Trades in Soda and Whisky;

The events over the weekend were quite something. The spat in the Oval Office has brought Europe together, with the UK at the forefront. While I would be an outright critic of Labour’s economic policy, Starmer has certainly stepped up as a leader in this crisis, backed up by the King. Tariffs and uncertainty help no one, least of all financial markets, and the only winner is gold. I will not attempt to analyse the political implications, as plenty of others are doing that more capably than I ever could. I will stick to the implications for financial markets.

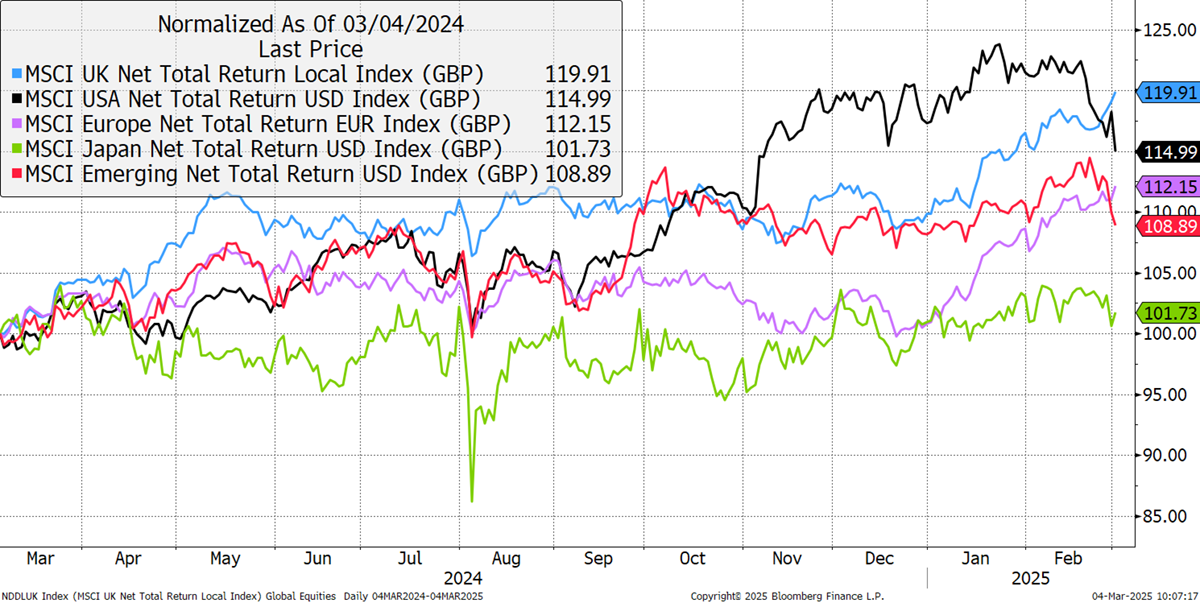

This mayhem is happening at an interesting time in markets. The global divergence between the US and the rest of the world equities is unprecedented. That US “exceptionalism” began after the 2008 financial crisis and was principally driven by the technology sector and, more recently, unusually high government spending. Something has changed, and with the help of a falling dollar, the Great Rotation is underway.

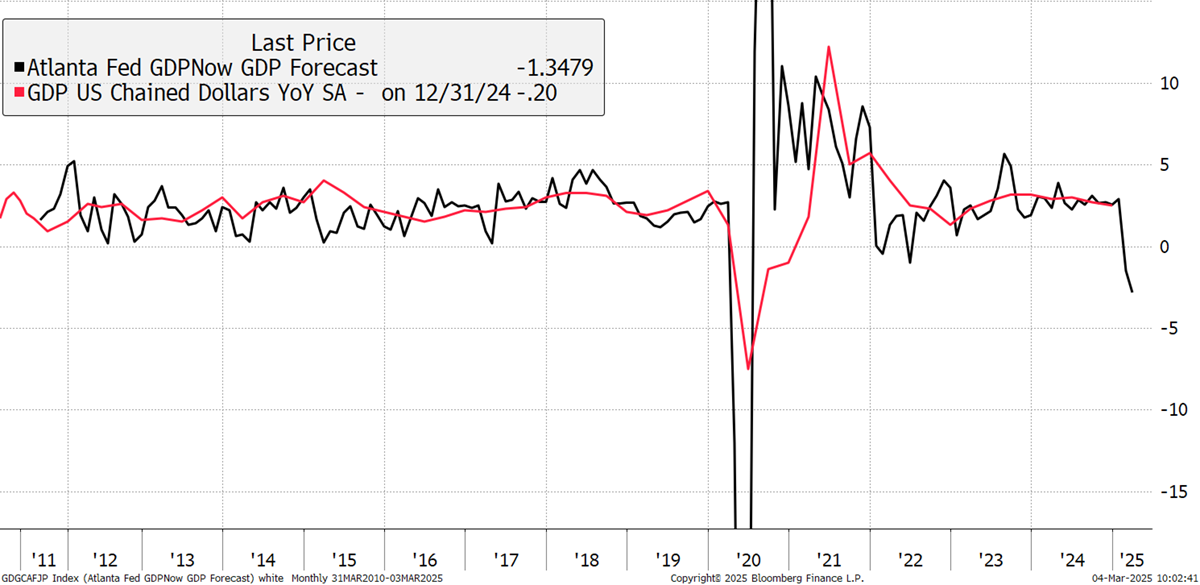

The Atlanta Fed calculated a GDP forecast for the US called GDPNow. In their own words:

“GDPNow is not an official forecast of the Atlanta Fed. Rather, it is best viewed as a running estimate of real GDP growth based on available economic data for the current measured quarter. There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model.”

It was created in 2010, after the financial crisis, and has been pretty accurate in estimating economic growth, albeit with some noise. The latest reading is quite a shock. It was +2.9% in January, -1.5% in February, and -2.8% today. The Atlanta Fed’s model is telling us that the US economy is headed for recession.

Atlanta Fed GDP NOW and GDP

One game changer is DOGE, which is aggressively cutting government spending. I have read that average incomes in Washinton DC are among the highest in the USA, but now there are layoffs, and local house prices are already down 12% this year. This recession is government-induced, with the thinking to get it done early and be ready for a boom ahead of the next election.

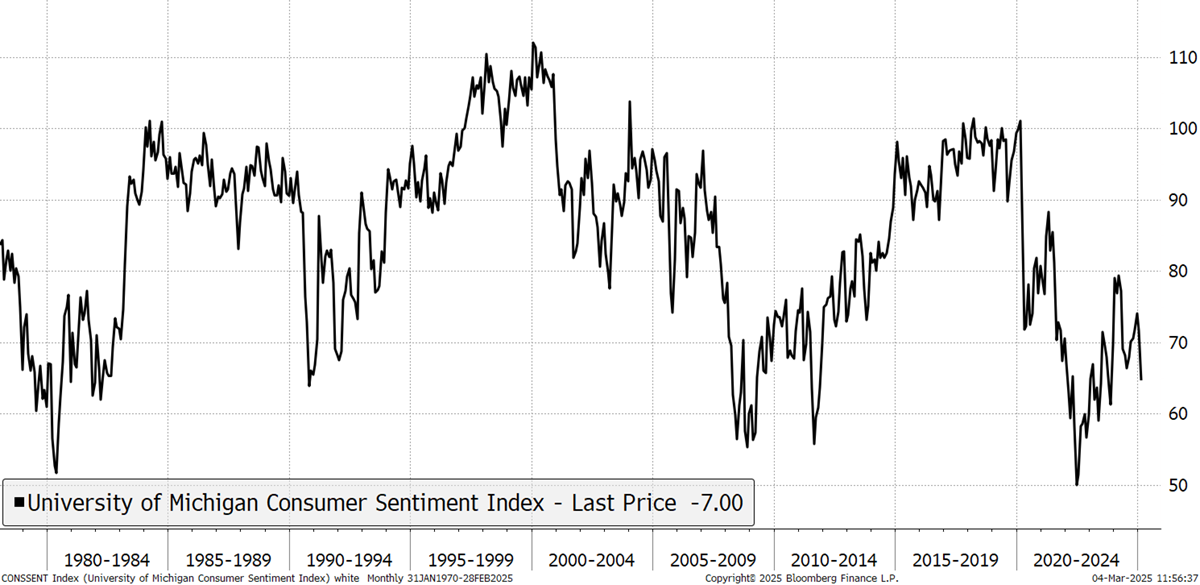

Although some parts of the economy have done well, the consumer hasn’t benefited from the post-pandemic recovery. Higher interest rates have squeezed household budgets, and consumer confidence is weak and falling. A shrinking government and a weak consumer are not a good thing for stockmarkets.

US Consumer Confidence

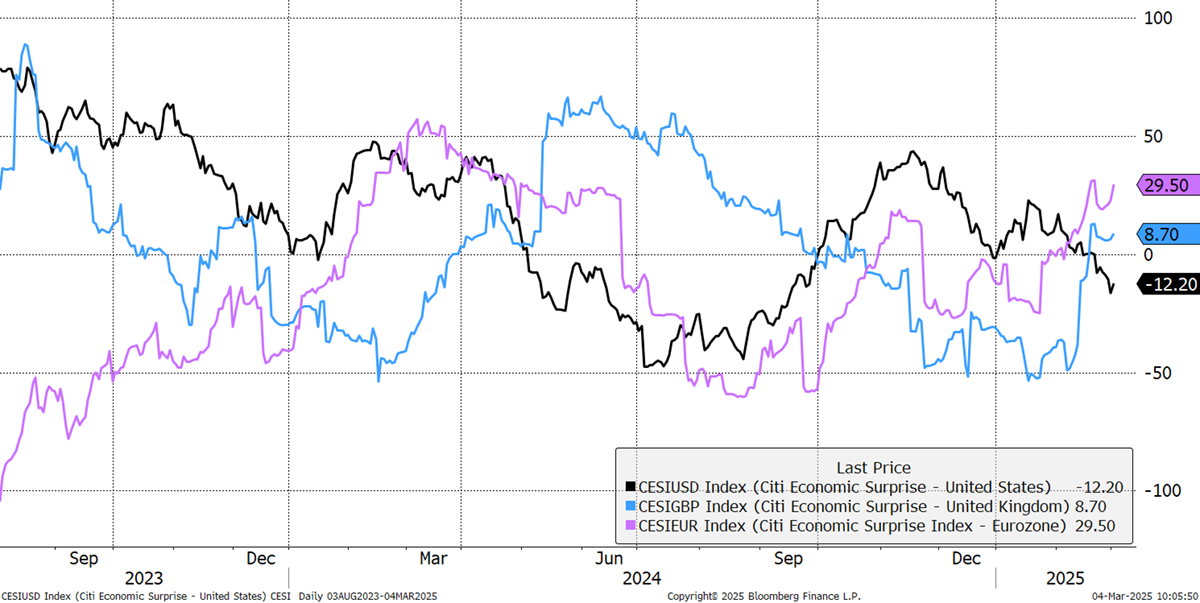

Economic surprises reflect whether the economic data is getting better or worse. Remarkably, in both the UK and Europe, recent data show things are improving while the US is turning down. This is a far cry from the status quo of recent years.

Economic Surprises

Remarkably, UK and European stocks have been doing well, while the US and the emerging markets have turned down. Much of Europe’s good performance has come from banks as interest rates have held firm. In the US, the banks have already recovered long ago, and US weakness has been expected, as the stockmarket has long been overcooked. Yet emerging markets are another negative surprise. I had expected them to be at the forefront of the great rotation, but they are not, and I need to address that.

Major Stockmarkets – Past Year Total Return (inc. dividends)

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd