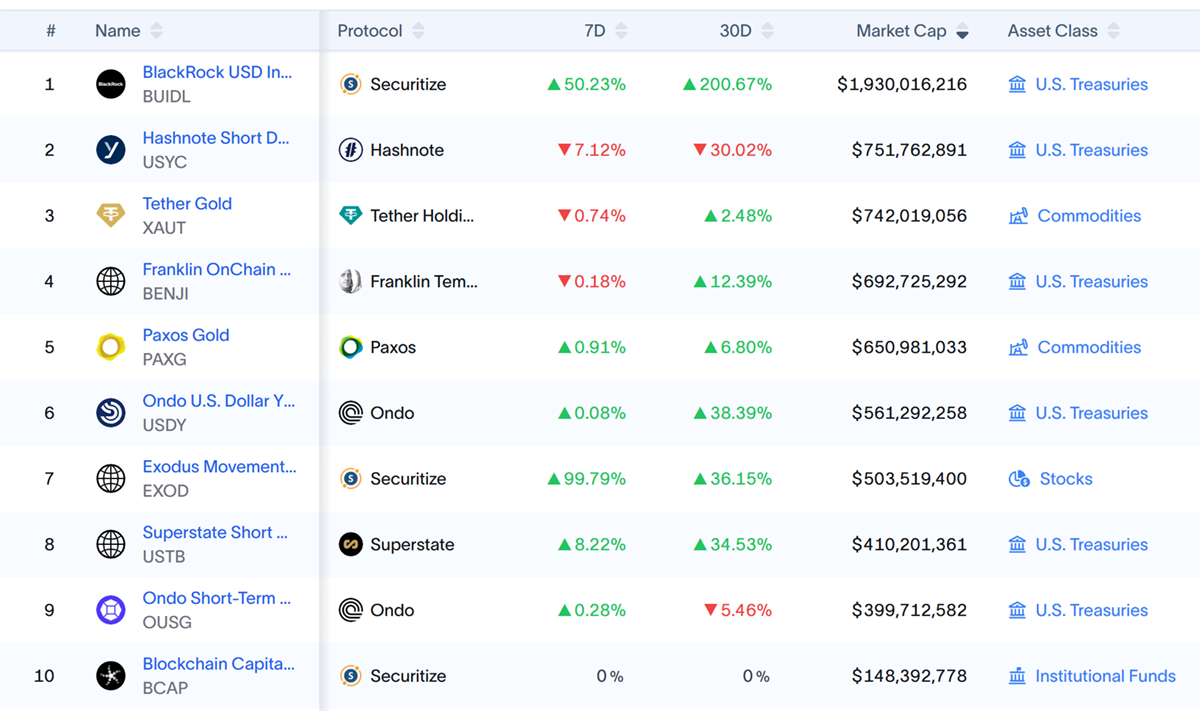

Top-10 Tokenized RWA

Among the top 10 tokenized RWAs, Ondo Finance’s flagship products, USDY and OUSG, rank 6th and 10th largest, respectively. These products play a significant role in bringing U.S. Treasury exposure on-chain while offering investors a stable yield with high security and transparency. The next section will explore USDY and OUSG in more detail.

Ondo Finance Ecosystem

Ondo Finance offers two flagship investment products: Ondo Short-Term US Treasuries Fund (OUSG) and Ondo US Dollar Yield Token (USDY), both designed to bring real-world financial assets on-chain.

Ondo Short-Term US Treasuries (OUSG)

OUSG provides investors with exposure to short-term U.S. Treasury bonds and government-sponsored enterprise (GSE) securities, offering a low-risk, highly liquid investment. With 24/7 tokenized subscriptions and redemptions, it ensures seamless access to financial instruments through blockchain technology.

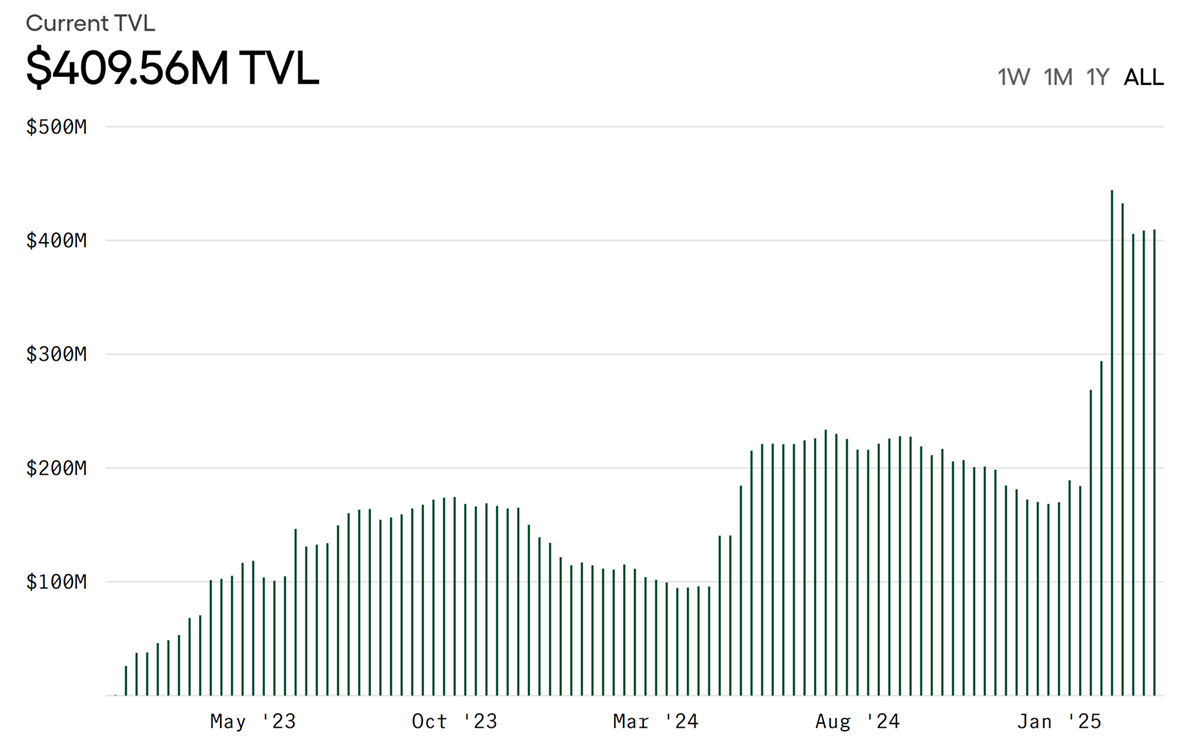

OUSG Fund TVL

Fuelled by the rise of the RWA narrative and a more crypto-friendly U.S. regulatory landscape, OUSG’s TVL surged past $400m in 2025. The fund currently offers a 4.1% APY.

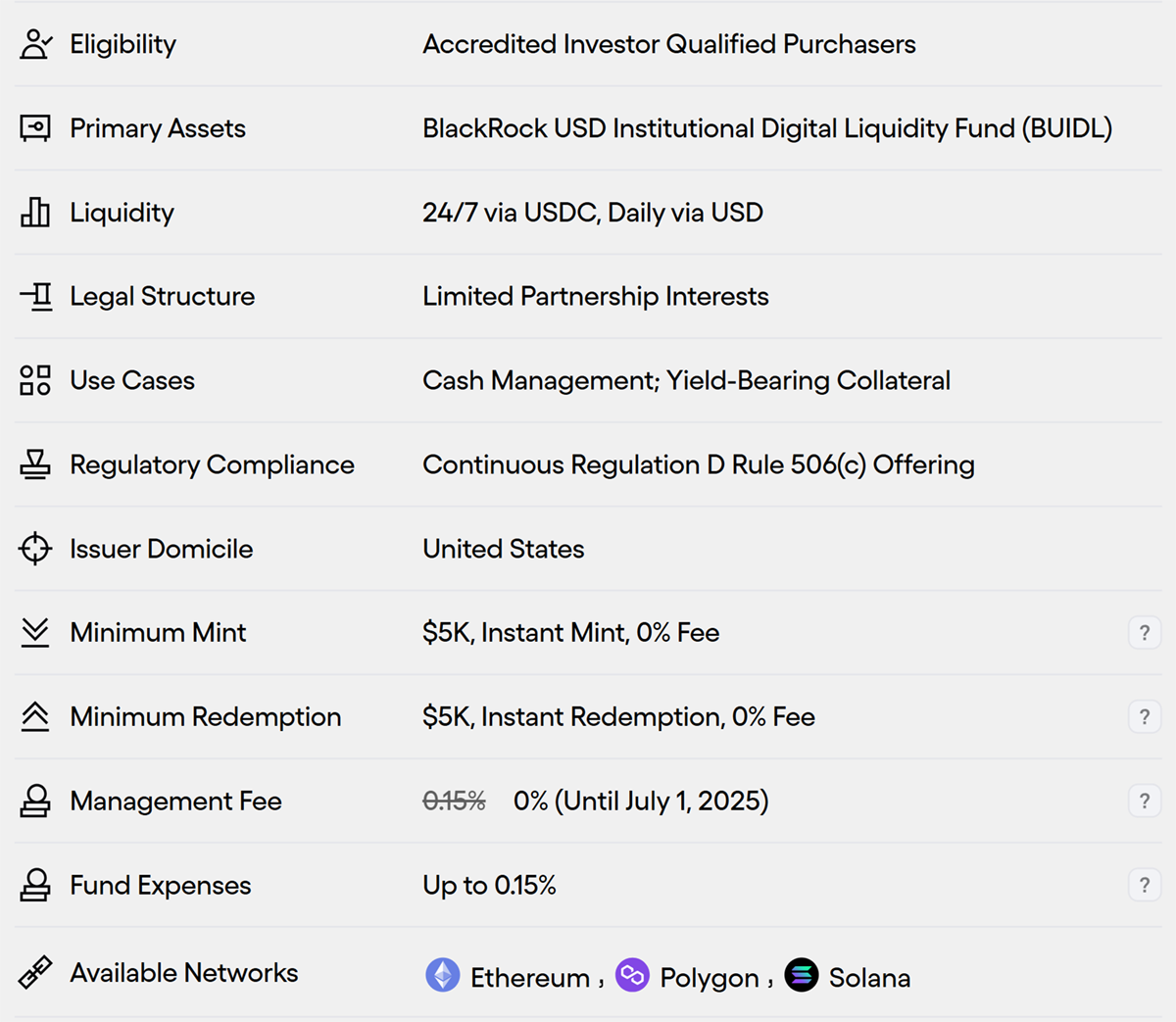

OUSG Fund Details

Offered through Ethereum, Polygon and Solana, direct investments in the OUSG Fund are only available to accredited investors and have a minimum mint/redemption (subscription/redemption value) of $5k. The fund typically charges a 0.15% management fee and an additional 0.15% as the fund’s expense, resulting in a total fee of 0.30%. It’s worth noting the management fee has been waived until 1 July 2025.

In addition to meeting the eligibility criteria, investors must not be located in certain jurisdictions, including Cuba, Iran, Russia and South Korea.

Investing in the OUSG Fund

When you deposit (invest) USDC in the OUSG fund, a smart contract automatically sends OUSG tokens representing your share in the fund. The fund follows a traditional GP/LP structure, where investors acquire OUSG tokens representing limited partnership interests. Managed by Ondo I GP LLC and Ondo Capital Management LLC, both subsidiaries of Ondo Finance, the fund invests proceeds from OUSG purchases into U.S. Treasury products, primarily BlackRock’s BUIDL.

The fund’s assets are also invested in Franklin Templeton’s Franklin on-chain U.S. Government Money Fund (FOBXX), WisdomTree’s Government Money Market Digital Fund (WTGXX), FundBridge Capital’s Delta Wellington Ultra Short Treasury On-Chain Fund (ULTRA) and Fidelity’s Fidelity Treasury Digital Fund (FYHXX).

Finally, OUSG tokens can also be used as collateral to borrow on Flux Finance, a DEX forked from Compound v2 by the Ondo team. Flux was later sold to the Neptune Foundation but continues to operate with the same structure, accepting only OUSG as collateral.

Ondo US Dollar Yield Token (USDY)

USDY is a tokenized note backed by short-term U.S. Treasuries and bank deposits and is Ondo Finance’s largest product.

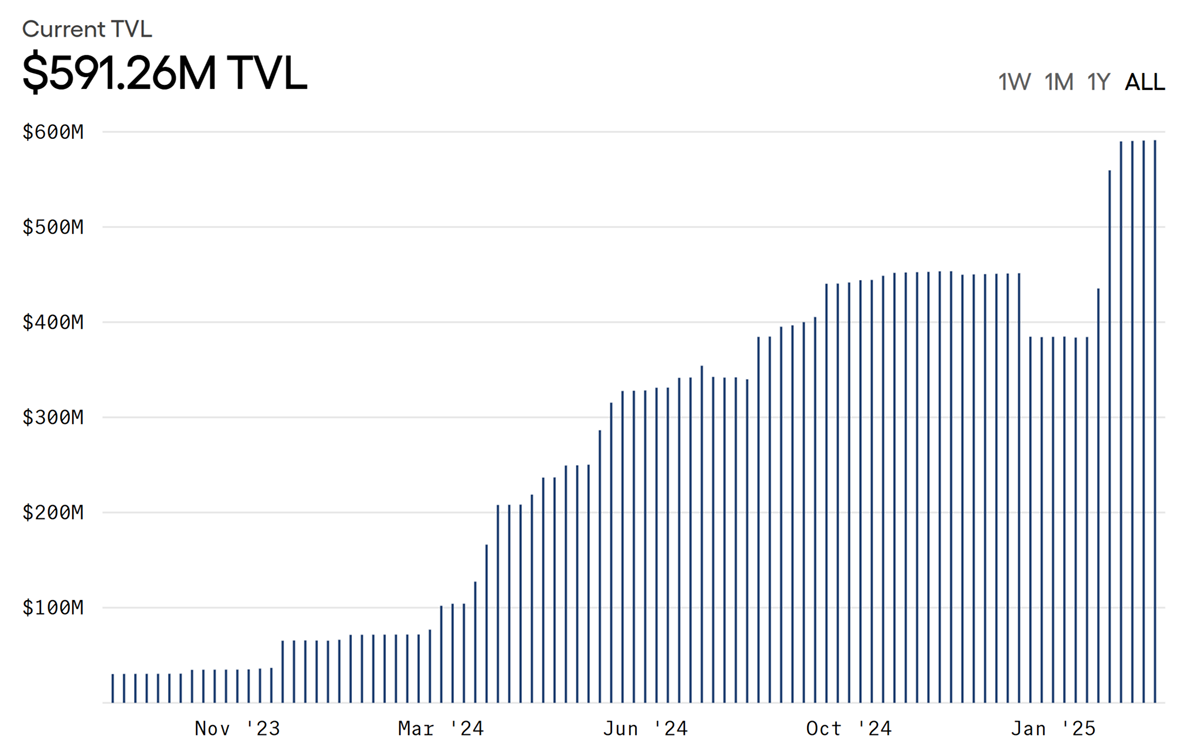

USDY TVL

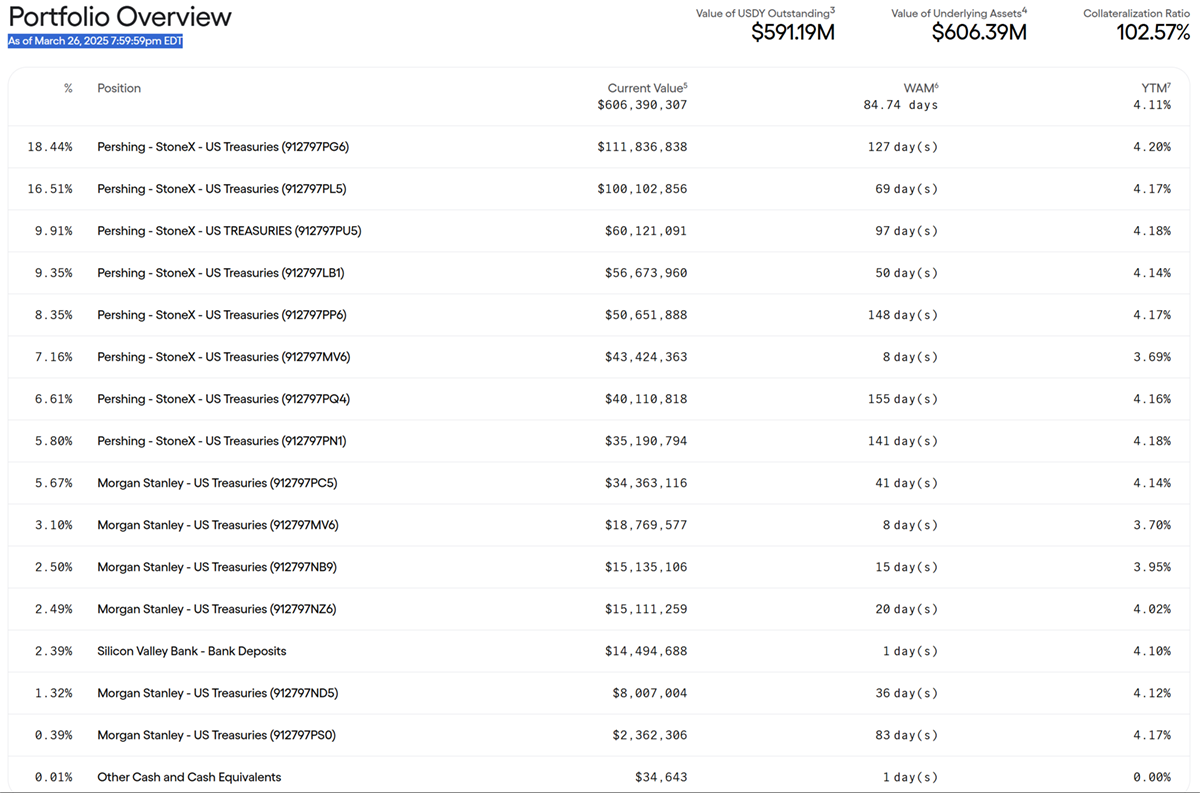

As illustrated by the above chart, USDY has generally seen consistent growth since early March 2024 and currently has a TVL (market cap) of over $591m. USDY is also the world's first yield-bearing token available on multiple public blockchains secured by US Treasuries and bank deposits.

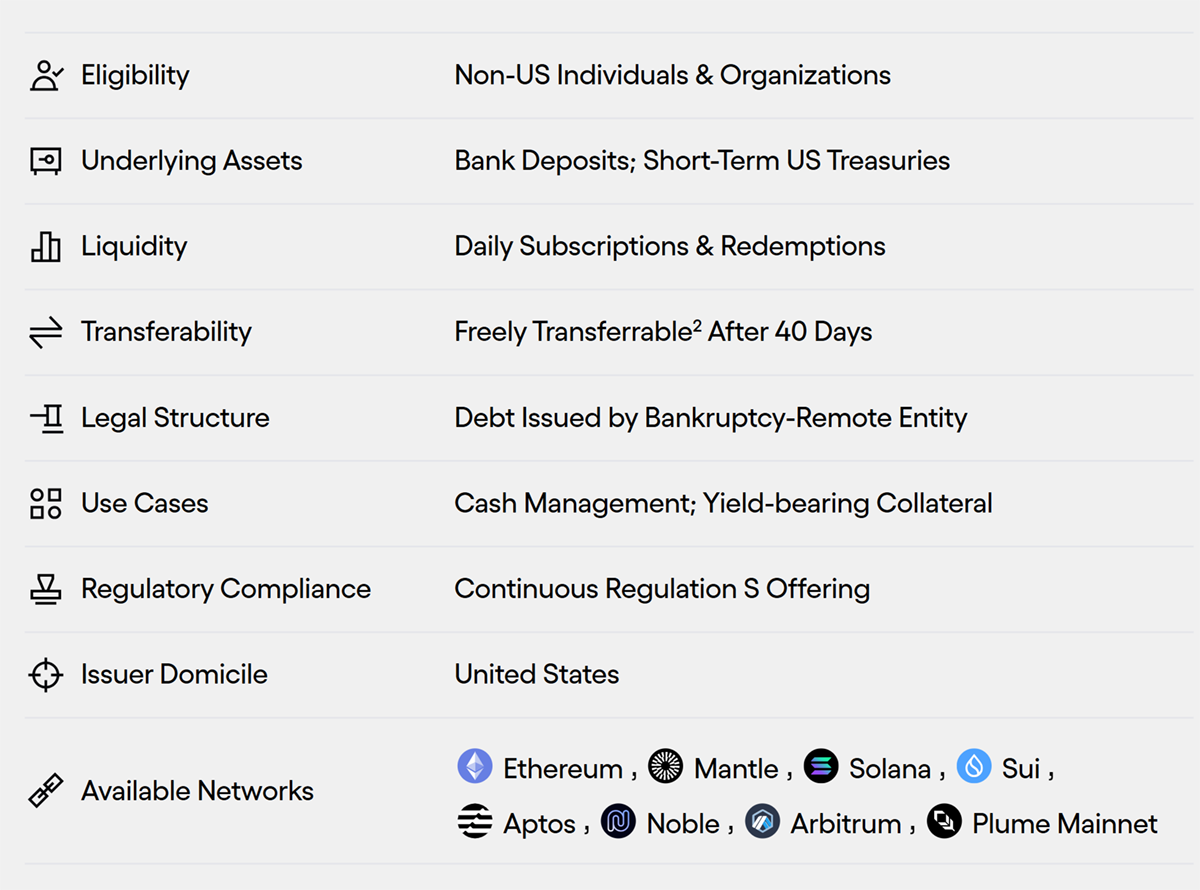

USDY Details

To comply with US regulations, minting USDY is only available to non-US customers and organisations. Although there isn’t a fee, minting USDY is a lengthy process. The token is currently available on multiple blockchains, including Ethereum, Solana, and Sui.

Although an investor starts earning interest as soon as their deposit is processed, it’s worth noting that Ondo Finance can only mint the transferable USDY tokens around 40-50 days later. Furthermore, investors can only redeem their investment in USD via bank wire to non-US bank accounts.

USDY Collateral at Work

With a collateralisation ratio of 102%, approximately $606 million worth of underlying assets back USDY. Most of the underlying assets are spread across StoneX and Morgan Stanley, with a small portion held in Silicon Valley Bank, which was acquired by First Citizens Bank following its collapse in 2023.

USDY is also currently trading on the open market on ByBit (CEX) and on DEXs, including Cetus and Orca.