The Banks Go On-Chain

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 151;

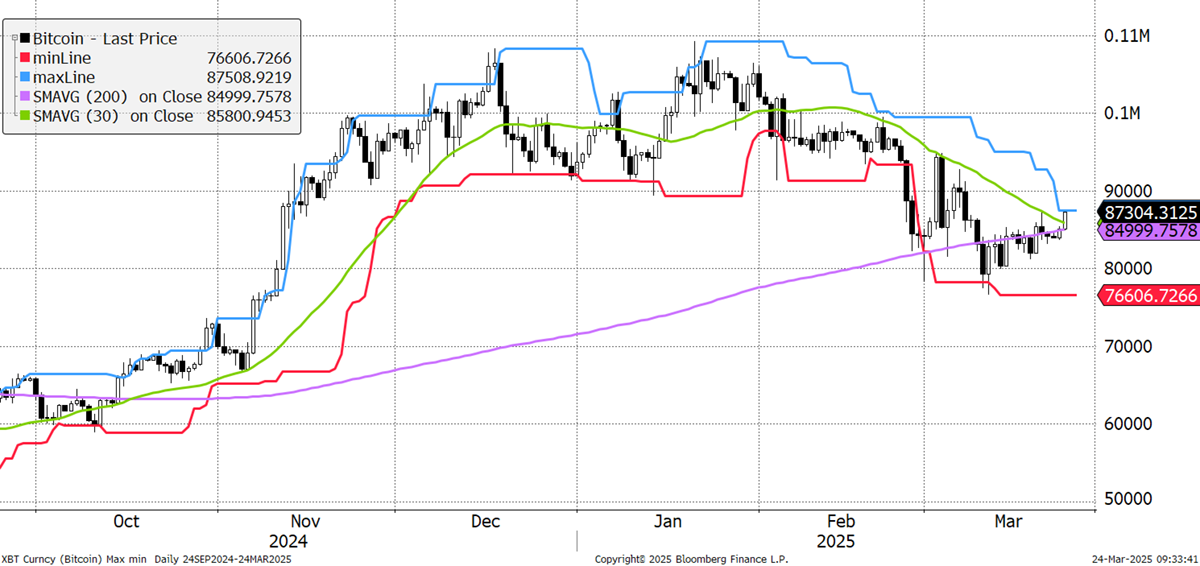

It’s a good start to the week, with the Bitcoin price back above the 30- and 200-day moving averages. Better yet, the price has touched the blue 20-day max line for the first time since January. The 200-day moving average may be offering support, and the short-term downtrend may have turned.

Bitcoin BYTE Score 4

That said, there is a downtrend line that dates back to January. It’s short-term, but a break would indicate the correction is behind us.

Bitcoin Downtrend Since January

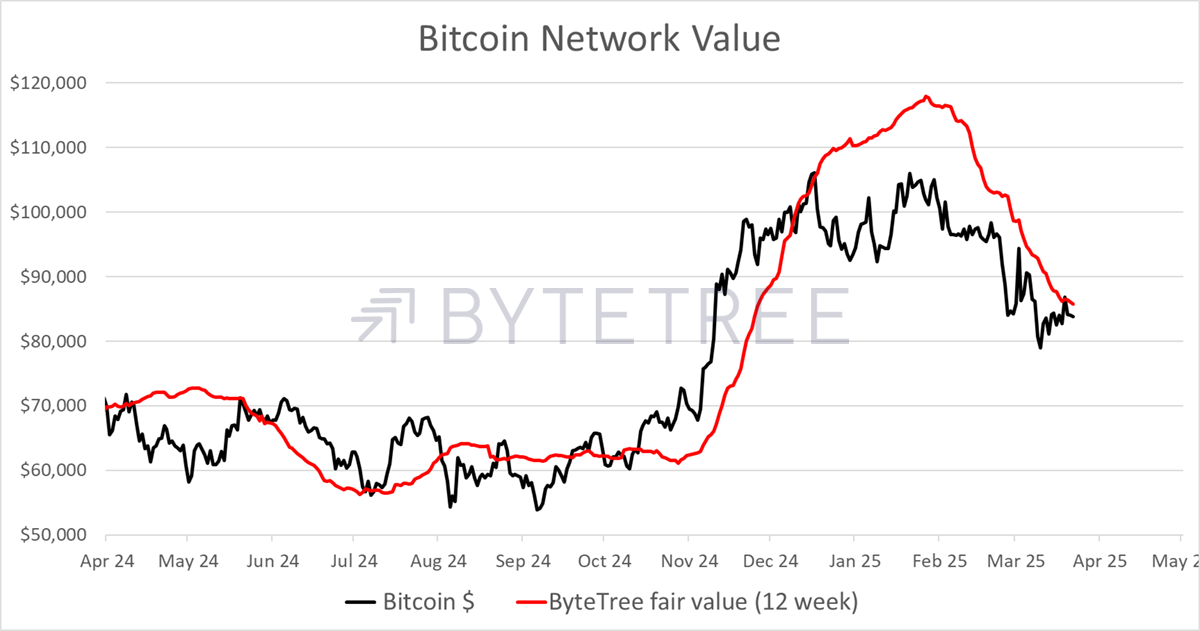

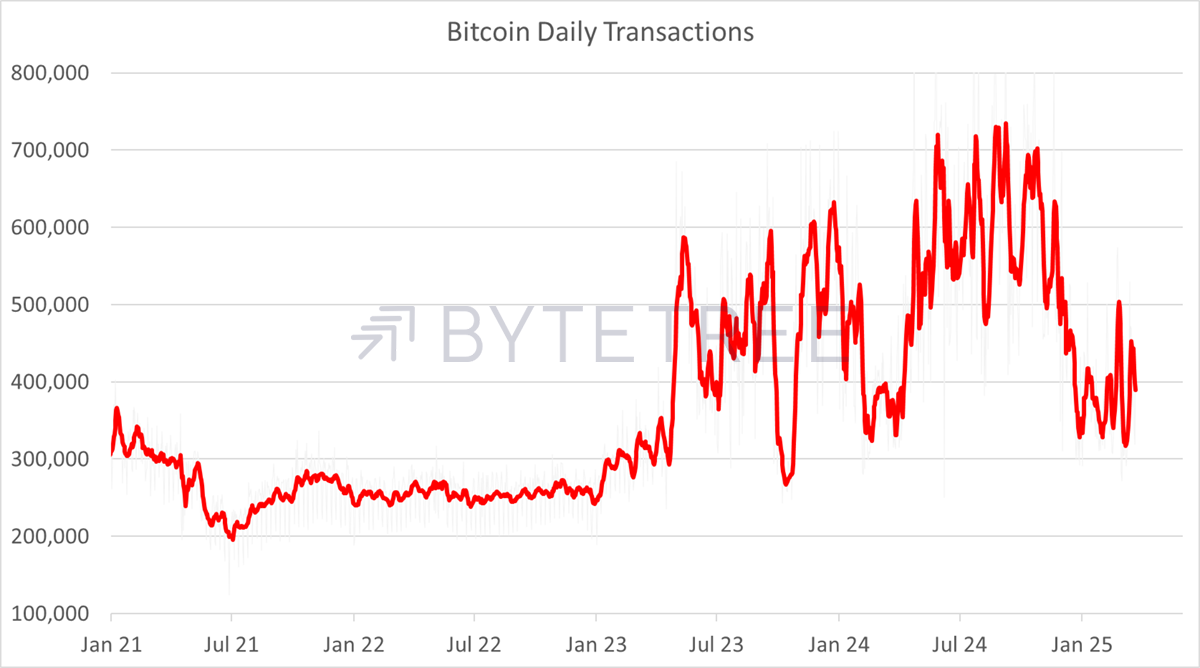

Looking at the on-chain activity, the network has slowed, but this is lagging data. But things are in the right place, and the network decline is slowing. Bitcoin is comfortable in the $80k zone.

Transactions have eased back as the activity from ordinals has declined, but these days, it’s not about transactions; it’s about money.

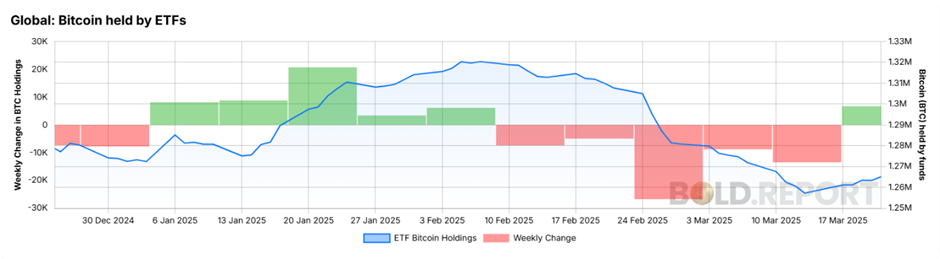

Last week, we saw inflows into the Bitcoin ETFs for the first time since February. That is good news, with most days attracting new money.

Bitcoin Held by ETFs

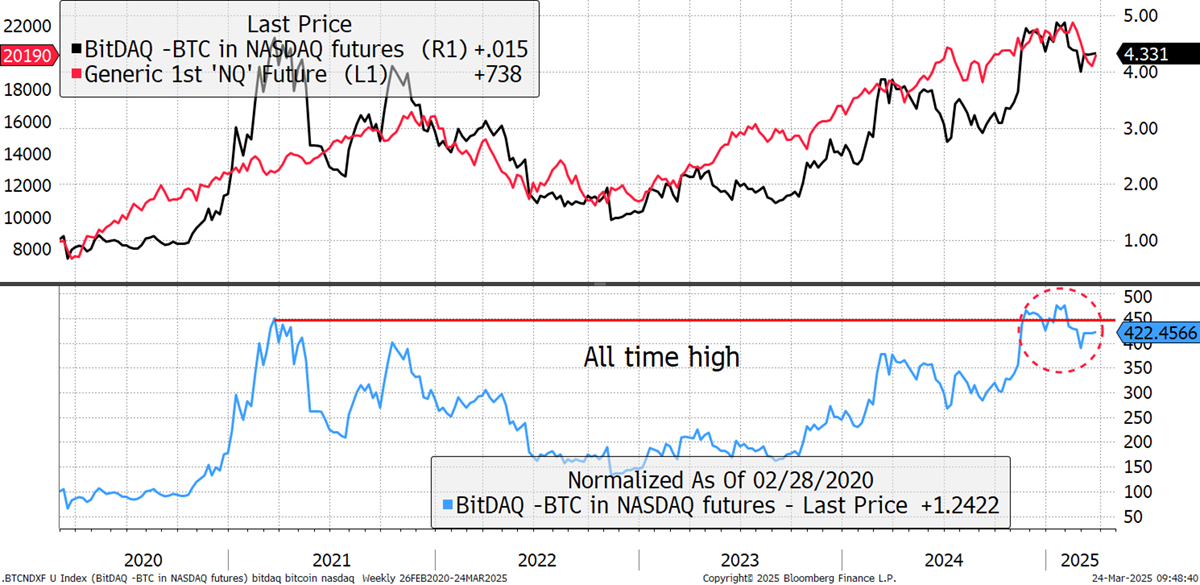

I believe that the next driver will be technology investors seeking diversification. That is why BTC in Nasdaq is so important, as normally when tech turns down, Bitcoin slumps. Not this time, which is a very positive sign. Bitcoin has held up well as it has become an increasingly credible asset.

Bitcoin vs NASDAQ

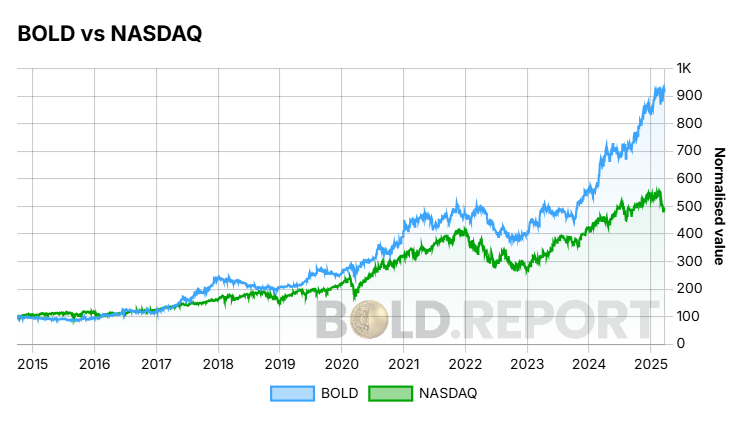

It’s time to mention ByteTree’s BOLD index, which blends Bitcoin and Gold on a 3:1 basis in favour of Gold. This has mimicked the Nasdaq for years but is now taking off. As institutional investors realise the power of the Bitcoin and Gold combination, they will embrace it.

BOLD vs NASDAQ

That’s the most bullish part because while the price of Bitcoin faces headwinds, the institutional world is heavily underweight, and that will support the price for years to come.