Resetting

Trades in Whisky and Soda;

The US Treasury Secretary, Scott Bessent, was interviewed on CNBC to make the point that they are working to avoid a financial crisis that could be the result of massive government spending over the past few years. He said, “We are resetting, and we are putting things on a sustainable path.”

There are no guarantees there won’t be a recession, but that doesn’t even phase him. He makes the point that after 35 years in the investment business, and at the forefront of it, I might add, he sees market corrections as normal. He’s not worried about the market, as “over the long term, if we put good tax policy in place, deregulation and energy security, the markets will do great.”

He’s right. Reading between the lines, he’s saying that the government does not create bull markets. Their job is to create good business conditions, such as competitive taxes, less regulation and a sound energy policy, and financial markets will take care of themselves. The trouble with the US equity bull market he inherited is that it was partly fuelled by a government deficit. He is genuinely concerned about the state of the outsized bond market and is egging on DOGE from the sidelines.

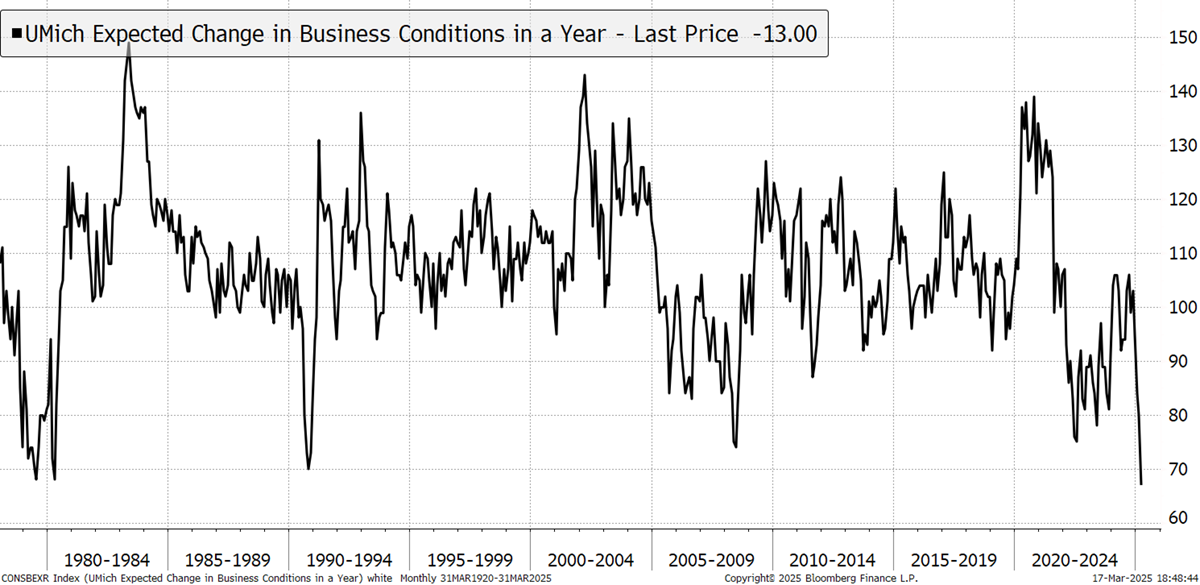

He may have a point, but this is creating mixed signals. For example, the weakest business expectations for years.

University of Michigan Change in Business Conditions

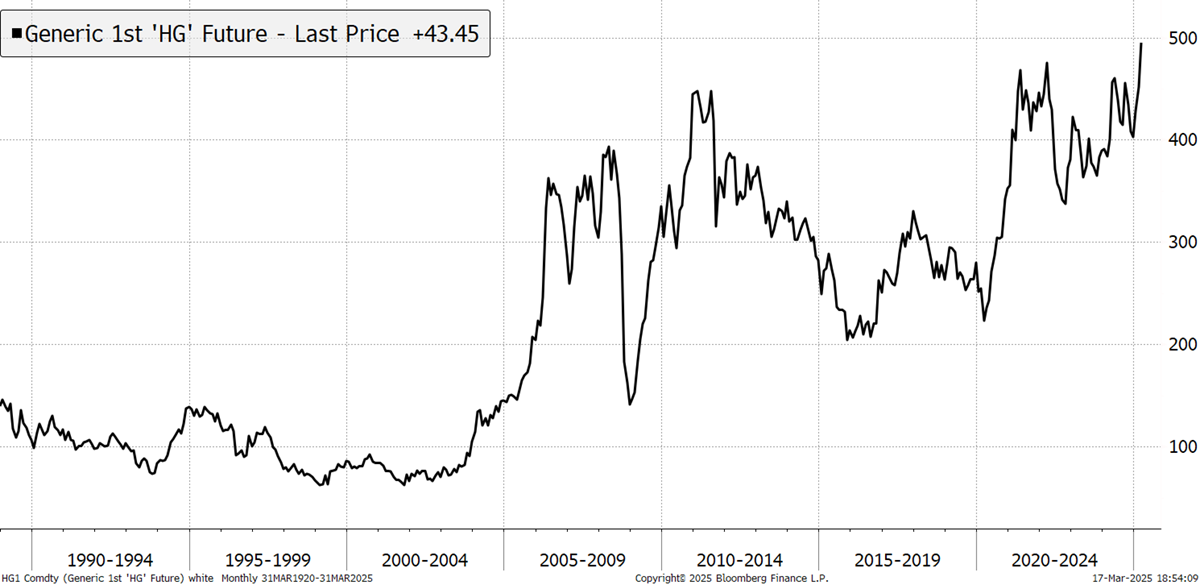

And then you see the price of copper making an all-time high, something I would associate with strong global growth. Could that really be happening when there’s so much talk of recession? Gold making highs is one thing, as it thrives on uncertainty, but copper?

Copper Price Makes an All-time High

Commodity prices are strengthening, and that is something to be aware of. It could be due to high demand, but more likely, it is the result of tariffs. Commodities are only useful when they are in the correct port. With the seismic shift in markets, there is so much to take in. What’s most important is to stay on the right side of the change. When the facts change…

I have two important trades this week. I’m adding a European fintech company while selling the yen.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd