The Double Discount

Trade in Soda;

There’s a property trade today, but before I get to that, investors mustn’t forget that President Trump is a property developer at heart who loves large piles of cheap debt. He has little intention of ever repaying it but is keen to reduce its cost. When asked about the new bear market in US stocks, he replied, “there is a period of transition”.

The disruptive nature of DOGE, tariffs and radical policy shifts is taking its toll on the US stockmarket. It was already significantly overvalued by historical standards and has cracked with the momentum stocks, faring the worst. The S&P 500 is only down by 8.5% from its peak, but with a weak dollar thrown in, it is down 13% in GBP. It’s a miserable turn for the US market, while most European markets and China are up. The biggest fallers have been Tesla (TSLA) - 45%, Palantir (PLTR), alongside some of Silicon Valley’s finest.

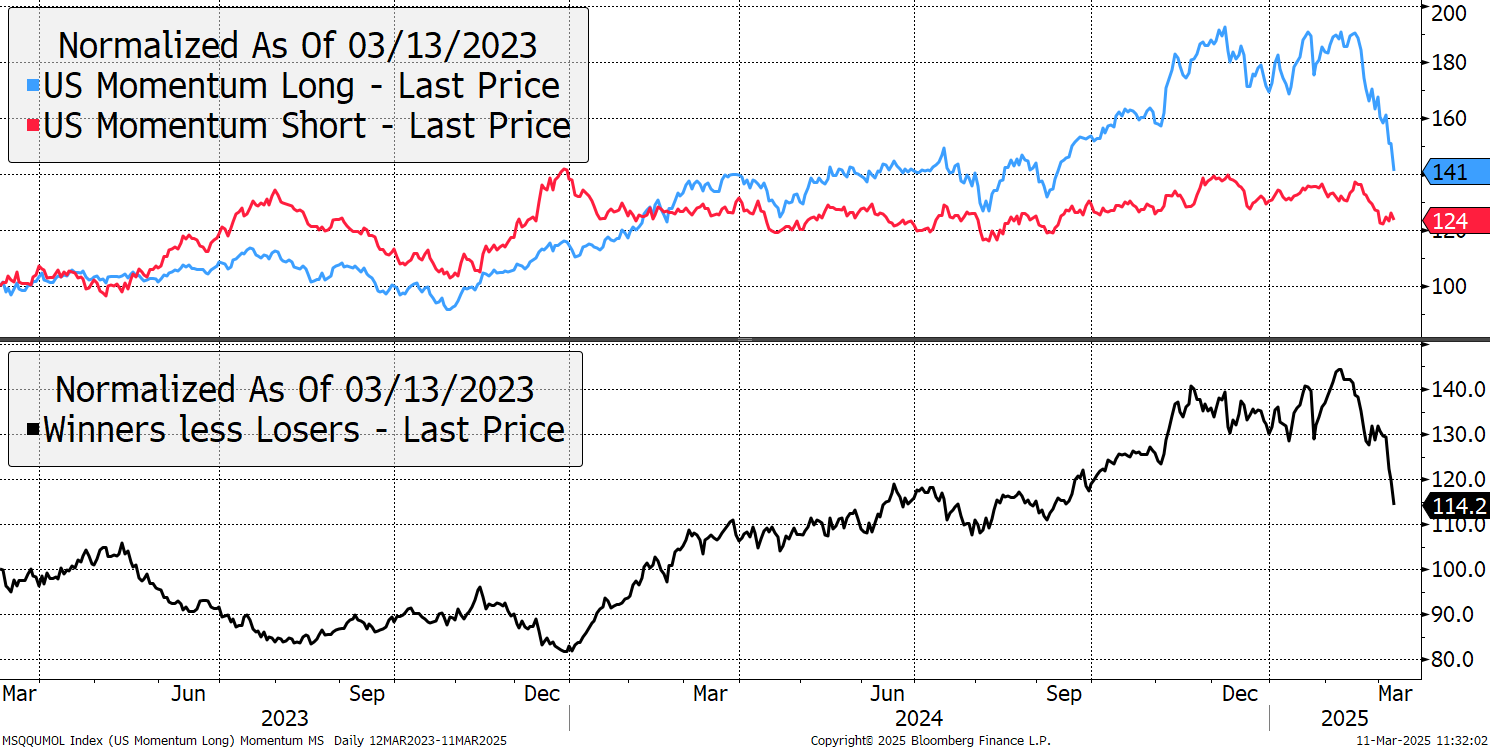

Looking at the momentum indices, the (past) winners are down 27% in recent weeks. This would qualify as a major momentum crash, and I would think there’s more to come, notwithstanding periodic relief rallies.

US Momentum Crash

Momentum winners and losers refer to the best and worst-performing stocks over the past year or so. Momentum indices track these groups of stocks, as shown.

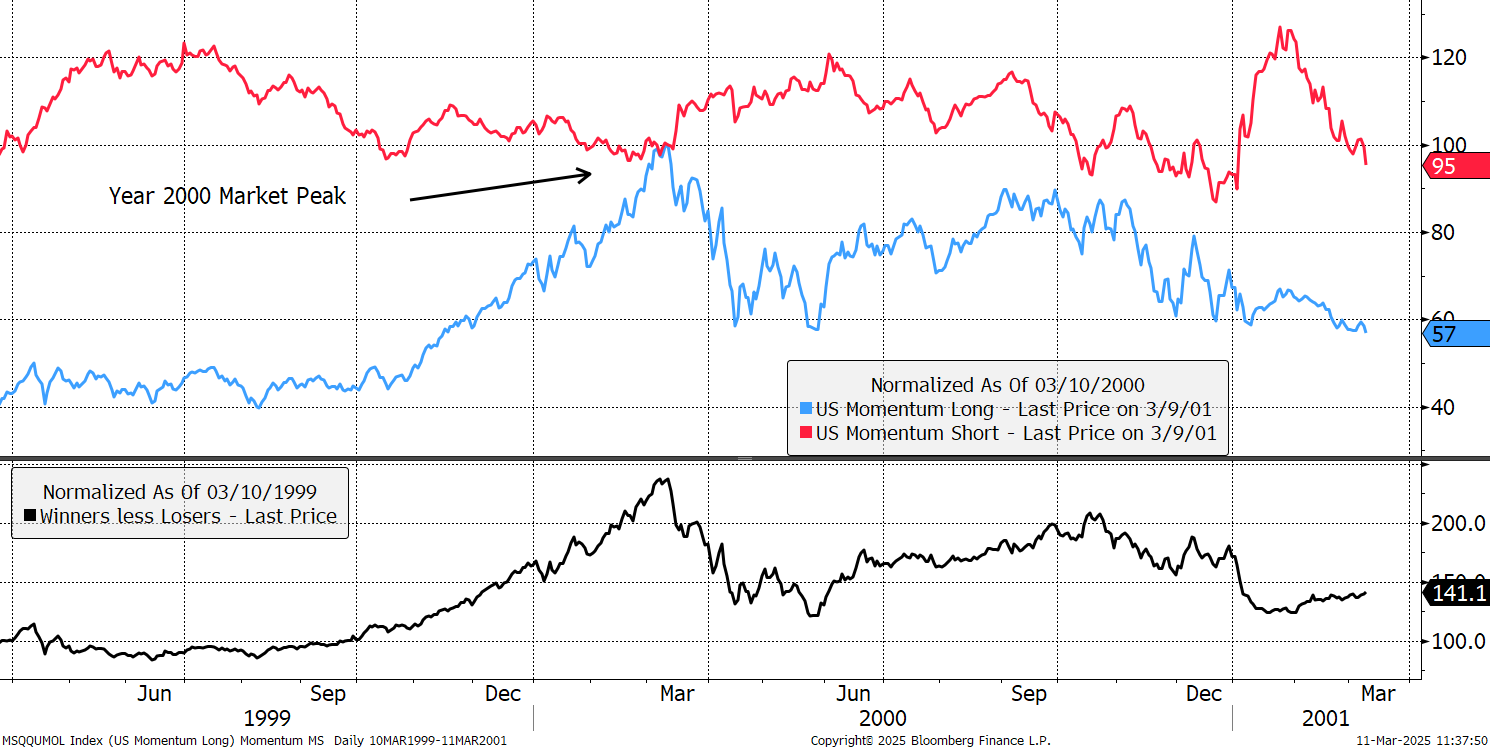

The losers have also fallen, but not by as much as I would expect. But they are still down by 9%, when in the momentum crash back in the dotcom bubble, they were actually up by 20%. I have rebased the chart to 10 March 2000, which was the market peak. That aligns the winners and losers in the run to and after that key day.

The Dotcom Bubble - US Momentum Crash in March 2000

The winners didn’t take long to halve in value, and in fact, it went on to be even worse. The losers weren’t actually losers in the negative discriminating sense. They were just cheap companies that were outside of the stampede in growth stocks. Investors who searched for ideas in that group not only went on to do well but avoided being carried out on a stretcher like Randolph Duke in Trading Places.

Some of the recent US policy choices strike me as an own goal. If you were boosting your defence budget, which has become a hot topic, would you buy an F35 fighter jet ($100m) knowing that the Pentagon can disable it at the flick of a switch? Perhaps it would be more cost-effective to recruit gamers who know how to operate drones in a new regiment called The King’s Own Cyberpunks. They could even work from home.

As equities fall, bonds should rise. I have been eager to add long-duration bonds to the Soda Portfolio because when interest rates fall, they have the kicker beyond holding cash. That said, if bond yields don’t fall when the stockmarket falls, then there’s real trouble because there is nowhere to hide.

A strong bond market means a lower cost of borrowing, and Trump wants to refinance America at lower rates. It makes you wonder how deliberate this is? I suspect it isn’t because a booming stockmarket is bound to be on his personal scorecard. But the fact remains, he has inherited a gargantuan stockmarket bubble, likely boosted by high government spending, which is now being withdrawn. That means we have the setup (high valuations) and the catalyst for its demise (austerity). I haven’t shown this chart for a while, but it’s finally beginning to stir. The jaws are closing.

US Equities Versus Bonds (prices)

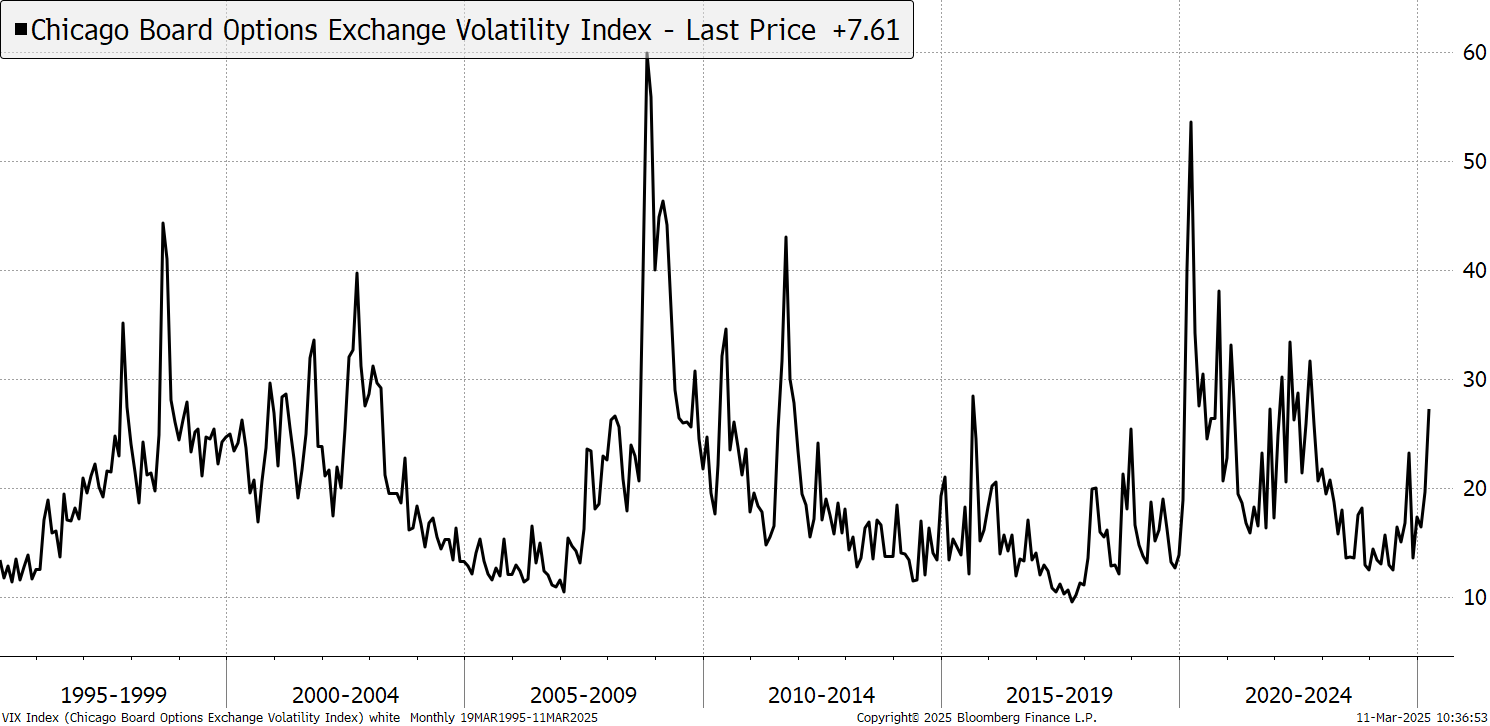

The recent fall in the stockmarket has been more than we are used to, and the VIX has started to rise. This measures the price of index options and is often interpreted as a measure of fear. When fear is high, the market normally bounces. So far, the VIX is at 28, which isn’t particularly high. That implies this selloff has more to run.

The VIX Smells Fear

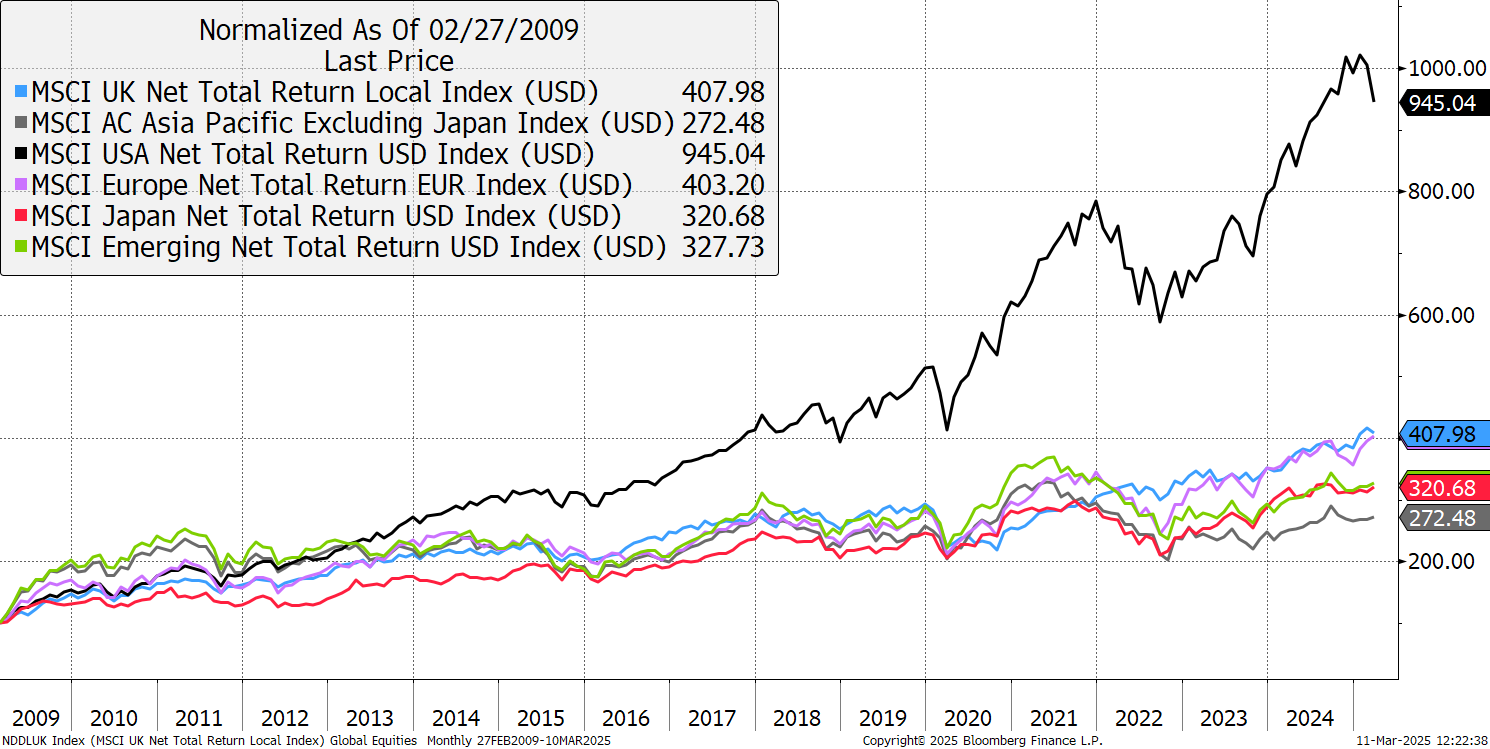

Given that the UK and Europe haven’t been part of this post-2008 surge, I continue to believe they are somewhat insulated from the US market fallout. Moreover, so much capital has chased US stocks that only a smidgen going the other way will see miracles happen. Already this year, we have seen spectacular performance from European banks and industry, especially in Germany, and with prices so low, there is no reason this shouldn’t continue.

Global Markets in USD Total Return (inc dividends)

I have decided to boost another area of European value that has been left behind by investors, which is commercial real estate. Prices collapsed in 2022 when interest rates rose but have stabilised since. Many property companies trade well below their net asset value (NAV), which means it’s cheaper to buy property via the stockmarket than directly.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd